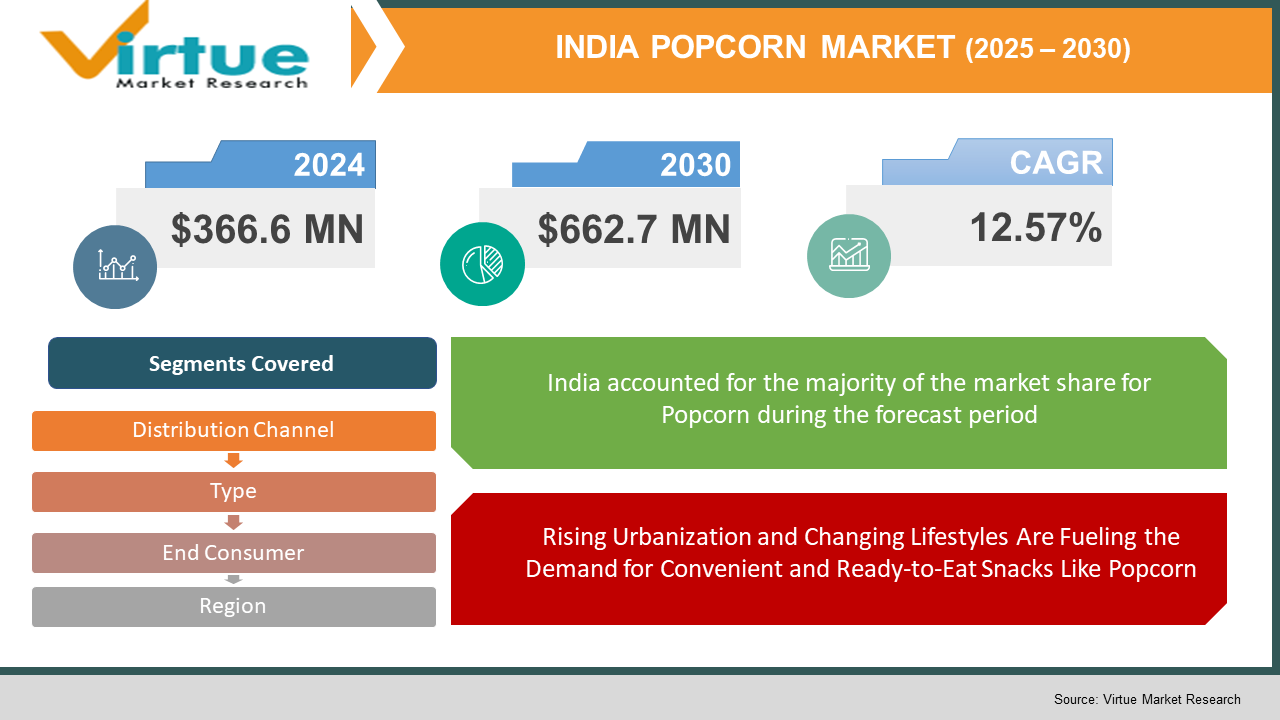

India Popcorn Market Size (2025-2030)

The India Popcorn Market was valued at USD 366.6 million in 2024 and is projected to reach a market size of USD 662.7 million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.57%.

The India popcorn market has witnessed remarkable growth in recent years, driven by the increasing popularity of ready-to-eat (RTE) and microwave popcorn among consumers. With changing lifestyles and rising disposable incomes, the demand for convenient and healthy snacking options has surged. Popcorn, being a low-calorie, fiber-rich snack, has gained traction among health-conscious individuals, further fueling its demand. Additionally, the expansion of modern retail chains, multiplexes, and online grocery platforms has made popcorn more accessible to consumers, contributing to the overall market expansion. The market is also benefiting from the introduction of innovative flavors, premium variants, and healthier formulations, such as organic and gluten-free popcorn. Manufacturers are leveraging digital marketing and social media platforms to enhance brand visibility and attract a younger audience. The rising influence of Western snacking habits, coupled with the rise of urbanization, is further accelerating market growth.

Key Market Insights:

- The India popcorn market has experienced strong growth because of shifting consumer preferences towards convenient and healthier snacking options. Over 60% of urban consumers prefer ready-to-eat (RTE) snacks, with popcorn emerging as a leading choice due to its low-calorie and fiber-rich properties. The increasing influence of Western food trends and a rise in home entertainment culture have further fueled popcorn consumption. The surge in online food delivery services and the rapid expansion of modern retail chains have also played a key role in making popcorn more accessible to a broader consumer base.

