Immunotherapy-based Pet Care Therapeutics Market size (2025-2030)

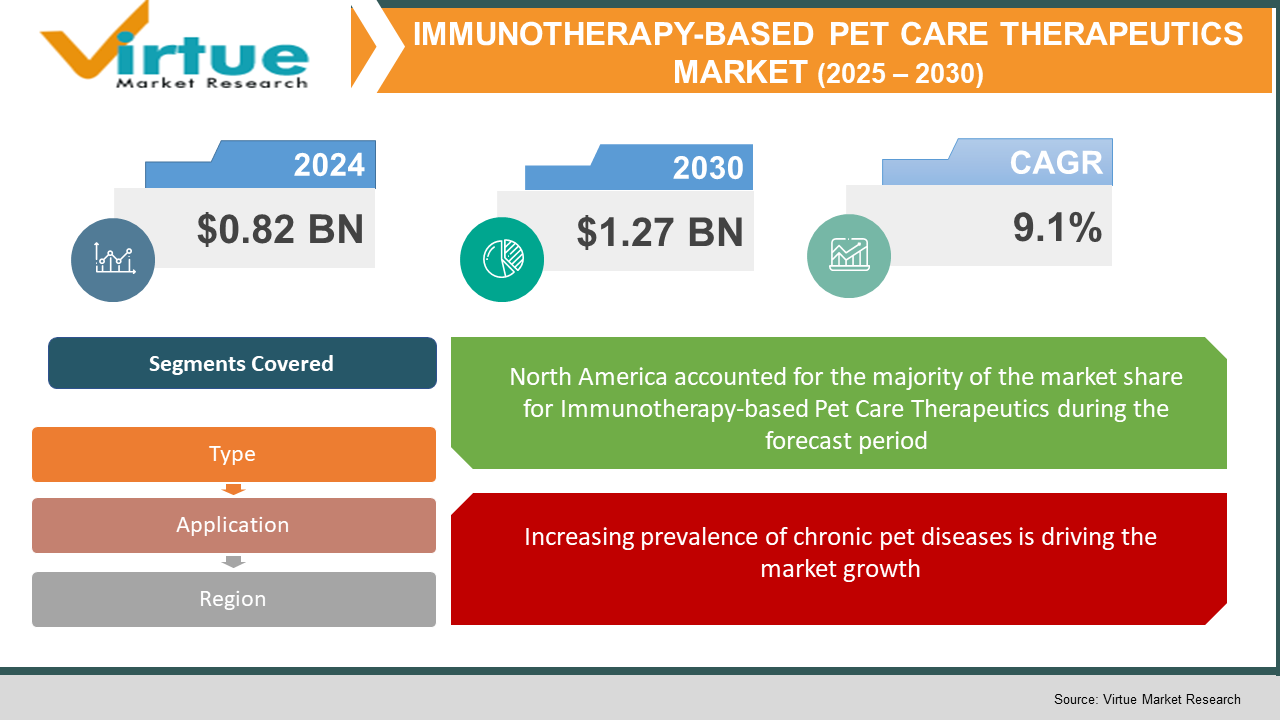

The Global Immunotherapy-based Pet Care Therapeutics Market was valued at USD 0.82 billion in 2024 and will grow at a CAGR of 9.1% from 2025 to 2030. The market is expected to reach USD 1.27 billion by 2030.

The Immunotherapy-based Pet Care Therapeutics Market involves the use of immunotherapy drugs and formulations to treat or manage chronic and infectious diseases in pets, primarily dogs and cats. Immunotherapy in veterinary care focuses on enhancing the animal’s immune response to combat allergies, cancers, and autoimmune diseases. With the increasing humanization of pets and rising awareness among pet owners about advanced treatments, the demand for immunotherapeutic solutions is steadily rising. This market also benefits from the growing prevalence of pet cancers, especially lymphoma and mast cell tumors, where immunotherapy has shown promising results. The development of monoclonal antibodies, allergy-specific immunotherapy, and other biologics tailored for animals is driving innovation. Additionally, the trend of personalized medicine and preventive care for pets is further fueling market growth, especially in North America and Europe.

Key market insights:

- Monoclonal antibody therapy holds the highest share in the product segment, accounting for over 35% of the global revenue in 2024.

- Cancer treatment remains the dominant application, contributing nearly 40% of the total application revenue in 2024.

- North America led the market with a 42% share in 2024, driven by pet insurance penetration and veterinary infrastructure.

- The demand for allergy-specific immunotherapy is growing rapidly, with a projected CAGR of 10.5% during the forecast period.

