Hydrocolloid Texturants for Food Market Size (2024-2030)

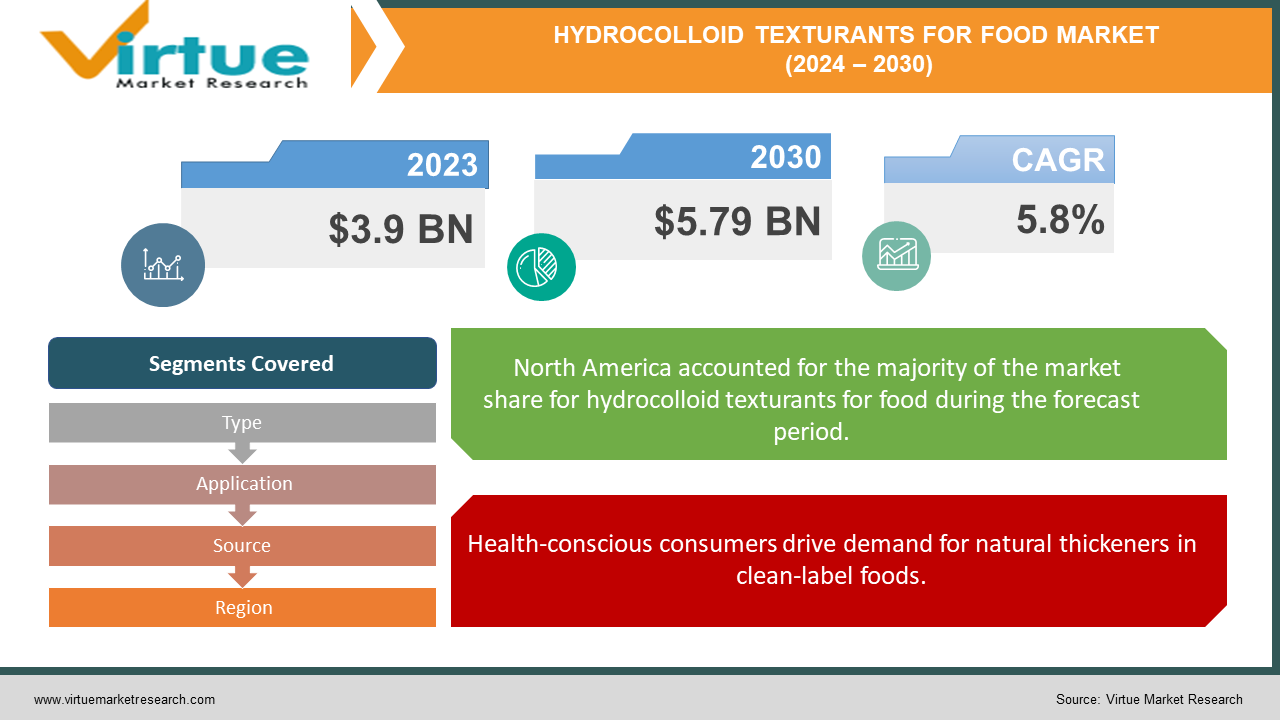

The Hydrocolloid Texturants for Food Market was valued at USD 3.9 billion in 2023 and is projected to reach a market size of USD 5.79 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.8%.

The hydrocolloid texturants market thrives on the growing demand for natural, minimally processed foods. Consumers are increasingly health-conscious and want to avoid artificial ingredients. Hydrocolloids, derived from plants, algae, and fermentation, perfectly align with this trend. Their versatility as thickening, gelling, and stabilizing agents makes them invaluable in various food applications. The market is further fueled by rising disposable incomes, busier lifestyles demanding convenient foods, and advancements in food processing technologies.

Key Market Insights:

The hydrocolloid texturants market is thriving due to a confluence of consumer preferences and industry trends. Health-conscious consumers are driving a surge in demand for natural ingredients, and hydrocolloids, derived from plants, algae, and fermentation, perfectly fit the bill. This shift towards natural alternatives is reflected in the market's growth rate, estimated to be around 4.1% to 5.8% annually.

