HYDRAULIC FRACTURING MARKET (2024 - 2030)

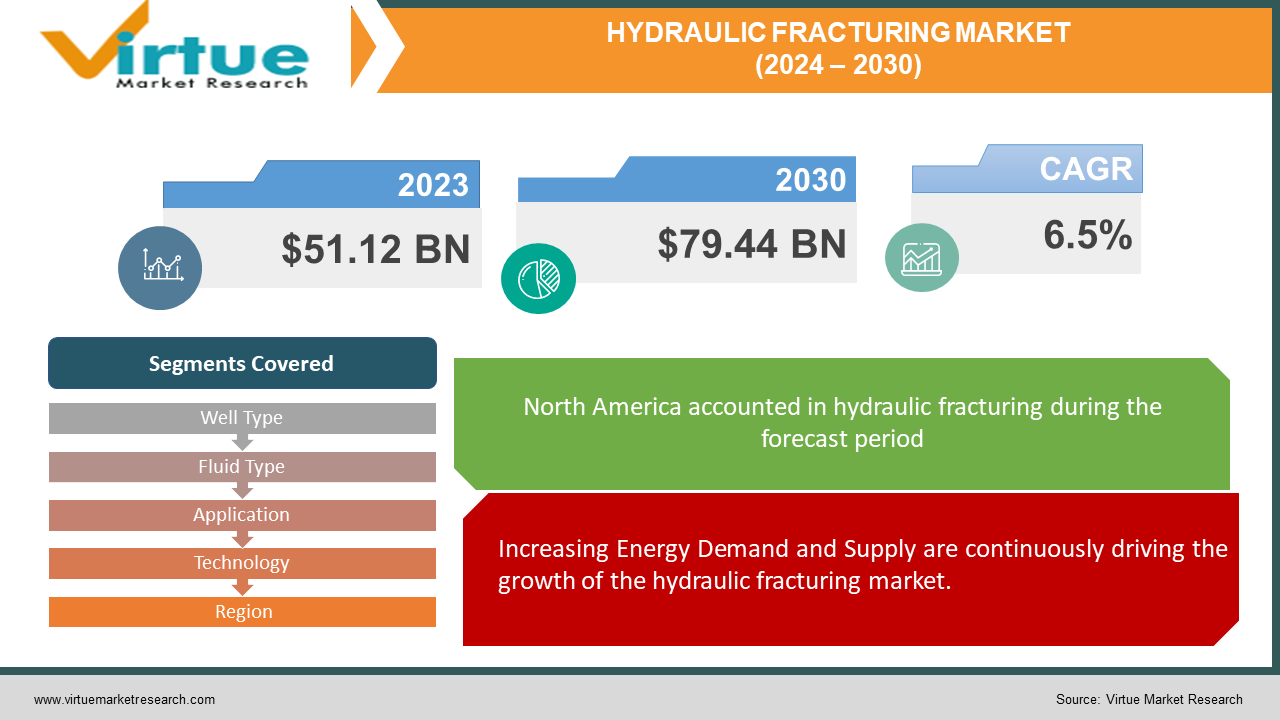

The Global Hydraulic Fracturing Market was valued at USD 51.12 billion and is projected to reach a market size of USD 79.44 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.5%.

The hydraulic fracturing market, commonly known as "fracking," is a key component of the global energy industry, primarily focused on the extraction of unconventional oil and natural gas reserves. It involves injecting high-pressure fluid, typically a mixture of water, sand, and chemicals, into deep underground rock formations to fracture them and release hydrocarbons. This technology has revolutionized energy production by enabling access to vast reserves of shale gas and tight oil, leading to increased energy independence and reduced energy costs in some regions. The industry faces ongoing environmental and regulatory challenges due to concerns about groundwater contamination, seismic activity, and greenhouse gas emissions. Despite these challenges, the hydraulic fracturing market continues to play a significant role in the global energy landscape, with its growth and evolution closely tied to advancements in drilling technology, environmental considerations, and geopolitical factors.

Key Market Insights:

According to data from the EIA, the United States has witnessed the drilling of approximately 4 million wells, with hydraulic fracturing employed in about 2 million of them. Notably, around 95% of successful drilling operations in the country involve hydraulic fracturing techniques.

The American Petroleum Institute anticipates that as much as 95% of natural gas well drilling shortly will necessitate fracturing. Total, a global integrated oil and gas company, is actively investing in research and development, filing around 200 patents annually to advance fracturing technology and enhance oil and gas output.

