Hydrogenated Rosin Market Size (2024 – 2030)

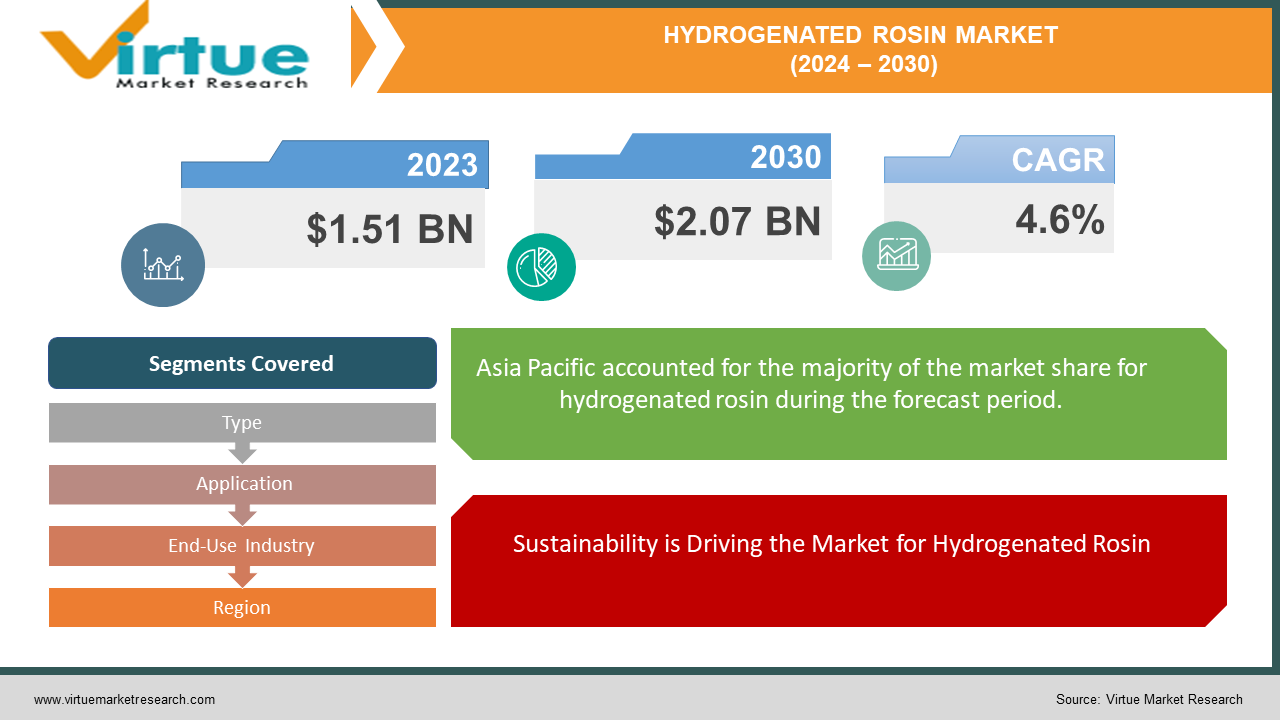

The Global Hydrogenated Rosin Market was valued at USD 1.51 billion in 2023 and is projected to reach a market size of USD 2.07 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.6%.

Hydrogenated rosin is a modified form of pine tree resin that has several benefits. It gets stability by hydrogenation and is resistant to color fading. This pale substance has good adhesion and mixes easily with a variety of chemicals, making it a flexible component. Adhesives, coatings, printing inks, cosmetics, and even certain food additives employ hydrogenated rosin. However, when handling it, be aware of the possibility of skin irritation.

Key Market Insights:

New uses for hydrogenated rosin are constantly being developed as a result of ongoing innovation. The market for bio-based coatings will grow at a compound annual growth rate of 10.2% to reach USD 24.5 billion by 2027. The market's reach is expanded by this diversification beyond more established industries like adhesives, opening up interesting opportunities in new fields like bio-based coatings.

Due to factors including rising industrialization, the Asia Pacific region is expected to retain its dominance in the rosin market through 2028, having had the biggest share of 42.5% in 2023.

Supply chain interruptions caused a 15% rise in the price of pine wood pulp globally in 2023. A product of pine wood, pine tree resin, may also be affected similarly.

Global Hydrogenated Rosin Market Drivers:

Sustainability is Driving the Market for Hydrogenated Rosin

One of the main factors driving the worldwide hydrogenated rosin market forward is the increasing trend of sustainability. Both sectors and consumers are actively looking for environmentally friendly ways to reduce their influence on the environment. Hydrogenated rosin, a bio-based substance made from real pine tree resin, offers a major benefit. In contrast to its rivals derived from petroleum, hydrogenated rosin has a sustainable origin story.

