In-flight Catering Market Size (2024 – 2030)

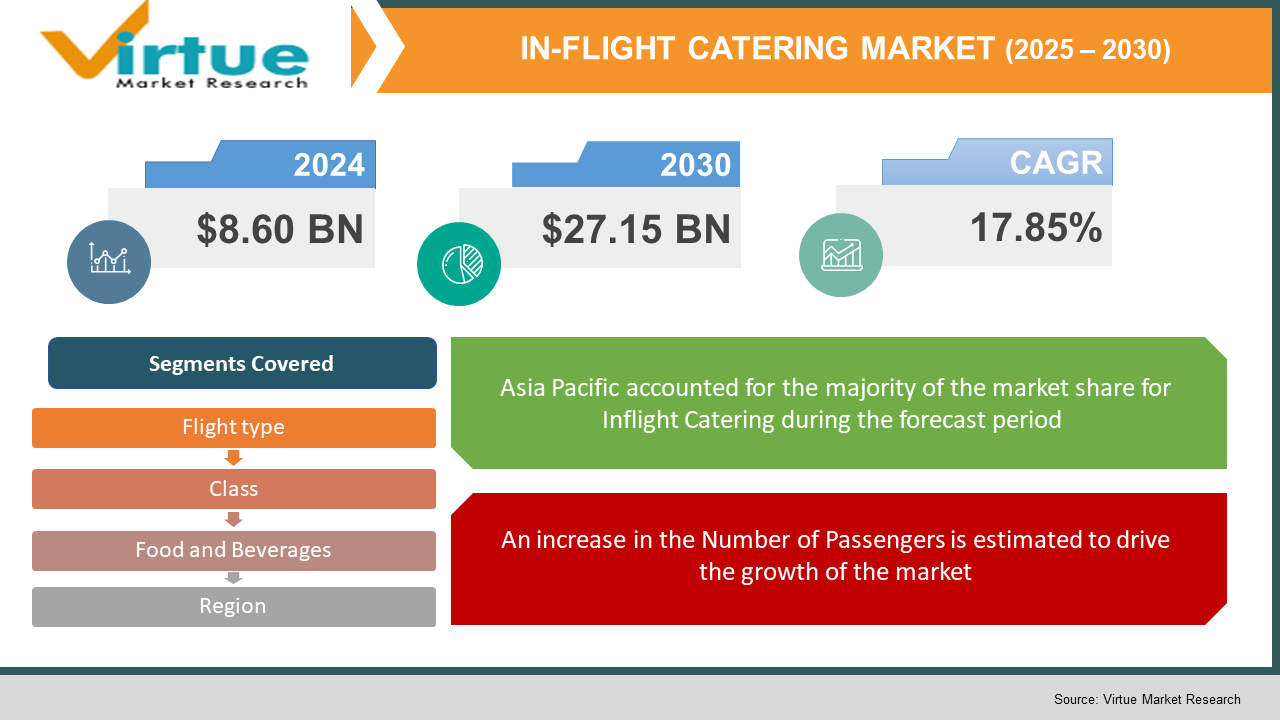

As per our research report, the Global In-flight Catering Market was valued at USD 8.60 billion and is projected to reach a market size of USD 27.15 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.85 %. A rise in the number of long-haul and non-stop flights, primarily due to the upsurge in leisure as well as business tourism, has led to increased passenger demand for catering services onboard and a steady rise in disposable income and growing adoption of technological advancements such as in-flight food and beverage ordering system are majorly driving the growth of the industry.

Industry Overview:

In-flight meals or in-flight meals are services that businesses provide to passengers in flight and at airports. Catering is becoming an important part of the business, especially for long-distance network operators. Meal planning and diet design are important processes of gastronomy. These meals are arranged by a professional airline catering service and served to passengers using the airline's service van. The quality and quantity of meals served on board will vary by airline and boarding class. Key market participants are increasingly adopting new concepts and systems from the field of production control to improve and improve the productivity of systems and processes. Key tools that catering providers use to improve their services include just-in-time production, lean manufacturing, inventory management systems, quality systems, and IT management systems. Airlines around the world, such as Virgin America, Air New Zealand, flydubai, and Japan Airlines, are expanding their services by offering digital F & B services. These services allow passengers to place orders via the in-flight IFE system. Emirates recently issued a meal ordering device to all flight attendants working in business class.

In 2017, Cathay Pacific redesigned its in-flight catering service by introducing dial-on-demand services in addition to pre-order options on the Hong Kong-London and Hong Kong-Chicago routes. In addition, major incumbent and full-service airlines are working with renowned chefs to redesign menus to enhance the in-flight experience. In 2018, Singapore Airlines announced a premium menu carefully selected by Gordon Ramsay for international flights. However, poor handling of food produces pollution or waste, and the market is estimateed to face challenges related to food transport and the low shelf life of the food being transported.

