In vitro Toxicity Testing Market Size (2023 – 2030)

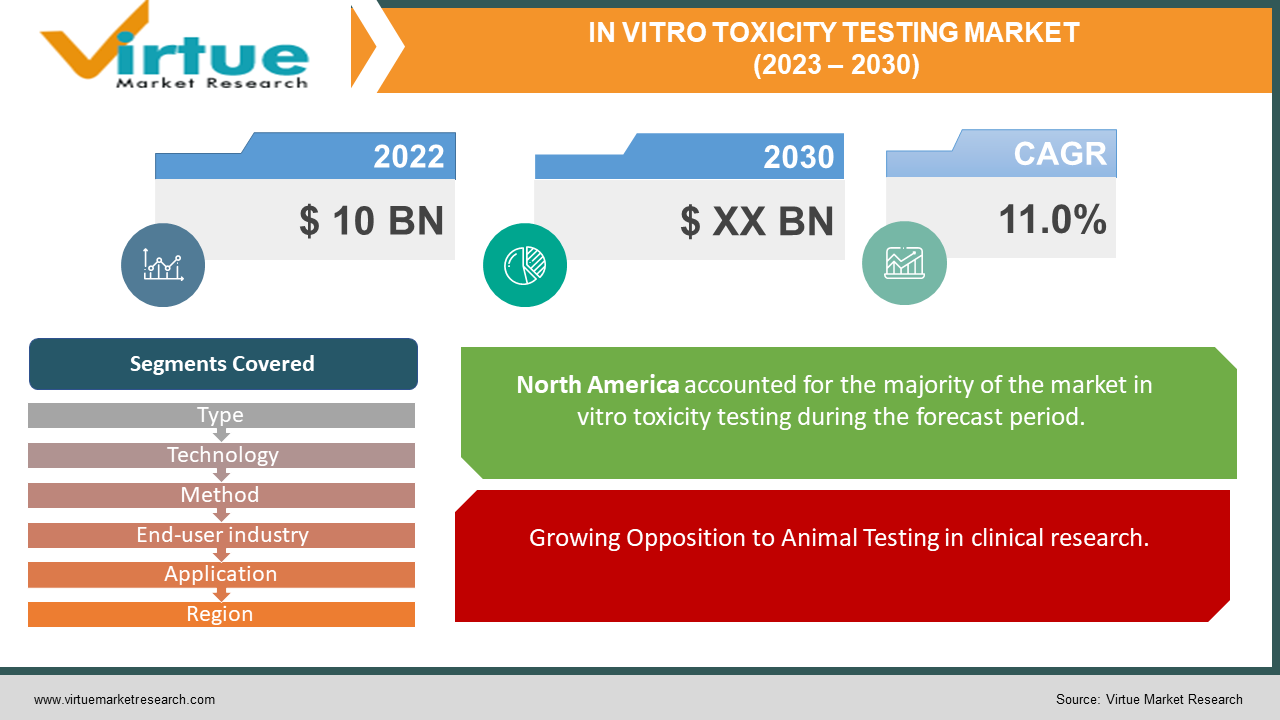

In Vitro Toxicity Testing Market is estimated to be $10 Billion in 2022 and is projected to grow at a CAGR of 11.0% from 2023 to 2030. One of the driving forces boosting the market is significant breakthroughs in toxicity science. In addition, the market for in-vitro toxicity testing is expected to rise due to high costs connected with traditional animal tests and socio-ethical problems related with animal experiments.

Industry Overview:

The scientific investigation of the effects of harmful chemical compounds on cultured bacteria or mammalian cells is known as in vitro toxicity testing. In vitro testing procedures are used in the early stages of the creation of potentially helpful novel substances such as therapeutic medications, agricultural chemicals, and food additives to discover potentially hazardous chemicals and to confirm the lack of particular toxic qualities. This technique is more often used in medicine development to examine safety and efficacy of the new drugs and to evaluate compounds according to their potency. In vitro toxicity testing can also be used to measure drug absorption, distribution, metabolism, and excretion (ADME), dosage response, and threshold response.

Advanced and innovative in vitro test methodologies for hazard characterization are likely to be driven by significant advances in biomedical sciences. Toxicology testing is becoming more sophisticated, owing to various new technologies that enhance the procedure. Currently, it is well positioned to benefit from promising biotechnology revolutions.

Market Drivers:

Growing Opposition to Animal Testing in clinical research:

The European Union approved regulations in 2004 prohibiting the use of animals in the testing of finished cosmetic products. It was further revised by forbidding the commercialization of cosmetics that were subjected to animal testing. This rising opposition to the use of animals in pre-clinical research and significant breakthroughs in in-vitro toxicology assays are driving market growth for in-vitro Toxicity Testing.

