Hydrometallurgical Recycling Market Size (2024 – 2030)

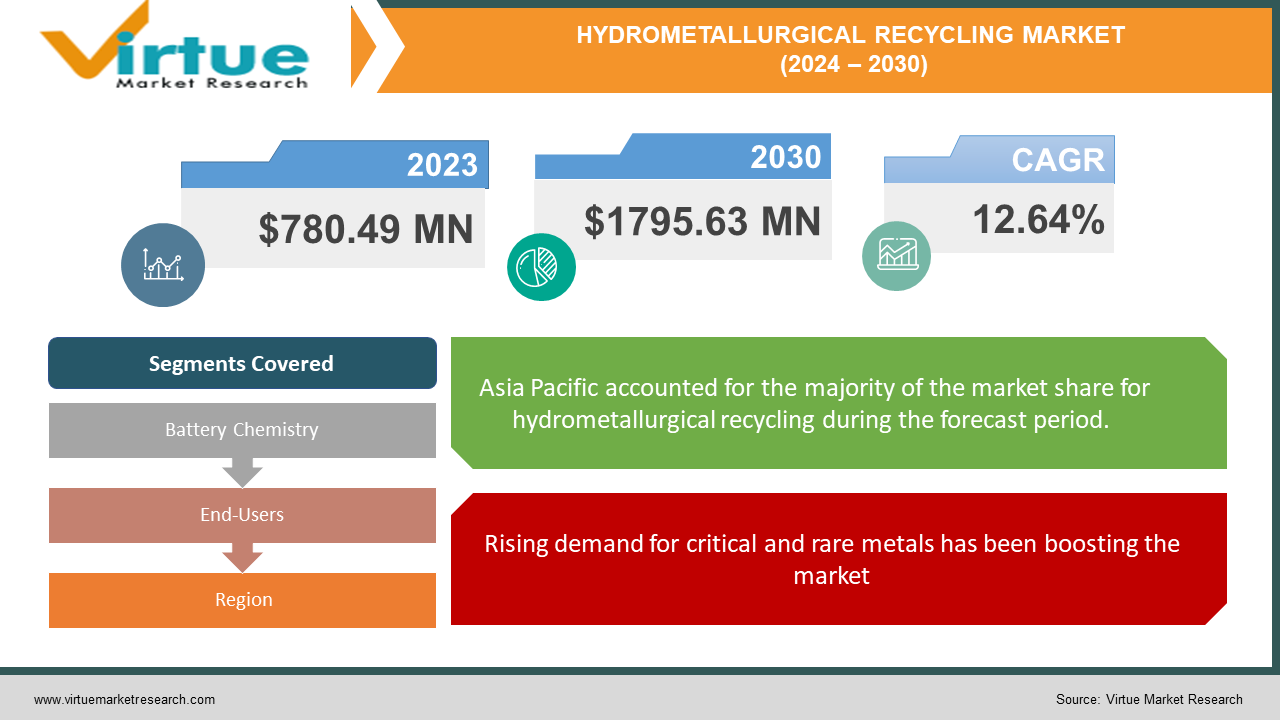

The global hydrometallurgical recycling market was valued at USD 780.49 million and is projected to reach a market size of USD 1795.63 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12.64%.

Aqueous chemistry is used in the hydrometallurgical recycling process to extract metals from ores, concentrates, and recovered materials. Leaching of wasted cathode material, impurity removal/purification of leach solution, and recovery of metal salts are the three key phases in hydrometallurgical processes. Silver and gold, which are less reactive metals, are frequently extracted using it. This method has been used for decades, primarily in the mining sector. However, technological advancements were limited. Presently, the market has seen a significant expansion owing to awareness and adoption. In the future, with a focus on green technologies and a circular economy, immense growth is anticipated. During the forecast period, a notable upsurge is predicted.

