In-Car Infotainment Market Size (2024-2030)

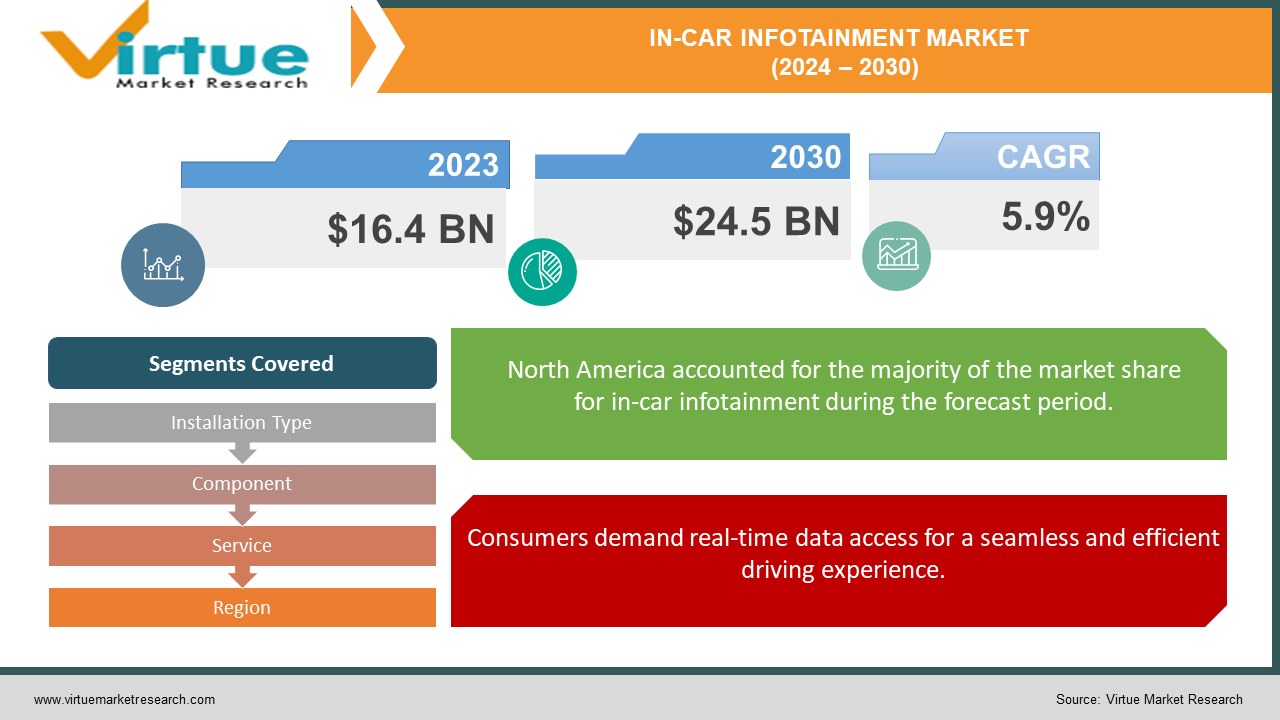

The Global In-Car Infotainment Market was valued at USD 16.4 billion in 2023 and is projected to reach a market size of USD 24.5 billion by the end of 2030. Over the forecast period of 2024 – 2030, the market is projected to grow at a CAGR of 5.9%.

The in-car infotainment market is on a fast track, fueled by the desire for a connected and entertaining driving experience. Consumers are increasingly looking for vehicles equipped with features like seamless smartphone integration, navigation systems, and access to multimedia content. This demand is driving the development of in-vehicle infotainment systems with a variety of features.

Key Market Insights:

Looking ahead, the market is expected to embrace cutting-edge technologies to further enhance the in-car experience. Integration of the Internet of Things (IoT) is anticipated, allowing for features like real-time traffic updates and remote diagnostics. Integration in infotainment systems is expected to grow at a CAGR of 16% over the next five years.

