Ilmenite Market Size (2024 – 2030)

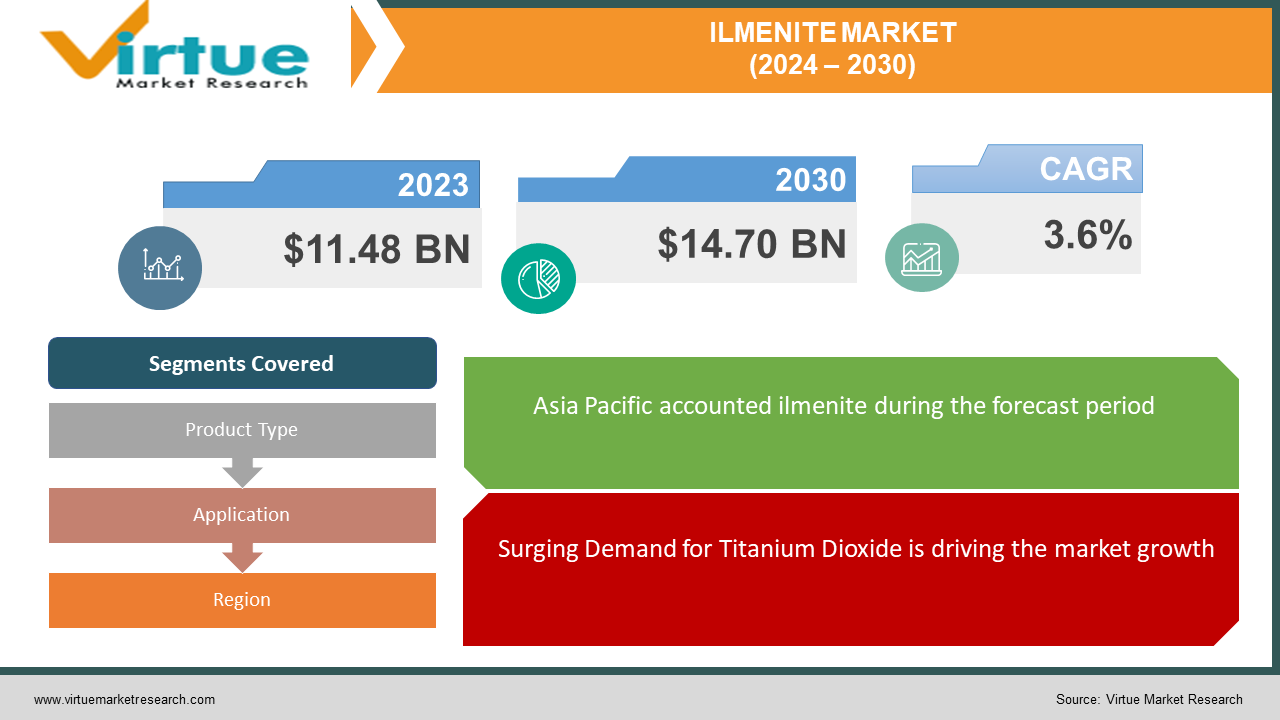

The Global Ilmenite Market was valued at USD 11.48 billion in 2023 and will row at a CAGR of 3.6% from 2024 to 2030. The market is expected to reach USD 14.70 billion by 2030.

Key Market Insights:

The ilmenite market is poised for moderate growth, driven by the ever-increasing demand for titanium dioxide, a pigment derived from ilmenite and used in paints, plastics, and various consumer goods. This growth is fueled by expanding construction, manufacturing, and aerospace sectors. However, the market faces headwinds. Environmental concerns surrounding mining practices and fluctuations in titanium dioxide prices pose challenges. Despite these hurdles, opportunities exist in the growing aerospace industry and the global focus on renewable energy, where titanium metal derived from ilmenite finds application. The path forward hinges on addressing environmental impact, implementing technological advancements to optimize processing, and navigating the dynamics of titanium dioxide pricing to ensure long-term sustainability.

Global Ilmenite Market Drivers:

Surging Demand for Titanium Dioxide is driving the market growth

Ilmenite's true value lies in its role as the primary source of titanium dioxide, a ubiquitous white pigment with a vast array of applications. This pigment's unmatched brilliance and versatility fuel the ilmenite market. From the immaculate white of paints and coatings that adorn our homes and infrastructure to the vibrant colors in plastics and the brightness of paper products, titanium dioxide is everywhere. Furthermore, its ability to enhance opacity and UV resistance makes it a critical ingredient in cosmetics and sunscreens. The growth story doesn't end there. The booming construction, automotive, and aerospace industries all rely heavily on titanium dioxide. As these sectors expand, their demand for paints, lightweight plastics, and high-performance materials intensifies, creating a ripple effect that drives the demand for ilmenite, the essential raw material. In essence, the increasing need for a dazzling white world, coupled with the growth of key industries, paints a bright future for the ilmenite market.

