Global Hydrofluorocarbon Blends Market size (2024-2030)

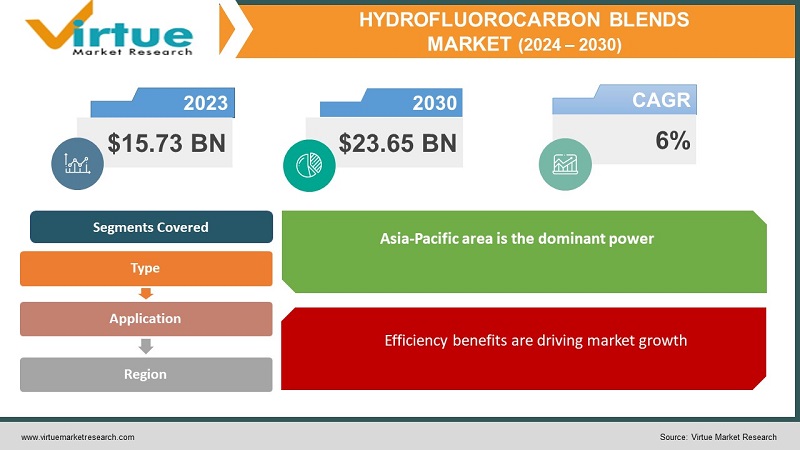

The Global Hydrofluorocarbon Blends Market Market was valued at USD 15.73 billion in 2023 and will grow at a CAGR of 6% from 2024 to 2030. The market is expected to reach USD 23.65 billion by 2030.

The Hydrofluorocarbon blend market refers to the sale of refrigerants made by combining multiple HFCs. These blends are commonly used in air conditioning and refrigeration systems but are being phased out due to environmental concerns. The overall HFC refrigerant market is expected to grow moderately in the coming years, but Hydrofluorocarbon Blends specifically may face a decline as regulations and sustainable alternatives take effect.

Key Market Insights:

A significant challenge for HFC Blends is the tightening regulations due to their high Global Warming Potential (GWP). The Montreal Protocol on Substances that Deplete the Ozone Layer mandates a gradual phase-out of HFCs. This is pushing the market towards more environmentally friendly alternatives like Hydrofluoroolefins (HFOs) with lower GWPs.

As regulations take effect, demand for HFC Blends is expected to decline. The market will likely see a rise in HFO-based refrigerants and other compliant technologies.

The future of the HFC Blends market hinges on stricter environmental regulations and the development of cost-effective, compliant alternatives. While the overall HFC refrigerant market might show moderate growth, HFC Blends are likely to see a decline in the long run.

Global Hydrofluorocarbon Blends Market Market Drivers:

Efficiency benefits are driving market growth:

HFC blends can act as a bridge between outdated and environmentally harmful refrigerants like CFCs and HCFCs, and the development of next-generation, eco-friendly solutions. Compared to their predecessors, HFC blends often boast superior energy efficiency. This translates to significant cost savings for businesses that rely on air conditioning and refrigeration systems. Imagine a supermarket chain replacing their old HCFC-based freezers with HFC blend units. The improved efficiency of the HFC blends would require less energy to maintain the desired freezing temperatures. This translates to lower electricity bills, a substantial benefit considering the constant operation of these systems. The energy savings extend beyond just financial gain. By consuming less energy, HFC blends contribute to a reduced carbon footprint for businesses. This environmental benefit, while not the primary driver for adoption, adds another layer of justification for their use during the transition period towards more sustainable alternatives. However, it's crucial to remember that HFC blends themselves are not the ultimate solution. As regulations tighten and next-generation refrigerants become more affordable, the market will shift away from HFC blends, prioritizing long-term environmental responsibility.

