Hygienic Valve Market Size (2024 – 2030)

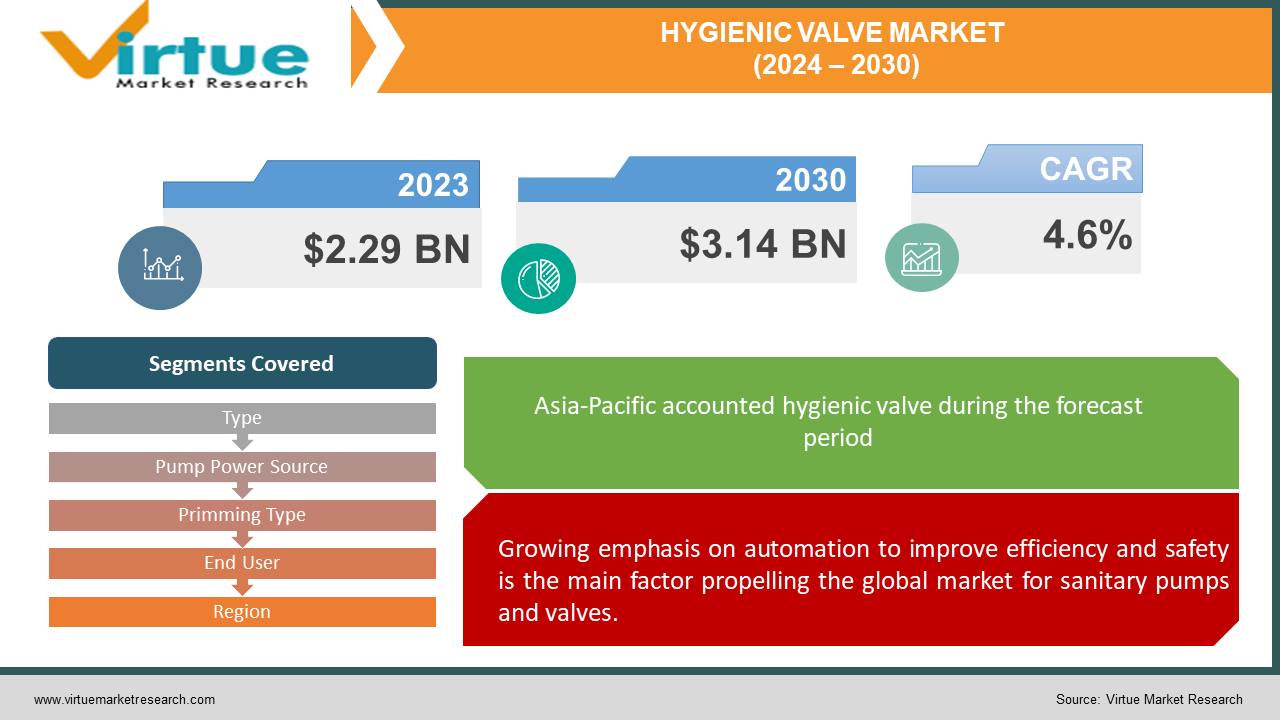

The Global Hygienic Valve Market size was exhibited at USD 2.29 billion in 2023 and is projected to hit around USD 3.14 billion by 2030, growing at a CAGR of 4.6% during the forecast period from 2024 to 2030.

Industrial pipe systems utilize specialized equipment, such as sanitary pumps and valves, to transport clean liquids and slurries. Pump valves help to control the flow of fluid via the pump. The growth of the market is ascribed to the worldwide surge in industrial operations and increased consciousness about hygiene in various sectors. Global industrial growth in a few industries, such as processed foods, beverages, medicines, and dairy goods, is providing significant impetus for the sanitary pump and valve market. Additional factors driving the need for sanitary pumps and valves in hygiene-centric sectors include manufacturers' increased awareness of hygiene standards in end-use industries and the delivery of uncontaminated products to end customers. Aiming to maintain safety and sanitary standards in end-use products and industries, governmental or affiliated authorities have formulated strict laws and regulations in response to the growing awareness. These legal frameworks can be thought of as engines driving the global sanitary pump and valve industry's growth.

