India Adhesives Market Size (2025-2030)

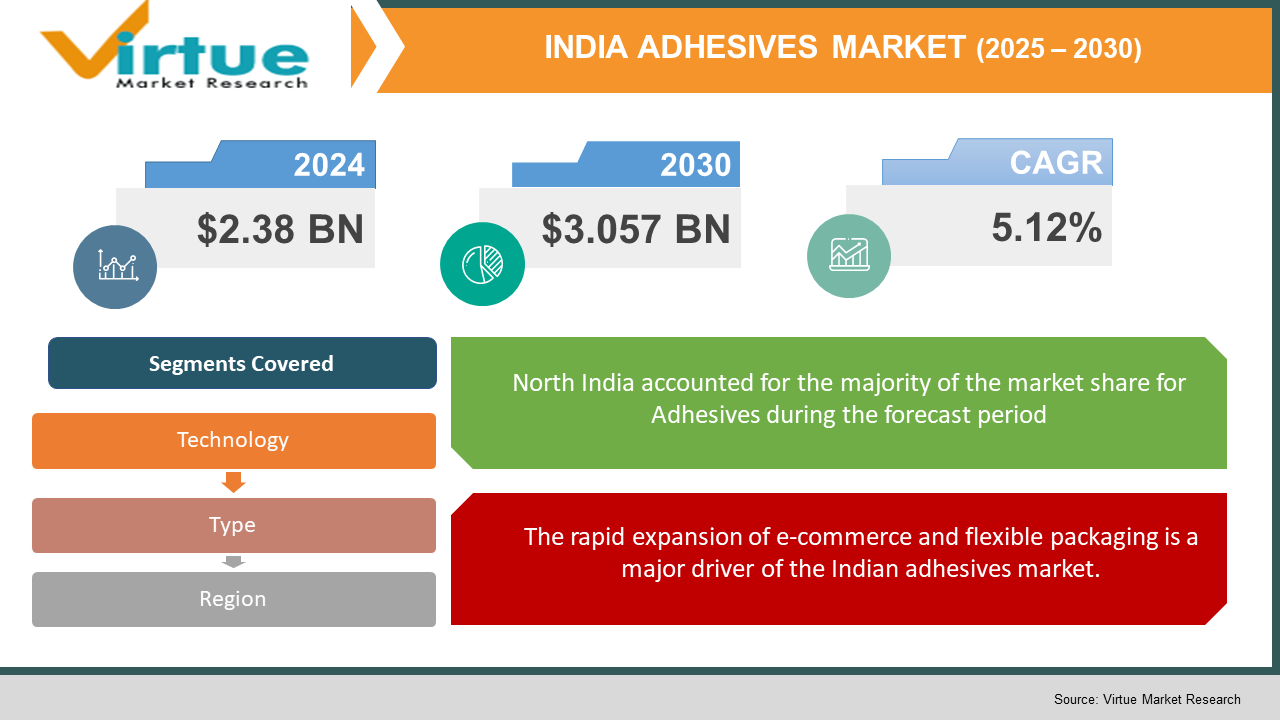

The India Adhesives Market was valued at USD 2.38 billion in 2024 and is projected to reach a market size of USD 3.057 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.12%.

The Indian adhesives market is a fast-growing sector fueled by increasing demand in the packaging, automotive, construction, electronics, healthcare, and furniture industries. Adhesives are used to bond, seal, and assemble materials, substituting conventional mechanical fasteners for increased durability and efficiency. With the development of water-based, solvent-based, hot melt, and reactive adhesives, the market is experiencing a transition toward environmentally friendly and high-performance products. The growth of e-commerce, flexible packaging, and lightweight auto materials has increased adhesive consumption further. Government programs such as "Make in India" and the development of infrastructure projects are driving industry expansion, with India becoming a major contributor to the international market of adhesives.

Key Market Insights:

- The packaging industry demand for adhesives has grown almost 3X over the past decade, fueled by the surge in e-commerce, flexible packaging, and food safety laws.

- Water-based adhesives currently command more than 60% of the overall market share in India, as companies shift towards sustainable, low-VOC, and eco-friendly bonding products.