Beyond their natural appeal, hydrocolloids offer a range of functionalities that make them invaluable for food manufacturers. These texturants can thicken, gel, stabilize emulsions, and enhance texture, making them a versatile tool across various applications. Bakery and confectionery products are the biggest beneficiaries, followed by dairy and frozen desserts. However, the reach of hydrocolloids extends far beyond, encompassing beverages, sauces, and dressings, and even soups and savory snacks.

Plant-based hydrocolloids are leading the market, reflecting the growing consumer interest in plant-forward options. These natural thickeners currently hold a dominant 63% market share, with projections indicating further growth to 64% by 2032. Busy lifestyles are also propelling the demand for convenient food options, and hydrocolloids play a crucial role in maintaining texture and stability in these products. As the market continues to evolve, leading players are constantly innovating to develop new hydrocolloid solutions that cater to both the needs of the food industry and the health-conscious consumer.

The Hydrocolloid Texturants for Food Market Drivers:

Health-conscious consumers drive demand for natural thickeners in clean-label foods.

Health-conscious consumers are actively seeking out natural ingredients, driving a significant market shift reflected in a CAGR of 4.1% to 5.8%. Hydrocolloids, derived from plants, algae, and fermentation, perfectly align with this trend. They offer a natural alternative to synthetic thickeners and stabilizers, allowing food manufacturers to create clean-label products that resonate with consumer preferences.

Hydrocolloids' versatility extends beyond thickening, offering a range of functionalities.

Hydrocolloids are not just one-trick ponies. They offer a range of functionalities beyond thickening, including gelling (important for setting desserts), stabilizing emulsions (preventing oil separation in salad dressings), and improving texture (creating a smooth mouthfeel in beverages). This versatility makes them highly valuable for food manufacturers across various applications, from bakery and confectionery products to dairy and frozen desserts, beverages, sauces, and dressings, and even soups and savory snacks.

Plant-based hydrocolloids lead the market, aligning with the growing demand for plant-forward options.

Plant-derived hydrocolloids are leading the market, currently holding a dominant 63% share. This aligns perfectly with the growing demand for plant-based ingredients, as consumers seek out more sustainable and ethically sourced food options. As consumer preference for plant-forward options continues to rise, the market share of plant-based hydrocolloids is projected to reach 64% by 2032, solidifying their position in the market.

Busy lifestyles fuel the need for convenient foods, where hydrocolloids ensure quality and texture.

Busy lifestyles are pushing the demand for convenient food options. However, convenience shouldn't come at the expense of quality. Hydrocolloids play a crucial role in maintaining texture and stability in these products. Whether it's preventing frozen meals from becoming mushy or ensuring sauces remain smooth, hydrocolloids are essential for preserving the quality of convenient food options. The overall market size is estimated to reach USD 7.2 billion by 2032, highlighting the significance of convenience food trends and the role hydrocolloids play in their success.

The Hydrocolloid Texturants for Food Market Restraints and Challenges:

Despite the positive outlook for the hydrocolloid texturants market, there are challenges that hinder its unbridled growth. Stringent regulations and international quality standards are a hurdle for manufacturers. The food industry is heavily regulated, and hydrocolloids must undergo rigorous safety and quality checks as mandated by various international bodies. This strict compliance process can be time-consuming and expensive for producers.

Another challenge is price volatility. The cost of raw materials used in hydrocolloid production fluctuates due to factors like weather patterns and global market dynamics. This translates to price fluctuations for hydrocolloids themselves, making it difficult for manufacturers to maintain consistent pricing for their products. Additionally, the market experiences intense competition from producers offering similar hydrocolloid solutions, putting pressure on profit margins.