Key Market Insights:

The key elements influencing the sanitary pumps and valves' worldwide market share are based on the unique characteristics of this specialized machinery. Sanitary pumps are mostly used as specialty equipment that uses industrial processing pipelines to pump slurries and clean liquids; pump valves control the liquid flow. These constituents are essential to the distribution of goods meant for human consumption or touch and include a wide range of categories, including but not limited to dairy products, food, drinks, fine chemicals, pharmaceuticals, cosmetics, and other things. Potential growth drivers for the sanitary pumps and valves market soon are the introduction of novel products, expanding business propensity towards plant automation, and enforcement of mandatory regulatory norms to maintain ideal hygiene levels.

Hygienic Valve Market Drivers:

Growing emphasis on automation to improve efficiency and safety is the main factor propelling the global market for sanitary pumps and valves.

Automation is becoming increasingly important to industries, and manufacturers are shifting their attention to include automation techniques to achieve lean manufacturing, standardize production processes, increase operational efficiency, and ensure plant safety. Automation integration helps businesses cut labor, minimize waste, lower production costs, avoid errors and downtime, improve process quality, and accelerate processing times. For process industries, the addition of fluid handling systems which include pumps and valves stands to be revolutionary. Fluid handling systems are used by the food, beverage, pharmaceutical, and chemical industries to move raw materials and make it easier to move different fluids or gases during production. Sanitary valves and pumps are essential components of fluid handling systems that facilitate an automated transition.

Strict government rules aimed at preserving ideal hygiene standards are a major factor driving the growth of the global market for sanitary pumps and valves.

Process sector manufacturers are required by various governments to comply with strict rules to maintain industry hygiene standards and provide customers with products that are free of contamination. To guarantee the quality and safety of food items, businesses involved in the food chain must adhere to a complex structure of laws and regulations that have been passed worldwide. To guarantee the purity and quality of finished products, including ingredients, equipment, containers, premises, and cleaning and disinfection solutions, the pharmaceutical sector must maintain strict hygiene requirements throughout the manufacturing process. Pharmaceutical makers must comply with regulations issued by organizations like the Thai Food and Drug Administration, the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), and the US Food and Drug Administration. As a result, producers in the dairy, food, beverage, and pharmaceutical industries are forced to abide by government regulations, which causes a general adoption of hygienic equipment and the installation of hygiene protocols in their facilities. This increases the need for sanitary valves and pumps of all kinds to maintain safety and hygienic practices, especially in industrial facilities.

Global Hygienic Valve Market Restraints and Challenges:

There are many different companies engaged in the sanitary pumps and valves industry, which is highly fragmented. These companies use strong networks of distributors and suppliers to expand their product lines internationally. International producers and distributors face a few difficulties, such as higher transportation costs, disparities in pricing, tariffs, sales taxes, and extra fees like shipping and customs duties. Many local businesses and grey market actors are also included in the industry ecosystem. These individuals are recognized for obtaining goods from low-cost areas and redistributing them to higher-cost areas through unapproved channels, thereby eschewing the original producer or trademark owner. The increased level of competition presents difficulties for well-established market participants, particularly in developing countries like South America and Asia Pacific. 304L or 316L stainless steel are examples of odorless, noncorrosive, and nontoxic materials that must be used in the construction of sanitary pumps and valves. The cost of the alloying components and the amount of alloy used determine the price of these stainless-steel variations. The total cost of manufacturing sanitary pumps and valves is affected by the erratic prices of raw materials. Significant variations in the cost of raw materials can make it difficult to regulate prices effectively and cause swings in profit margins. The sales of sanitary valves and pumps are likewise affected by these changes in the final product's price.

Global Hygienic Valve Market Opportunities:

Industry stakeholders may benefit from sanitary pumps and valves with sensors and IIoT integration, which might reduce maintenance and shutdown expenses. Manually monitoring a variety of sanitary pumps and valves takes a lot of time, and traditional monitoring methods that require retrofitting can be expensive. Numerous elements go into remote pump and valve monitoring, one of which is the retrofit sensor devices installed to the equipment that are used to detect the position of the valves. Real-time valve monitoring is made possible in manufacturing plants by integrating a remote monitoring solution. The benefits of using IIoT-enabled hygienic pumps and valves include significant cost savings, faster process recovery during maintenance downtime, improved safety, fewer errors, and quality deviations, useful analytics, and the avoidance of unscheduled plant outages.