Growing awareness on drug product safety.: Toxicological testing is critical for the creation of novel medications as well as the enhancement of the therapeutic potential of current compounds. According to the US Food and Drug Administration (FDA), screening novel compounds for pharmacological activity and hazard potential in animals is critical.

Invention of New Technologies:

New and promising technologies in analytical laboratories and invention of new 3D cell culture approaches has the potential to boost the in vitro toxicity testing market. 3D cell culture is the next milestone in the market for in vitro toxicity testing.

Market Restraints:

Regulatory authorities' reluctance to consider other approaches for demonstrating safety and efficacy

Across a variety of industries, there has been a growing emphasis on the development and use of non-animal-based testing procedures. Validated alternative tests can be used instead of in vivo tests by regulatory agencies. In such cases, in vitro approaches must demonstrate their superiority in terms of safety and efficacy over animal methods. Even after the assay has demonstrated its superior scientific significance, a number of countries have indicated a reluctance to use in vitro testing over in vivo procedures. Animal testing data is still used by a number of regulatory authorities in the United States. For the evaluation of new toxicological test methods, many agencies employ in vivo methodologies.

COVID-19 Impact on Global In vitro Toxicity Testing Market

COVID-19 outbreak has just been growing at an exponential rate since 2020. This has resulted in a notable drop in the number of frequent patient visits to hospitals and clinics, as well as a decrease in the number of profile studies completed under normal conditions. To some extent, this is projected to hinder the market expansion.

However, the pandemic hasn't had a substantial impact on raw material supplies for in vitro toxicology technologies, aside from transportation delays caused by travel restrictions and certain driver shortage difficulties. The stabilization of the global economy is expected to gradually raise the number of diagnostic procedures that have been put on hold or other pipeline drugs, resulting in market growth for in vitro toxicity testing.

IN VITRO TOXICITY TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

11.0% |

|

Segments Covered |

By Type, Technology, Method, End-user industry, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Merck KGaA, Charles River, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Catalent, Inc., General Electric Company, Quest Diagnostics Incorporated, Eurofins Scientific SE, Laboratory Corporation of America Holdings, Agilent Technologies, Inc. |

Segment Analysis

The Global In-vitro Toxicity Testing Market is segmented based on type, technology, method, end-user industry and region.

In vitro Toxicity Testing Market Segmentation - By Type

1. Consumables

2. Services

3. Assays Kits

-

Bacterial Toxicity Assays

-

Enzyme Toxicity Assays

-

Cell-based Elisa & Western Blots

-

Receptor-binding Assays

-

Tissue Culture Assays

-

Others

In 2022, consumables are projected to be the most profitable segment of the in vitro toxicity testing market. The rising need for high-quality reagents, as well as the frequent use of media in in vitro toxicity investigations, might be attributable to this segment's considerable proportion.

In vitro Toxicity Testing Market Segmentation - By Technology

1. Cell Culture Technologies

2. High Throughput technologies

3. OMICS Technology

4. Molecular Imaging

5. Others

Cell-culture technology is estimated to dominate the market globally. This technology is set to be an excellent model for screening toxic efforts as it provides consistent results.

In vitro Toxicity Testing Market Segmentation - By Method

1. Cellular Assays

2. Bio-Chemical Assays

3. Ex- Vivo Models.

4. In Silico Models

Due to their quick adoption and technological improvement in these segments, the in silico models approach and Ex-vivo models have been identified as current trends in the in vitro toxicity testing market, and are expected to grow significantly by 2027.

In 2021, cellular assays are estimated to have the greatest proportion of the entire in-vitro toxicity testing market. Viability, functioning, and proliferation of cells can all be detected and measured using cellular assays. When compared to biochemical and ex vivo approaches, this method of toxicity detection is faster, more effective, and less expensive. In comparison to biochemical assays, these assays allow for the integration of targets and pathways in a more physiological setting. Advances in cell-based technologies, such as high-content screening and label-free detection, are projected to boost the market for cellular assays even further.

In vitro Toxicity Testing Market Segmentation - By End-user industry

1. Food Industry

2. Pharmaceutical Industry

3. Cosmetics Industry

4. Household Products

5. Chemical Industry

6. Academic Research Laboratories

The pharmaceutical and biopharmaceuticals sector of the in vitro toxicity testing market is predicted to account for the biggest market share in recent times and will continue to do so throughout the forecast period. Toxicity testing is an important step in medication development, which underpins the segment's rise.

The growing popularity of cosmetics, owing to increased disposable incomes and their widespread availability, has prompted the industry to engage in breakthrough product research and development. Furthermore, demand for cruelty-free cosmetics and personal care goods has risen dramatically which, in turn is boosting the growth of the market for in vitro toxicity testing.

Continuous advancements in toxicity profiling are expected to increase the application of in vitro models in chemical industry.

