Hyperloop Technology Market Size (2025-2030)

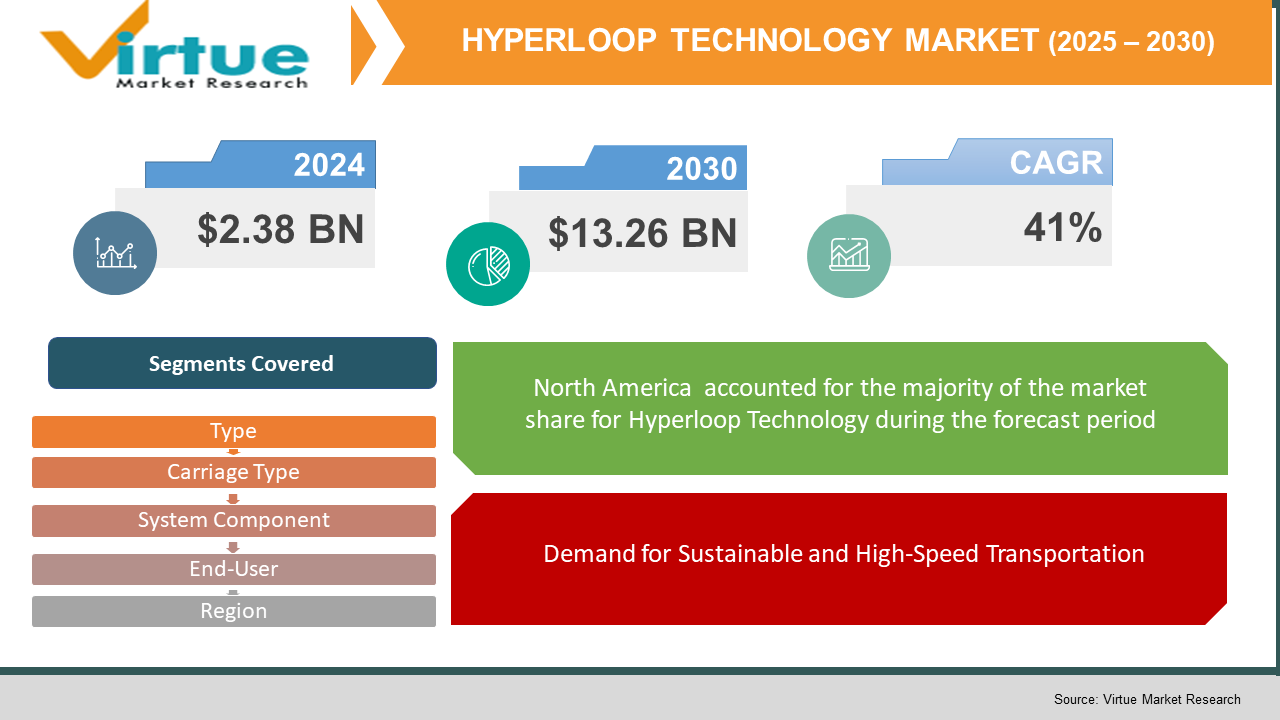

The Hyperloop Technology Market was valued at USD 2.38 billion in 2024 and is projected to reach a market size of USD 13.26 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 41%.

The Hyperloop Technology Market represents a paradigm shift in the transportation and logistics industries, offering a fifth mode of transportation with unparalleled speed, efficiency, and sustainability. Hyperloop technology involves pushing passenger or freight pods at aircraft speeds through a network of low-pressure tubes, with magnetic levitation and propulsion technologies reducing friction and air resistance. This unique concept seeks to bridge the gap between air and ground travel by providing a system that is much faster than high-speed rail and more ecologically benign than aviation. The market's current scenario is a thriving community of ambitious startups, major aerospace and engineering corporations, and government agencies all competing to overcome challenging technological and regulatory challenges. The core appeal of Hyperloop lies in its potential to revolutionize inter-city travel, reducing transit times from hours to minutes and thereby redrawing economic and social maps. For instance, a journey that currently takes over six hours by car could be completed in under 45 minutes. The market is not just about building the physical infrastructure; it encompasses a wide array of sub-sectors, including advanced materials science for tube and capsule construction, sophisticated software for autonomous control and network management, and cutting-edge vacuum and magnetic levitation technologies. While no commercial Hyperloop system is fully operational yet, several full-scale test tracks have been constructed globally, where prototypes are consistently breaking speed and efficiency records. The long-term vision extends beyond passenger transport to include high-speed cargo logistics, which could fundamentally disrupt global supply chains by enabling on-demand, express delivery of goods between manufacturing hubs and distribution centers. The market's trajectory is heavily dependent on continued technological breakthroughs, the establishment of a clear international regulatory framework, and securing the massive capital investment required for large-scale network deployment.

