Hydrogen Electrolyser Market Size (2024 – 2030)

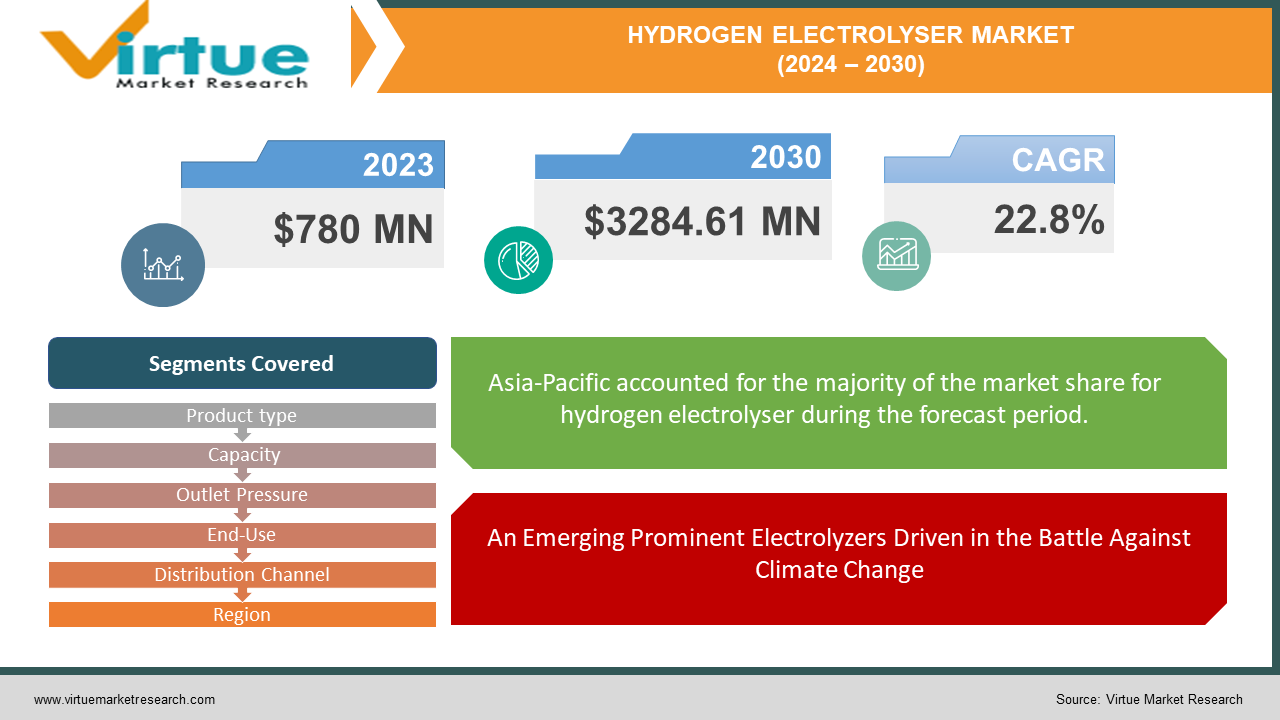

The Global Hydrogen Electrolyser Market was valued at USD 780 million in 2023 and is projected to reach a market size of USD 3284.61 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 22.8%.

Fuel cells are revolutionized by a device called a hydrogen electrolyzer. Using electricity to split apart water molecules (H2O) and produce hydrogen gas (H2) and oxygen gas (O2) through electrolysis, it uses hydrogen instead of fuel to create energy. This procedure is essential to a clean energy-powered future. Green hydrogen, a fuel choice that burns cleanly, can be produced by electrolyzers using renewable electricity sources like solar or wind. Alkaline (AEL), polymer electrolyte membrane (PEM), and solid oxide (SOEL) are the three primary types of electrolyzers, each with advantages and disadvantages. The most widely used technology, albeit less effective, is AELs. PEMs cost more to produce but are more efficient. Although SOELs have the maximum efficiency, their high operating temperature requirements make maintenance more difficult.

Key Market Insights:

The ability to produce electrolyzers is increasing. Globally, it reached over 11 GW annually in 2023, with two-thirds coming from China and Europe. It is anticipated that this greater capacity and research and development activities will result in lower electrolyzer prices. Although up-front expenses are still a barrier (the market is expected to reach USD 1 billion in 2024), developments are making choices more accessible. According to Market Insights, the market will grow to USD 4 billion by 2032, a considerable drop in the average cost of an electrolyzer.