Its environmentally benign quality makes it a good substitute in many applications, especially adhesives. Exciting possibilities are opened by hydrogenated rosin's compatibility with bio-resins, another group of sustainable materials. The creation of next-generation, environmentally conscious adhesives is made possible by the synergy between hydrogenated rosin and bio-resins. The market is expected to increase significantly because of the bio-adhesive potential, which directly addresses the increasing need for sustainable solutions in a variety of sectors.

Regional Factors Influence the Hydrogenated Rosin Industry Environment

The market for hydrogenated rosin is growing unevenly in different parts of the world, creating an interesting picture. While global expansion is anticipated, several regions are anticipated to have a more notable upsurge. Market participants now have strategic opportunities as a result. A primary cause of this unequal expansion is the existence of advantageous rules. Some governments may have sustainability programs that encourage the usage of bio-based goods such as hydrogenated rosin. Companies may provide hydrogenated rosin solutions and profit from the increased demand for environmentally friendly alternatives thanks to this regulatory drive. Another element impacting regional expansion is the competitive environment. Areas where there are less well-established competitors in the hydrogenated rosin industry provide promising opportunities for newcomers. Because there is less rivalry, businesses may more readily establish themselves in the market and possibly see faster development. Businesses may capitalize on the enormous potential in the worldwide hydrogenated rosin market by deliberately focusing on these areas with less competition and more benevolent laws.

Global Hydrogenated Rosin Market Restraints and Challenges:

Even if the worldwide market for hydrogenated rosin shows potential, there are obstacles to overcome. The price of hydrogenated rosin can be greatly affected by changes in the cost of raw materials, especially pine tree resin, which can reduce manufacturing profitability. Furthermore, market share may be constrained by competition from less expensive substitutes such as tall oil rosin, particularly in applications like printing inks. Furthermore, the usage of hydrogenated rosin in some sectors may be restricted by rigorous rules controlling chemical use, necessitating ongoing reformulation to conform. Finally, there's a chance that certain prospective end-user sectors are unaware of the advantages hydrogenated rosin offers in terms of sustainability. The worldwide hydrogenated rosin market must overcome obstacles such as price volatility, alternative competition, regulatory barriers, and low knowledge to realize its full potential.

Global Hydrogenated Rosin Market Opportunities:

A strong tailwind is the sustainability wave. Hydrogenated rosin, which is made from genuine pine tree resin, is well-positioned to profit from the rising demand for bio-based goods. Due to its compatibility with bio-resins, it is perfect for the creation of environmentally friendly adhesives, a trend that has enormous promise. Another important factor is innovation, as fields like natural inks and coatings are always seeing the emergence of new uses. Diversification opens up new and interesting opportunities while expanding the market's reach. Certain areas have untapped potential because of things like lax rules from the government or a lack of competitors, which can open doors for smart entrance and quick growth. Future market expansion may be facilitated by improvements in hydrogenated rosin's qualities brought about by breakthroughs in production techniques and applications. The worldwide hydrogenated rosin market looks forward to a bright and prosperous future by taking advantage of these changes.

HYDROGENATED ROSIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Type, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Eastman Chemical Company (US), Foreverest Resources Ltd. (China), G.C. RUTTEMAN & Co. B.V. (Netherlands), Harima Chemicals Group, Inc (Japan), Henan Haofei Chemical Co., Ltd (China) |

Global Hydrogenated Rosin Market Segmentation: By Type

-

Partially Hydrogenated Rosin

-

Highly Hydrogenated Rosin

It might be difficult to pinpoint the precise dimensions and pace of growth of partly and highly hydrogenated rosin sectors. Due to its wide range of applications in adhesives, partially hydrogenated rosin is probably the market leader now. However, due to its unique qualities that make it ideal for the rapidly expanding bio-based coatings sector, highly hydrogenated rosin may be the rising star. A more informative strategy may be to monitor growth within important application areas and the kind of rosin that is most appropriate for them, rather than concentrating just on segment size. This would provide a better roadmap for the hydrogenated rosin market's future.

Global Hydrogenated Rosin Market Segmentation: By Application

-

Adhesives

-

Printing Inks

-

Coatings

-

Cosmetics

-

Food Additives

In the realm of applying hydrogenated rosin, adhesives are without a doubt kings. Because of its inherent adhesive qualities, it works well with a wide range of commonly used adhesives in the construction and packaging sectors. The adhesives category has the biggest demand for hydrogenated rosin due to its well-established and wide-ranging application base. This demand overrides the potential development of other applications, such as bio-coatings, which is still a new industry.