In vitro Toxicity Testing Market Segmentation - By Application

1. Endocrine Disruption

2. Ocular Toxicity

3. Dermal Toxicity

4. Systemic Toxicology

5. Cytotoxicity

6. Others

Technological advancements in Dermal Toxicity and risk assessments tools are estimated to drive the segment growth across the globe. Systemic toxicity segment is anticipated to hold the major share of global in vitro testing market owing to multiple organ development for assessing toxicity.

In vitro Toxicity Testing Market Segmentation - Regional Analysis

-

North America- With an increased focus of government bodies on drug discovery, increase in healthcare expenditure, and presence of adequate infrastructure for growth and development of drug discovery technologies, North America dominated the in-vitro toxicity testing market and accounted for the largest revenue share of over XX% in 2021.

-

Europe- The in-vitro toxicity testing market in Europe is predicted to grow at a CAGR of 12.9% from $XX Mn in 2021. Due to increased healthcare awareness related to blood reaction and donation, greater per-capita income and expenditure, and enhanced healthcare infrastructure, Europe turns out to be the largest contributor to the market.

-

Asia-Pacific – In vitro toxicology testing market in Asia Pacific is expected to develop at the fastest rate during the forecast period. This is due to the emergence of CROs for outsourcing toxicology-related research projects, opposition to animal testing leading to the use of alternative methods, an expanding pharmaceutical drug pipeline, and rising consumer awareness of product safety, all of which are driving adoption of in vitro toxicology testing in Asia Pacific.

-

Rest of the World – Middle East and Africa region is anticipated to have minimal growth in in vitro toxicity testing market owing to advancements in appearance of various analytical methods over biotechnology. These regions account for nearly 2/5th of the overall B2B operational activities of the global In-Vitro Toxicity Testing market.

Key Players of Global In Vitro Toxicity Testing Market

-

Merck KGaA

-

Charles River

-

Bio-Rad Laboratories, Inc.

-

Thermo Fisher Scientific Inc.

-

Catalent, Inc.

-

General Electric Company

-

Quest Diagnostics Incorporated

-

Eurofins Scientific SE

-

Laboratory Corporation of America Holdings

-

Agilent Technologies, Inc.

Market Insights and Developments:

-

2019 - Covance has launched a new R&D centre in Shanghai, China, to help grow the in vitro toxicity testing industry in the Asia Pacific area.

-

2019- Abbott and Intoximeters have agreed to commercialise Abbott's SoToxa Mobile Test System, a handheld oral fluid solution for alcohol and drug testing, in the United States. Benzodiazepines, methamphetamine, amphetamine, cocaine, opiates, and cannabis can all be tested with this product.

Chapter 1. In vitro Toxicity Testing Market - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. In vitro Toxicity Testing Market - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. In vitro Toxicity Testing Market - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. In vitro Toxicity Testing Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. In vitro Toxicity Testing Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. In vitro Toxicity Testing Market - By Type

6.1 Consumables

6.2 Services

6.3 Assays Kits

6.3.1 Bacterial Toxicity Assays

6.3.2 Enzyme Toxicity Assays

6.3.3 Cell-based Elisa & Western Blots

6.3.4 Receptor-binding Assays

6.3.5 Tissue Culture Assays

6.3.6 Others

Chapter 7. In vitro Toxicity Testing Market - By Technology

7.1 cell Culture Technologies

7.2 High Throughput technologies

7.3 OMICS Technology

7.4 Molecular Imaging

7.5 Others

Chapter 8. In vitro Toxicity Testing Market - By Method

8.1 Cellular Assays

8.2 Bio-Chemical Assays

8.3 Ex- Vivo Models.

8.4 In Silico Models

Chapter 9. In vitro Toxicity Testing Market - By End-user industry

9.1 Food Industry

9.2 Pharmaceutical Industry

9.3 Cosmetics Industry

9.4 Household Products

9.5 Chemical Industry

9.6 Academic Research Laboratories

Chapter 10. In vitro Toxicity Testing Market - By Application

10.1 Endocrine Disruption

10.2 Ocular Toxicity

10.3 Dermal Toxicity

10.4 Systemic Toxicology

10.5 Cytotoxicity

10.6 Others

Chapter 11. In vitro Toxicity Testing Market - By Region

11.1 North America

11.2 Europe

11.3 Asia-Pacific

11.4 Latin America

11.5 The Middle East

11.6 Africa

Chapter 12. In vitro Toxicity Testing Market – Key players

12.1 Merck KGaA

12.2 Charles River

12.3 Bio-Rad Laboratories, Inc.

12.4 Thermo Fisher Scientific Inc.

12.5 Catalent, Inc.

12.6 General Electric Company

12.7 Quest Diagnostics Incorporated

12.8 Eurofins Scientific SE

12.9 Laboratory Corporation of America Holdings

12.10 Agilent Technologies, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900