COVID-19 impact on the Inflight Catering market:

The COVID19 pandemic has created a total crisis of imposing travel restrictions and suspending flights in order to contain the spread of the virus around the world. Due to security regulations, some airlines have provided passengers with cold meals / pre-packaged food in bottled water. The sector is showing signs of improvement in 2021, but international passenger transport, in particular, is well below pre-COVID 19 levels. Nevertheless, North American and European airlines are gradually reintroducing pre-COVID 19 menus.

Food poisoning has always been a priority for catering companies, but the old protocol was designed solely to prevent food poisoning, so the pandemic has brought new dynamics and essential safety protocols to commercial aviation specialty kitchens. The pandemic is also responsible for raising catering standards in the areas of food safety, cleaning, and disinfection, which means that onboard catering companies are incurring additional costs to ensure optimized standards.

MARKET DRIVERS:

An increase in the Number of Passengers is estimateed to drive the growth of the market:

The exponential increase in the number of passengers traveling by air is estimateed to be the main driver of the growth of the in-flight foodservice industry. Despite the slowdown in economic growth in countries, the number of domestic and international passengers traveling by air is still increasing, thereby boosting the growth of the market. However, the healthy growth of the market is anticipated due to the increase in consumer estimateations for nutritious and healthy food which is also estimateed to drive the growth of the market. In addition, the adoption of online platforms by major airlines for meal orders is estimateed to further increase meal reservations.

Technological Advancements in the Flight Operation are also driving the growth of the market:

The increased automation and ubiquity of in-flight meal management have enabled food service providers and airlines to collaborate and deliver an enriching passenger experience at a minimal cost. In addition, increased investment in the aviation sector is estimateed to benefit the catering market as the global in-flight catering company will invest more and increase significantly. market share of in-flight catering services. In addition, the Government of India has approved 100% foreign direct investment (FDI) in scheduled air freight services, regional air freight services and passenger airlines. Scheduled. However, FDI capital above 49% will require government approval. India's aviation industry is estimateed to receive an investment of Rs 35,000 crore ($4.99 billion) over the next four years.

MARKET RESTRAINTS:

Lack of services and Cuisines on International flights is restraining the growth of the market:

Private planes provide very good services to the people but sometimes when there is an international flight there are many international passengers who travel over a large distance and they demand different cuisines which are not delivered by the planes service providers which created a bad impression on the customers and also restraint the growth of the Catering market.

IN-FLIGHT CATERING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.85% |

|

Segments Covered |

By Flight type, Class, Food and Beverages and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Gate Gourmet (Gategroup Holding), LSG Sly Chefs, dnata, SATS Ltd, and Do & Co. Other companies gaining traction in the market include ANA Catering Service Co. Ltd. (ANAC), Emirates Flight Catering, Flying Food Group, Newrest Group Services SAS, and Servair, S.A. |

This research report on the Inflight Catering Market has been segmented and sub-segmented based on Flight type, Class, Food and Beverages, and region.

Inflight Catering Market - By Flight Type

-

Full-Service Carrier (FSC)

-

Low-Cost Carrier (LCC)

-

Others

Based on flight type, the in-flight catering service market is divided into full-service carriers (FSC), low-cost carriers (LCC), and so on. The FSC segment will have the largest market share in 2018 and is estimateed to maintain its advantage over the forecast period. As FSCs tend to be international or long-haul flights, a growing trend towards international travel is estimateed to have a positive impact on segment growth. International airlines are usually long-haul flights, and their basic ticket prices include a variety of services such as in-flight entertainment, checked baggage, food, and drinks.

The LCC segment is estimateed to grow significantly during the forecast period. The primary factor driving growth is the upsurge in the travel and tourism industry, the rise in economic activity, urbanization, and rising consumer preference for low fare and nonstop carriers. As a result, there has been an increasing demand for onboard catering services, to better serve the customer needs. Numerous LCCs operate on international routes, in turn creating a significant demand for local as well as international cuisines onboard.

Inflight Catering Market - By Class

-

Economy Class

-

Business Class

-

First Class

-

Others

On the basis of class, the market is segmented into economy class, business class, first-class, and others. The economy class is estimateed to become the leading segment over the next six years. A key factor driving the segment's growth is its affordable fares compared to other classes, which ultimately attract large numbers of visitors. In addition, the availability of low-cost meal options is estimateed to accelerate the growth of this segment soon.

The entrepreneurial class is poised to grow at a substantial CAGR of just over 7% from 2019 to 2025. The growth in the number of business travelers along with the expansion of the global business network is one of the key factors that have a positive impact on growth. Various emerging economies around the world have seen outstanding GDP growth, which has spurred travelers to book business class tickets for their air travel. In-flight meals on long-haul flights play an important role in attracting customers. As a result, different airlines are considering promoting their services by making food the focal point. Together, these factors are estimateed to underpin the market over the forecast period.

