Immune Response Testing Market Size (2024–2030)

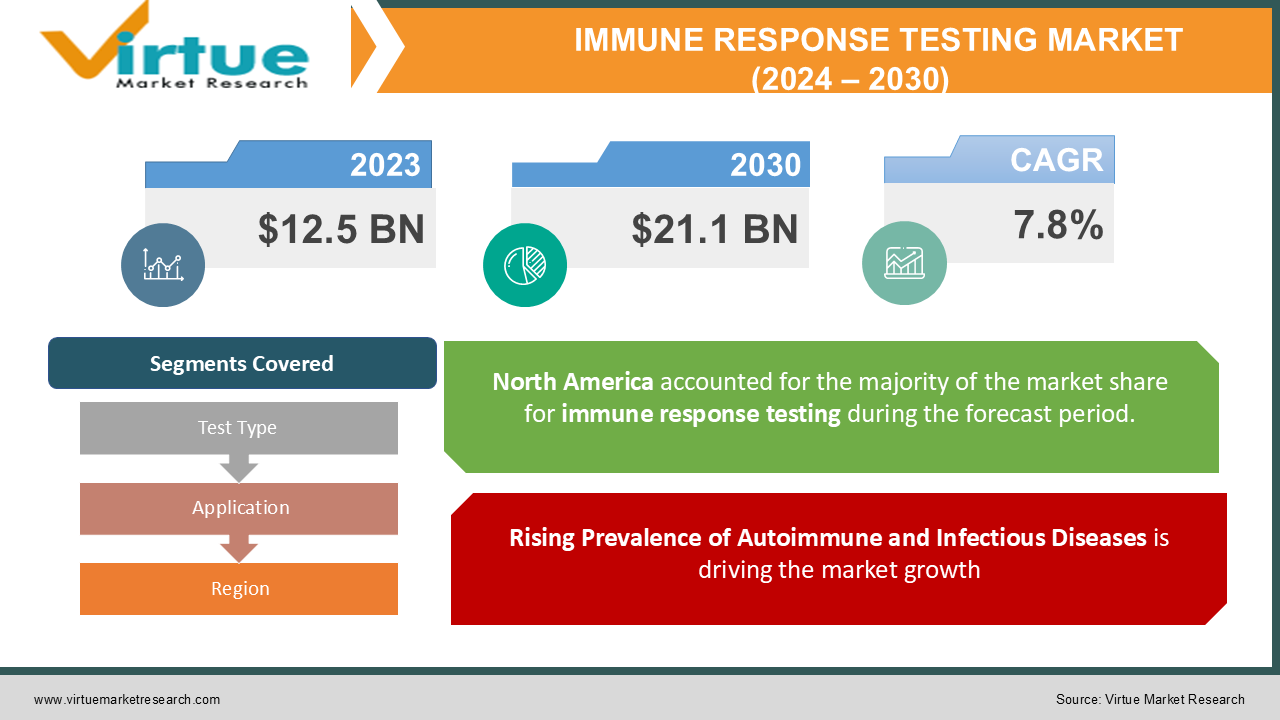

The Global Immune Response Testing Market was valued at USD 12.5 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030, reaching approximately USD 21.1 billion by the end of 2030.

Immune response testing refers to diagnostic procedures and assays that evaluate the immune system's reaction to infections, vaccines, allergens, and therapies. These tests are critical in the fields of clinical diagnostics, vaccine development, and drug discovery as they provide insight into how the immune system functions and responds to various stimuli.

The increasing prevalence of autoimmune diseases, infectious diseases, and the global focus on vaccine development, particularly in light of the COVID-19 pandemic, are significant factors driving the market's growth. Moreover, the surge in research and development activities for immunotherapies and personalized medicine has created a greater demand for advanced immune response testing technologies.

Key Market Insights:

-

The serological tests segment accounted for approximately 30% of the market share in 2023, driven by the widespread use of antibody-based tests in disease diagnostics and vaccine efficacy assessments.

-

Cell-based assays are expected to grow at the fastest CAGR of 8.5%, owing to their increasing application in immunotherapy research and cancer treatment development.