The Hydrocolloid Texturants for Food Market Opportunities:

The hydrocolloid texturants market brims with exciting potential for future growth. Rising disposable incomes in developing economies paint a promising picture. As consumers in these regions have more money to spend, their demand for processed and convenient food options is expected to surge. This creates a perfect scenario for hydrocolloids, which excel at maintaining texture and stability in these very products. Furthermore, advancements in food processing technologies are constantly pushing the boundaries of innovation. These new techniques could lead to the development of entirely novel hydrocolloids with a wider range of functionalities or functionalities tailored to specific applications. This opens doors for exciting new possibilities within the market. The growing interest in functional foods presents another compelling opportunity. Consumers are increasingly seeking out food products that offer health benefits beyond basic nutrition. Fortunately, some hydrocolloids possess functional properties themselves, such as dietary fiber content or prebiotic effects. By highlighting these health benefits, manufacturers can create new market opportunities for specific types of hydrocolloids, catering to this growing consumer demand. Beyond current applications, the market holds even more potential. Research and development efforts focused on identifying entirely new applications for hydrocolloids in different food and beverage categories can unlock entirely new market segments, further propelling growth. Finally, the focus on sustainability resonates with today's environmentally conscious consumers. Manufacturers can capitalize on this trend by focusing on sustainable sourcing of raw materials used in hydrocolloid production. Additionally, promoting the eco-friendly aspects of certain hydrocolloids compared to synthetic alternatives can further entice environmentally conscious consumers and propel the market forward.

HYDROCOLLOID TEXTURANTS FOR FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Application, Source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Ingredion, Archer Daniels Midland, CP Kelco, FMC Corporation, DSM, Tate & Lyle, Kerry Group |

Hydrocolloid Texturants for Food Market Segmentation: By Type

-

Gelatine

-

Pectin

-

Carrageenan

-

Alginates

-

Agar

-

Xanthan Gum

-

Guar Gum

-

Locust Bean Gum

-

Other Hydrocolloids

Analysing the hydrocolloid texturants market by type reveals some interesting trends. Gelatine reigns supreme as the most dominant segment, widely used for its gelling and thickening properties in confectionery, dairy products, and desserts. On the other hand, the information available doesn't definitively point to a fastest-growing segment by type. However, the market demonstrates a strong shift towards plant-based options, which aligns with the rising consumer demand for natural ingredients.

Hydrocolloid Texturants for Food Market Segmentation: By Application

-

Bakery and Confectionery

-

Dairy and Frozen Desserts

-

Beverages

-

Sauces and Dressings

-

Soups and Savory Snacks

The bakery and confectionery segment reigns supreme in the hydrocolloid texturants market by application, utilizing these texturants for thickening batters, creating textures, and stabilizing fillings. While the fastest-growing segment isn't explicitly mentioned in publicly available reports, the rising demand for convenient food options suggests that applications like sauces and dressings or soups and Savory snacks could be strong contenders

Hydrocolloid Texturants for Food Market Segmentation: By Source

-

Plant-Based

-

Seaweed-Based

-

Microbial Based

The plant-based segment reigns supreme in the hydrocolloid texturants market, holding the largest share and projected to grow even further. This dominance aligns perfectly with the rising consumer preference for natural ingredients. Seaweed-based hydrocolloids follow closely behind, offering valuable functionalities. Meanwhile, the microbial-based segment is the fastest-growing owing to its unique properties and caterers to specific needs within the food industry.

Hydrocolloid Texturants for Food Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: A mature market with established players and high consumer awareness of hydrocolloids. The demand for clean-label products and convenient food options is driving growth, with a focus on functionality and texture in applications like bakery, dairy, and beverages. Stringent regulations pose a challenge, but innovation in this region is high.

Asia-Pacific: This region is experiencing the fastest growth due to rising disposable incomes and a burgeoning middle class seeking processed and convenient foods. The demand for natural ingredients is also increasing, with a growing focus on plant-based hydrocolloids. However, regulatory frameworks can vary across countries within the region.

COVID-19 Impact Analysis on the Hydrocolloid Texturants for Food Market:

The COVID-19 pandemic undeniably impacted the hydrocolloid texturants market. Short-term challenges arose from disrupted supply chains due to lockdowns, affecting raw material availability and costs. This led to price fluctuations and potential shortages. Additionally, shifting consumer behaviour saw a surge in demand for shelf-stable and convenient foods, initially pushing up hydrocolloid demand for these products. Production slowdowns due to factory closures and workforce limitations also caused temporary supply issues.

