Immunotherapy-based Pet Cancer Therapeutics Market Size (2024 –2030)

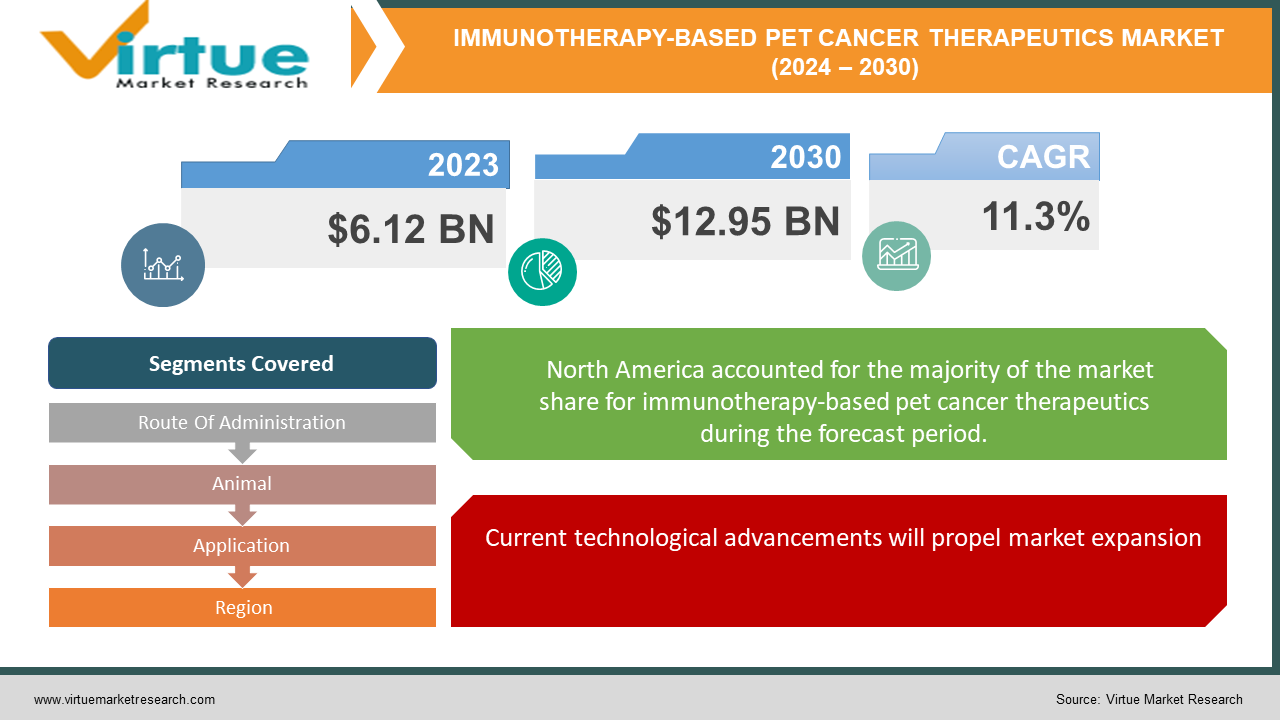

The Global Immunotherapy-based Pet Cancer Therapeutics Market was estimated to be worth USD 6.12 billion in 2023 and is projected to reach a value of USD 12.95 billion by 2030, growing at a CAGR of 11.3% during the forecast period 2024-2030.

Specialized medical care known as "pet cancer therapy" is used to diagnose, treat, and manage cancer in animals such as cats and dogs. It includes similar treatments to those given to cancer patients in humans, such as immunotherapy, chemotherapy, radiation therapy, targeted therapies, and palliative care. These therapies are offered by veterinary oncologists to aid animals suffering from various cancers and enhance their quality of life. With the advancement of veterinary medicine, pet owners can now provide their beloved pets with comprehensive and compassionate treatment for cancer, thanks to the increased availability and effectiveness of these therapies. Boehringer Ingelheim International GmbH's NexGard PLUS, a new chewable tablet that guards against both internal and external parasites, has received FDA approval. Its active components, which include pyrantel, moxidectin, and afoxolaner, combine to offer a potent defense against common parasite threats. Bexacat (bexagliflozin tablets) received FDA clearance, marking a significant milestone for Elanco Animal Health Incorporated. This novel oral therapy is the first of its kind for feline diabetes and presents a fresh method of treating the illness without injecting insulin. Bexacat tablets fill a gap in veterinary medicine and are simple to use. Leading biotechnology business ELIAS Animal Health LLC, which specializes in treating cancer in pets, has made a noteworthy development in oncolytic virotherapy. Utilizing a modified strain of the vaccinia virus, their ground-breaking Oncolytic Vaccinia Virus Treatment—which Genelux Corporation has now licensed—targets and eliminates cancer cells in companion animals. Because the virus can selectively infect and kill cancer cells while sparing healthy tissue, this therapy offers a novel approach to treating a variety of pet cancers.