Key Market Insights:

Up to 95% of rare metals may be recovered by hydrometallurgical recycling from the black mass of batteries. According to Statista, by 2030, there will be a seven-fold rise in the amount of battery materials accessible for recycling globally, reaching 1.4 million tons. It is anticipated that about seven million tons will be accessible by 2040. According to a paper released by ACS publications, retired batteries have the potential to provide 60% of cobalt, 53% of lithium, 57% of manganese, and 53% of nickel globally by 2040. Every year, recycling copper reduces 40 million metric tons of CO2 emissions and 100 million MWh of electrical energy use. It is anticipated that throughout this period, recycling rates will increase to 17% in 2060. Compared to landfilling and incineration, which account for 50% and 18% of the share, respectively, this will still be less. As such, companies are focusing on public education and awareness to increase recycling statistics. Additionally, incentives and awards are being given for recognition to attract a broader base.

Hydrometallurgical Recycling Market Drivers:

Rising demand for critical and rare metals has been boosting the market.

The need for effective recycling techniques is being driven by the rising demand for key metals, such as lithium, cobalt, and other elements. They are utilized in many high-tech applications, including electronics, renewable energy systems, and electric cars. Conventional methods of extracting and mining these metals are frequently unsustainable from an economic and environmental standpoint. An economical and environmentally friendly substitute for extracting these precious metals from industrial waste streams, end-of-life goods, and urban mining operations is hydrometallurgical recycling. The hydrometallurgical recycling industry is anticipated to grow as a result of sustainably supplying the growing demand for key metals.

Environmental regulations and sustainability initiatives are accelerating the growth rate.

Industries are adopting more sustainable recycling techniques, such as hydrometallurgical recycling, in response to strict environmental restrictions that aim to reduce waste output, conserve natural resources, and minimize environmental damage. Reducing waste and maximizing resource efficiency are the two main goals of the circular economy, and governments and international organizations are prioritizing these points. Because of various laws, certifications, and other compilation standards, companies are bound to spend money on technologies like hydrometallurgical recycling to abide by laws and fulfill sustainability goals.

Hydrometallurgical Recycling Market Restraints and Challenges:

Initial investments, a lack of skilled expertise, water consumption, and selective metal recovery are the main issues that the market is currently facing.

Establishing the technology for hydrometallurgical recycling requires high expenses for technology, equipment, and infrastructure. A lot of companies, especially small and medium-sized ones, find difficulties in accommodating these charges. This can be a major barrier, limiting the expansion. Secondly, the whole process is demanding and complex. It requires laborers who have sufficient knowledge about the operations and work efficiently. Additionally, improper use, leakage, and spilling of chemicals and reagents can lead to soil pollution, air contamination, and other environmental hazards. It can also pose a risk to the human body. Thirdly, this process typically requires large amounts of water for leaching, purification, and separation. This can be an obstacle in areas with water deficiency and restrictions. Furthermore, the method has specific metals that can be recovered from industrial and other mining processes. It can be difficult to maximize metal recovery rates while reducing impurities and byproducts, especially when dealing with metals that have comparable chemical characteristics or low feedstock concentrations.

Hydrometallurgical Recycling Market Opportunities:

Innovations in the industry are being encouraged to develop advanced equipment. Technological advancements, including solvent extraction, ion exchange, and electrochemical processes, are increasing the effectiveness, economy, and suitability of hydrometallurgical recycling for a greater variety of materials and metals. Furthermore, research and development initiatives are being emphasized towards reducing energy consumption. With these advancements, it is possible to enhance recovery rates and improve extraction efficiency. Secondly, the expansion of end-of-life product recycling has been providing the market with many possibilities. Hydrometallurgical recycling techniques are being applied to recover metals from electronic waste like laptops and smartphones, batteries, solar panels, etc. Rare earth elements have gained prominence. This provides an opportunity for the market to use this technology in the electronic and energy sectors. Apart from this, investments by business tycoons towards various emerging startups and companies have been beneficial.