Many environmentalists, particularly in the United States, have been advocating for more environmentally friendly fracturing techniques, which can be achieved through the adoption of foam-based fracturing technology. Continued advancements in this technology hold the potential to not only spur market growth but also substantially reduce environmental impacts. Foam-based fluids have discovered specific applications in coalbed fracturing within Canada, notably on arid coalbeds where the introduction of water can be detrimental to the formation's cleats. Although research into foam fracturing remains predominantly conducted in the United States and Canada, it is a relatively novel concept in other countries.

Alberta has reached a daily crude oil production level of 1,280 cubic meters, and the Alberta Energy Regulator envisions a total crude oil production of approximately 4.2 million barrels per day by the year 2025.

As per the U.S. Energy Information Administration (EIA), it is projected that shale oil production within the United States will experience a 27% increase by the year 2050.

Hydraulic Fracturing Market Drivers:

Increasing Energy Demand and Supply are continuously driving the growth of the hydraulic fracturing market.

As global energy demand continues to rise, particularly for natural gas and oil, hydraulic fracturing has become crucial in unlocking previously inaccessible hydrocarbon resources, such as shale gas and tight oil. The abundant availability of these resources, made accessible through fracking, helps meet the growing energy needs of various industries and households, enhancing energy security and reducing dependence on imports. This driver is closely linked to economic growth and energy policies, as it shapes the market's expansion in response to fluctuating supply and demand dynamics.

Technological advancements in the hydraulic fracturing market are poised to heighten the growth of the industry extensively.

Advances in hydraulic fracturing technology have been instrumental in the market's growth. Innovations in drilling techniques, such as horizontal drilling, and improvements in fracking fluids and proppants have made the extraction of oil and gas from unconventional reservoirs more efficient and cost-effective. The development of data analytics and reservoir modeling tools has allowed companies to better target productive areas, optimizing resource recovery and reducing environmental impacts. These technological advancements have spurred the industry's expansion and competitiveness, attracting investment and driving market growth.

Hydraulic Fracturing Market Restraints and Challenges:

Environmental concerns associated with hydraulic fracturing are a lot more challenging for this market.

Hydraulic fracturing has raised significant environmental concerns, including the potential contamination of groundwater through the release of fracking fluids and the migration of methane into drinking water sources. The disposal of wastewater from fracking operations and the risk of spills can also pose environmental risks. The process has been associated with induced seismic activity, which can lead to minor earthquakes in some regions. Addressing these environmental concerns through proper regulations, monitoring, and sustainable practices is an ongoing challenge for the industry.

One significant challenge for hydraulic fracturing is the regulatory and public perception, which could most probably slow down the growth of this market.

The hydraulic fracturing industry faces varying degrees of regulation in different regions, and the regulatory landscape can be complex and subject to change. Public perception of fracking is often negative, driven by concerns about water quality, air pollution, and the overall environmental impact. This leads to opposition and public protests, making it challenging for the industry to operate and expand. Navigating these regulatory challenges and improving public perception while maintaining profitability is a significant hurdle for companies involved in hydraulic fracturing.

Hydraulic Fracturing Market Opportunities:

Opportunities in the hydraulic fracturing market include the continued development and refinement of technology and techniques, such as enhanced drilling methods, more environmentally friendly fracking fluids, and advanced monitoring systems, which can enhance operational efficiency and reduce environmental impacts. The increasing global demand for natural gas and oil, especially in emerging economies, presents growth prospects for the industry, with opportunities for market expansion and investment in regions with substantial unconventional energy reserves. The ongoing transition to cleaner energy sources, such as natural gas, offers a bridge to a lower-carbon future, positioning hydraulic fracturing as a critical component of the energy transition.

HYDRAULIC FRACTURING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Well Type, Fluid Type, Application, Technology and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Halliburton, Schlumberger, Baker Hughes Weatherford, FTS International, Calfrac Well Services, RPC, Inc., Keane Group (now part of C&J Energy Services), Patterson-UTI Energy, ProPetro |

Hydraulic Fracturing Market Segmentation:

Hydraulic Fracturing Market Segmentation: By Well Type:

-

Horizontal Wells

-

Vertical Wells

The largest segment by well type in the hydraulic fracturing market is horizontal wells having an approximate share of 85.7%. This dominance can be attributed to the higher productivity and increased recovery rates associated with horizontal wells compared to vertical wells. Horizontal drilling allows for more extensive contact with hydrocarbon-rich reservoirs, resulting in improved resource extraction efficiency. In unconventional resource plays, such as shale gas and tight oil, where hydraulic fracturing is most commonly employed, horizontal wells have become the preferred choice, driving their prominence in the market. The fastest-growing segment is also the horizontal well category growing at a CAGR of 17.8%. This is because horizontal wells allow for increased contact with underground hydrocarbon reserves, significantly improving production rates compared to vertical wells. Horizontal drilling enables operators to access more extensive reservoirs and enhances the recovery of oil and natural gas, making it an attractive choice for maximizing output. The technology associated with horizontal drilling and hydraulic fracturing has seen substantial advancements, further contributing to its rapid growth and adoption in the industry.