Global Immunotherapy-based Pet Care Therapeutics Market Drivers

Increasing prevalence of chronic pet diseases is driving the market growth

Chronic illnesses like cancer, osteoarthritis, and inflammatory diseases in pets are becoming more common due to increased lifespan and lifestyle-related factors. Veterinary clinics are reporting a rise in cancer diagnoses among older dogs and cats, creating a demand for long-term and advanced treatment options. Immunotherapy offers a non-invasive, targeted approach to manage such conditions, thereby gaining acceptance among veterinarians and pet owners. As opposed to chemotherapy, immunotherapeutics are often more specific, reducing side effects and improving quality of life. This makes them more appealing for treating chronic ailments. Rising diagnostic capabilities are enabling earlier detection of diseases, allowing timely initiation of immunotherapies. Furthermore, the increased use of regular veterinary check-ups, especially in urban regions, has led to the identification of conditions that were previously overlooked or undiagnosed. This trend supports the wider adoption of therapeutic biologics. With supportive clinical studies validating the efficacy of immunotherapy in conditions like canine lymphoma and feline asthma, chronic diseases continue to be a primary driver for this market.

Growing pet ownership and humanization trends is driving the market growth

Globally, the number of households with companion animals has been steadily increasing, with pets now considered integral members of families. This emotional connection has led to higher willingness to spend on advanced medical treatments, including cutting-edge therapies like immunotherapy. Pet owners are no longer satisfied with basic care; instead, they seek personalized and effective treatments that mirror human healthcare standards. This has especially been the case in North America and Europe where per capita spending on pet health has doubled in the last decade. Pet insurance plans increasingly cover immunotherapeutic treatments, making them more accessible to a broader consumer base. Additionally, millennials, who represent a major portion of pet owners, are more open to adopting innovative medical solutions. They are digitally aware, research-oriented, and tend to seek premium health options for their pets. This shift in consumer behavior underlines the growing relevance of the immunotherapy-based therapeutics segment in veterinary care.

Advancements in veterinary immunotherapy technologies is driving the market growth

The immunotherapy segment in pet care is being reshaped by biotechnological innovations. From recombinant cytokines and monoclonal antibodies to dendritic cell therapies, the tools of human oncology and immunology are being adapted for veterinary use. Companies are developing animal-specific monoclonal antibodies that modulate immune pathways to treat diseases like atopic dermatitis and osteosarcoma. These innovations have increased treatment specificity, reduced adverse reactions, and improved therapeutic outcomes in pets. Additionally, allergen-specific immunotherapy (ASIT) has witnessed significant improvements, offering customized formulations for individual pets, which enhance tolerance and minimize allergic flare-ups. Advances in diagnostics have made it easier to identify disease biomarkers and tailor immunotherapy regimens accordingly. Moreover, strategic collaborations between human biotech companies and veterinary pharmaceutical firms are accelerating the translation of successful therapies from humans to animals. This convergence of technology and veterinary sciences has positioned immunotherapy as a revolutionary approach to pet care, unlocking new treatment possibilities and broadening the scope of therapeutic intervention.

Global Immunotherapy-based Pet Care Therapeutics Market Challenges and Restraints

High treatment costs and limited affordability is restricting the market growth

Immunotherapy treatments, while effective, are significantly more expensive than traditional therapies such as antibiotics or corticosteroids. Monoclonal antibodies and biologics require complex manufacturing processes, contributing to high development and retail costs. For many pet owners, especially in low-income and middle-income regions, the price point of these therapies remains a barrier. Additionally, veterinary clinics must invest in specialized infrastructure and training to administer immunotherapeutic solutions, increasing overhead costs that are passed on to consumers. Pet insurance policies that cover immunotherapy are still limited in scope and availability in many countries. In regions without sufficient insurance penetration, the out-of-pocket burden restricts access to these treatments. Moreover, unlike human healthcare systems, there are limited reimbursement mechanisms for pet treatments, making affordability a consistent challenge. Until the cost structure is optimized through mass production, biosimilars, or government support, affordability will remain a major restraint.

Lack of awareness and trained veterinary professionals is restricting the market growth

Despite increasing interest in advanced veterinary care, there remains a significant knowledge gap among general practitioners about immunotherapy for pets. Many veterinarians, especially in emerging markets, still rely on conventional methods and are unaware of the latest immunological advancements. Training on immunotherapy administration and patient selection is sparse in most veterinary curricula. This knowledge gap restricts the wider application of immunotherapy solutions. In some regions, even if the products are available, veterinarians may not feel confident in recommending or administering them due to lack of case exposure or hands-on training. Furthermore, the general public is often unaware of immunotherapeutic options for pets, leading to lower demand. Without effective awareness campaigns and continuing education for veterinary professionals, this market risks underpenetration, particularly in developing countries. Bridging this educational and informational divide is essential to fully realize the market’s potential and ensure that pet owners receive accurate guidance on treatment options.