-

The clinical diagnostics application held over 50% of the total market revenue in 2023, attributed to the rising number of autoimmune and infectious disease diagnoses.

-

The Asia-Pacific region is expected to witness the fastest growth, with a CAGR of 9.3%, due to increasing healthcare expenditure, expanding biotechnology industry, and growing focus on vaccine development.

-

The rise of personalized medicine is a significant trend shaping the immune response testing market, as it demands highly specific immune function tests to tailor therapies for individual patients.

Global Immune Response Testing Market Drivers:

Rising Prevalence of Autoimmune and Infectious Diseases is driving the market growth

The increasing global prevalence of autoimmune diseases such as rheumatoid arthritis, lupus, and multiple sclerosis, along with infectious diseases like HIV, tuberculosis, and viral infections, is a major driver for the immune response testing market. Autoimmune diseases occur when the immune system mistakenly attacks healthy tissues in the body, leading to chronic inflammation and damage. Immune response tests, including cytokine release assays and cell-based assays, play a critical role in diagnosing these conditions by evaluating the activity of immune cells and their response to various antigens. Similarly, infectious diseases continue to be a significant health burden worldwide, especially in developing regions. Immune response testing is essential for the early detection and diagnosis of infections, helping healthcare professionals understand the immune system's response to pathogens and guiding treatment decisions. For instance, serological tests that detect antibodies produced by the immune system in response to infections are widely used in the diagnosis of viral and bacterial infections. The growing awareness of these diseases, coupled with advancements in diagnostic technologies, has resulted in increased demand for immune response testing. Additionally, governments and healthcare organizations are placing a strong emphasis on early disease detection and personalized medicine, further driving the market for immune testing solutions.

Growth in Immunotherapy and Vaccine Development is driving the market growth

The rising adoption of immunotherapies, particularly in cancer treatment, is significantly contributing to the growth of the immune response testing market. Immunotherapies harness the body's immune system to fight cancer by stimulating the immune response against tumor cells. Understanding the immune response is critical for determining the effectiveness of these therapies, making immune response tests indispensable in immunotherapy development and monitoring. Additionally, the global focus on vaccine development, especially in the wake of the COVID-19 pandemic, has increased the demand for immune response testing. Vaccine development relies heavily on evaluating the immune system's reaction to vaccine candidates, including the production of specific antibodies and the activation of immune cells. Tests such as ELISA and serological assays are widely used to assess vaccine efficacy and safety during clinical trials. The surge in research activities for developing vaccines for emerging infectious diseases, such as Zika, Ebola, and COVID-19, has further driven the need for advanced immune response testing. Governments, pharmaceutical companies, and academic institutions are investing heavily in vaccine R&D, creating a growing market for immune testing technologies that enable accurate assessment of immune responses during the vaccine development process.

Technological Advancements in Immune Testing Platforms is driving the market growth

Technological advancements in immune testing platforms have significantly enhanced the accuracy, sensitivity, and efficiency of immune response testing. The development of automated and multiplexed immune assays, such as ELISA (enzyme-linked immunosorbent assay) and flow cytometry-based assays, has revolutionized the field by enabling high-throughput screening of multiple biomarkers in a single test. Automated immune testing systems have reduced manual intervention and human error, providing more consistent and reliable results. These systems have also improved the turnaround time for test results, which is particularly critical in clinical diagnostics and research applications. The introduction of multiplex assays, which can simultaneously detect multiple immune markers in a single sample, has greatly enhanced the ability to evaluate complex immune responses, especially in diseases like cancer and autoimmune disorders. Furthermore, innovations in point-of-care (POC) testing devices have made immune response testing more accessible, allowing for rapid and real-time monitoring of immune function in clinical settings and even at home. POC immune tests are increasingly being used in remote or resource-limited areas where access to centralized laboratories may be limited, further expanding the market for immune testing technologies.