Global Hydrogen Electrolyser Market Drivers:

An Emerging Prominent Electrolyzers Driven in the Battle Against Climate Change

Governments everywhere are setting ambitious decarbonization targets because of the looming threat of climate change. Hydrogen, in particular green hydrogen generated by electrolyzers, is emerging as a game-changer in this global search for clean energy alternatives. For many industries that have historically relied on fossil fuels, green hydrogen—which is produced by splitting water molecules with clean electricity from renewable sources like solar or wind—offers a sustainable fuel alternative. Significant expenditures in hydrogen electrolyzer technology are being driven by this paradigm change. Take the transportation industry, which is a significant source of greenhouse gas emissions. Vehicles fuelled by hydrogen fuel cells present a clean option to traditional gasoline-driven automobiles. However, the ability to manufacture clean hydrogen is a prerequisite for widespread adoption. The secret is provided by electrolyzers, which facilitate the creation of green hydrogen, provide these cars with a clean fuel supply, and lower exhaust emissions. Similarly, renewable hydrogen can take the place of fossil fuels in carbon-intensive, high-temperature processes seen in the steel and cement industries to enable greener production techniques. The potential for decarbonization in a few industries is driving a spike in funding for the study, creation, and application of hydrogen electrolyzer technology. Because of the financial incentives provided by governments, electrolyzers are becoming an increasingly important tool in the battle against climate change.

Electrolyzers and Hydrogen Fuel Cells are Dancing Toward a Clean Transportation Future

There is a mutually beneficial dance going on between the markets for hydrogen fuel cells and hydrogen electrolyzers. A positive feedback loop that drives the adoption of clean energy is created when one grows at the expense of the other. On the one hand, there is a significant need for clean hydrogen petrol due to the growth of the hydrogen fuel cell business. Since they only produce water vapor as a byproduct, hydrogen fuel cell cars present a tempting alternative to conventional gasoline-powered automobiles. However, a readily available source of pure hydrogen is essential for this technology to function to its fullest capacity. Here's where electrolyzers come into play. Renewable energy sources, such as solar or wind power, can power electrolyzers to create green hydrogen, a sustainable and clean fuel. The need for electrolyzers to produce hydrogen rises in direct proportion to the demand for hydrogen fuel cell vehicles. Due to the market pull created by this, more money is invested in production, R&D, and electrolyzer technology. The increasing efficiency and cost-effectiveness of electrolyzers renders green hydrogen production more feasible, hence increasing consumer interest in hydrogen fuel cell vehicles. This reinforces the positive feedback loop by increasing demand for hydrogen fuel cell cars. The development of hydrogen fuel cell technology and electrolyzers is working in concert to create a future of clean transportation.

Global Hydrogen Electrolyser Market Restraints and Challenges:

The need for clean energy is driving expansion in the global hydrogen electrolyzer market, but there are obstacles in the way. This sophisticated equipment has high upfront prices, which puts a burden on finances, particularly in cost-sensitive sectors. Furthermore, even though the creation of green hydrogen depends on clean electricity generated by wind and solar power, many regions' current grid infrastructure is unable to accommodate this intermittent supply. Moreover, a strong hydrogen infrastructure for distribution, transportation, and storage is necessary for the widespread use of hydrogen fuel cells, but this infrastructure is currently nonexistent in most places. Ultimately, even with these developments, electrolyzer technology still needs to be improved in terms of cost-effectiveness, durability, and efficiency.

Global Hydrogen Electrolyser Market Opportunities:

The worldwide market for hydrogen electrolyzers is full of prospects. Decarbonization is a top priority for governments, and green hydrogen produced by electrolyzers is seen as revolutionary for power production, industry, and clean transportation. The development of electrolyzer technology will be aided by this increase in investment in renewable energy. The thrilling segment? With developments bringing new materials, cutting production costs, and increasing efficiency, innovation is growing. Green hydrogen production with electrolyzers is becoming even more appealing as solar and wind power costs keep falling. And the story doesn't end there! Demand for both industries is driven by the perfect synergy created by the growing hydrogen fuel cell market. Hydrogen electrolyzers are an attractive field with many new applications such as industrial decarbonization and green ammonia production.