Market opportunities

The global Immunotherapy-based Pet Care Therapeutics Market is poised for transformative growth, with multiple untapped avenues presenting significant opportunities for stakeholders. One key area lies in expanding access to immunotherapeutics in emerging economies, where pet ownership is rising rapidly but advanced veterinary care remains limited. By developing cost-effective biologics and establishing local production hubs, companies can make these therapies more accessible and affordable. Another major opportunity is in expanding species coverage. While current immunotherapies predominantly focus on dogs and cats, there is a growing market for treatments targeting exotic pets and small mammals, which are increasingly kept as companions. Additionally, there is significant potential in the development of preventive immunotherapy solutions, including vaccines and immunostimulants that can proactively strengthen the immune system against chronic diseases. The integration of artificial intelligence and machine learning in diagnostics can further personalize immunotherapy regimens based on individual pet genetics, thereby increasing efficacy and reducing trial-and-error treatments. Moreover, partnerships between human biotech firms and veterinary health providers can accelerate technology transfer and reduce R&D costs. The emergence of tele-veterinary services and digital health platforms also presents a unique opportunity to improve education around immunotherapy and facilitate remote consultations. Regulatory bodies are increasingly supporting pet wellness innovations, streamlining approval pathways for veterinary biologics. Combined with a cultural shift toward holistic and preventative pet care, these developments are paving the way for a more inclusive and scalable market for immunotherapy-based pet therapeutics.

IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

14.1% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zoetis, Merck Animal Health, Elanco, Virbac, Ceva Santé Animale, Aratana Therapeutics, Kindred Biosciences, VetStem Biopharma, Torigen Pharmaceuticals, and Biovet. |

Immunotherapy-based Pet Care Therapeutics Market segmentation

Immunotherapy-based Pet Care Therapeutics Market segmentation By Type:

• Monoclonal Antibodies

• Allergy-specific Immunotherapy

• Cancer Vaccines

• Recombinant Cytokines

• Immunostimulants

Monoclonal antibodies dominate the landscape, accounting for over one-third of the market revenue in 2024. These biologics are highly targeted and effective in treating chronic conditions like lymphoma and atopic dermatitis. Their specificity reduces side effects, and they offer long-lasting results. They are widely accepted among veterinary professionals and are increasingly covered by pet insurance plans. Advancements in animal-specific monoclonal antibodies have further fueled this segment's growth, and strong pipeline developments point to sustained dominance.

Immunotherapy-based Pet Care Therapeutics Market segmentation By Application:

• Cancer Treatment

• Allergy Management

• Autoimmune Diseases

• Infectious Diseases

• Others

Cancer treatment leads the application segment with approximately 40% share in 2024. Immunotherapy offers a targeted approach to managing cancers like mast cell tumors and lymphoma in dogs and cats. Its growing preference over chemotherapy, due to lower toxicity and higher precision, has cemented its position in oncology-focused veterinary practices. The emotional value associated with prolonging pet life has further increased demand for advanced treatments in this area. Continued innovation and success rates will maintain its leading role.

Immunotherapy-based Pet Care Therapeutics Market Regional segmentation

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

North America holds the largest share in the global Immunotherapy-based Pet Care Therapeutics Market, accounting for 42% in 2024. This dominance is attributed to widespread pet insurance coverage, high veterinary healthcare expenditure, and early adoption of advanced medical technologies. The United States, in particular, is home to numerous veterinary pharmaceutical and biotech companies actively investing in pet-specific immunotherapies. Strong awareness among pet owners and well-established veterinary hospitals support early diagnosis and treatment uptake. Additionally, regulatory frameworks like the FDA’s Center for Veterinary Medicine ensure efficient product approval processes. Veterinary education in the U.S. emphasizes evidence-based medicine, encouraging broader adoption of immunotherapy. Moreover, pet ownership in North America continues to rise, with pet parents increasingly willing to invest in premium healthcare. The presence of organized distribution networks and veterinary chains further supports product availability and accessibility. Combined, these factors position North America as the undisputed leader in this market and a primary driver of global growth.