Existing infrastructure is driving market growth:

The high cost of replacing existing air conditioning and refrigeration systems designed for HFC blends is a major driver for their continued use as a temporary solution. Imagine a large office building with a complex network of HFC blend-based AC units. Replacing these units entirely to accommodate new refrigerants would be a significant financial undertaking. The cost would encompass not just the new equipment itself, but also the labor involved in dismantling the old system, potential modifications to ductwork and piping, and the disruption to daily operations during installation. HFC blends offer a cost-effective stopgap solution. Businesses can maintain the existing infrastructure while still achieving some level of environmental improvement compared to older refrigerants. This "buy time" approach allows for better planning and budgeting for a future system overhaul. Additionally, as technology advances, the cost of newer, more sustainable refrigerants is likely to decrease, making a full system switch more financially viable in the long run. Of course, this benefit comes with the caveat that HFC blends are not a permanent solution. Regulations and environmental concerns will eventually push the market towards a complete shift, but HFC blends play a crucial role in easing the transition for businesses by minimizing upfront costs and disruptions.

Phased approaches to regulations are driving market growth:

The Montreal Protocol's phased approach to HFC elimination acts as a double-edged sword for the HFC blends market. On one hand, it acknowledges the reality of existing infrastructure and the need for industries to adapt. This creates a window of opportunity for continued use of HFC blends. Businesses that rely heavily on these refrigerants can utilize this timeframe to develop long-term solutions. Imagine a large food processing plant that depends on HFC blends for its massive cold storage facilities. The Montreal Protocol's gradual phase-out allows them to strategically plan for the future. They can invest in research and development of alternative cooling systems compatible with their existing infrastructure or explore partnerships with refrigerant manufacturers to create custom solutions. Additionally, this timeframe provides them with the opportunity to train staff on handling and maintaining new refrigerants, ensuring a smooth transition when the time comes. The phased approach isn't just about giving industries a break; it's about facilitating a measured and responsible shift towards a more sustainable future for our planet. However, it's important to remember that this window has a closing time. Businesses must leverage this period effectively to develop long-term solutions, ensuring a smooth transition away from HFC blends before regulations tighten completely.

Global Hydrofluorocarbon Blends Market Market challenges and restraints:

Stringent Environmental Regulations are a significant hurdle for the Hydrofluorocarbon Blends Market:

The Achilles' heel of HFC blends is their environmental impact. Their high Global Warming Potential (GWP) translates to a significant contribution to global warming, trapping heat in the atmosphere at much higher rates than other gases. This has led to the Montreal Protocol, an international treaty, enforcing a gradual phase-out of HFCs. This phase-out acts as a powerful market force, pushing the industry towards more sustainable alternatives. Hydrofluoroolefins (HFOs) are emerging as the frontrunners in this race. They boast a dramatically lower GWP, making them a much greener choice for refrigeration and air conditioning systems. As regulations tighten and environmental consciousness rises, HFC blends will face increasing pressure. The phase-out provides a window of opportunity for businesses to adapt, but the long-term trend is undeniable - the market is headed towards a future dominated by HFOs and other eco-friendly cooling solutions.

Shifting Consumer Preferences are throwing a curveball at the Hydrofluorocarbon Blends Market market:

The rise of environmental consciousness is posing a significant challenge to the HFC blend market. Consumers and businesses are becoming increasingly vocal about their desire for eco-friendly products and services. This translates to a growing demand for air conditioning and refrigeration systems that utilize sustainable refrigerants. HFC blends, while offering some efficiency advantages, struggle to compete with this evolving market sentiment. Their high GWP, despite offering temporary cost benefits, clashes with the growing consumer preference for environmentally responsible solutions. Imagine a large electronics retailer looking to update its air conditioning system. In the past, they might have opted for HFC blends based on their efficiency and affordability. However, with the rising focus on sustainability, they're more likely to consider alternatives with a lower environmental footprint. This shift in consumer and business priorities could lead to a decline in the HFC blend market share as companies prioritize long-term environmental responsibility over short-term cost advantages. HFC blends may offer a temporary bridge, but the future of cooling systems is undoubtedly tilting towards a more sustainable future.