- Flavored and gourmet popcorn segments have seen a 30% year-on-year growth, with caramel, cheese, and spicy flavors becoming increasingly popular. The need for healthier variants, such as organic, gluten-free, and air-popped popcorn, is also on the rise. Brands are responding to this trend by introducing innovative and premium-quality products. Additionally, the microwave popcorn category has gained traction, with a growing number of health-conscious consumers opting for preservative-free and non-GMO alternatives.

- The expansion of multiplexes and cinemas has remarkably contributed to the rising popcorn sales, with over 70% of moviegoers purchasing popcorn during screenings. This trend is further supported by a surge in domestic and international movie releases, leading to increased footfall in theaters. Furthermore, convenience stores and supermarkets have become key distribution channels, accounting for nearly 50% of total retail popcorn sales, while e-commerce platforms have seen a 20% annual increase in popcorn sales due to rising digital adoption.

India Popcorn Market Drivers:

Rising Urbanization and Changing Lifestyles Are Fueling the Demand for Convenient and Ready-to-Eat Snacks Like Popcorn

India's rapid urbanization and evolving consumer lifestyles have remarkably contributed to the increasing demand for convenient and ready-to-eat (RTE) snacks, with popcorn emerging as a top choice. As more people shift to fast-paced urban environments, the need for on-the-go, easy-to-consume snacks has surged. Popcorn, being a light yet satisfying option, caters to the growing urban workforce, students, and busy individuals looking for quick, hassle-free food options. This trend has also been fueled by increasing disposable incomes, allowing consumers to explore premium and gourmet popcorn variants.

Growing Health-Consciousness and Demand for Low-Calorie, High-Fiber Snacks Is Boosting the Popcorn Market in India

The rising awareness regarding health and wellness has encouraged Indian consumers to opt for healthier snack alternatives, making popcorn a popular choice. Unlike traditional fried snacks, popcorn is perceived as a low-calorie, high-fiber option that aligns with fitness trends and dietary preferences. With the rising prevalence of obesity, diabetes, and heart-related ailments, consumers are actively seeking guilt-free snack options that offer both taste and nutrition. Companies are responding to this demand by launching air-popped, organic, and fiber-rich popcorn variants, catering to health-conscious consumers.

Expansion of the Organized Retail and E-commerce Sector Is Driving the Accessibility and Availability of Popcorn Products

The rapid expansion of organized retail chains, supermarkets, and hypermarkets across India has significantly improved the availability and accessibility of popcorn products. Consumers now have a wider range of options, from traditional butter and salted popcorn to gourmet flavors like caramel, cheese, and masala. Additionally, the increasing penetration of e-commerce platforms has made it easier for consumers to purchase popcorn online, with brands leveraging digital marketing and attractive discounts to drive sales. The convenience of doorstep delivery, subscription-based snack boxes, and growing demand for premium snacks through online channels have further accelerated market growth.

Increasing Popularity of Flavored and Gourmet Popcorn Variants Is Enhancing Consumer Appeal and Market Expansion

While traditional salted and butter popcorn continues to be widely popular, the need for flavored and gourmet popcorn variants has been witnessing remarkable growth. Consumers are showing a keen interest in innovative flavors such as spicy peri-peri, chocolate-coated, caramel, and cheese popcorn, driven by evolving taste preferences and a willingness to experiment. Several startups and established brands are introducing premium handcrafted and artisanal popcorn varieties, creating a niche market segment that appeals to both young and adult consumers. The rising trend of gifting gourmet popcorn hampers during festivals and celebrations is also fueling the market expansion.

India Popcorn Market Restraints and Challenges:

High Competition, Price Sensitivity, and Limited Consumer Awareness Pose Challenges to Market Growth

The India popcorn market faces significant challenges because of intense competition from traditional snack foods like namkeens, chips, and other regional delicacies that hold strong cultural preferences. Additionally, the market is highly price-sensitive, making it difficult for premium and gourmet popcorn brands to attract a broad consumer base. While urban areas have embraced flavored and microwave popcorn, rural and semi-urban regions still lack awareness and accessibility to such products. Moreover, the perishable nature of ready-to-eat popcorn and the need for proper packaging and storage solutions add to operational costs, impacting profit margins for manufacturers.

India Popcorn Market Opportunities:

The India popcorn market presents significant opportunities fueled by increasing health consciousness among consumers, leading to a shift from fried snacks to low-calorie, fiber-rich alternatives like popcorn. The growing urban population, expanding middle class, and rising disposable incomes are boosting the demand for gourmet and flavored popcorn, creating a lucrative segment for premium brands. Additionally, the surge in e-commerce platforms and online food delivery services is making it easier for consumers to access a wide variety of popcorn options. Innovations in flavors, such as cheese, caramel, and spicy masala, along with healthier options like organic and air-popped popcorn, further enhance market growth potential.