COVID-19 Impact Analysis on the Immunotherapy-based Pet Care Therapeutics Market

The COVID-19 pandemic had a multifaceted impact on the Immunotherapy-based Pet Care Therapeutics Market. In the initial stages of the pandemic, global supply chains were severely disrupted, delaying clinical trials and manufacturing processes for veterinary immunotherapies. Veterinary clinics operated under restricted hours, limiting the number of elective procedures and consultations, which led to deferred diagnoses and treatment plans. However, the pandemic also reinforced the emotional importance of pets, leading to a surge in pet adoptions and stronger human-animal bonds. As people spent more time at home, they became more attentive to their pets' health, leading to increased veterinary visits once restrictions eased. Telehealth platforms for pet care gained popularity, enabling continuity of care and consultations for chronic illnesses. These virtual platforms became valuable tools for discussing immunotherapy options with pet owners. The increased digital awareness and growing acceptance of preventive care played a key role in boosting long-term demand. Additionally, the pandemic exposed vulnerabilities in global veterinary drug supply chains, prompting local production initiatives and investments in veterinary biotechnology. In the medium term, manufacturers have adapted by diversifying supply chains and prioritizing biologics that support immune health. The post-pandemic period is expected to witness a rise in immunotherapy adoption, especially as awareness around disease prevention and chronic condition management continues to grow. Overall, while short-term disruptions were significant, the long-term impact of COVID-19 is likely to be positive for the market, accelerating innovation, demand, and investment in veterinary immunotherapeutics.

Latest trends/Developments

The Immunotherapy-based Pet Care Therapeutics Market is undergoing significant transformation driven by technological innovation, strategic collaborations, and evolving consumer expectations. One major trend is the emergence of personalized immunotherapy, where treatments are tailored to an individual pet’s genetic and immunological profile. Advances in genomic sequencing and AI-powered diagnostics are making this approach more viable and scalable. Another key trend is the increasing investment by human pharmaceutical companies in the veterinary sector, with many leveraging their biologics expertise to develop animal-specific treatments. Collaborations between biotech startups and established veterinary players have led to the rapid commercialization of innovative therapies, including monoclonal antibodies and therapeutic vaccines. In parallel, veterinary telemedicine is evolving to include remote immunotherapy monitoring, making follow-up care more accessible. The regulatory landscape is also adapting, with faster approval pathways for animal biologics. There’s growing interest in “green immunotherapy,” which involves using plant-based or naturally derived immune-boosting compounds. Additionally, startups are working on delivery innovations, such as long-acting injectables and transdermal patches, to improve treatment compliance. In terms of distribution, e-commerce platforms are gaining traction, offering direct-to-consumer access to immunomodulatory supplements and veterinary prescriptions. Another trend worth noting is the rising use of immunotherapy in preventive veterinary care, such as allergy prevention in young pets. As consumers demand higher transparency, companies are also investing in education and awareness campaigns around biologics and their benefits. Altogether, these developments signal a rapidly maturing market that is poised to deliver high-value care and broaden the horizons of pet healthcare.

Key Players:

- Zoetis

- Elanco

- Virbac

- Boehringer Ingelheim

- Kindred Biosciences

- Aratana Therapeutics

- Biovet

- VetImmune

- Nextmune

- VetStem Biopharma

Chapter 1. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Monoclonal Antibodies

6.3 Allergy-specific Immunotherapy

6.4 Cancer Vaccines

6.5 Recombinant Cytokines

6.6 Immunostimulants

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Cancer Treatment

7.3 Allergy Management

7.4 Autoimmune Diseases

7.5 Infectious Diseases

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. IMMUNOTHERAPY-BASED PET CARE THERAPEUTICS MARKET – Company Profiles – (Overview, Type , Portfolio, Financials, Strategies & Developments)

9.1 Zoetis

9.2 Elanco

9.3 Virbac

9.4 Boehringer Ingelheim

9.5 Kindred Biosciences

9.6 Aratana Therapeutics

9.7 Biovet

9.8 VetImmune

9.9 Nextmune

9.10 VetStem Biopharma

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global market was valued at USD 0.82 billion in 2023 and is projected to reach USD 1.27 billion by 2030, growing at a CAGR of 14.1% during the forecast period.

Major drivers include rising pet ownership, increasing chronic pet diseases, innovation in veterinary immunotherapies, and growing acceptance of biologics in veterinary medicine.

Segments include:

By Type: Monoclonal Antibodies, Vaccines, Allergen-specific Immunotherapy

By Application: Cancer, Allergies, Autoimmune Disorders

North America leads the market with over 38% share, driven by advanced veterinary infrastructure, strong R&D investments, and widespread pet healthcare awareness.

Zoetis, Merck Animal Health, Elanco, Virbac, Ceva Santé Animale, Aratana Therapeutics, Kindred Biosciences, VetStem Biopharma, Torigen Pharmaceuticals, and Biovet.