Hydraulic Fracturing Market Segmentation: By Fluid Type:

-

Water-Based

-

Oil-Based

-

Foam-Based

The largest segment by fluid type in the hydraulic fracturing market is Water-Based having a market share of 87.6% because water-based fracturing fluids are more cost-effective and environmentally friendly compared to oil-based alternatives. With increasing environmental regulations and the industry's focus on sustainability, water-based fluids are preferred due to their reduced environmental impact and easier disposal, making them a popular choice among hydraulic fracturing operators. Water is more readily available and cost-efficient, contributing to the dominance of the water-based fluid segment in the market. The fastest-growing segment by fluid type is also the foam-based fracturing fluids growing at a CAGR of 22.3%, due to its advantages, such as reduced water usage, improved proppant transport, and enhanced fracture conductivity. Foam-based fluids are environmentally friendly and can mitigate some of the concerns related to water resource usage and wastewater disposal, making them an attractive choice for hydraulic fracturing operations, especially in regions where water scarcity and environmental regulations are significant concerns.

Hydraulic Fracturing Market Segmentation: By Application:

-

Shale Gas

-

Tight Oil

-

Coalbed Methane

-

Others

The largest segment by application in the hydraulic fracturing market is typically Shale Gas having a prominent share of 71%. Shale gas extraction involves the hydraulic fracturing of underground shale rock formations to release natural gas. This segment's prominence is primarily due to the abundance of shale gas reserves in regions like North America, which has driven extensive drilling and fracking operations. Shale gas is considered a crucial component of the energy mix, offering a relatively cleaner-burning fossil fuel compared to coal, and has gained significance as a bridge to a lower-carbon energy future. The fastest-growing segment in the hydraulic fracturing market is shale gas expected to grow with a CAGR of 25.6%. Shale gas has seen rapid growth due to its increasing role in the global energy mix, driven by its abundance and the advancements in hydraulic fracturing technology that have made it economically viable to extract from previously inaccessible shale formations. The growing demand for cleaner-burning natural gas, especially in power generation and industrial processes, has led to increased investment in shale gas development.

Hydraulic Fracturing Market Segmentation: By Technology:

-

Plug and Perf

-

Sliding Sleeve

-

Coil Tubing

The largest segment by technology in the hydraulic fracturing market is the Plug and Perf method holding a revenue share of 72%. This technology involves perforating the well casing at specific intervals and subsequently isolating these perforations with plugs. It is widely used because of its versatility and efficiency, allowing for precise control of hydraulic fracturing stages and maximizing reservoir contact. The Plug and Perf method can be customized to suit different geological conditions and reservoir properties, making it a preferred choice for many operators seeking to optimize well performance cost-effectively. The Coil Tubing technology segment is the fastest-growing in the hydraulic fracturing market. This growth can be attributed to its versatility and cost-effectiveness. Coil tubing allows for continuous, non-stop operations, reducing downtime between stages and increasing overall well productivity. It is particularly well-suited for complex well designs, including extended-reach horizontal wells. Advancements in coil tubing technology, such as larger-diameter tubing and more powerful equipment, have further accelerated its adoption, making it a preferred choice for many hydraulic fracturing operations.

Hydraulic Fracturing Market Segmentation: Regional Analysis:

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest region in the hydraulic fracturing market having a market share of 39%. This dominance can be attributed to the prolific shale reserves in the U.S., such as the Permian Basin and Marcellus Shale, which have driven substantial growth in hydraulic fracturing operations. The region has a well-established oil and gas industry, advanced drilling technologies, and supportive regulatory frameworks that have facilitated the rapid expansion of hydraulic fracturing activities, making it the largest market for unconventional oil and gas extraction. North America is also the fastest-growing region in the hydraulic fracturing market growing at a CAGR of 22%. This growth is driven by the significant development of unconventional oil and gas resources, such as shale gas and tight oil, which led to a surge in hydraulic fracturing activities. The U.S. established itself as a major player in energy production, achieving greater energy independence and economic growth.