Key Market Insights:

- Global Market Valuation Range: The hyperloop technology market demonstrates significant valuation variations across different research sources, with 2024 estimates ranging from USD 1.09 billion to USD 2.5 billion, indicating a nascent but rapidly expanding sector with diverse analytical perspectives on market sizing methodologies.

- US Market Concentration: The United States hyperloop technology market specifically was valued at USD 80 million in 2024, representing approximately 3-7% of the total global market depending on the baseline valuation, showcasing the technology's early-stage development in America's transportation infrastructure landscape.

- The low cost of the technology compared to other modes of transportation is driving market growth, with construction costs estimated at 50-60% lower than traditional high-speed rail infrastructure per mile of track.

- The passenger transportation application dominates current market development focus, with multiple companies developing pod-based systems capable of carrying 28-40 passengers per vehicle, targeting urban and intercity transportation networks.

- Freight transportation applications represent approximately 35-40% of current development efforts, with hyperloop systems designed to handle containerized cargo loads of 10-15 tons per pod, revolutionizing supply chain logistics and distribution networks.

- The hyperloop technology market demonstrates significant concentration among pioneering companies, with approximately 8-12 major players controlling 70-80% of current development projects, patents, and prototype testing facilities globally.

- Hyperloop projects require comprehensive environmental impact assessments, with studies indicating 70-80% lower carbon emissions compared to equivalent aviation routes and 40-50% lower than high-speed rail systems.

- Early economic modeling suggests hyperloop technology could reduce transportation costs by 40-60% compared to existing high-speed transportation alternatives, fundamentally altering intercity travel economics and accessibility.\

- Hyperloop freight applications could revolutionize supply chain logistics, with preliminary studies indicating 2-3 day reduction in transcontinental shipping times and 20-30% reduction in logistics costs for time-sensitive cargo.

Market Drivers:

Demand for Sustainable and High-Speed Transportation

A primary driver for the Hyperloop market is the escalating global demand for transportation solutions that are both faster and more sustainable. Existing modes of transport, such as aviation and automobiles, are major contributors to greenhouse gas emissions and are reaching their capacity limits in congested corridors. Hyperloop technology presents a compelling alternative, promising to be fully electric and capable of being powered by renewable energy sources. By offering airline speeds on the ground, it directly addresses the need to reduce carbon footprints while simultaneously slashing travel times between major economic hubs, fostering greater connectivity and economic productivity.

Advancements in Enabling Technologies

The rapid maturation of key enabling technologies is a significant force propelling the market forward. Breakthroughs in magnetic levitation (maglev), materials science, battery technology, and autonomous control systems are making the Hyperloop concept increasingly feasible and economically viable. Innovations in high-strength composite materials are reducing the weight of pods, while advancements in vacuum pump efficiency are lowering the energy costs of operation. The convergence of these technologies de-risks the development process and attracts the investment needed to transition from theoretical designs and prototypes to commercially operational systems, creating a positive feedback loop of innovation.

Market Restraints and Challenges:

The Hyperloop market faces formidable restraints, primarily the astronomical upfront capital investment required for infrastructure development, which can deter both private and public funding. Establishing a clear and comprehensive regulatory framework for safety, certification, and cross-border operations remains a major, unresolved challenge. Furthermore, technical hurdles related to maintaining a stable vacuum over long distances and ensuring passenger safety during potential emergencies or system failures are significant concerns. Public perception and land acquisition rights also present substantial obstacles to large-scale deployment.