HYDROGEN ELECTROLYSER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

22.8% |

|

Segments Covered |

By Product type, Capacity, Outlet Pressure, End-Use, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cummins Inc. (US), Enapter S.r.l. (Italy), FirstElement Fuel (Canada), Green Hydrogen Systems (China), H-TEC SYSTEMS GmbH (Germany), IHI Corporation (Japan), John Cockerill (Belgium), McPhy Energy S.A. , Ming Yang Smart Energy Group Limited, Nel ASA, NEL Hydrogen US, Inc., Plug Power Inc. , Shengli Oil & Gas Field Equipment Corporation , Siemens Energy , thyssenkrupp nucera |

Global Hydrogen Electrolyser Market Segmentation: By Product Type

-

Alkaline Electrolyzers (AEL)

-

Polymer Electrolyte Membrane (PEM) Electrolyzers

-

Solid Oxide Electrolyzers (SOEL)

The market for hydrogen electrolyzers is experiencing a major upheaval. Polymer Electrolyte Membrane (PEM) electrolyzers are growing at the quickest rate, whereas Alkaline Electrolytes (AELs) were formerly the industry leader. PEM's dominance is a result of its higher efficiency, which extracts more hydrogen from each electrical unit. Furthermore, PEM's modular design enables flexible scalability to meet different production requirements. Although PEM now has greater upfront costs, manufacturing advances are reducing those expenses. Another benefit of PEM is its capacity to swiftly start and halt output, which makes it perfect for balancing the grid's varying energy demands. PEM is the recommended option for new projects and large-scale hydrogen generation because of its benefits in efficiency, scalability, and response time, even if AELs are still relevant because of their cost and proven technology.

Global Hydrogen Electrolyser Market Segmentation: By Capacity

-

Up to 150 kW

-

151 kW to 500 kW

-

500 kW to 1000 kW

-

Above 1000 kW

The market for hydrogen electrolyzers with the most increase in mega-projects (>1000 kW) is the capacity market. The need for clean hydrogen in heavy industries like chemicals and steel, where large-scale manufacturing is crucial, is what's driving this boom. These mega-watt electrolyzers are less expensive per unit of hydrogen than smaller ones because of economies of scale. These high-capacity systems are also required by the growing number of green hydrogen production facilities that run on renewable energy. Lastly, the adoption of mega-watt electrolyzers is further accelerated by government subsidies for large-scale clean hydrogen projects. Smaller capacities serve certain applications, but the over 1000 kW market remains dominant because of cost advantages and the drive towards clean heavy industry.

Global Hydrogen Electrolyser Market Segmentation: By Outlet Pressure

-

Up to 10 Bar

-

11-40 Bar

-

More than 40 Bar

The market for hydrogen electrolyzers is dominated by the 11–40 Bar pressure range. This sweet spot is the most well-liked option across multiple sectors because it provides a few benefits. Because of its adaptability, it can be used for a variety of purposes, including industrial processes, hydrogen refueling stations, and on-site hydrogen generation for fuel cells. For many users, the 11–40 Bar range offers a more economical alternative since it maintains a fair balance between efficiency and pressure, in contrast to higher pressure solutions that use more energy and cost more money. Furthermore, a large amount of the current hydrogen infrastructure, like as stations and pipelines, is built for this pressure range. Adopting 11–40 Bar electrolyzers doesn't require costly infrastructure improvements thanks to this compatibility.

Global Hydrogen Electrolyser Market Segmentation: By End-Use

-

Mobility

-

Energy Storage

-

Industrial Applications

-

Others

It's difficult to identify the clear market leader in hydrogen electrolyzers based on end-use. Growth is dependent on a few variables, and the front-runner may change over time. Mobility, or supplying fuel for hydrogen fuel cell vehicles, has historically taken the lead. Battery electric cars, however, may slow its growth. Energy storage, which uses renewable energy to balance the grid, has potential, but it also requires grid modernization and affordable storage options. Applications for the industry are the dark horse. Because of the enormous volumes needed, this market sector has the potential to be the largest in terms of sheer market size. It is driven by the need for clean hydrogen in industries like ammonia and steel production. Considering combined growth, as hydrogen infrastructure grows and costs come down, both industrial applications and mobility could soar at the same time.