Global Hydrogenated Rosin Market Segmentation: By End-Use Industry

-

Packaging

-

Construction

-

Automotive

-

Pharmaceuticals

-

Food & Beverages

The industries that use the most hydrogenated rosin are packaging and construction, probably because they depend so heavily on strong adhesives for anything from building materials to food containers. Future leaders may even come from the packaging industry, thanks to the rise in bio-based adhesives, which frequently include hydrogenated rosin. Although it can be difficult to determine precise sector proportions, both businesses have sizable demand bases, with packaging perhaps taking the lead in future development as consumers become more environmentally sensitive.

Global Hydrogenated Rosin Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

As the largest consumer and the one with the quickest rate of growth in the worldwide hydrogenated rosin market, the Asia Pacific region has a dominating position. This domination is due to the strong demand for adhesives, coatings, and other industrial uses, which is being fueled by the fast industrialization of nations like China and India. Furthermore, hydrogenated rosin and other bio-based products are favored by some Asian policies that promote sustainability. It's interesting to note that growing sub-economies in this region that are seeing a spike in demand for rosin-using items are predicted to increase at the highest rate.

COVID-19 Impact Analysis on the Global Hydrogenated Rosin Market:

Without a doubt, the COVID-19 epidemic had an impact on the world market for hydrogenated rosin. Movement restrictions and lockdowns caused supply chain disruptions and reduced demand from important consumer sectors like adhesives and construction. The market had a brief setback as a result. Nonetheless, it is expected that the market will recover with the relaxation of limitations. The precise magnitude of this resurgence and its enduring consequences may rely on a multitude of elements particular to the industry's reaction and the general economic recuperation.

Recent Trends and Developments in the Global Hydrogenated Rosin Market:

The market for hydrogenated rosin is seeing some very interesting changes. Strong growth is being seen in its primary application sectors, such as coatings, inks, and adhesives, which immediately correlates to an increase in the demand for hydrogenated rosins. Sustainability is a big trend, and hydrogenated rosin is becoming more popular in the creation of bio-resins and adhesives because of its bio-based origin and compatibility with environmentally acceptable substitutes. Growing demand for eco-friendly products is anticipated to be a major factor in this market. Additionally, innovation is growing as new uses for natural inks and coatings appear on the scene. These advancements, together with possible geographical differences in market expansion, indicate that hydrogenated rosin has a bright future.

Key Players:

-

Eastman Chemical Company (US)

-

Foreverest Resources Ltd. (China)

-

G.C. RUTTEMAN & Co. B.V. (Netherlands)

-

Harima Chemicals Group, Inc (Japan)

-

Henan Haofei Chemical Co., Ltd (China)

Chapter 1. Hydrogenated Rosin Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hydrogenated Rosin Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hydrogenated Rosin Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hydrogenated Rosin Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hydrogenated Rosin Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hydrogenated Rosin Market – By Application

6.1 Introduction/Key Findings

6.2 Adhesives

6.3 Printing Inks

6.4 Coatings

6.5 Cosmetics

6.6 Food Additives

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Hydrogenated Rosin Market – By Type

7.1 Introduction/Key Findings

7.2 Partially Hydrogenated Rosin

7.3 Highly Hydrogenated Rosin

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Hydrogenated Rosin Market – By End-User

8.1 Introduction/Key Findings

8.2 Packaging

8.3 Construction

8.4 Automotive

8.5 Pharmaceuticals

8.6 Food & Beverages

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Hydrogenated Rosin Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Hydrogenated Rosin Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Eastman Chemical Company (US)

10.2 Foreverest Resources Ltd. (China)

10.3 G.C. RUTTEMAN & Co. B.V. (Netherlands)

10.4 Harima Chemicals Group, Inc (Japan)

10.5 Henan Haofei Chemical Co., Ltd (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hydrogenated Rosin Market size is valued at USD 1.51 billion in 2023.

The worldwide Global Hydrogenated Rosin Market growth is estimated to be 4.6% from 2024 to 2030.

The Global Hydrogenated Rosin Market is segmented By Type (Partially Hydrogenated Rosin, Highly Hydrogenated Rosin); By Application (Adhesives, Printing Inks, Coatings, Cosmetics, Food Additives); By End-Use Industry (Packaging, Construction, Automotive, Pharmaceuticals, Food & Beverages) and by region.

The market for hydrogenated rosin is predicted to be driven by the rising demand for sustainable and bio-based goods. It is a desirable ingredient for eco-friendly adhesives due to its natural adhesive qualities and compatibility with a variety of bio-resins. Moreover, the growing use of hydrogenated rosin in the manufacturing of natural coatings and inks is probably going to drive market expansion.

The COVID-19 epidemic probably caused a disruption in the global market for hydrogenated rosin, while the precise effect is unknown. Movement restrictions and lockdowns had an impact on supply chains and demand from important sectors like adhesives and construction. As these limitations loosened, the market is anticipated to have partially recovered.