Market Opportunities:

Significant market opportunities lie in the application of Hyperloop technology for high-value, time-sensitive cargo and freight logistics. This creates a new paradigm for supply chain management and e-commerce fulfillment, offering a faster and more reliable alternative to air freight. There is also immense potential in licensing proprietary technologies developed for Hyperloop, such as advanced control systems and levitation technology, to other industries. Furthermore, integrating Hyperloop corridors with existing transportation hubs like airports and train stations presents a major opportunity for creating seamless, multi-modal transit networks.

HYPERLOOP TECHNOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

41% |

|

Segments Covered |

By Type, carriage type, system component, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hyperloop Transportation Technologies (HyperloopTT), Hardt Hyperloop, TransPod, Zeleros Hyperloop, Nevomo, The Boring Company, and DP World CargoSpeed, |

Hyperloop Technology Market Segmentation:

Hyperloop Technology Market Segmentation by Type:

- Capsule

- Tube

- Propulsion System

- Levitation System

- Power System

The propulsion system segment is the fastest growing, driven by intense competition to develop more efficient, powerful, and cost-effective linear electric motors. As companies move from small-scale tests to full-speed prototypes, the demand for advanced propulsion hardware and control software is accelerating, attracting significant R&D investment and fostering rapid innovation.

The tube remains the most dominant segment by market value, as it represents the largest single component of capital expenditure in any Hyperloop project. The manufacturing, material science, and construction associated with creating hundreds of kilometers of precision-engineered, vacuum-sealed tubing constitute the foundational infrastructure and the bulk of the project cost.

Hyperloop Technology Market Segmentation by Carriage Type:

- Passenger

- Cargo/Freight

The cargo/freight segment is the fastest-growing carriage type, as it presents a lower regulatory barrier to entry and a more immediate business case compared to passenger transport. The potential to revolutionize logistics by providing on-demand, high-speed delivery of goods is attracting significant interest from logistics companies and e-commerce giants.

Passenger transport remains the most dominant focus in terms of long-term vision and public discourse, commanding the majority of media attention and conceptual design efforts. The ultimate goal for most Hyperloop ventures is to transform human travel, making it the most dominant segment in terms of project planning and ultimate market potential.

Hyperloop Technology Market Segmentation by System Component:

- Control Systems

- Graphene and Advanced Materials

- Vacuum Pumps

- Power Distribution Network

Control systems are the fastest-growing component segment, fueled by the critical need for sophisticated, AI-driven software to manage autonomous pod operation, network traffic, and safety protocols. As test tracks become more complex, the demand for robust, real-time control and simulation software is expanding rapidly, representing a key area of innovation.

Graphene and advanced materials represent the most dominant component segment in terms of research and value. The structural integrity, weight, and performance of both the tube and capsule are entirely dependent on these materials. The high cost and critical importance of carbon fiber and other composites make this the most valuable component market.

Hyperloop Technology Market Segmentation by End-User:

- Logistics and Transportation Providers

- Government and Defense

- Industrial Manufacturing

- Aerospace

Logistics and transportation providers are the fastest-growing end-user segment. These companies are actively exploring and investing in Hyperloop technology to gain a competitive edge in the rapidly evolving world of e-commerce and global supply chains, viewing it as a transformative technology for next-generation freight movement.

Government and Defense is the most dominant end-user segment currently, primarily acting as funders, regulators, and strategic partners in most large-scale projects. National and regional governments are the key stakeholders driving feasibility studies, providing land rights, and establishing the regulatory frameworks necessary for any Hyperloop network to be built.

Hyperloop Technology Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

North America dominates the market, holding a 35% share, due to the presence of several leading Hyperloop technology pioneers, significant venture capital investment from Silicon Valley, and multiple active test sites. The region's robust aerospace and tech industries provide a strong foundation for innovation and talent.

The Asia-Pacific region is the fastest-growing, driven by strong government support in countries like China, South Korea, and India for advanced infrastructure projects. Rapid urbanization and the need to connect sprawling megacities are creating a fertile ground for large-scale Hyperloop feasibility studies and potential deployments.

COVID-19 Impact Analysis:

The COVID-19 pandemic has had both positive and negative impacts on the Hyperloop technology market. On one hand, it caused short-term disruptions to supply chains and delayed construction at some test sites due to lockdowns. On the other hand, the crisis underscored the fragility of existing global supply chains and the need for more resilient, automated, and contactless modes of transportation. This has spurred greater long-term interest in Hyperloop for cargo, positioning it as a key technology for future-proofing national infrastructure.