HYDROMETALLURGICAL RECYCLING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.64% |

|

Segments Covered |

By Battery Chemistry, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Boliden Group, Umicore, Glencore, Teck Resources, Aurubis, Freeport-McMoRan, Vale, Rio Tinto, Anglo American1, Nyrstar |

Hydrometallurgical Recycling Market Segmentation: By Battery Chemistry

-

Lithium-nickel Manganese Cobalt

-

Lithium-iron Phosphate

-

Lithium-manganese Oxide

-

Lithium-titanate Oxide

-

Lithium-nickel Cobalt Aluminum Oxide

Lithium-nickel manganese cobalt is the largest growing type. Because lithium-nickel manganese cobalt (NMC) batteries include rich metals that may be recovered with high purity and low energy consumption, they are desirable in hydrometallurgical recycling. Lithium-ion batteries, which are widely utilized in consumer electronics, energy storage systems, and electric vehicles (EVs), depend on NMC as a critical component. NMC batteries are in higher demand because of the rising popularity of electric vehicles (EVs) and renewable energy technologies, which makes NMC an important material for recycling. Valuable metals, including cobalt, nickel, manganese, and lithium, are present in NMC batteries and may be collected and recycled using hydrometallurgical recycling techniques. Recovering these precious metals from NMC batteries lessens the need to extract virgin resources and encourages resource conservation. The lithium-iron phosphate sector is anticipated to develop at the fastest rate. This is explained by the rising demand for lithium-ion batteries, which are utilized in a variety of products and systems, such as energy storage systems, electric cars, and portable electronics. Effective recycling techniques are becoming more and more necessary as these batteries approach the end of their useful lives to recover precious metals like phosphate, iron, and lithium. The use of chemical methods to leach and recover these metals from old batteries is an efficient option provided by hydrometallurgical recycling.

Hydrometallurgical Recycling Market Segmentation: By End-Users

-

Automotive

-

Industrial

-

Power

-

Marine

The automotive segment is the largest growing end user. Numerous materials, including precious metals like gold, silver, and platinum, as well as metals like steel, aluminum, and copper, are found in vehicles. End-of-life vehicles (ELVs) and automotive waste may effectively recover these metals using hydrometallurgical recycling methods, rendering them a significant resource for recycling. Recycling metals from old cars lessens the need for the extraction of virgin materials, protects natural resources, and reduces the negative effects of mining on the environment. Through hydrometallurgical procedures, the automobile industry recovers and reuses metals from ELVs, promoting sustainable materials management and resource conservation. The power industry is the fastest-growing. This is explained by the growing need in the power industry for effective and environmentally friendly energy storage options, including batteries. Energy storage is becoming more and more necessary to reduce intermittency problems as renewable energy sources gain popularity. An important part of recycling old batteries is hydrometallurgical recycling, which makes it possible to recover precious metals like nickel, cobalt, and lithium.

Hydrometallurgical Recycling Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market. Countries like China, India, and Japan are at the forefront. The primary reason for this dominance is because of the substantial industrial base and manufacturing sector. This generates a sizable market for technology and services related to hydrometallurgical recycling. Rapid industrialization and urbanization in the Asia-Pacific area have expanded metal consumption across several industries, including electronics, infrastructure, automotive, and construction. Because of this, there is an increasing demand for sustainable metal recycling solutions to handle the growing amount of industrial trash and end-of-life items. Governments are progressively enforcing laws and policies to encourage recycling, lessen waste production, and solve environmental issues. These programs establish a regulatory framework that is favorable to the growth of the hydrometallurgical recycling industry.

COVID-19 Impact Analysis on the Global Hydrometallurgical Recycling Market:

The market was harmed by the viral epidemic. Lockdowns, restricted movement, and social isolation were all part of the new normal. This had an impact on the supply chain, logistics, and transportation. The focus was on working remotely. Production and manufacturing activities were thus halted. Recycling facilities faced operational challenges due to safety protocols. An economic downturn was seen. Numerous individuals lost their employment. The majority of the money was intended to be used on applications related to healthcare. Launches and partnerships were delayed as a result. Many people focused only on purchasing the basics. Following the epidemic, the market has started to pick up due to the relaxation of rules and restrictions. The pandemic played a vital role in spreading awareness about sustainability. Besides, a lot of medical waste was being generated. Recycling solutions have become extremely necessary to tackle solid waste.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.The development of hydrometallurgical recycling methods that are sustainable and have a low impact on the environment in terms of energy, water, and other resources is becoming increasingly important. The recycling business is becoming more sustainable as green technologies like bioleaching, enzymatic processes, and electrochemical approaches gain popularity as substitutes for conventional chemical-based processes.