Additionally, Augmented Reality (AR) is expected to play a role, creating a more immersive and informative driving experience. AR is projected to grow at a CAGR of 14.5% from 2022 to 2027.

User-friendly interfaces and voice control are also poised to become even more important as the industry prioritizes a seamless and distraction-free user experience.

In-Car Infotainment Market Drivers:

Consumers demand real-time data access for a seamless and efficient driving experience.

Gone are the days of simply listening to the radio while driving. Consumers today crave a connected car experience, one that integrates seamlessly with their digital lives. This translates into a demand for features like real-time traffic updates. Imagine being alerted to unexpected congestion and rerouting your journey to avoid rush hour detours. Additionally, real-time weather information displayed on the infotainment system allows drivers to be prepared for sudden downpours or snowstorms, enhancing safety and overall preparedness.

In-car infotainment systems become central hubs offering smartphone and app integration for a more connected ride.

In-vehicle infotainment systems are no longer just glorified radios. They're evolving into central hubs that offer a variety of functionalities, transforming the driving experience. Seamless smartphone integration is a key feature, allowing drivers to connect their phones for hands-free calling, music streaming, and most importantly, navigation. This eliminates the need to fumble with phones while driving, promoting safer on-road behavior. But it doesn't stop there. Advanced app integration allows drivers to access a whole new world of in-car entertainment.

Integration of advanced driver-assistance systems with infotainment systems enhances driver awareness and promotes safer driving.

The rise of advanced driver-assistance systems (ADAS) is not only revolutionizing car safety but also influencing in-car infotainment. When these systems are integrated with the infotainment system, crucial safety information can be displayed directly to the driver. This can include blind-spot detection warnings or lane departure alerts, enhancing the driver's situational awareness and promoting safer driving by reducing the risk of accidents. Imagine having a visual warning displayed on the infotainment system if a vehicle is approaching your blind spot while you're trying to change lanes.

User-centric features like customizable profiles and natural language voice control personalize the in-car experience.

User-friendliness and customization are becoming top priorities for drivers. In-car infotainment systems are moving towards user-centricity, allowing drivers to personalize their experience. Imagine creating customizable profiles that store individual preferences for music, navigation settings, and even climate control for different drivers in a household. This eliminates the need to constantly adjust settings and ensures a comfortable and personalized driving experience for everyone. Furthermore, voice control with natural language processing is becoming increasingly sophisticated.

In-Car Infotainment Market Restraints and Challenges:

The in-car infotainment market is on a fast track, but there are bumps along the road. While consumers crave features like real-time traffic and weather updates, these often come at a premium. The added cost of advanced infotainment systems can be a barrier for budget-minded car buyers, and subscription fees for services like traffic updates can add to the expense.

Safety is also a concern. Distraction remains a risk, especially with complex menus or voice recognition systems that require drivers to take their eyes off the road. As in-car infotainment becomes more connected, cybersecurity becomes paramount. Hackers could potentially access personal data or disrupt vehicle functions, making robust security measures a top priority.

Technology itself presents a challenge. The rapid pace of innovation, while exciting, can lead to infotainment systems becoming outdated quickly. Consumers may be hesitant to invest in a system that might be obsolete within a few years. Finally, seamless integration of various technologies within the system can be tricky. Compatibility issues between smartphones and apps can disrupt user experience, creating frustration for drivers. Despite these challenges, the in-car infotainment market is poised for growth. By addressing these concerns and continuing to innovate, the industry can create a safe, user-friendly, and feature-rich experience for drivers of the future.

In-Car Infotainment Market Opportunities:

The in-car infotainment market isn't just about overcoming challenges, it's brimming with opportunities. Personalization is key, with features like user profiles storing music preferences, navigation settings, and even climate control for different drivers. Voice control can become even more intuitive, mimicking natural language for a smoother experience. Looking ahead, exciting tech integration is on the horizon. The Internet of Things (IoT) could provide hyper-accurate traffic updates and suggest nearby points of interest. Imagine never missing a turn with Augmented Reality (AR) displaying directions directly on the windshield. Safety remains paramount, with advanced driver-assistance systems (ADAS) offering real-time warnings through the infotainment system. Features promoting driver wellness, like fatigue detection, could also be integrated.