Inflight Catering Market - By Food and Beverages

-

Meal

-

Bakery & Confectionery

-

Beverage

-

Others

Based on Food and Beverages, Markets are categorized into food, bakery, confectionery, drinks, and more. The food segment will hold the largest market share in 2018 and will hold a leading position throughout the forecast period. Key factors driving growth include increased acceptance of side dishes for travelers and increased demand for catering services on long-haul direct flights. Major in-flight catering providers are making great efforts to provide passengers with culturally diverse meals. Increasing demand for healthy, nutritious meals for passengers, and the willingness of customers to pay relatively high prices for such meals, may drive growth over the next six years. The beverage segment is estimateed to witness significant growth during the forecast period. Among the main factors influencing the growth of the segment is the increased passenger demand for tea, coffee, and healthy juices, usually on short-haul flights. In addition, benefits such as a wide range of beverage options, from juices to different types of alcohol for passengers, further fuel the growth of this segment. In addition, flight attendants at some airlines are beginning to offer personalized drinks to increase customer satisfaction.

Inflight Catering Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, The Asia Pacific region is estimateed to dominate the in-flight catering services market and maintain that dominance over the forecast period. It is estimateed to grow at a significant CAGR of over 7% between 2019 and 2025. Key factors contributing to growth include the rise of the middle class and the increase in overseas travel and tourism due to improved living standards. In addition, the growing number of airlines in the region is estimateed to create significant growth opportunities for in-flight catering providers in the region.

Significant growth is estimateed in Europe during the forecast period. The region is seeing an increasing number of established airlines entering the budget hierarchy, which should increase the demand for in-flight catering services on low-cost flights. In addition, increasing passenger purchasing power for healthy and organic meals and airline collaboration with experienced food professionals are some of the factors that are estimateed to create significant growth opportunities in the coming years. Growth is also estimateed to accelerate as major operators launch new routes and expand airlines.

Inflight Catering Market - Share by company:

Companies like:

- Gate Gourmet (Gategroup Holding)

- LSG Sly Chefs

- dnata

- SATS Ltd

- Do & Co

gaining traction in the market include ANA Catering Service Co. Ltd. (ANAC), Emirates Flight Catering, Flying Food Group, Newrest Group Services SAS, and Servair, S.A., and others are playing a pivotal role in the market.

Recently Gategroup Holding entered into a 30-year joint venture with Asiana Airlines of South Korea to establish itself as the operator’s sole in-flight caterer, serving passengers traveling to destinations across North America, Australia, Europe, and Asia.

Dubai National Air Transport Association (dnata) introduced its newest flight catering facility at Dublin Airport, which comprises an industrial-sized kitchen, food preparation and assembly area, and storage.

Suppliers invest in research and development to develop technologically advanced systems that give them a competitive advantage over other providers and provide an economic benefit to the industry. The industry is estimateed to see several mergers and acquisitions over the next few years. Companies are taking proactive steps to gain market share and provide a diversified product portfolio.

NOTABLE HAPPENINGS IN THE INFLIGHT CATERING MARKET IN THE RECENT PAST:

- Service Launch - In March 2022, Newrest announced that the company began providing hot meal services on two-class flights of Air Transat from various countries across Europe like Belgium, England, France, the Netherlands, Portugal, and Spain.

- Collaboration - In July 2021, gategroup signed a partnership renewal agreement with LATAM Airlines to provide inflight catering services for an additional five years. According to the agreement, gategroup will serve LATAM Airlines at 16 locations, which include two new strategic domestic locations: Bogotá, Colombia, and Santiago, Chile

- Service launch - In Nov 2021, the Indian low-cost carrier IndiGo announced that it was resuming its meal services that had been suspended since the COVID-19 pandemic. The airline's announcement came after the Indian Civil Aviation Ministry allowed airlines to resume in-flight meal services on all domestic flights.

Chapter 1. In-flight Catering Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. In-flight Catering Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. In-flight Catering Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. In-flight Catering Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. In-flight Catering Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. In-flight Catering Market – By Flight Type

6.1. Full-Service Carrier (FSC)

6.2. Low-Cost Carrier (LCC)

6.3. Others

Chapter 7. In-flight Catering Market – By Class

7.1. Economy Class

7.2. Business Class

7.3. First Class

7.4. Others

Chapter 8. In-flight Catering Market – By Food and Beverages

8.1. Meal

8.2. Bakery & Confectionery

8.3. Beverage

8.4. Others

Chapter 9. In-flight Catering Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. In-flight Catering Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1 Gate Gourmet (Gategroup Holding)

10.2 LSG Sly Chefs

10.3 dnata

10.4 SATS Ltd

10.5 Do & Co

Download Sample

Choose License Type

2500

4250

5250

6900