HYGIENIC VALVE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Type, Pump Power Source, Primming Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alfa Laval AB, Dover Corporation, GEA Group AG, Graco, Inc. (Newell Brands Inc.), IDEX Corporation, KSB SE & Co. KGaA, Spirax Sarco Limited, SPX Flow, Inc., Verder International B.V., Xylem, Inc. |

Global Hygienic Valve Market Segmentation: By Type

-

Centrifugal Pumps

-

Positive Displacement Pumps

Pump types in the market are divided into centrifugal, positive displacement, and other categories. The market for positive displacement pumps saw considerable growth in 2023. There are several types of positive displacement (PD) pumps that are appropriate for high-purity and hygienic applications in sanitary end-use industries. These pumps are known for their ability to move fluid by using either reciprocating or rotating mechanical force to capture and transport predefined volumes of fluid from the pump intake to the pump outlet. Positive displacement pumps are all capable of efficiently pumping extremely viscous fluids.

Global Hygienic Valve Market Segmentation: By Pump Power Source

-

Electric

-

Air

The market is divided into two categories based on the power source for pumps: electric and air. With the largest revenue share in 2023, the electric category led the market. Electric sanitary pumps provide accurate pressure and overflow rate control, guaranteeing dependable operation. This accuracy is especially important in areas that demand precise handling or dosing of sensitive compounds. In quiet industrial spaces or laboratories, for example, when noise level is a concern, electric sanitary pumps can function more silently than some other types of pumps.

Global Hygienic Valve Market Segmentation: By Primming Type

-

Non-self-Primming

-

Self-Primming

Self-priming and non-self-priming prime types of prime are the two segments of the market. In 2023, the category that wasn't self-priming had the largest revenue share. External priming is necessary for non-self-priming pumps, which entails adding startup liquid to the pump before each initiation. Among the methods used are natural priming, vacuum pump priming, manual priming, jet pump priming, inserting a foot valve, utilizing a separator, and priming a pump with an ejector.

Global Hygienic Valve Market Segmentation: By End User

-

Processed Food

-

Dairy

-

Alcoholic Beverage

-

Non-alcoholic Beverage

-

Pharmaceutical

-

Others

Processed foods, dairy, non-alcoholic beverages, alcoholic beverages, pharmaceuticals, and other end-user businesses make up the market's end-user segmentation. The sanitary pumps and valves market showed encouraging growth in the pharmaceutical industry in 2023. The pharmaceutical sector is essential to major improvements in both environmental and human health, which makes safe and high-quality product manufacture necessary. A safe, dependable, and effective production process is necessary to provide the best possible product quality.

Global Hygienic Valve Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market is investigated regionally in North America, Europe, Asia Pacific, and Latin America. The Asia Pacific region had the highest revenue share in 2023. The last twenty years have seen a rise in the consumption and appeal of frozen foods and health-conscious goods. The region's processed food sector is expanding due to the growing demand for convenient and ready-to-eat (RTE) food options. Throughout the forecast period, the rise of the pharmaceutical, chemical, and processed food industries is anticipated to fuel market expansion in this area.

COVID-19 Impact Analysis on the Global Hygienic Valve Market:

The global health and economic crises that have been brought on by the COVID-19 pandemic. Many firms were compelled to halt operations and cease manufacturing during the first two to three months of the outbreak. Sanitary pump and valve production was negatively impacted in the first and second quarters of 2020 by the tremendous disruptions experienced during this period in industrial purchases as well as the import and export of consumer goods. Businesses strengthened their operations by looking for safer ways to continue manufacturing or finding new sources of income in response to the pandemic's obstacles. Notably, demand for products in the food and pharmaceutical industries increased during this time. As a result, these industries quickly recovered two or three months following the pandemic's first downturn.