Expansion of End-Use Industries is driving the market growth

The paint and coatings industry is the undisputed champion of ilmenite-derived titanium dioxide. This white wonder pigment finds its way into countless paints used to beautify and protect our homes, buildings, and infrastructure. As urbanization flourishes and infrastructure development gallops forward across the globe, the demand for paints and coatings skyrockets. This translates to a positive ripple effect for the ilmenite market. However, the influence of titanium dioxide extends far beyond walls. The ever-expanding plastics industry utilizes it to create bright and opaque plastic products, while the paper industry leverages its properties to enhance paper quality and opacity. This widespread use across these ever-growing industries paints a promising picture for ilmenite, the irreplaceable source material for this versatile pigment. Essentially, our growing desire for a vibrant and well-protected world, coupled with the continuous development of these key industries, guarantees a bright future for ilmenite.

Aerospace & Defense Applications is driving the market growth

Ilmenite boasts another hidden gem: titanium metal. This metal's exceptional strength-to-weight ratio makes it a star player in the aerospace and defense industries. Aircraft manufacturers crave lightweight materials for efficiency, and titanium delivers, allowing them to build stronger, faster planes. Similarly, the defense sector utilizes titanium for its exceptional durability in armored vehicles and other mission-critical equipment. As the aerospace and defense industries continue to flourish, their demand for titanium surges, creating a positive feedback loop that drives up the demand for ilmenite, the essential source of this wonder metal.

Global Ilmenite Market challenges and restraints:

Environmental and Regulatory Concerns are restricting the market growth

Ilmenite mining faces a growing tension between economic viability and environmental responsibility. The extraction process can significantly disrupt habitats, erode topsoil, and pollute waterways. This raises public concerns and necessitates stricter environmental regulations. Obtaining mining permits can be a lengthy process due to environmental impact assessments and public hearings. Furthermore, implementing sustainable mining practices, such as proper waste management and land reclamation, adds to production costs. Companies must navigate this complex landscape by balancing responsible resource extraction with economic feasibility. Investing in innovative technologies to minimize environmental impact and forging partnerships with local communities can be crucial steps toward ensuring a sustainable future for the Ilmenite Market.

Volatility in Titanium Dioxide Prices

The Ilmenite Market walks a tightrope due to its dependence on the volatile pricing of titanium dioxide (TiO2). Since ilmenite is the primary source material for TiO2, a key pigment in paints, plastics, and coatings, ilmenite producers face the brunt of price swings. Several factors contribute to this volatility. Fluctuations in the cost of raw materials used in TiO2 production, like sulfuric acid or chlorine, can directly impact the final price. Geopolitical situations, such as trade wars or regional instability disrupting supply chains, can also cause price spikes. Additionally, global economic conditions play a role. During economic downturns, demand for TiO2 in construction and manufacturing sectors may decline, leading to a domino effect where lower TiO2 demand translates to lower ilmenite prices. This constant price flux makes it challenging for ilmenite producers to make long-term investment decisions, hindering advancements in mining and processing technologies or resource exploration. To mitigate these risks, some producers may explore contracts with TiO2 manufacturers to secure stable pricing or diversify their operations to lessen dependence on a single product.

Market Opportunities:

The Ilmenite Market presents exciting growth opportunities for companies that can navigate its challenges. The rising demand for titanium dioxide (TiO2) in paints, plastics, and personal care products fueled by a growing global population and increasing urbanization creates a strong pull for ilmenite. Furthermore, the expanding aerospace and defense sectors, which utilize titanium metal derived from ilmenite, offer a promising avenue for market expansion. Opportunities also lie in exploring alternative, geographically diverse ilmenite resources to lessen dependence on traditional sources and mitigate price fluctuations. Technological advancements in ilmenite processing hold immense potential. Developing more efficient and environmentally friendly extraction methods can minimize environmental impact and potentially lower production costs. Additionally, advancements in separating rutile, a valuable titanium dioxide precursor, from ilmenite can enhance profitability. By capitalizing on these opportunities, ilmenite producers can ensure a sustainable and thriving market for the future.

ILMENITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.6% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Iluka Resources Limited, Rio Tinto Group, The Chemours Company, Tronox Limited, Coromandel International Limited, Future Resources Ltd, Trafigura Group Pte Ltd, Abbott Blackstone, Yucheng Jinhe Industrial Co., Ltd. |

Ilmenite Market Segmentation - By Product Type

-

Ilmenite Concentrate

-

Leucoxene

While both Ilmenite Concentrate and Leucoxene are sources of titanium, the market is dominated by Ilmenite Concentrate. This dominance stems from its higher abundance and affordability. Ilmenite deposits are more readily available globally, and the extraction and processing are generally less expensive compared to Leucoxene. This translates to a more consistent supply and a competitive price point for producers of titanium dioxide (TiO2), the primary application for ilmenite. Leucoxene, with its higher titanium content, finds use in specific high-grade applications or as an alternative source material in regions with limited ilmenite resources, but its overall market presence remains smaller due to its higher cost.