Key Market Insights:

Monoclonal antibody therapies account for approximately 35% of the immunotherapy-based pet care therapeutics market share, driven by their targeted approach and effectiveness in treating various conditions, particularly in oncology.

The canine segment constitutes around 60% of the market demand for immunotherapy-based pet care therapeutics, reflecting the larger population of dogs as pets and the higher incidence of certain diseases amenable to immunotherapy in canines.

In terms of application, cancer immunotherapy represents about 45% of the market share, as cancer remains one of the leading causes of death in companion animals and immunotherapy offers promising treatment options.

The adoption of personalized immunotherapy treatments for pets, tailored to an individual animal's specific condition and genetic profile, is growing at a rate of approximately 18% annually, driven by advancements in veterinary medicine and the increasing willingness of pet owners to invest in cutting-edge treatments for their animals.

Global Immunotherapy-based Pet Cancer Therapeutics Market Drivers:

Expanding pet ownership and the human-animal bond can support industry growth:

The growing number of pet owners and their growing emotional attachment to their animals has had a significant impact on the market for cancer therapies for animals. Many people feel deeply responsible for the health and well-being of their pets because they view them as beloved family members. This attachment prompts pet owners to spend more money on cutting-edge cancer therapies in an effort to heal ailments and improve the quality of life for their animals. Pet owners are becoming more willing to spend money on innovative cancer therapies that can better treat their pets' conditions, reduce their pain, and lengthen their lives. This demand highlights a growing need for effective treatments that address these issues and reflects a desire to give their cherished animals the best care possible.

Current technological advancements will propel market expansion:

Ongoing research and studies have played a major role in the recent advances in animal oncology and therapy. Researchers have devoted their efforts to developing novel anticancer drugs, increasing their potency, and reducing any potential harm to pets' health. This dedication is essential as groups like the Petco Foundation, the Animal Cancer Foundation, the PetCure Oncology Veterinary Cancer Society, and others work together to create targeted cancer treatments with low side effects. Growing funding for oncology research in animals is propelling the creation of novel cancer therapies that put patient safety and effectiveness first. This funding expedites advancement in both fields by supporting research initiatives meant to identify commonalities between canine and human cancers. The ultimate objective is to progress cancer treatment options, enhancing quality of life and improving outcomes through novel therapies, for both humans and pets.

Immunotherapy-based Pet Cancer Therapeutics Market Challenges and Restraints:

One major obstacle to the global market for cancer drugs is the cost of pet cancer therapies. Pet owners may face significant financial hardships due to the costs of diagnostics, procedures, radiation therapy, and prescription drugs. Many pet owners are unable to afford advanced cancer treatments due to their high costs, which forces them to make difficult decisions about the level of care they can provide for their animals. Pricing is still a major problem for pet cancer medications, even in the face of growing demand and awareness. Restricting access to these treatments modifies market dynamics and influences the availability and uptake of advanced therapies in general. In order to guarantee that pets receive the best care possible without financial limitations limiting treatment options, it is still imperative that these cost challenges be addressed.

Immunotherapy-based Pet Cancer Therapeutics Market Opportunities:

The way that money is spent on veterinary care has changed significantly because people now view their pets as loved family members rather than merely companions. Due to this evolution, pet owners are now much more willing to spend money on giving their dogs long, healthy lives. The cost of treating cancer in pets has increased as a result of increased awareness of the available cancer therapy options. More and more pet owners are prepared to spend money on cutting-edge cancer treatments in an effort to enhance the general health and well-being of their animals. This pattern demonstrates a great desire to give their animals the best care possible. The general rise in veterinary healthcare expenditures is another factor driving the market for cancer treatments for pets. Opportunities for research, creativity, and the creation of cutting-edge cancer treatment options for pets are made possible by this financial support. As a result, new approaches to pet cancer therapy are constantly emerging, improving the prognosis and quality of life for animals with the disease.