COVID-19 Impact Analysis on the Global Hydraulic Fracturing Market:

The COVID-19 pandemic had a profound impact on the global hydraulic fracturing market. Reduced energy demand, caused by lockdowns and economic disruptions, led to a significant decrease in oil and gas prices, making many hydraulic fracturing operations economically unviable. Oil companies scaled back production and capital expenditures, leading to layoffs and reduced drilling activity. The pandemic accelerated the industry's focus on cost-cutting measures and efficiency improvements. While the market faced short-term challenges, it also highlighted the need for resilience and adaptability in the face of global disruptions, ultimately driving innovation and a renewed emphasis on sustainable practices in hydraulic fracturing.

Latest Trends/ Developments:

One trend in the hydraulic fracturing market is the increasing use of data analytics and digital technologies to optimize drilling and production processes. Advanced sensors, real-time monitoring, and data-driven decision-making are becoming more prevalent, allowing companies to enhance operational efficiency, reduce costs, and improve safety.

A significant development in the market is the growing emphasis on environmental and social responsibility. There is an increasing focus on reducing the environmental footprint of hydraulic fracturing operations, such as minimizing water usage, improving the recycling and treatment of wastewater, and developing more eco-friendly fracking fluids. Social considerations, including community engagement and addressing public concerns, are also becoming integral to the industry's development and long-term sustainability.

Key Players:

-

Halliburton

-

Schlumberger

-

Baker Hughes

-

Weatherford

-

FTS International

-

Calfrac Well Services

-

RPC, Inc.

-

Keane Group (now part of C&J Energy Services)

-

Patterson-UTI Energy

-

ProPetro

In July 2021, Halliburton unveiled ExpressFiber, a single-use fiber-optic cable aimed at providing precise, direct subsurface measurements, including cross-well communication. The launch of ExpressFiber in North America for unconventional operations will be made possible through an exclusive 5-year partnership with UK-based Well-Sense Technology Ltd, which offers FiberLine Intervention (FLI), a wellbore-surveying technique.

Chapter 1. Global Hydraulic Fracturing Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Hydraulic Fracturing Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Hydraulic Fracturing Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Hydraulic Fracturing Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Hydraulic Fracturing Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Hydraulic Fracturing Market – By Well Type

6.1. Horizontal Wells

6.2. Vertical Wells

Chapter 7. Global Hydraulic Fracturing Market – By Fluid Type

7.1. Water-Based

7.2. Oil-Based

7.3. Foam-Based

Chapter 8. Global Hydraulic Fracturing Market – By Application

8.1. Shale Gas

8.2. Tight Oil

8.3. Coalbed Methane

8.4. Others

Chapter 9. Global Hydraulic Fracturing Market – By Technology

9.1. Plug and Perf

9.2. Sliding Sleeve

9.3. Coil Tubing

Chapter 10. Global Hydraulic Fracturing Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Well Type

10.1.3. By Fluid Type

10.1.4. By Application

10.1.5. Technology

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Well Type

10.2.3. By Fluid Type

10.2.4. By Application

10.2.5. Technology

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Well Type

10.3.3. By Fluid Type

10.3.4. By Application

10.3.5. Technology

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Well Type

10.4.3. By Fluid Type

10.4.4. By Application

10.4.5. Technology

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Well Type

10.5.3. By Fluid Type

10.5.4. By Application

10.6.5. Technology

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Hydraulic Fracturing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1. Halliburton

11.2. Schlumberger

11.3. Baker Hughes

11.4. Weatherford

11.5. FTS International

11.6. Calfrac Well Services

11.7. RPC, Inc.

11.8. Keane Group (now part of C&J Energy Services)

11.9. Patterson-UTI Energy

11.10. ProPetro

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hydraulic Fracturing Market was valued at USD 48 Billion in 2022 and is projected to reach a market size of USD 79.44 Billion by the end of 2030 growing at a CAGR of 6.5%.

Increasing Energy Demand and Technological advancements in the hydraulic fracturing market are drivers of the Hydraulic Fracturing market.

Based on technology, the Global Hydraulic Fracturing Market is segmented into Plug and Perf, Sliding Sleeve, and Coil Tubing.

North America is the most dominant region for the Global Hydraulic Fracturing Market.

Halliburton, Schlumberger, and Baker Hughes are a few of the key players operating in the Global Hydraulic Fracturing Market.