INDIA POPCORN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.57% |

|

Segments Covered |

By Type, END Consumer, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Act II, 4700BC Popcorn, Popcorn & Co., Kurkure Popcorn |

India Popcorn Market Segmentation:

India Popcorn Market Segmentation: By Type:

- Microwave Popcorn

- Ready-To-Eat Popcorn

Ready-to-eat (RTE) popcorn is the dominant segment in the India popcorn market, fueled by the increasing demand for on-the-go snacking, urbanization, and busy lifestyles, which make convenience a top priority for consumers seeking quick and hassle-free options. With a variety of flavors, premium packaging, and the rising trend of healthy snacking, RTE popcorn has gained immense popularity among health-conscious individuals and young consumers looking for tasty yet low-calorie alternatives to traditional fried snacks.

Microwave popcorn is the fastest-growing segment in the India popcorn market, supported by the growing culture of home entertainment, increasing preference for cost-effective snacking, and growing awareness about air-popped and low-oil popcorn as a healthier alternative to deep-fried snacks. As more consumers invest in home movie experiences, particularly post-pandemic, the demand for microwave popcorn continues to surge, offering a balance between convenience, affordability, and the fresh taste of homemade popcorn.

India Popcorn Market Segmentation: By Distribution Channel:

- On-Trade

- Off-Trade

On-trade distribution is the dominant segment in the India popcorn market, primarily fueled by its strong presence in entertainment venues such as cinemas, multiplexes, amusement parks, and live event arenas, where popcorn is an essential part of the customer experience. Theaters and multiplexes, in particular, account for a significant share of popcorn sales as consumers associate the snack with movie-watching, making it a non-negotiable indulgence during their outings. Additionally, premium pricing, the availability of gourmet flavors, and combo meal options at these venues further contribute to the segment's dominance, ensuring a steady demand for freshly popped and flavored popcorn, even at higher price points.

Off-trade distribution is the fastest-growing segment in the India popcorn market, propelled by the increasing consumer preference for convenient, ready-to-eat, and microwave popcorn options that can be enjoyed at home or on the go. The rapid expansion of modern retail chains, supermarkets, hypermarkets, convenience stores, and e-commerce platforms has significantly improved product accessibility, making it easier for consumers to purchase their favorite popcorn brands anytime. With the surge of digital grocery shopping and doorstep delivery services, more consumers are opting for packaged popcorn, benefiting from discounts, subscription models, and bulk purchasing options. The shift in snacking habits, driven by work-from-home culture, binge-watching trends, and a preference for healthier alternatives to fried snacks, has further accelerated the growth of this segment, positioning it as a key driver for future market expansion.

India Popcorn Market Segmentation: By End Consumer:

- Household

- Commercial

The household segment is the dominant consumer category in the India popcorn market, driven by the growing popularity of convenient snacking options for home consumption. With the rise of home entertainment, streaming services, and family movie nights, more consumers are stocking up on microwave and ready-to-eat popcorn as a go-to snack. Health-conscious consumers are also embracing air-popped and low-calorie popcorn as a guilt-free alternative to traditional fried snacks, further strengthening this segment. Additionally, the affordability and availability of popcorn in retail stores, supermarkets, and online platforms make it an attractive choice for households across urban and semi-urban areas.

The commercial segment is the fastest-growing in the India popcorn market, driven by the booming entertainment and hospitality industries, where popcorn remains a staple offering. Multiplexes, amusement parks, stadiums, and quick-service restaurants (QSRs) are driving the demand for fresh and gourmet popcorn, often selling it at premium prices as part of their concession strategies. Additionally, businesses in the airline and railway catering sectors are increasingly including popcorn as a snack option due to its long shelf life and easy storage. As experiential dining and themed food offerings gain traction, gourmet and flavored popcorn variants in cafes, malls, and event spaces are further propelling the growth of this segment.

India Popcorn Market Segmentation: Regional Analysis:

Since the India popcorn market is regionally concentrated within the country, growth is primarily driven by urban and metropolitan areas where the need for convenient and ready-to-eat snacks is soaring. Major cities such as Mumbai, Delhi, Bengaluru, Chennai, and Hyderabad lead in popcorn consumption due to the widespread presence of multiplex cinemas, malls, and quick-service restaurants that serve popcorn as a staple snack. Additionally, rising disposable incomes and changing lifestyles have encouraged consumers in tier-2 and tier-3 cities to adopt packaged and microwave popcorn for home consumption, further expanding the market.

