India Polymer Modifiers Market Size (2025-2030)

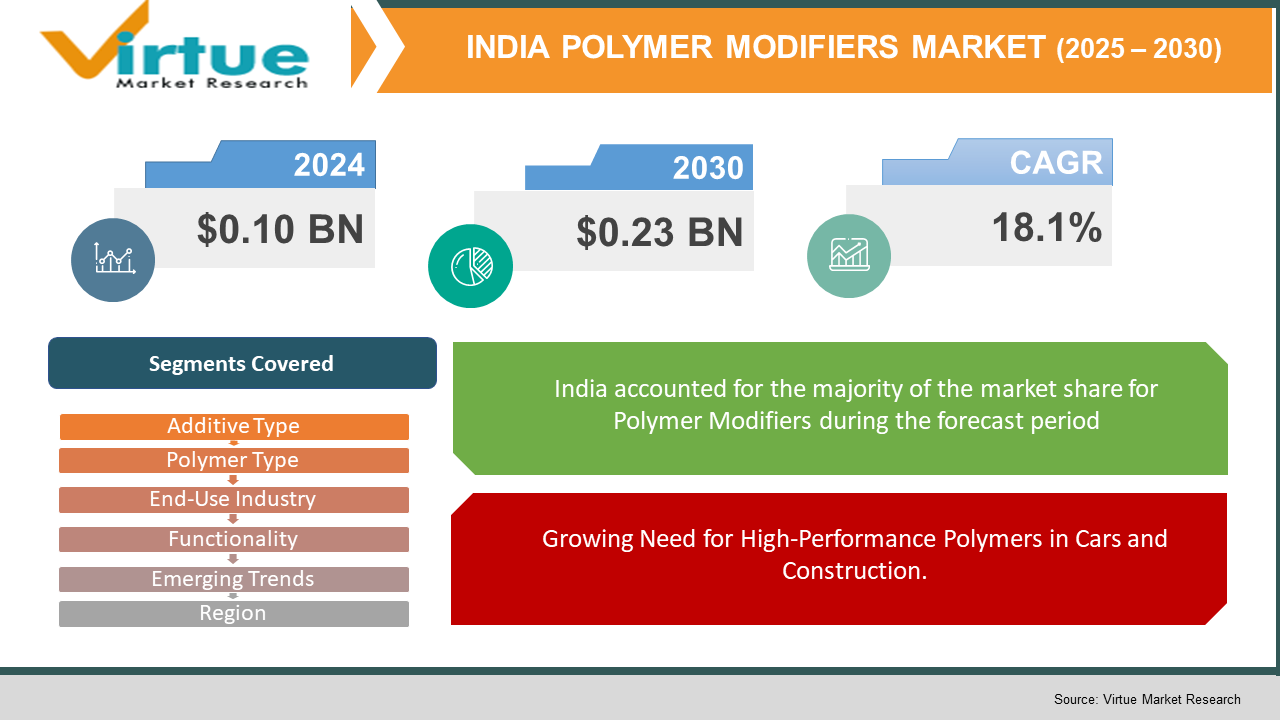

The India Polymer Modifiers Market was valued at $0.10 billion and is projected to reach a market size of $0.23 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 18.1%.

The India Polymer Modifiers Market is changing quickly, thanks to the country's industrial growth and more detailed needs for materials in different sectors. Manufacturers are looking to improve the performance and durability of their polymers, which makes modifiers really important for things like impact resistance and UV protection. You’ll see these polymer modifiers are used a lot in industries like automotive, construction, packaging, and consumer goods, where innovation and efficiency are key. As production gets smarter with more automation and AI, we're seeing the development of better polymer compounds. With India's rapid urban growth and infrastructure projects, there’s a big push for high-performance plastics, and modifiers help make that happen. There’s also a trend toward lighter and more sustainable materials, leading to the creation of eco-friendly additives that meet environmental standards. The manufacturing scene in India is evolving with the help of digital technology and Industry 4.0 practices, which make material design and use simpler. The rise of e-commerce and smart devices is boosting demand for modified polymers with better features. Plus, the focus on local manufacturing and expanding export zones is increasing the need for materials that meet high-quality standards both at home and abroad. As the uses for polymers get more complex, modifiers will continue to be a key part of the process to improve performance and keep costs down. This growth is making the polymer industry more adaptive and focused on technology, fitting a wide range of specific needs.