IMMUNOTHERAPY-BASED PET CANCER THERAPEUTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.3% |

|

Segments Covered |

By Route of Administration, animal, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AB Science, Boehringer Ingelheim International GmbH, ELIAS Animal Health LLC, Karyopharm Therapeutics,Pfizer Inc., Regeneus Ltd., Rhizen Pharmaceuticals AG, Torigen Pharmaceuticals Inc., VetDC Inc., Virbac, Zoetis Inc. |

Global Immunotherapy-based Pet Cancer Therapeutics Market Segmentation: By Route of Administration

-

Oral

-

Injection

With a 47% market share in 2022, oral administration overtook other categories as the most popular category for immunotherapy-based pet cancer treatments. This dominance is ascribed to the accessibility of different oral immunotherapy options, including liquids, pills, and capsules, which provide easy administration at a reasonable cost. Anticipating future developments, the injectable mode of administration is anticipated to grow at the quickest rate, with a compound annual growth rate (CAGR) of 10.2% over the estimated period. This projected growth is due to a number of factors, including the perception that injectable therapies are more effective than oral ones, acting more quickly and carrying a lower risk of side effects. The range and effectiveness of injectable immunotherapy options for treating pet cancer are also being increased by developments in injectable technologies, such as intratumoral and subcutaneous injection equipment.

Global Immunotherapy-based Pet Cancer Therapeutics Market Segmentation: By animal

-

Dogs

-

Cats

With 52% of cases worldwide, dogs account for a larger share of the pet cancer therapy market than cats or other animals. Dog owners are generally more willing to seek out and pay for cancer treatments for their cherished pets, and dogs have a higher incidence of cancer than cats or other pets. These factors contribute to the dominance of dogs over other pet species. The growth of the industry has been further supported by the fact that significant research and development efforts in canine cancer treatments have been sparked by the genetic similarities between humans and dogs. On the other hand, with a projected growth rate of 39%, cats are predicted to have the fastest growth rate in the pet cancer therapy market. This increase is caused by a number of factors, including the fact that cats typically live longer than many other pets, which makes them more vulnerable to age-related diseases like cancer. Additionally, the number of cats worldwide is increasing steadily, which expands the pool of possible patients. The ability to identify and treat cancer in cats has improved due to advancements in feline healthcare and diagnostics, which has increased the demand for specialized therapies catered to the unique needs of felines. In summary, cats are positioned for rapid growth driven by their longer lifespans, increasing population, and advancements in feline healthcare, while dogs currently dominate the market for pet cancer therapies due to higher incidence rates and owners' willingness to invest in treatments. The continuous efforts to improve pet cancer treatments through research and development are beneficial to both segments.

Global Immunotherapy-based Pet Cancer Therapeutics Market Segmentation: By Application

-

Lymphoma

-

Mast Cell Cancer

-

Melanoma

-

Mammary

-

Squamous Cell Cancer

-

Others

Due to a number of factors, lymphoma has the largest share (38%) of pet cancer treatments worldwide. Both dogs and cats can develop lymphoma, a cancer that is frequently treated effectively with a variety of veterinary oncology treatment options. Treatment developments, such as customized chemotherapy regimens, have greatly enhanced the prognosis of pets with lymphoma. Its dominant position in the market is a result of a combination of high incidence rates and generally positive treatment outcomes. Conversely, at 24%, melanoma is growing at the fastest rate in the market. There are other reasons for this increase as well. Melanoma is a kind of skin cancer that can affect both dogs and cats, and its occurrence has been rising recently. Currently, pet owners are keeping a closer eye on the condition of their pets' skin, which allows for early detection and treatment. Furthermore, developments in veterinary oncology have led to more precise and effective treatments created especially for the management of melanoma in animals. The melanoma category in the pet cancer therapeutics market is growing due to consumer demand for customized treatments designed for this particular cancer type.

Global Immunotherapy-based Pet Cancer Therapeutics Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

With a commanding 48% market share, the North American region is set to lead the pet cancer therapeutics sector. The prevalence of pet cancers, growing per capita veterinary care spending, rising pet adoption rates, a strong healthcare system, and the existence of significant market players are some of the factors contributing to this dominance. With almost 90 million dog owners in the US alone, the market for pet cancer treatments has significant potential in this area. The need for efficient healthcare solutions is growing along with awareness of pet health issues. On the other hand, with an anticipated growth rate of 33%, the Asia-Pacific region is witnessing the fastest growth in the pet cancer treatment market. Pet ownership is expanding quickly in nations like China and India thanks to rising middle class and disposable income levels. Alongside this shift in culture toward pet ownership, there is a growing demand for cutting-edge treatment options due to increased awareness of pet health issues, such as cancer. The availability of specialized veterinary care centered on cancer therapies and growing public awareness are driving the rapid evolution of the pet healthcare sector in the region.

COVID-19 Impact on the Global Immunotherapy-based Pet Cancer Therapeutics Market:

Due to alterations in the veterinary healthcare system, the pet cancer treatment market experienced considerable difficulties and slower growth during the COVID-19 pandemic. According to the 2020 report from the Global Animal Health Association, a lot of pet owners reported that their animals had delays or missed veterinary appointments, which is indicative of larger problems with access to veterinary care. The availability of regular and specialized care for pets, including cancer treatments, was impacted by these disruptions. To protect their pets' health during the pandemic, pet owners resorted more and more to pet medications in response to these difficulties. This change in consumer behavior raised the demand for pet health medications intended to prevent and treat chronic illnesses, such as cancer. Despite these challenges, the coordinated efforts of animal welfare organizations—which supplied crucial services and support during the pandemic—benefited the animal healthcare system. During the COVID-19 disruptions, these organizations were instrumental in advancing therapies and maintaining continuity in pet care.