Technological Advancements are a growing nightmare for Hydrofluorocarbon Blends Market:

The future of HFC blends is under threat by the innovation brewing in the world of refrigerants. The development of next-generation, low-GWP refrigerants like Hydrofluoroolefins (HFOs) is rapidly changing the game. These new players boast a significantly lower Global Warming Potential compared to HFC blends. This translates to a much smaller environmental footprint, making them a far more attractive option from a sustainability standpoint. But the threat goes beyond just environmental benefits. As research and development continue, HFOs and other alternatives are becoming increasingly cost-competitive with HFC blends. Additionally, advancements are being made in their efficiency, making them not only environmentally friendly but also potentially more economical in the long run. This one-two punch of environmental responsibility and potentially lower operating costs creates a compelling case for adopting these next-generation refrigerants in new air conditioning and refrigeration systems. As HFOs and their counterparts become more readily available and cost-effective, they are likely to become the go-to choice for new installations, leaving HFC blends behind as a relic of a less environmentally conscious era.

Market Opportunities:

The Hydrofluorocarbon Blends market offers a unique set of opportunities despite its eventual phase-out. They act as a bridge for industries transitioning from older, highly polluting refrigerants by providing improved efficiency and lower energy costs. This "breathing room" allows time to develop long-term eco-friendly solutions. HFC blends also offer a cost-effective stopgap, delaying expensive system overhauls until more sustainable and affordable alternatives become mainstream. For specialized applications requiring high-temperature or low-pressure performance, certain HFC blends can fill the gap until suitable green options are available. The phased HFC elimination allows industries a window to invest in R&D, explore alternative cooling technologies, or collaborate on custom solutions. Finally, research continues to improve the efficiency of HFC blends, potentially making them more attractive in the short term. However, these opportunities shouldn't overshadow the market's inevitable decline. The true value lies in strategically using HFC blends as a stepping stone toward a more sustainable future for the cooling industry.

HYDROFLUROCARBON BLENDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International (US), Chemours (US), Arkema (France), Daikin Industries (Japan), Zhejiang Juhua Co., Ltd (China), Navin Fluorine International (India), Gujarat Fluorochemicals (India), Linde (Ireland), Air Liquide (France), Shandong Yuan Chemical Co. (China) |

Hydrofluorocarbon Blends Market Segmentation

Hydrofluorocarbon Blends Market Segmentation By Type:

- Azeotropic Blends

- Zeotropic Blends

While both Azeotropic and Zeotropic blends hold a share in the Hydrofluorocarbon Blends market, Azeotropic blends are likely the more prominent sector. This is because they offer a simpler design and operation due to their constant boiling point throughout evaporation. This makes them easier to integrate into existing air conditioning and refrigeration systems, particularly in residential and commercial applications like R-410A used in AC units. Zeotropic blends, while offering wider temperature range capabilities, require more complex system designs, which can be a barrier for some users. However, as regulations tighten and the market transitions towards more sustainable alternatives, the dominance of both Azeotropic and Zeotropic blends is likely to diminish.

Hydrofluorocarbon Blends Market Segmentation By Application:

- Air Conditioning Systems

- Refrigeration Systems

Within the Hydrofluorocarbon Blends market, Air Conditioning Systems are likely the most prominent sector. It’s important to remember that the prominence of both Air Conditioning and Refrigeration Systems using HFC blends is likely to decline in the long run due to stricter regulations and the development of more sustainable alternatives.

Market Segmentation: Regional Analysis:

Hydrofluorocarbon Blends Market Segmentation by region

- Asia-Pacific

- North America

- Europe

- South America

- Middle East and Africa

While specific data for HFC blends alone is limited, analysis of the broader HFC refrigerant market suggests that Asia Pacific currently dominates the Hydrofluorocarbon Blends market. This is driven by factors like a booming population, rapid urbanization, and rising disposable income, leading to a surge in demand for air conditioners and refrigerators, both of which often utilize HFC blends. This trend is expected to continue shortly, though stricter environmental regulations may eventually lead to a shift towards more sustainable alternatives across all regions.