Key Market Insights:

India's quick growth in industry and infrastructure has really increased the need for better polymer modifiers. Now, over 60% of the polymers used in construction and automotive industries include these modifiers to boost thermal stability, durability, and efficiency, which fits right in with the country’s goals through programs like ‘Smart Cities’ and ‘Make in India’.

About 35% of India’s plastic use comes from the packaging sector, and modifiers are becoming more popular for making flexible, lightweight, and recyclable packaging. This is especially true because of the higher demand for sustainable solutions in e-commerce, fast-moving consumer goods, and retail, which are expected to grow quickly.

Also, around 42% of Indian manufacturers of plastics and polymers are putting money into eco-friendly additives and bio-based modifiers. This trend is largely due to environmental regulations and the push for materials that can be recycled and have a lower carbon footprint, especially in industries like automotive, agriculture, and consumer products.

On the tech side, the rise of Industry 4.0 tools, like AI for formulation and automation, is making production more accurate and improving product performance. About 28% of polymer firms in India are using digital tools to improve how they blend additives and check quality, which speeds up innovation in polymer designs.

Indian companies are also teaming up more with global additive suppliers and research centers. Nearly 30% of local polymer producers are starting agreements for technology licensing or joint ventures to get better access to advanced modifier technologies, strengthen their supply chains, and rely less on imports of high-performance materials.

India Polymer Modifiers Market Key Drivers:

Growing Need for High-Performance Polymers in Cars and Construction.

In India, the automotive and construction sectors are starting to use more polymer modifiers to boost things like heat resistance, strength, and UV protection in their materials. This shift comes from the need for lighter, tougher, and weatherproof materials that adhere to strict standards. In cars, these modifiers help improve fuel efficiency and cut down on emissions by allowing the use of lighter materials while keeping safety in mind. In construction, modified polymers find their way into things like pipes, insulation, and roofing to make them last longer and perform better.

Focus on Eco-Friendly Additives.

With rising environmental concerns and regulations, the market is moving towards more sustainable polymer modifiers. Companies are now creating bio-based and non-toxic additives from renewable materials to replace harmful chemicals. These green modifiers not only meet environmental standards but also appeal to customers looking for sustainable options. This trend towards eco-friendly additives is popping up in various industries, including packaging, automotive, and construction, where there’s a growing need for materials that are recyclable and have less impact on the environment.

India Polymer Modifiers Market Restraints and Challenges:

Challenges in India's Polymer Modifiers Market.

India's Polymer Modifiers Market is facing a few tough challenges that could slow its growth. One big issue is the changing prices of raw materials, especially those linked to crude oil like polymers and monomers. When crude oil prices go up and down, it affects the costs and availability of these important materials, which can drive up the prices of polymer modifiers. There's also pressure from strict environmental rules. Some polymer modifiers can release harmful substances during production or disposal, which leads to restrictions on keeping the environment and people safe. Meeting these regulations often means companies need to invest a lot in greener manufacturing processes, raising their costs. On top of that, competition from other materials like high-density polyethylene (HDPE) and low-density polyethylene (LDPE) is tough. These alternatives can provide similar benefits at lower prices, making them more appealing for manufacturers looking to save money.

India Polymer Modifiers Market Opportunities:

Opportunities in India's Polymer Modifiers Market.