Global Immune Response Testing Market Challenges and Restraints:

High Cost of Advanced Immune Testing Technologies is restricting the market growth

One of the major challenges facing the global immune response testing market is the high cost associated with advanced immune testing technologies. Sophisticated diagnostic platforms, such as cell-based assays, multiplex immunoassays, and flow cytometry-based systems, require significant investments in terms of equipment, reagents, and skilled personnel. These high costs can be a barrier to adoption, particularly in resource-limited healthcare settings and developing regions. The cost of immune testing is further exacerbated by the need for specialized laboratories and trained professionals who can perform and interpret complex tests. For example, advanced assays that evaluate immune cell function or cytokine release often require highly skilled technicians and expensive reagents, limiting their accessibility to smaller healthcare facilities and research institutions. Moreover, the reimbursement policies for immune response testing can vary significantly across different countries and healthcare systems, which can impact the affordability of these tests for patients and healthcare providers. In some cases, insurance coverage for advanced immune testing may be limited, leading to out-of-pocket expenses for patients.

Complexity in Immune Response Interpretation is restricting the market growth

Another key challenge in the immune response testing market is the complexity of interpreting immune responses, which can vary widely depending on the individual's health status, genetic factors, and the specific antigen or pathogen being tested. The immune system is highly dynamic and can respond differently to various stimuli, making it difficult to obtain clear and consistent results from immune tests. For example, in autoimmune diseases, the immune system may target the body's own tissues, leading to false-positive results in some tests. Similarly, in immunosuppressed individuals, such as those undergoing cancer treatment or organ transplantation, immune responses may be diminished, resulting in false-negative test results. The variability in immune responses can also complicate the development of standardized testing protocols and reference ranges. This lack of standardization can lead to discrepancies in test results across different laboratories and diagnostic platforms, which can affect the accuracy and reliability of immune testing in clinical practice. To overcome these challenges, ongoing research is focused on developing more precise and personalized immune response testing methodologies that can account for individual variations in immune function. Advances in bioinformatics and data analytics are also being used to improve the interpretation of complex immune data, helping healthcare providers make more informed decisions based on test results.

Market Opportunities:

The global immune response testing market offers substantial growth opportunities, particularly in the areas of personalized medicine, immunotherapy, and infectious disease diagnostics. The increasing demand for personalized treatment strategies has created a need for immune testing solutions that can provide detailed insights into an individual's immune system and tailor therapies accordingly. Immune response tests that can predict how a patient will respond to immunotherapies, such as immune checkpoint inhibitors or CAR-T cell therapies, are becoming critical tools in oncology.In the context of infectious diseases, there is a growing need for rapid and accurate immune tests that can detect immune responses to emerging pathogens, such as COVID-19, and evaluate the effectiveness of vaccines. The development of immune tests that can differentiate between various types of immune responses, such as neutralizing antibodies and memory T cells, is expected to play a key role in managing future pandemics and controlling outbreaks. Additionally, the expansion of immune testing in developing regions presents an untapped market opportunity. As healthcare infrastructure improves in countries across Asia, Africa, and Latin America, the demand for affordable and accessible immune testing solutions is expected to grow. Governments and international organizations are increasingly investing in immunology research and public health programs, creating opportunities for market expansion in these regions.

IMMUNE RESPONSE TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Test Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Abbott Laboratories, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Siemens Healthineers AG, Merck KGaA, QIAGEN N.V., Danaher Corporation, Luminex Corporation, Eurofins Scientific SE |

Immune Response Testing Market Segmentation: By Test Type

-

Serological Tests

-

Cell-based Assays

-

Cytokine Release Assays

-

ELISA

-

Others

The serological tests segment is expected to dominate the market, accounting for over 30% of the market share in 2023. These tests are widely used for diagnosing infectious diseases, measuring vaccine efficacy, and monitoring immune responses in clinical trials

Immune Response Testing Market Segmentation: By Application

-

Clinical Diagnostics

-

Vaccine Development

-

Drug Discovery

-

Immunotherapy Monitoring

-

Others

The clinical diagnostics segment holds the largest market share, contributing 50% of total revenue in 2023. This dominance is driven by the rising incidence of autoimmune diseases and infections that require immune response testing for diagnosis and treatment monitoring.