Ilmenite Market Segmentation - By Application

-

Titanium Dioxide Production

-

Welding Electrodes

-

Refractories

-

Other Applications

Titanium Dioxide Production reigns supreme as the dominant application within the Ilmenite Market. This dominance is driven by the widespread use of TiO2, a pigment derived from ilmenite, in a vast array of products. From paints and coatings that brighten our homes and infrastructure to plastics with enhanced durability and whiteness, TiO2 plays a crucial role. The ever-growing demand for these products, particularly in a developing world with increasing urbanization, fuels the need for ilmenite as the primary source material for TiO2 production. While ilmenite finds applications in welding electrodes, refractories, and other areas, the sheer volume and diverse applications of TiO2 solidify its position as the clear leader within the Ilmenite Market.

Ilmenite Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region reigns supreme in the Ilmenite Market. This dominance is fueled by a confluence of factors. Firstly, it boasts a massive population, creating a vast consumer base for products that rely on titanium dioxide, a key derivative of ilmenite. Secondly, the region is a powerhouse in aquaculture, leading to a readily available supply of ilmenite through the mineral sands extracted from the seabed during these operations. Furthermore, several Asian countries have a strong cultural affinity for seafood, which often translates to increased demand for processing and preservation techniques that utilize titanium dioxide. Finally, the burgeoning middle class in many Asian nations, coupled with the presence of established processing hubs, fuels the demand for ilmenite in the region. These factors combine to solidify Asia Pacific's position as the undisputed leader in the Global Ilmenite Market.

COVID-19 Impact Analysis on the Global Ilmenite Market

The COVID-19 pandemic delivered a temporary blow to the Ilmenite Market. Lockdowns and disruptions in global supply chains hampered mining operations and transportation of ilmenite concentrate. This initial shockwave impacted the production and availability of titanium dioxide (TiO2), the primary derivative of ilmenite. Downstream industries reliant on TiO2, such as paints and coatings, faced production slowdowns due to decreased demand during construction and renovation slumps. However, the impact wasn't uniform across all applications. The hygiene and sanitation focus during the pandemic led to a surge in demand for disinfectants and personal care products, some of which utilize TiO2. This somewhat offset the decline in construction-related applications. As economies reopened and construction activity rebounded, the demand for TiO2 and subsequently ilmenite started to recover. Looking ahead, the long-term impact of COVID-19 on the Ilmenite Market is expected to be moderate. The growing emphasis on hygiene and a potential increase in infrastructure spending in some regions could even create new opportunities for ilmenite demand. The market's resilience will depend on navigating potential price fluctuations in TiO2 and ensuring sustainable mining practices to meet the growing demand in a post-pandemic world.

Latest trends/Developments

The Ilmenite Market is witnessing a wave of innovation and a focus on sustainability. One key trend is the development of environment-friendly processing techniques. Companies are exploring methods to reduce water consumption, minimize waste generation, and utilize cleaner energy sources during ilmenite extraction and processing. This focus on sustainability is driven by stricter environmental regulations and a growing consumer preference for ethically sourced materials. Another trend gaining traction is the exploration of alternative ilmenite resources. With a growing emphasis on geographic diversification and mitigating dependence on traditional sources, companies are looking at seabed mining and extracting titanium from unconventional sources like blast furnace slag, a byproduct of steel production. Technological advancements are also playing a role. Research into improved mineral separation techniques aims to extract rutile, a valuable precursor for TiO2 production, more efficiently from ilmenite. Additionally, the development of cost-effective methods to utilize lower-grade ilmenite deposits could expand the resource base and ensure a stable supply for the future. These trends, coupled with the ever-increasing demand for titanium dioxide in various industries, position the Ilmenite Market for an innovative and sustainable future.

Key Players:

-

Iluka Resources Limited

-

Rio Tinto Group

-

The Chemours Company

-

Tronox Limited

-

Coromandel International Limited

-

Future Resources Ltd

-

Trafigura Group Pte Ltd

-

Abbott Blackstone

-

Yucheng Jinhe Industrial Co., Ltd.

Chapter 1. ILMENITE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ILMENITE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ILMENITE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ILMENITE MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ILMENITE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ILMENITE MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Ilmenite Concentrate

6.3 Leucoxene

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. ILMENITE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Titanium Dioxide Production

7.3 Welding Electrodes

7.4 Refractories

7.5 Other Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. ILMENITE MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. ILMENITE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Iluka Resources Limited

9.2 Rio Tinto Group

9.3 The Chemours Company

9.4 Tronox Limited

9.5 Coromandel International Limited

9.6 Future Resources Ltd

9.7 Trafigura Group Pte Ltd

9.8 Abbott Blackstone

9.9 Yucheng Jinhe Industrial Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Ilmenite Market was valued at USD 11.48 billion in 2023 and will row at a CAGR of 3.6% from 2024 to 2030. The market is expected to reach USD 14.70 billion by 2030.

Surging Demand for Titanium Dioxide and expansion of End-Use Industries These are the reasons that are driving the market.

Based on product type it is divided into two segments – Ilmenite Concentrate, Leucoxene

Asia-Pacific is the most dominant region for the Ilmenite Market.

Future Resources Ltd, Trafigura Group Pte Ltd, Abbott Blackstone, Yucheng Jinhe Industrial Co., Ltd.