The India Polymer Modifiers Market is seeing a lot of chances for growth thanks to new technology in polymers, like nanocomposites and antimicrobial additives. These developments are making products more durable and effective in industries like automotive, construction, and electronics. As people become more aware of environmental issues and government rules tighten, there's a push towards sustainable and recyclable additives, which is leading to greener manufacturing. The automotive sector is particularly interested in lightweight materials, which is increasing the need for high-performance modifiers that boost strength and durability while helping with fuel efficiency. There are also cool innovations like smart additives that can repair themselves and remember shapes, opening even more possible uses. Plus, with e-commerce and packaged goods on the rise, there's more demand for additives that make packaging clearer and last longer while also providing antimicrobial protection. All these trends suggest a bright future for polymer modifiers in India, focusing on sustainable and innovative solutions that fit the needs of different industries

INDIA POLYMER MODIFIERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

18.1% |

|

Segments Covered |

By Additive Type, polymer type, end use industry, functionality, emerging trends, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Clariant AG, Evonik Industries AG, Dow Inc., LANXESS AG, Arkema, Akzo Nobel N.V., Lubrizol Corporation, Kaneka Corporation, Songwon Industrial Co., Ltd. |

India Polymer Modifiers Market Segmentation:

India Polymer Modifiers Market Segmentation: By Additive Type

- Plasticizers

- Stabilizers

- Antioxidants

- Flame Retardants

- Impact Modifiers

- UV Stabilizers

- Others

The antioxidants segment is growing the fastest in India's polymer modifiers market. With more demand for durable and sustainable products, antioxidants help extend the life and effectiveness of plastics. They're especially important in packaging, automotive, and construction, where materials face degradation from the environment. The push for eco-friendly options and strict environmental rules is driving the use of antioxidants in polymer mixes, showing a bigger shift towards sustainability.

Plasticizers still lead India’s polymer modifiers market, holding a large share of revenue. They're widely used in various sectors like packaging, automotive, and construction because they add flexibility and workability to polymers. Plasticizers make it possible to create cost-effective, lightweight, and adaptable plastic products to meet the rising demand from urban growth and consumer trends. Even with alternatives emerging, plasticizers are still essential due to their reliability and versatility.

India Polymer Modifiers Market Segmentation: By Polymer Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Engineering Plastics

In the India Polymer Modifiers Market, polypropylene (PP) is catching on quickly. It's lightweight, resistant to chemicals, and recyclable, which makes it a great fit for packaging, automotive, and consumer goods. As industries look for better plastics, more and more people are choosing polypropylene, and that’s increasing the demand for additives that help with processing it.

On the other hand, polyethylene (PE) is still the top player when it comes to volume. It's widely used in packaging, especially in the food and drink sector, and also in construction for things like sheets, plates, films, and pipes. New grades of polyethylene that offer better performance are helping it stay popular across different uses.

India Polymer Modifiers Market Segmentation: By End-Use Industry

- Packaging

- Automotive

- Construction

- Electrical and Electronics

- Consumer Goods

The packaging industry is the fastest-growing part of India's polymer modifiers market, fueled by the boom in e-commerce, organized retail, and food and beverage sectors, which has led to a higher demand for new and eco-friendly packaging. Additives like barrier agents and UV stabilizers are used to improve packaging performance and keep products fresh.

On the other hand, the automotive industry is still the biggest user of polymer modifiers in India. The push for lightweight and fuel-efficient materials has made impact modifiers and UV stabilizers common for making durable automotive parts. These additives help components like bumpers and dashboards resist wear and tear, enhancing vehicle safety and lifespan. With the rise of electric vehicles needing lighter materials, the demand for advanced plastic modifiers is growing. The automotive sector's big role in India's economy and its drive for innovation keep it as the top consumer of polymer modifiers.

India Polymer Modifiers Market Segmentation: By Functionality

- Property Modifiers

- Property Stabilizers

- Property Extenders

- Processing Aids

In the India Polymer Modifiers Market, property stabilizers lead the functional segment because they improve the durability of polymer products. Common types, like heat stabilizers, UV stabilizers, and antioxidants, are used in industries such as construction, automotive, packaging, and agriculture. They help prevent damage from heat, light, and oxygen, keeping polymers working well over time. Their use in products like PVC pipes and outdoor packaging shows their importance for reliability and safety.