Latest Trend/Development:

Trends and advancements in immunotherapy-based pet care therapeutics are happening quickly. In order to make pet treatments safer and more effective, researchers are always working to improve them. Because oral immunotherapy is simple for pet owners to administer, it continues to be popular for use in pill and liquid form. Because they act quickly and have fewer side effects, injectables like intratumoral and subcutaneous injections are becoming more and more popular. Utilizing genetic data and health profiles, personalized treatments catered to the specific requirements of each pet are becoming increasingly popular. The development of novel, targeted treatments is also aided by technologies such as AI and genomics. The safety and efficacy of these treatments are guaranteed by regulatory approvals and standards.

Key Players:

-

AB Science

-

Boehringer Ingelheim International GmbH

-

Elanco Animal Health Incorporated

-

ELIAS Animal Health LLC

-

Karyopharm Therapeutics

-

Pfizer Inc.

-

Regeneus Ltd.

-

Rhizen Pharmaceuticals AG

-

Torigen Pharmaceuticals Inc.

-

VetDC Inc.

-

Virbac

-

Zoetis Inc.

Market News:

-

To help save the lives of animals in Fort Wayne, Petco Love, a nationwide nonprofit organization, gave $35,000 to Fort Wayne Animal Care and Control in July 2022.

-

June 2022 saw Petco Love uphold its long-standing commitment to the Cornell University College of Veterinary Medicine by contributing $75,000 to help defray the cost of dogs' and cats' cancer treatments. These contributions demonstrate Petco Love's dedication to promoting veterinary care and animal welfare.

Chapter 1. Immunotherapy-based Pet Cancer Therapeutics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Immunotherapy-based Pet Cancer Therapeutics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Immunotherapy-based Pet Cancer Therapeutics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Immunotherapy-based Pet Cancer Therapeutics Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Immunotherapy-based Pet Cancer Therapeutics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Immunotherapy-based Pet Cancer Therapeutics Market – By Route of Administration

6.1 Introduction/Key Findings

6.2 Oral

6.3 Injection

6.4 Y-O-Y Growth trend Analysis By Route of Administration

6.5 Absolute $ Opportunity Analysis By Route of Administration, 2024-2030

Chapter 7. Immunotherapy-based Pet Cancer Therapeutics Market – By animal

7.1 Introduction/Key Findings

7.2 Dogs

7.3 Cats

7.4 Y-O-Y Growth trend Analysis By animal

7.5 Absolute $ Opportunity Analysis By animal, 2024-2030

Chapter 8. Immunotherapy-based Pet Cancer Therapeutics Market – By Application

8.1 Introduction/Key Findings

8.2 Lymphoma

8.3 Mast Cell Cancer

8.4 Melanoma

8.5 Mammary

8.6 Squamous Cell Cancer

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Immunotherapy-based Pet Cancer Therapeutics Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Route of Administration

9.1.3 By animal

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Route of Administration

9.2.3 By animal

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Route of Administration

9.3.3 By animal

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Route of Administration

9.4.3 By animal

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Route of Administration

9.5.3 By animal

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Immunotherapy-based Pet Cancer Therapeutics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 AB Science

10.2 Boehringer Ingelheim International GmbH

10.3 Elanco Animal Health Incorporated

10.4 ELIAS Animal Health LLC

10.5 Karyopharm Therapeutics

10.6 Pfizer Inc.

10.7 Regeneus Ltd.

10.8 Rhizen Pharmaceuticals AG

10.9 Torigen Pharmaceuticals Inc.

10.10 VetDC Inc.

10.11 Virbac

10.12 Zoetis Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Immunotherapy-based Pet Cancer Therapeutics Market was estimated to be worth USD 6.12 billion in 2023 and is projected to reach a value of USD 12.95 billion by 2030, growing at a CAGR of 11.3% during the forecast period 2024-2030.

Growing the human-animal relationship and pet ownership can help the industry grow and Modern technical developments that will push the market growth are the factors driving the Global Immunotherapy-based Pet Cancer Therapeutics Market.

The market's expansion may be hampered by high treatment costs.

Melanoma application type is the fastest growing in the Global Immunotherapy-based Pet Cancer Therapeutics Market.

Asia-Pacific region is the fastest growing in the Global Immunotherapy-based Pet Cancer Therapeutics Market.