- Hot melt adhesive adoption has increased by almost 5X in the e-commerce industry, largely because of their quick-setting characteristics, strength, and higher bonding power in shipping and logistics applications.

- Lightweight automotive production has resulted in a 15% weight reduction of vehicles with structural adhesives, improving fuel efficiency and overall vehicle performance dramatically. More than 70% of the construction adhesives applied today are moving towards environmentally friendly formulations, such as low-emission, non-toxic, and energy-saving products to comply with the green building requirements.

India Adhesives Market Drivers:

The rapid expansion of e-commerce and flexible packaging is a major driver of the Indian adhesives market.

The fast development of India's e-commerce and packaging sector has become a dominant force for the adhesives market. Increasing internet penetration, digitalization, and shifting lifestyles have fueled unprecedented growth in online retailing and e-commerce portals. This, in turn, has stimulated demand for premium adhesives in uses including carton closing, flexible packing, labelling, lamination, and tamper-evident packing. Adhesives are now indispensable in maintaining product safety, shelf life, and transportation convenience, particularly in food & beverages, pharmaceuticals, and personal care products. Furthermore, eco-friendly and recyclable adhesives are also on the rise as a result of increasing environmental awareness and strict regulations on single-use plastics. The flexible packaging market, especially stand-up pouches, resealable packaging, and multi-layer laminations, is increasingly employing advanced adhesive technologies like hot-melt, solvent-free, and bio-based adhesives. With companies investing in automated packaging solutions to cater to the growing demand, adhesive consumption is likely to grow, and this sector will be a major growth driver for the market in the next few years.

The automotive industry is increasingly relying on high-strength adhesives to improve vehicle performance and reduce weight.

The automotive and transportation industry is yet another key driver of India's adhesives market. With the trend toward lightweight vehicle production, adhesives have emerged as a key substitute for mechanical fasteners such as rivets, bolts, and screws. Adhesives find extensive application in the automotive industry in body panel bonding, seat assembly, interior trim, and structural reinforcement, which results in vehicle durability, crash resistance, and fuel efficiency. With India's transition towards the adoption of electric vehicles (EVs), adhesives are taking centre stage in battery assembly, thermal management, and lightweight structural parts. Advanced adhesive technologies contribute to vehicle light-weighting by as much as 15% and improve performance while lowering emissions. Further, government programs like Faster Adoption and Manufacturing of Electric Vehicles (FAME II), Make in India, and stricter emission standards are compelling producers to embrace high-performance, environment-friendly adhesives. The rising application of composite materials, new-generation bonding technologies, and nanotechnology-based adhesives in the production of automobiles is driving the market even more. With the ongoing development in the automotive sector, the need for structural and speciality adhesives is likely to grow considerably in the Indian market.

India Adhesives Market Restraints and Challenges:

One of the major challenges facing the Indian adhesives market is the fluctuation in raw material prices, which directly impacts production costs and profitability.

One of the biggest challenges for the Indian adhesives industry is the volatility in raw material prices, which has a direct bearing on production costs and profitability. Adhesives are dependent on critical raw materials like petrochemical derivatives, resins, polymers, and speciality chemicals, most of which are prone to price fluctuations because of crude oil price movements, supply chain issues, and geopolitical tensions. India, relying so much on imported raw materials, also suffers from further cost pressures from exchange rates, global trade agreements, and regulatory fluctuations. The drive towards sustainable and environmentally friendly adhesives has also led to greater demand for bio-based raw materials, which tend to be more costly than traditional materials. Adhesive makers have to weather these price fluctuations while keeping the quality of the product, performance level, and price competitiveness intact. To counter this threat, businesses are emphasizing local sourcing, alternative raw material development, and diversification of supply bases. However, persistent volatility of input prices continues to be an important problem that may affect market stability and margins in the future.