Key Players:

-

Boliden Group

-

Umicore

-

Glencore

-

Teck Resources

-

Aurubis

-

Freeport-McMoRan

-

Vale

-

Rio Tinto

-

Anglo American1

-

Nyrstar

-

In March 2024, a direct material recycling method for semi-solid lithium-ion batteries, termed Liforever, was unveiled by 24M Technologies, a battery technology business with headquarters in Massachusetts. The method is intended to lessen the negative effects of lithium-ion batteries on the environment by increasing the effectiveness and affordability of battery material recovery and reuse. Liforever is included in 24M's battery production process, which preserves active elements in their original state as opposed to conventional recycling techniques that grind batteries into a material known as black mass.

-

In May 2023, Metso Corporation released a news release announcing a sustainable battery black mass recycling procedure. Mass recycling of battery black is increasingly being used to offset the supply of fresh battery metals and lower the carbon footprint of the battery supply chain. The procedure rounds out Metso's broad range of battery material technology offerings, which include hydrometallurgical processing, concentration, and related services.

-

In April 2023, in Harjavalta, Finland, Fortum Battery Recycling inaugurated the biggest closed-loop hydrometallurgical battery recycling plant in Europe. The facility is the largest recycling plant by capacity on the continent and the first hydrometallurgical recycling operation on a commercial scale in Europe. It responds to the rising demand from European producers for environmentally friendly battery materials.

Chapter 1. Hydrometallurgical Recycling Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hydrometallurgical Recycling Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hydrometallurgical Recycling Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hydrometallurgical Recycling Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hydrometallurgical Recycling Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hydrometallurgical Recycling Market– By Battery Chemistry

6.1 Introduction/Key Findings

6.2 Lithium-nickel Manganese Cobalt

6.3 Lithium-iron Phosphate

6.4 Lithium-manganese Oxide

6.5 Lithium-titanate Oxide

6.6 Lithium-nickel Cobalt Aluminum Oxide

6.7 Y-O-Y Growth trend Analysis By Battery Chemistry

6.8 Absolute $ Opportunity Analysis By Battery Chemistry, 2024-2030

Chapter 7. Hydrometallurgical Recycling Market– By End-Users

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Industrial

7.4 Power

7.5 Marine

7.6 Y-O-Y Growth trend Analysis By End-Users

7.7 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 8. Hydrometallurgical Recycling Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Battery Chemistry

8.1.3 By End-Users

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Battery Chemistry

8.2.3 By End-Users

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Battery Chemistry

8.3.3 By End-Users

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Battery Chemistry

8.4.3 By End-Users

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Battery Chemistry

8.5.3 By End-Users

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Hydrometallurgical Recycling Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Boliden Group

9.2 Umicore

9.3 Glencore

9.4 Teck Resources

9.5 Aurubis

9.6 Freeport-McMoRan

9.7 Vale

9.8 Rio Tinto

9.9 Anglo American1

9.10 Nyrstar

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global hydrometallurgical recycling market was valued at USD 780.49 million and is projected to reach a market size of USD 1795.63 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12.64%.

Rising demand for critical & rare metals, environmental regulations, and sustainability initiatives are the main factors propelling the global hydrometallurgical recycling market.

Based on end-users, the global hydrometallurgical recycling market is segmented into automotive, industrial, power, and marine.

Asia-Pacific is the most dominant region for the global hydrometallurgical recycling market.

Boliden Group, Umicore, and Glencore are the key players operating in the global hydrometallurgical recycling market.