Immune Response Testing Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the global immune response testing market, accounting for 40% of the total revenue in 2023. This dominance is attributed to the region's strong healthcare infrastructure, extensive research in immunology, and high adoption of advanced diagnostic technologies.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a profound impact on the global immune response testing market, driving unprecedented demand for serological and antibody tests to detect past infections and measure immunity to the virus. The pandemic also accelerated vaccine development, with immune response testing playing a central role in assessing vaccine efficacy during clinical trials. Governments and health organizations worldwide invested heavily in immune testing infrastructure to control the spread of the virus, leading to rapid advancements in immune assay technologies. While the pandemic initially disrupted global supply chains, the market quickly recovered as manufacturers ramped up production of immune testing kits and reagents. The ongoing need for COVID-19 booster shots and long-term surveillance of immune responses has ensured sustained demand for immune response testing in the post-pandemic era. Looking forward, the lessons learned from COVID-19 are expected to influence future pandemic preparedness strategies, with immune response testing remaining a critical tool in the early detection and management of infectious diseases.

Latest Trends/Developments:

Several key trends are shaping the immune response testing market, including the increasing focus on personalized medicine and the growing use of multiplex immune assays that allow for simultaneous testing of multiple biomarkers. The rise of digital health platforms and telemedicine is also driving demand for at-home immune testing kits, enabling patients to monitor their immune function remotely. Advances in bioinformatics and artificial intelligence are transforming the way immune data is analyzed, allowing for more accurate interpretation of complex immune responses. These technologies are particularly useful in immunotherapy research, where precise measurements of immune activity are required to assess treatment outcomes. Another important trend is the increasing focus on sustainability in diagnostic testing. Manufacturers are exploring eco-friendly materials and production processes to reduce the environmental impact of immune testing kits and reagents.

Key Players:

-

Thermo Fisher Scientific Inc.

-

Abbott Laboratories

-

Bio-Rad Laboratories, Inc.

-

F. Hoffmann-La Roche Ltd

-

Siemens Healthineers AG

-

Merck KGaA

-

QIAGEN N.V.

-

Danaher Corporation

-

Luminex Corporation

-

Eurofins Scientific SE

Chapter 1. Immune Response Testing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Immune Response Testing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Immune Response Testing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Immune Response Testing Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Immune Response Testing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Immune Response Testing Market – By Test Type

6.1 Introduction/Key Findings

6.2 Serological Tests

6.3 Cell-based Assays

6.4 Cytokine Release Assays

6.5 ELISA

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Test Type

6.8 Absolute $ Opportunity Analysis By Test Type, 2024-2030

Chapter 7. Immune Response Testing Market – By Application

7.1 Introduction/Key Findings

7.2 Clinical Diagnostics

7.3 Vaccine Development

7.4 Drug Discovery

7.5 Immunotherapy Monitoring

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Immune Response Testing Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Test Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Test Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Test Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Test Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Test Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Immune Response Testing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Thermo Fisher Scientific Inc.

9.2 Abbott Laboratories

9.3 Bio-Rad Laboratories, Inc.

9.4 F. Hoffmann-La Roche Ltd

9.5 Siemens Healthineers AG

9.6 Merck KGaA

9.7 QIAGEN N.V.

9.8 Danaher Corporation

9.9 Luminex Corporation

9.10 Eurofins Scientific SE

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global immune response testing market was valued at USD 12.5 billion in 2023 and is expected to reach USD 21.1 billion by 2030, growing at a CAGR of 7.8%.

Key drivers include the rising prevalence of autoimmune and infectious diseases, growth in immunotherapy and vaccine development, and technological advancements in immune testing platforms.

The market is segmented by test type (serological tests, cell-based assays, cytokine release assays, ELISA) and application (clinical diagnostics, vaccine development, drug discovery, immunotherapy monitoring).

North America is the dominant region, accounting for 40% of total market revenue in 2023, driven by strong healthcare infrastructure and advanced immunology research.

Key players include Thermo Fisher Scientific Inc., Abbott Laboratories, Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd, Siemens Healthineers, and others.