India Adhesives Market Opportunities:

The Indian adhesives market is destined for strong growth as a result of technological developments, sustainability pressures, and widening industrial uses. The growth in environmentally friendly adhesives, including bio-based and water-based adhesives, is a huge opportunity as industries turn attention to minimizing environmental footprints. The e-commerce and packaging industry, which is booming, is raising the need for pressure-sensitive adhesives (PSAs) and hot-melt adhesives, particularly for flexible packaging and labelling. The automotive and aerospace sectors are moving towards lightweight bonding solutions in place of conventional fasteners to enhance efficiency. Government policies in infrastructure, smart cities, and green buildings are also driving demand for construction adhesives. Moreover, the electronics and medical industries are high-potential sectors with increasing demand for advanced adhesives in wearable devices, circuit boards, and medical tapes. With growing investments in R&D and innovation, the sector is poised for steady growth in the years to come.

INDIA ADHESIVES MARKET REPORT COVERAGE:

|

REPORT METRIC A |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.12% |

|

Segments Covered |

By Type, technology, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

india |

|

Key Companies Profiled |

3M India, National Starch, Bostik Findley, Pidilite Industries Limited, Sika AG, H.B. Fuller Company, Henkel Adhesives Technologies India Private Limited, Nikhil Adhesives Limited |

India Adhesives Market Segmentation:

India Adhesives Market Segmentation: By Technology

- Water-based

- Solvent-based

- Hot Melt Adhesives

- Reactive Adhesives

- Pressure-sensitive Adhesives

India's adhesives market is classified according to technology into water-based, solvent-based, hot melt, reactive, and pressure-sensitive adhesives (PSA). Water-based adhesives are in the lead with their environmentally friendly nature and large application base in packaging and construction. Solvent-based adhesives with high bonding properties find applications in the automotive and electronics industries. Hot melt adhesives are on the rise in packaging, woodworking, and hygienic uses because of their fast-setting characteristics. Reactive adhesives, such as epoxy, polyurethane, and acrylic adhesives, are commonly applied in industrial uses that demand great durability. Pressure-sensitive adhesives (PSA) are used mostly in labels, tapes, and medical devices. The usage of bio-based adhesives is also increasing with growing environmental issues and strict legislation.

India Adhesives Market Segmentation: By Type

- Acrylic Adhesives

- Epoxy Adhesives

- Polyurethane Adhesives

- Silicone Adhesives

- Cyanoacrylate Adhesives

India categorizes adhesives into cyanoacrylate, silicone, polyurethane (PU), epoxy, and acrylic adhesives by composition and characteristics. Acrylic adhesives have a broad use in packaging, construction, and the medical industry owing to the toughness and ultraviolet resistance provided by them. Automotive and aerospace uses are found in epoxy adhesives as they are tougher and more capable of withstanding extreme conditions. Polyurethane adhesives provide flexibility and water resistance and are well-suited for footwear, furniture, and industrial bonding. Silicone adhesives with high-temperature stability are needed in electronics and construction. Cyanoacrylate adhesives, referred to as superglue, are quick to bond and are utilized in consumer products and medical devices. Specialty adhesives demand is on the rise as industries demand high-performance solutions.

India Adhesives Market Segmentation: Regional Analysis:

Indian adhesives market is regionally divided into North, West, South, and East India, each having different industrial demand. North India experiences high demand because of fast infrastructure growth and the location of manufacturing centres in Delhi, Punjab, and Haryana. West India, comprising Maharashtra and Gujarat, is a major market because of the concentration of automotive, packaging, and chemical industries. South India is also becoming a large consumer as electronics, construction, and healthcare sectors grow with Bengaluru and Chennai taking the lead in demand. East India, though smaller in size, is seeing steady growth with infrastructure development and growing industrialization of states such as West Bengal and Odisha. As government policies like "Make in India" give a fillip to domestic manufacturing, all regions are seeing higher consumption of adhesives in all industries.