COVID-19 Impact Analysis on the Global Hydrofluorocarbon Blends Market Market

The COVID-19 pandemic caused a temporary disruption to the Hydrofluorocarbon blend market. Lockdowns and supply chain slowdowns limited the production and installation of new air conditioning and refrigeration systems, leading to a decline in demand for HFC blends. However, the impact wasn't uniform across all sectors. The commercial refrigeration segment, particularly in food service, likely experienced a sharper decline due to restaurant closures. On the other hand, residential demand for HFC blends might have seen a slight increase as people spent more time indoors. Overall, the pandemic's impact is expected to be short-term. As economic activity rebounds and infrastructure projects resume, the demand for HFC blends is likely to return to pre-pandemic levels in the short term. However, this is unlikely to be a long-term trend. Stricter environmental regulations and the development of more sustainable refrigerants will likely exert a stronger influence on the market in the coming years, pushing the Hydrofluorocarbon blend market toward a gradual decline.

Latest trends/Developments

The Hydrofluorocarbon blend market finds itself at a crossroads. While it offers temporary advantages like improved efficiency over older refrigerants and compatibility with existing infrastructure, its future is clouded by environmental concerns. The most prominent trends highlight this duality. Regulations like the Montreal Protocol are pushing the market towards a phase-out of HFC blends due to their high Global Warming Potential. This has led to the development of next-generation, low-GWP alternatives like Hydrofluoroolefins (HFOs) that boast a significantly smaller environmental footprint. As HFOs and other sustainable refrigerants become more cost-competitive and efficient, they are likely to become the preferred choice for new systems, diminishing the market share of HFC blends. However, HFC blends still offer some opportunities in the short term. They can act as a bridge for industries transitioning away from older, highly polluting refrigerants, and their affordability can be a stopgap solution until more sustainable alternatives become widely available. Additionally, some HFC blends cater to niche applications with their specific performance characteristics until suitable eco-friendly replacements are developed. The key takeaway is that the Hydrofluorocarbon blend market is in a state of flux. While it might experience a reprieve due to its practical advantages, stricter regulations and the rise of sustainable alternatives will undoubtedly lead to its decline in the long run.

Key Players:

- Honeywell International (US)

- Chemours (US)

- Arkema (France)

- Daikin Industries (Japan)

- Zhejiang Juhua Co., Ltd (China)

- Navin Fluorine International (India)

- Gujarat Fluorochemicals (India)

- Linde (Ireland)

- Air Liquide (France)

- Shandong Yuan Chemical Co. (China)

Chapter 1. GLOBAL HYDROFLUOROCARBON BLENDS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL HYDROFLUOROCARBON BLENDS MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL HYDROFLUOROCARBON BLENDS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL HYDROFLUOROCARBON BLENDS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL HYDROFLUOROCARBON BLENDS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL HYDROFLUOROCARBON BLENDS MARKET – By Type

6.1. Introduction/Key Findings

6.2 Azeotropic Blends

6.3. Zeotropic Blends

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL HYDROFLUOROCARBON BLENDS MARKET – By Application

7.1. Introduction/Key Findings

7.2 Air Conditioning Systems

7.3. Refrigeration Systems

7.4. Y-O-Y Growth trend Analysis By Application

7.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. GLOBAL HYDROFLUOROCARBON BLENDS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL HYDROFLUOROCARBON BLENDS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International (US)

9.2. Chemours (US)

9.3. Arkema (France)

9.4. Daikin Industries (Japan)

9.5. Zhejiang Juhua Co., Ltd (China)

9.6. Navin Fluorine International (India)

9.7. Gujarat Fluorochemicals (India)

9.8. Linde (Ireland)

9.9. Air Liquide (France)

9.10 .Shandong Yuan Chemical Co. (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hydrofluorocarbon Blends Market Market was valued at USD 15.73 billion in 2023 and will grow at a CAGR of 6% from 2024 to 2030. The market is expected to reach USD 23.65 billion by 2030.

Efficiency benefits, Existing infrastructure, and a Phased approach to regulations are the reasons that are driving the market

Based on Application it is divided into two segments – Air Conditioning Systems, Refrigeration Systems

North America is the most dominant region for the luxury vehicle Market

Honeywell International (US), Chemours (US), Arkema (France), Daikin Industries (Japan), Zhejiang Juhua Co., Ltd (China).