Recent Trends and Developments in the Global Hygienic Valve Market:

QUANTM, an electric-operated double diaphragm pump intended for a variety of fluid transfer applications, was introduced by Graco Inc. The pump provides a wide range of building supplies to facilitate a few industrial and sanitary uses, such as pharmaceuticals, food and beverage processing, and chemical processing. To increase the selection of precision agricultural components such as waterproof motorized valves, manifolds, controllers, and associated accessories IDEX Corporation announced that it has acquired KZValve, LLC. A brand-new range of stainless-steel air-operated sanitary butterfly valves was unveiled by Valworx. These valves are approved for use in the food, beverage, personal care, and animal care industries. They meet USDA, FDA, and 3-A regulations and have Tri-Clamp ends for sanitary connections.

Key Players:

-

Alfa Laval AB

-

Dover Corporation

-

GEA Group AG

-

Graco, Inc. (Newell Brands Inc.)

-

IDEX Corporation

-

KSB SE & Co. KGaA

-

Spirax Sarco Limited

-

SPX Flow, Inc.

-

Verder International B.V.

-

Xylem, Inc.

Chapter 1. Hygienic Valve Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hygienic Valve Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hygienic Valve Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hygienic Valve Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hygienic Valve Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hygienic Valve Market – By Type

6.1 Introduction/Key Findings

6.2 Centrifugal Pumps

6.3 Positive Displacement Pumps

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Hygienic Valve Market – By Pump Power Source

7.1 Introduction/Key Findings

7.2 Electric

7.3 Air

7.4 Y-O-Y Growth trend Analysis By Pump Power Source

7.5 Absolute $ Opportunity Analysis By Pump Power Source, 2024-2030

Chapter 8. Hygienic Valve Market – By Primming Type

8.1 Introduction/Key Findings

8.2 Non-self-Primming

8.3 Self-Primming

8.4 Y-O-Y Growth trend Analysis By Primming Type

8.5 Absolute $ Opportunity Analysis By Primming Type, 2024-2030

Chapter 9. Hygienic Valve Market – By End User

9.1 Introduction/Key Findings

9.2 Processed Food

9.3 Dairy

9.4 Alcoholic Beverage

9.5 Non-alcoholic Beverage

9.6 Pharmaceutical

9.7 Others

9.8 Y-O-Y Growth trend Analysis By End User

9.9 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 10. Hygienic Valve Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.3 By End User

10.1.4 By Primming Type

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Pump Power Source

10.2.4 By Primming Type

10.2.5 By End User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Pump Power Source

10.3.4 By Primming Type

10.3.5 By End User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Pump Power Source

10.4.4 By Primming Type

10.4.5 By End User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Pump Power Source

10.5.4 By Primming Type

10.5.5 By End User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Hygienic Valve Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Alfa Laval AB

11.2 Dover Corporation

11.3 GEA Group AG

11.4 Graco, Inc. (Newell Brands Inc.)

11.5 IDEX Corporation

11.6 KSB SE & Co. KGaA

11.7 Spirax Sarco Limited

11.8 SPX Flow, Inc.

11.9 Verder International B.V.

11.10 Xylem, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hygienic Valve Market size is valued at USD 2.29 billion in 2023.

The worldwide Global Hygienic Valve Market growth is estimated to be 4.6% from 2024 to 2030.

The Global Hygienic Valve Market is segmented By Type (Centrifugal, Positive Displacement, Other Pump Types); By Pump Power Source (Air, Electric); By Priming Type (Self-Priming, Non-Self-Priming); By End-User (Processed Foods, Dairy, Non-Alcoholic Beverages, Alcoholic Beverages, Pharmaceuticals, Other End-User Industries) and by region.

The food and beverage, pharmaceutical, and biotech industries are anticipated to drive growth in the global hygienic valve market. The need for hygienic valves is being driven by these industries' growing emphasis on cleanliness and hygiene. Furthermore, there is a growing need for sophisticated sanitary valves with features like self-cleaning mechanisms and integration with digital monitoring systems due to the increased adoption of automation in these industries.

The global market for hygienic valves was affected by the COVID-19 pandemic in many ways. As the pharmaceutical and biotech sectors raced to research and produce vaccines and cures, there was a spike in demand for sanitary valves. Conversely, lockdowns and supply chain interruptions resulted in brief delays in the manufacture and delivery of sanitary valves.