On the other hand, processing aids are the fastest-growing segment, driven by the need for efficient polymer production. These additives help with smoother extrusion and quicker mold release, making manufacturing faster. There’s a noticeable demand for these aids in packaging, where quality and durability are key. The automotive and construction sectors are also using better processing aids for high-quality components. The introduction of multifunctional processing aids that improve surface finish and cut energy use is boosting this segment's growth.

India Polymer Modifiers Market Segmentation: By Emerging Trends

- Sustainable Additives

- Advanced Applications

- Regulatory Compliance

The sustainable additives segment is growing quickly in India’s Polymer Modifiers Market, thanks to more awareness about the environment and stricter regulations. More industries, like packaging, automotive, and construction, are choosing bio-based and recyclable additives to meet sustainability goals. Manufacturers are putting money into R&D to create eco-friendly options that still perform well. This shift is also backed by government support for sustainable practices.

Advanced applications lead the market, with high-performance additives being crucial for automotive, construction, electronics, and packaging. There’s an increasing demand for additives that improve thermal stability, mechanical strength, and UV resistance. In the automotive industry, using lightweight materials for better fuel efficiency means more impact modifiers and processing aids. The construction sector needs weather-resistant additives for durable infrastructure. Electronics benefit from additives that enhance flame retardancy and insulation, helping the growth of electric vehicles and advanced gadgets. The packaging industry uses additives that extend shelf life and improve barrier properties, fitting with sustainability efforts.

India Polymer Modifiers Market Segmentation: By Region

The India Polymer Modifiers Market is growing fast. It's mainly due to better polymer technologies, a push for sustainable additives, and more industries using high-performance polymer additives. In 2024, the market was worth about USD 100 million and is expected to hit USD 230 million by 2033, with an annual growth rate of 5.4%. The market breaks down into different types of additives, plastic types, applications, and functions. The main additive types are plasticizers, stabilizers, flame retardants, and impact modifiers. Plastic types include commodity plastics, engineering plastics, and high-performance plastics. Applications cover packaging, automotive, consumer goods, and construction, while functions range from property modifiers to processing aids. The demand for lightweight, durable, and versatile plastic products is pushing this market forward. There's also a strong focus on sustainable and eco-friendly polymer additives, partly due to strict regulations. This trend is leading to a rise in bio-based and recyclable additives, which fit with global sustainability goals and are backed by government programs that encourage green practices. Because of all this, the India Polymer Modifiers Market is likely to keep growing, thanks to ongoing innovation in materials.

COVID-19 Impact Analysis on the India Polymer Modifiers Market:

The COVID-19 pandemic hit the India Polymer Modifiers Market hard, causing major supply disruptions and a big drop in demand. In the early days of the pandemic, lockdowns led to a huge fall in polymer demand. Key products like polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) saw sales drop by more than 50% in the first quarter of 2020. The automotive and construction industries, which are big users of polymer modifiers, were especially affected since operations stopped and there were labor shortages. Many small converters struggled too, with some having to shut down or work at lower capacities because of workforce issues and logistics problems. As restrictions started to lift and the economy opened back up, the market began to slowly recover. The pandemic also made hygiene a bigger priority, leading to more demand for medical-grade materials, which created new opportunities for polymer modifiers, especially in healthcare. Plus, the situation pushed the industry to focus more on sustainability, with a shift towards eco-friendly and bio-based additives. While the initial impact was tough, it highlighted the need for flexibility and innovation, paving the way for a more resilient and varied polymer modifiers market in India.

Trends/Developments:

In December 2024, the DCPC pushed back the enforcement date for the Quality Control Orders (QCOs) on three polymer products to June 6, 2025. This gives industry players more time to meet new standards.

In September 2024, there was a change to the enforcement date for these QCOs. Many expected more extensions to help the industry get ready.

In July 2024, Lubrizol Corporation announced they were investing $200 million in a new manufacturing facility in Aurangabad, Maharashtra. This place will be their biggest in India and the second largest worldwide, aimed at supporting the area's growing needs in transportation and industrial fluids.