Latest Trends and Developments:

The latest trends in the Hyperloop market are centered on improving the economic feasibility and scalability of the technology. A key development is the focus on optimizing tunneling and construction techniques to drastically reduce costs. There is also a significant trend towards developing standardized components and regulatory frameworks through collaborative efforts between competing companies and government agencies. Another major development is the integration of advanced AI and digital twin technology to simulate and manage entire networks for optimal efficiency and safety before construction begins.

Key Players in the Market:

- Hyperloop Transportation Technologies (HyperloopTT)

- Hardt Hyperloop

- Virgin Hyperloop (now dormant, IP assets exist)

- TransPod

- Zeleros Hyperloop

- Nevomo

- The Boring Company

- DP World CargoSpeed

- AECOM

- TUM Hyperloop (formerly WARR Hyperloop)

Chapter 1. Hyperloop System Component Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Hyperloop System Component Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Hyperloop System Component Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Hyperloop System Component Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Hyperloop System Component Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Hyperloop System Component Market– By Type

6.1 Introduction/Key Findings

6.2 Capsule

6.3 Tube

6.4 Propulsion System

6.5 Levitation System

6.6 Power System

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Hyperloop System Component Market– By Carriage Type

7.1 Introduction/Key Findings

7.2 Passenger

7.3 Cargo/Freight

7.4 Y-O-Y Growth trend Analysis By Carriage Type

7.5 Absolute $ Opportunity Analysis By Carriage Type , 2025-2030

Chapter 8. Hyperloop System Component Market– By System Component

8.1 Introduction/Key Findings

8.2 Control Systems

8.3 Graphene and Advanced Materials

8.4 Vacuum Pumps

8.5 Power Distribution Network

8.6 Y-O-Y Growth trend Analysis System Component

8.7 Absolute $ Opportunity Analysis System Component , 2025-2030

Chapter 9. Hyperloop System Component Market– By End-User

9.1 Introduction/Key Findings

9.2 Logistics and Transportation Providers

9.3 Government and Defense

9.4 Industrial Manufacturing

9.5 Aerospace

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 10. Hyperloop System Component Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By System Component

10.1.4. By Carriage Type

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By System Component

10.2.4. By Carriage Type

10.2.5. End-User

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By End-User

10.3.4. By Carriage Type

10.3.5. System Component

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-User

10.4.3. By Carriage Type

10.4.4. By Type

10.4.5. System Component

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By System Component

10.5.3. By End-User

10.5.4. By Carriage Type

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. HYPERLOOP SYSTEM COMPONENT MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Hyperloop Transportation Technologies (HyperloopTT)

11.2 Hardt Hyperloop

11.3 Virgin Hyperloop (now dormant, IP assets exist)

11.4 TransPod

11.5 Zeleros Hyperloop

11.6 Nevomo

11.7 The Boring Company

11.8 DP World CargoSpeed

11.9 AECOM

11.10 TUM Hyperloop (formerly WARR Hyperloop)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The primary drivers are the urgent global need for faster and more sustainable transportation alternatives to combat climate change and traffic congestion, coupled with significant technological advancements in enabling fields like magnetic levitation, autonomous systems, and materials science, which are making the concept increasingly viable.

The most significant concerns revolve around the extremely high initial capital investment required for infrastructure, the lack of established international safety and regulatory standards, technical challenges in maintaining system integrity over long distances, and securing public trust and land acquisition rights for new transport corridors.

Key players include Hyperloop Transportation Technologies (HyperloopTT), Hardt Hyperloop, TransPod, Zeleros Hyperloop, Nevomo, The Boring Company, and DP World CargoSpeed, alongside major engineering firms like AECOM and influential university teams such as TUM Hyperloop and Delft Hyperloop.

North America currently holds the largest market share, estimated at approximately 35%, due to a high concentration of pioneering companies, strong venture capital support, and the presence of several major test facilities.

The Asia-Pacific region is demonstrating the fastest growth, driven by ambitious government-backed infrastructure initiatives, rapid urbanization, and a strong political will to adopt transformative technologies to connect its burgeoning megacities.