COVID-19 Impact Analysis on the India Adhesives Market:

The COVID-19 pandemic had a dual effect on the Indian adhesives market, breaking supply chains and cutting demand from major industries such as automotive, construction, and furniture because of lockdowns and stopped production operations. Nevertheless, the healthcare and packaging industries experienced higher demand, especially for adhesives in medical tapes, labels, and flexible packaging for food and e-commerce. The short-term closure of factories caused shortages and fluctuating prices of raw materials, impacting production expenses. As companies responded, industries shifted towards bio-based and high-performance adhesives, in response to emerging hygiene and sustainability regulations. The automotive and construction industries recovered slowly, spurred by government stimulus and infrastructure spending. Furthermore, the increase in e-commerce and flexible packaging demand spurred innovation in adhesive formulations, rendering the market more sustainable to future shocks.

Latest Trends/ Developments:

The Indian adhesives market is experiencing quick developments fueled by sustainability, innovation, and industry demand. One of the prominent trends is the move towards green adhesives, with water-based and bio-based products becoming increasingly popular as a result of tougher environmental regulations. Hot melt adhesives are gaining traction in packaging, automotive, and hygiene products owing to their quick-setting nature and solvent-free formula. The automotive sector is turning its attention to lightweight bonding solutions, which would replace conventional mechanical fasteners for enhanced fuel efficiency. In building construction, intelligent adhesives with increased durability and heat resistance are required. The growth of e-commerce and flexible packaging has driven the demand for high-performance pressure-sensitive adhesives (PSAs) in labels and tapes. Furthermore, nanotechnology and hybrid adhesives are transforming performance by providing better bonding strength and resistance. With increasing investments in infrastructure, healthcare, and electronics, the market for adhesives is expected to grow robustly in India.

Key Players:

- 3M India

- National Starch

- Bostik Findley

- Pidilite Industries Ltd

- Sika AG

- H.B. Fuller Company

- Henkel Adhesives Technologies India Private Limited

- Nikhil Adhesives Limited

Chapter 1. INDIA ADHESIVES MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. INDIA ADHESIVES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. INDIA ADHESIVES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. INDIA ADHESIVES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. INDIA ADHESIVES MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. INDIA ADHESIVES MARKET – By Types

6.1 Introduction/Key Findings

6.2 Acrylic Adhesives

6.3 Epoxy Adhesives

6.4 Polyurethane Adhesives

6.5 Silicone Adhesives

6.6 Cyanoacrylate Adhesives

6.7 Y-O-Y Growth trend Analysis By Types

6.8 Absolute $ Opportunity Analysis By Types , 2025-2030

Chapter 7. INDIA ADHESIVES MARKET – By Technology

7.1 Introduction/Key Findings

7.2 Water-based

7.3 Solvent-based

7.4 Hot Melt Adhesives

7.5 Reactive Adhesives

7.6 Pressure-sensitive Adhesives

7.7 Y-O-Y Growth trend Analysis By Technology

7.8 Absolute $ Opportunity Analysis By Technology , 2025-2030

Chapter 8. INDIA ADHESIVES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia Pacific

8.1.1. By Country

8.1.1.1. India

8.1.2. By Types

8.1.3. By Technology

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. INDIA ADHESIVES MARKET – Company Profiles – (Overview, Packaging Types Portfolio, Financials, Strategies & Developments)

9.1 3M India

9.2 National Starch

9.3 Bostik Findley

9.4 Pidilite Industries Ltd

9.5 Sika AG

9.6 H.B. Fuller Company

9.7 Henkel Adhesives Technologies India Private Limited

9.8 Nikhil Adhesives Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The India Adhesives Market was valued at USD 2.38 billion in 2024 and is projected to reach a market size of USD 3.057 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.12%.

The market for adhesives in India is propelled by fast industrialization, infrastructure development, and increasing demand from the packaging, automotive, and construction industries. The trend toward environment-friendly adhesives and the development of high-performance bonding technologies is also boosting market growth.

Based on Service Provider, the India Adhesives Market is segmented in-to Adhesive manufacturers, Raw Material Suppliers, Distributors & Wholesalers, End-to-End Solution Providers.

Western India is the most dominant region for the India Adhesives Market.

3M India, National Starch, Bostik Findley, Pidilite Industries Limited, Sika AG, H.B. Fuller Company, Henkel Adhesives Technologies India Private Limited, Nikhil Adhesives Limited are the key players in the India Adhesives Market.