Global Hydrogen Electrolyser Market Segmentation: By Distribution Channel

-

Direct Sales

-

Indirect Sales

The geography of hydrogen electrolyzer distribution is changing. Indirect sales are quickly taking the lead as the fastest-growing market, yet direct sales—where manufacturers engage directly with end users—have historically been the conventional paradigm. Sales, marketing, and installation are handled by middlemen such as distributors or engineering firms in indirect sales. This strategy has a few benefits. Reaching a larger consumer base speeds up market penetration. By offering beneficial services like finance and system integration, these middlemen can increase the accessibility of hydrogen solutions. This is especially important as projects get more complicated and call for knowledge on how to integrate infrastructure, storage, and renewable energy sources—a skill that engineering, procurement, and construction (EPC) firms excel at. A wider sales network is required to service the growing client base in the transportation, industry, and power sectors, a need that indirect channels may successfully fill.

Global Hydrogen Electrolyser Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific (APAC) and European markets are leading the global hydrogen electrolyzer market, which is a hive of activity spanning several regions. Growth in APAC, especially in China, Japan, and South Korea, is booming thanks to government policies. The adoption of hydrogen is being facilitated by expansive clean energy objectives, tax cuts, and generous subsidies. Furthermore, these nations are under pressure to reduce their reliance on fossil fuels and tackle air pollution, which makes clean-burning hydrogen quite appealing. The APAC industry is further propelled by China's ambitious aspirations for hydrogen development. Europe continues to be a strong contender because of its well-established dedication to the shift to sustainable energy. Their extensive research and development work in hydrogen technology puts them in a strong position to flourish in the future.

COVID-19 Impact Analysis on the Global Hydrogen Electrolyser Market:

The market for hydrogen electrolyzers was not particularly affected by COVID-19. Initial hiccups include supply chain tangles, project delays, and lockdowns. Production was halted by a paucity of raw materials, which poured fuel to the fire. During the economic slump, investments in renewable energy, such as electrolysis, temporarily decreased. But the pandemic wasn't all bad news. It made conventional energy systems' flaws clear and sparked fresh interest in clean alternatives like hydrogen. More long-term investments in the industry may result from this. Furthermore, renewable energy technologies were frequently given priority in government stimulus packages, which would have provided the hydrogen electrolyzer business with a much-needed boost. Even while the pandemic created some temporary setbacks, it might have eventually catalyzed the use of clean energy, opening the door for hydrogen electrolyzers to have a more promising future.

Recent Trends and Developments in the Global Hydrogen Electrolyser Market:

There are a lot of interesting innovations in the worldwide hydrogen electrolyzer market. Governments are becoming more and more supportive, putting laws into place and providing funding dedicated to the advancement and use of electrolyzers. This makes the market more conducive to expansion. In the meantime, creativity is exploding. Scientists are always working to reduce costs by increasing efficiency and creating new, more durable, and reasonably priced materials for electrolyzers. Beyond simply fuel cell automobiles, these technologies are finding more and more uses. Expanding the commercial potential of electrolyzers are new areas such as industrial decarbonization and green ammonia production. Reducing expenses is an additional top objective. Contributing elements include improvements in manufacturing, increased output, and falling costs for the renewable energy sources used to power electrolyzers. Industry participants are banding together to expedite progress even more.

Key Players:

-

Cummins Inc. (US)

-

Enapter S.r.l. (Italy)

-

FirstElement Fuel (Canada)

-

Green Hydrogen Systems (China)

-

H-TEC SYSTEMS GmbH (Germany)

-

IHI Corporation (Japan)

-

John Cockerill (Belgium)

-

McPhy Energy S.A.

-

Ming Yang Smart Energy Group Limited

-

Nel ASA

-

NEL Hydrogen US, Inc.

-

Plug Power Inc.