However, the long-term outlook appears promising. The pandemic heightened health consciousness, potentially increasing demand for hydrocolloids with functional benefits like fibre or prebiotics. Evolving food trends like home cooking and online grocery shopping could create new opportunities for hydrocolloids used in meal kits and DIY food products. Furthermore, the growing focus on sustainability aligns well with the potential for highlighting the responsible sourcing of raw materials used in hydrocolloid production. While the initial impact of COVID-19 presented hurdles, the market's future seems bright. The increasing demand for clean-label, convenient, and functional foods perfectly align with the functionalities offered by hydrocolloids. Manufacturers who can adapt to these evolving preferences and prioritize sustainable practices are well-positioned to thrive in the post-pandemic market.

Latest Trends/ Developments:

The hydrocolloid texturants market is buzzing with exciting developments. The clean-label movement and consumer preference for plant-based options remain a top driver. Manufacturers are responding by developing novel hydrocolloids derived from sources like pea protein and citrus fibre. Innovation is another key trend, with research focused on creating hydrocolloids with specific functionalities. These might offer superior gelling, cater to dietary needs, or even boast health benefits. Microbial hydrocolloids, produced through fermentation, are also gaining traction due to their unique properties. Sustainability is a growing concern, and companies are prioritizing responsible sourcing of raw materials and eco-friendly production practices. The rise of e-commerce platforms is creating new opportunities for direct-to-consumer sales, allowing manufacturers to reach a wider audience. Finally, the market is moving towards tailored solutions. Manufacturers are developing hydrocolloids specifically designed for various food and beverage applications, ensuring optimal texture, mouthfeel, and functionality in the final product. These trends showcase the dynamic nature of the hydrocolloid texturants market, where innovation and adaptation are key to success.

Key Players:

-

Cargill

-

Ingredion

-

Archer Daniels Midland

-

CP Kelco

-

FMC Corporation

-

DSM

-

Tate & Lyle

-

Kerry Group

Chapter 1. Hydrocolloid Texturants for Food Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hydrocolloid Texturants for Food Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hydrocolloid Texturants for Food Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hydrocolloid Texturants for Food Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hydrocolloid Texturants for Food Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hydrocolloid Texturants for Food Market – By Type

6.1 Introduction/Key Findings

6.2 Gelatine

6.3 Pectin

6.4 Carrageenan

6.5 Alginates

6.6 Agar

6.7 Xanthan Gum

6.8 Guar Gum

6.9 Locust Bean Gum

6.10 Other Hydrocolloids

6.11 Y-O-Y Growth trend Analysis By Type

6.12 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Hydrocolloid Texturants for Food Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery and Confectionery

7.3 Dairy and Frozen Desserts

7.4 Beverages

7.5 Sauces and Dressings

7.6 Soups and Savory Snacks

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Hydrocolloid Texturants for Food Market – By Source

8.1 Introduction/Key Findings

8.2 Plant-Based

8.3 Seaweed-Based

8.4 Microbial Based

8.5 Y-O-Y Growth trend Analysis By Source

8.6 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 9. Hydrocolloid Texturants for Food Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By Source

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Source

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Source

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Source

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Source

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Hydrocolloid Texturants for Food Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill

10.2 Ingredion

10.3 Archer Daniels Midland

10.4 CP Kelco

10.5 FMC Corporation

10.6 DSM

10.7 Tate & Lyle

10.8 Kerry Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Hydrocolloid Texturants for Food Market was valued at USD 3.9 billion in 2023 and is projected to reach a market size of USD 5.79 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.8%.

Surging Demand for Clean-Label and Minimally Processed Foods, Functional Versatility and Broad Applications, Plant-Based Boom, Convenience Food Trends and Maintaining Quality.

Gelatin, Pectin, Carrageenan, Alginates, Agar, Xanthan Gum, Guar Gum, Locust Bean Gum, Other Hydrocolloids.

North America currently holds the dominant position due to its established market, high consumer awareness, and focus on innovation.

Cargill, Ingredion, Archer Daniels Midland, CP Kelco, FMC Corporation, DSM, Tate & Lyle, Kerry Group.