Subscription-based services can make advanced features more accessible. Paying only for the features in use, like music streaming or advanced navigation opens the door for a wider range of car buyers to experience the benefits of in-car infotainment. But at the end of the day, it's all about user experience. Carmakers need to prioritize intuitive and user-friendly systems that minimize distraction. Voice control, gesture recognition, and clear interfaces are all crucial for creating a truly enjoyable in-car experience for drivers.

IN-CAR INFOTAINMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Installation Type, Component, Service, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Harman International, Panasonic Corporation, Alps Alpine, Robert Bosch, Continental, Denso Corporation, Ford Motor Company, General Motors Company, BMW Group, Volkswagen AG, Samsung Electronics |

In-Car Infotainment Market Segmentation: By Installation Type

-

OEM (Original Equipment Manufacturer)

-

Aftermarket

The in-car infotainment market is segmented by installation type, with OEM (Original Equipment Manufacturer) systems, pre-installed by carmakers, currently holding the dominant share. This is because OEM systems offer a seamless integration with the vehicle. However, the aftermarket segment is seeing the fastest growth. This is due to the increasing demand for customization options and the affordability of aftermarket systems, making them attractive to budget-conscious consumers.

In-Car Infotainment Market Segmentation: By Component

-

Hardware

-

Software

In the By Component sector, Hardware is the most dominant segment due to the increasing demand for features like larger touchscreens, high-resolution displays, and advanced audio systems. However, the Software segment is expected to be the fastest-growing segment. This is driven by the rising popularity of in-car apps, integration with advanced driver-assistance systems, and the need for continuous software updates to ensure functionality and security.

In-Car Infotainment Market Segmentation: By Service

-

Entertainment

-

Navigation

-

Communication

-

Safety & Security

The dominant service segment in the in-car infotainment market is likely Entertainment, encompassing features like music streaming, radio, and video playback. This segment caters to the basic desire for a comfortable and entertaining driving experience. On the other hand, the fastest-growing segment is expected to be Safety & Security. With rising concerns about driver safety and the increasing adoption of ADAS, features like emergency calling and integration with driver-assistance systems are gaining significant traction.

In-Car Infotainment Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The North America market boasts a high demand for cutting-edge features and seamless connectivity with almost 45% of the total market share in 2023. Consumers here expect advanced functionalities like navigation with real-time traffic updates, music streaming integration, and smartphone mirroring. The presence of established carmakers and a strong focus on technological innovation drive the market forward.

European markets prioritize safety and premium features. Strict regulations push car manufacturers to integrate advanced driver-assistance systems (ADAS) with in-car infotainment for a safer driving experience. Additionally, European consumers often seek high-quality audio systems and luxurious in-car entertainment options.

Asia-Pacific is experiencing rapid growth in the in-car infotainment market, fueled by a growing middle class and increasing car ownership. Affordability is a key factor here, with a rising demand for cost-effective in-car infotainment systems. However, the market is also catching up with advanced features, with a growing interest in smartphone integration and navigation systems.

COVID-19 Impact Analysis on the In-Car Infotainment Market:

The COVID-19 pandemic undeniably impacted the in-car infotainment market, acting like a double-edged sword. Lockdowns and supply chain disruptions led to car manufacturer slowdowns, creating a shortage of vehicles with these advanced systems. Additionally, the economic downturn caused a decrease in consumer spending on new cars, further impacting market growth. Some consumers even shifted priorities, placing less emphasis on features like navigation and entertainment during lockdowns.