-

Shengli Oil & Gas Field Equipment Corporation

-

Siemens Energy

-

thyssenkrupp nucera

Chapter 1. Hydrogen Electrolyser Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hydrogen Electrolyser Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hydrogen Electrolyser Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hydrogen Electrolyser Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hydrogen Electrolyser Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hydrogen Electrolyser Market – By Product Type

6.1 Introduction/Key Findings

6.2 Alkaline Electrolyzers (AEL)

6.3 Polymer Electrolyte Membrane (PEM) Electrolyzers

6.4 Solid Oxide Electrolyzers (SOEL)

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Hydrogen Electrolyser Market – By Capacity

7.1 Introduction/Key Findings

7.2 Up to 150 kW

7.3 151 kW to 500 kW

7.4 500 kW to 1000 kW

7.5 Above 1000 kW

7.6 Y-O-Y Growth trend Analysis By Capacity

7.7 Absolute $ Opportunity Analysis By Capacity, 2024-2030

Chapter 8. Hydrogen Electrolyser Market – By Outlet Pressure

8.1 Introduction/Key Findings

8.2 Up to 10 Bar

8.3 11-40 Bar

8.4 More than 40 Bar

8.5 Y-O-Y Growth trend Analysis By Outlet Pressure

8.6 Absolute $ Opportunity Analysis By Outlet Pressure, 2024-2030

Chapter 9. Hydrogen Electrolyser Market – By End-Use

9.1 Introduction/Key Findings

9.2 Mobility

9.3 Energy Storage

9.4 Industrial Applications

9.5 Others

9.6 Y-O-Y Growth trend Analysis By End-Use

9.7 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 10. Hydrogen Electrolyser Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Direct Sales

10.3 Indirect Sales

10.4 Y-O-Y Growth trend Analysis By Distribution Channel

10.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. Hydrogen Electrolyser Market , By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Product Type

11.1.2.1 By Capacity

11.1.3 By Outlet Pressure

11.1.4 By Distribution Channel

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Product Type

11.2.3 By Capacity

11.2.4 By Outlet Pressure

11.2.5 By End-Use

11.2.6 By Distribution Channel

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Product Type

11.3.3 By Capacity

11.3.4 By Outlet Pressure

11.3.5 By End-Use

11.3.6 By Distribution Channel

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Product Type

11.4.3 By Capacity

11.4.4 By Outlet Pressure

11.4.5 By End-Use

11.4.6 By Distribution Channel

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Product Type

11.5.3 By Capacity

11.5.4 By Outlet Pressure

11.5.5 By End-Use

11.5.6 By Distribution Channel

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Hydrogen Electrolyser Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Cummins Inc. (US)

12.2 Enapter S.r.l. (Italy)

12.3 FirstElement Fuel (Canada)

12.4 Green Hydrogen Systems (China)

12.5 H-TEC SYSTEMS GmbH (Germany)

12.6 IHI Corporation (Japan)

12.7 John Cockerill (Belgium)

12.8 McPhy Energy S.A.

12.9 Ming Yang Smart Energy Group Limited

12.10 Nel ASA

12.11 NEL Hydrogen US, Inc.

12.12 Plug Power Inc.

12.13 Shengli Oil & Gas Field Equipment Corporation

12.14 Siemens Energy

12.15 thyssenkrupp nucera

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hydrogen Electrolyser Market size is valued at USD 780 million in 2023.

The worldwide Global Hydrogen Electrolyser Market growth is estimated to be 22.8% from 2024 to 2030.

The Global Hydrogen Electrolyser Market is segmented By Product Type (Alkaline Electrolyzers (AEL), Polymer Electrolyte Membrane (PEM) Electrolyzers, Solid Oxide Electrolyzers (SOEL)); By Capacity (Up to 150 kW, 151 kW to 500 kW, 500 kW to 1000 kW, Above 1000 kW); By Outlet Pressure (Up to 10 Bar, 11-40 Bar, More than 40 Bar); By End-Use (Mobility, Energy Storage, Industrial Applications, Others); By Distribution Channel (Direct Sales, Indirect Sales) and by region.

Due to a few factors, the global market for hydrogen electrolyzers is expected to grow and prosper in the future. It is expected that governments to maintain a firm grip on power by enacting laws and providing incentives that advance the development of clean energy and hydrogen. Technological developments will continue to lower prices and improve the efficiency of electrolyzers, increasing their appeal. Ultimately, the market for hydrogen electrolyzers is expected to continue expanding because of the growing demand for clean hydrogen in a few industries, including transportation, manufacturing, and power generation.

The global market for hydrogen electrolyzers was impacted by the COVID-19 epidemic in a variety of ways. Although the early disruptions resulted in project delays, they also brought attention to the need for renewable energy alternatives, which spurred long-term investment in the field.