While urban regions dominate the market, rural areas are emerging as a promising growth segment, driven by increased penetration of organized retail and e-commerce platforms. With the expansion of modern trade stores and online grocery shopping, popcorn brands are reaching previously untapped regions, making them more accessible to a broader audience. The introduction of affordable single-serving packs and locally inspired flavors has also contributed to growing demand in smaller towns and villages, ensuring widespread market penetration across India.

COVID-19 Impact Analysis on the India Popcorn Market:

The COVID-19 pandemic had a mixed impact on the India popcorn market, causing initial disruptions but also creating new opportunities. During the lockdowns, the closure of cinemas, shopping malls, and public entertainment spaces led to a significant decline in on-trade sales, affecting the revenue of popcorn vendors in these establishments. The supply chain also faced challenges because of restrictions on transportation and production slowdowns, causing temporary shortages and fluctuations in pricing.

However, the off-trade segment, particularly ready-to-eat and microwave popcorn, witnessed a surge in need as consumers spent more time at home and sought convenient snacking options for entertainment and work-from-home routines. E-commerce and online grocery platforms played a crucial role in maintaining market stability by enabling direct-to-consumer deliveries. As restrictions eased and cinemas reopened, the market saw a gradual recovery, with brands focusing on new flavors, healthier variants, and expanded distribution channels to cater to evolving consumer preferences in the post-pandemic era.

Latest Trends/ Developments:

The India popcorn market is experiencing a wave of innovation driven by changing consumer preferences, with a growing emphasis on health-conscious snacking and premium flavors. Brands are introducing organic, non-GMO, and air-popped popcorn variants that cater to the rising demand for healthier alternatives. The inclusion of functional ingredients such as protein, fiber, and superfoods is gaining popularity among health-conscious consumers. Additionally, gourmet and artisanal popcorn with exotic flavors like cheese truffle, caramel almond, peri-peri, and chocolate-drizzled varieties are attracting urban consumers who seek premium snacking experiences.

The rapid expansion of e-commerce and online grocery platforms is reshaping distribution channels, with direct-to-consumer (D2C) models gaining traction. Leading popcorn brands are leveraging digital marketing strategies, influencer collaborations, and subscription-based offerings to boost engagement and brand loyalty. The resurgence of in-theater popcorn sales post-pandemic has further fueled market recovery, with cinemas offering customized flavor options and combo deals to enhance customer experience. Sustainable packaging initiatives, such as biodegradable and recyclable popcorn bags, are also becoming a key focus as brands align with eco-conscious consumer preferences.

Key Players:

- Act II

- 4700BC Popcorn

- Popcorn & Co.

- Kurkure Popcorn

- American Garden

- Too Yumm!

- Urban Platter

Chapter 1. India Popcorn Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Distribution Channel s

1.5. Secondary Distribution Channel s

Chapter 2. India Popcorn Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. India Popcorn Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Distribution Channel Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. India Popcorn Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. India Popcorn Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. India Popcorn Market – By Type

6.1 Introduction/Key Findings

6.2 Microwave Popcorn

6.3 Ready-To-Eat Popcorn

6.4 Y-O-Y Growth trend Analysis By Type :

6.5 Absolute $ Opportunity Analysis By Type :, 2025-2030

Chapter 7. India Popcorn Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 On-Trade

7.3 Off-Trade

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. India Popcorn Market – By End Consumer

8.1 Introduction/Key Findings

8.2 Household

8.3 Commercial

8.4 Y-O-Y Growth trend Analysis End Consumer

8.5 Absolute $ Opportunity Analysis End Consumer , 2025-2030

Chapter 9. India Popcorn Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Distribution Channel

9.1.3. By End Consumer

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Distribution Channel

9.2.3. By End Consumer

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Distribution Channel

9.3.3. By End Consumer

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By END CONSUMER

9.4.3. By Distribution Channel

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By END CONSUMER

9.5.3. By Distribution Channel

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. India Popcorn Market – Company Profiles – (Overview, Product Product Type Type Portfolio, Financials, Strategies & Developments)

10.1 Act II

10.2 4700BC Popcorn

10.3 Popcorn & Co.

10.4 Kurkure Popcorn

10.5 American Garden

10.6 Too Yumm!

10.7 Urban Platter

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The India Popcorn Market was valued at USD 366.6 million in 2024 and is projected to reach a market size of USD 662.7 million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.57%.

Rising consumer demand for convenient, healthy, and flavored snacking options.

Based on Type, the India Popcorn Market is segmented into Microwave and Ready-To-Eat Popcorn.

Major cities such as Mumbai, Delhi, Bengaluru, Chennai, and Hyderabad are the most dominant regions for the India Popcorn Market.

Act II, 4700BC Popcorn, Popcorn & Co., Kurkure Popcorn are the leading players in the India Popcorn Market.