However, there were also positive consequences. The pandemic highlighted the importance of connectivity, leading to a rise in features like real-time traffic updates and remote diagnostics as people relied more on personal vehicles for safe travel. Hygiene concerns also played a role, with voice control and touchless interaction becoming more desirable. This trend could influence the development of user interfaces that minimize physical contact. Finally, a potential long-term boost might be on the horizon. Public transportation concerns during the pandemic may have led some consumers to prioritize car ownership, which could translate to a future increase in demand for in-car infotainment features. Moving forward, the industry's ability to adapt to these evolving trends and cater to changing consumer needs will be critical for its continued success.

Latest Trends/ Developments:

The in-car infotainment market is constantly evolving, embracing new technologies to enhance the driving experience. One exciting trend is the integration of Artificial Intelligence (AI). AI can personalize your drive by learning your habits and recommending music, navigation routes based on traffic patterns, or even suggesting points of interest you might enjoy. Imagine the system learning the user’s love for a specific coffee shop chain and suggesting a convenient location during a long road trip.

Another key development is the deeper integration of Advanced Driver-Assistance Systems (ADAS) with infotainment. Safety is paramount, and this fusion allows crucial information from features like blind-spot detection or lane departure warnings to be displayed directly on the infotainment screen. This keeps important safety alerts in your field of vision, promoting safer driving practices. Looking ahead, Augmented Reality (AR) navigation has the potential to be a game-changer.

Key Players:

-

Harman International

-

Panasonic Corporation

-

Alps Alpine

-

Robert Bosch

-

Continental

-

Denso Corporation

-

Ford Motor Company

-

General Motors Company

-

BMW Group

-

Volkswagen AG

-

Samsung Electronics

Chapter 1. In-Car Infotainment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. In-Car Infotainment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. In-Car Infotainment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. In-Car Infotainment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. In-Car Infotainment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. In-Car Infotainment Market – By Installation Type

6.1 Introduction/Key Findings

6.2 OEM (Original Equipment Manufacturer)

6.3 Aftermarket

6.4 Y-O-Y Growth trend Analysis By Installation Type

6.5 Absolute $ Opportunity Analysis By Installation Type, 2024-2030

Chapter 7. In-Car Infotainment Market – By Component

7.1 Introduction/Key Findings

7.2 Hardware

7.3 Software

7.4 Y-O-Y Growth trend Analysis By Component

7.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 8. In-Car Infotainment Market – By Service

8.1 Introduction/Key Findings

8.2 Entertainment

8.3 Navigation

8.4 Communication

8.5 Safety & Security

8.6 Y-O-Y Growth trend Analysis By Service

8.7 Absolute $ Opportunity Analysis By Service, 2024-2030

Chapter 9. In-Car Infotainment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Installation Type

9.1.3 By Component

9.1.4 By By Service

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Installation Type

9.2.3 By Component

9.2.4 By Service

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Installation Type

9.3.3 By Component

9.3.4 By Service

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Installation Type

9.4.3 By Component

9.4.4 By Service

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Installation Type

9.5.3 By Component

9.5.4 By Service

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. In-Car Infotainment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Harman International

10.2 Panasonic Corporation

10.3 Alps Alpine

10.4 Robert Bosch

10.5 Continental

10.6 Denso Corporation

10.7 Ford Motor Company

10.8 General Motors Company

10.9 BMW Group

10.10 Volkswagen AG

10.11 Samsung Electronics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The In-Car Infotainment Market was valued at USD 16.4 billion in 2023 and is projected to reach a market size of USD 24.5 billion by the end of 2030. Over the forecast period of 2024 – 2030, the market is projected to grow at a CAGR of 5.9%.

Connected Car Craze, Multifunctional Hub Convenience, Safety Focus with ADAS Integration, Evolving User Preferences for Personalization.

Entertainment, Navigation, Communication, Safety & Security.

Asia-Pacific currently leads the in-car infotainment market due to its large and growing middle class, but North America's focus on advanced features could challenge this dominance in the future.

Harman International, Panasonic Corporation, Alps Alpine, Robert Bosch, Continental, Denso Corporation, Ford Motor Company, General Motors Company, BMW Group, Volkswagen AG, Samsung Electronics.