In June 2024, the DCPC updated the QCOs and moved the enforcement date to September 6, 2024, to give manufacturers extra time to comply.

In December 2023, India's Department of Chemicals and Petrochemicals (DCPC) introduced QCOs for three polymer products, including High-Density Polyethylene (HDPE) and Polypropylene (PP) woven sacks, with a starting enforcement date of June 3, 2024.

Key Players:

- BASF SE

- Clariant AG

- Evonik Industries AG

- Dow Inc.

- LANXESS AG

- Arkema

- Akzo Nobel N.V.

- Lubrizol Corporation

- Kaneka Corporation

- Songwon Industrial Co., Ltd.

Chapter 1 India Polymer Modifiers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2 India Polymer Modifiers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3 India Polymer Modifiers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4 India Polymer Modifiers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5 India Polymer Modifiers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 India Polymer Modifiers Market – By Additive Type

6.1 Introduction/Key Findings

6.2 Plasticizers

6.3 Stabilizers

6.4 Antioxidants

6.5 Flame Retardants

6.6 Impact Modifiers

6.7 UV Stabilizers

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Additive Type

6.10 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7 India Polymer Modifiers Market – By Polymer Type

7.1 Introduction/Key Findings

7.2 Polyethylene (PE)

7.3 Polypropylene (PP)

7.4 Polyvinyl Chloride (PVC)

7.5 Polystyrene (PS)

7.6 Engineering Plastics

7.7 Y-O-Y Growth trend Analysis By Polymer Type

7.8 Absolute $ Opportunity Analysis By Polymer Type , 2025-2030

Chapter 8 India Polymer Modifiers Market – By Functionality

8.1 Introduction/Key Findings

8.2 Property Modifiers

8.3 Property Stabilizers

8.4 Property Extenders

8.5 Processing Aids

8.6 Y-O-Y Growth trend Analysis Functionality

8.7 Absolute $ Opportunity Analysis Functionality, 2025-2030

Chapter 9 India Polymer Modifiers Market – By Emerging Trends

9.1 Introduction/Key Findings

9.2 Sustainable Additives

9.3 Advanced Applications

9.4 Regulatory Compliance

9.5 Y-O-Y Growth trend Analysis Emerging Trends

9.6 Absolute $ Opportunity Analysis Emerging Trends, 2025-2030

Chapter 10 India Polymer Modifiers Market – By End-Use Industry

10.1 Introduction/Key Findings

10.2 Packaging

10.3 Automotive

10.4 Construction

10.5 Electrical and Electronics

10.6 Consumer Goods Y-O-Y Growth trend Analysis End-Use Industry

10.7 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 11 India Polymer Modifiers Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. Asia Pacific

11.1.1. By Country

11.1.1.1. India

11.1.2. By End-Use Industry

11.1.3. By Emerging Trends

11.1.4. By Functionality

11.1.5. Polymer Type

11.1.6. Additive Type

11.1.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12 India Polymer Modifiers Market – Company Profiles – (Overview, Additive Type Portfolio, Financials, Strategies & Developments)

12.1 BASF SE

12.2 Clariant AG

12.3 Evonik Industries AG

12.4 Dow Inc.

12.5 LANXESS AG

12.6 Arkema

12.7 Akzo Nobel N.V.

12.8 Lubrizol Corporation

12.9 Kaneka Corporation

12.10 Songwon Industrial Co., Ltd

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Growing demand for lightweight and durable plastics, increasing adoption of sustainable additives, and rising applications in automotive and packaging sectors

Automotive, packaging, construction, and consumer goods industries are the major adopters, leveraging polymer modifiers for enhanced performance.

Rising environmental regulations and consumer preference for eco-friendly products are driving the use of bio-based and recyclable polymer modifiers

Strict quality control orders and compliance requirements are encouraging manufacturers to adopt higher-quality and standardized polymer additives

Trends include advanced sustainable additives, increased investment in local manufacturing, and growing integration of polymer modifiers in high-performance plastics.