Hydraulic Components Market Size (2024-2030)

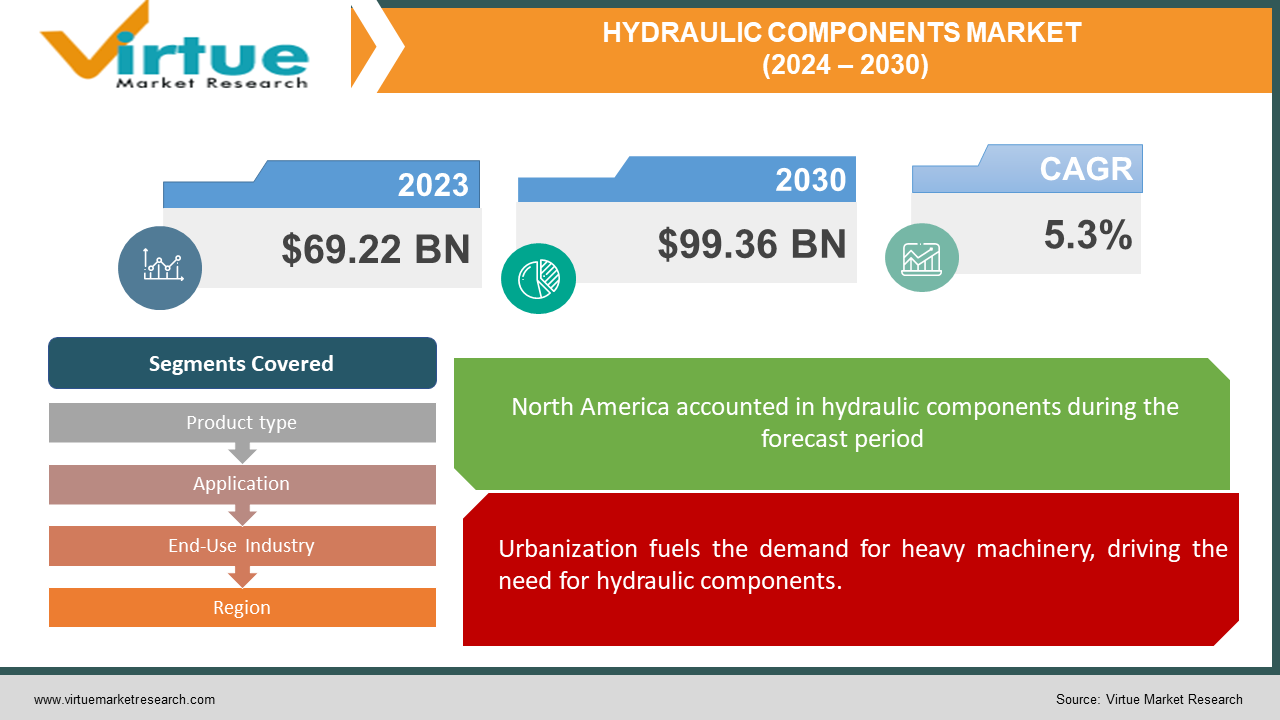

The Hydraulic Components Market was valued at USD 69.22 billion in 2023 and is projected to reach a market size of USD 99.36 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.3%.

The hydraulic components market plays a critical role in powering essential machinery across industries. From construction equipment to agricultural machinery, these components transfer fluid power to enable movement and functionality. The market is driven by factors like the ever-growing need for construction and infrastructure development, alongside the rise of automation in manufacturing. Advancements in hydraulic component technology, offering improved efficiency, are another key growth factor. However, concerns about oil leaks and the need for regular maintenance can pose challenges. With Asia Pacific experiencing rapid industrialization, the region is expected to see significant growth in the hydraulic components market.

Key Market Insights:

The rise of automation in manufacturing is another key driver. As factories become more automated, there's a growing demand for reliable and efficient hydraulic systems. This presents an opportunity for manufacturers of innovative and high-performance hydraulic components. Additionally, environmental concerns are pushing the development of more efficient components that minimize leakage and energy consumption, creating a space for eco-friendly solutions in the market.

Looking towards the future, the Asia Pacific region is poised to be a major growth driver for the hydraulic components market due to its rapid industrialization. Manufacturers seeking to expand their reach should consider this market. However, challenges like oil leaks and the need for regular maintenance persist.

The Hydraulic Components Market Drivers:

Urbanization fuels the demand for heavy machinery, driving the need for hydraulic components.

Rapid urbanization and increasing infrastructure projects across the globe are fueling the demand for heavy machinery – a prime user of hydraulics. This translates to a significant rise in demand for hydraulic components.

Manufacturing automation necessitates reliable and efficient hydraulic systems.

The manufacturing sector's growing embrace of automation necessitates reliable and efficient hydraulic systems. This creates a lucrative opportunity for manufacturers of innovative and high-performance hydraulic components that can ensure smooth operation in automated production lines.

Environmental focus pushes the development of leak-proof and energy-saving components.

As environmental concerns climb the priority list, the focus is shifting towards developing more efficient hydraulic components. Minimizing leakage and reducing energy consumption are key areas of innovation, opening doors for companies specializing in eco-friendly hydraulic solutions.

Asia Pacific's rapid industrialization creates a major growth market for hydraulics.

The rapid industrialization of the Asia Pacific region presents a significant growth driver for the hydraulic components market. Manufacturers looking to expand their reach should have a strategic focus on this region.

Innovation to address oil leaks and maintenance needs will give companies a competitive edge.

While hydraulic systems offer power and versatility, concerns regarding oil leaks and the need for regular maintenance persist. Companies that can address these challenges through innovative designs or extended service life components will likely hold a competitive edge in this market.

The Hydraulic Components Market Restraints and Challenges:

The hydraulic components market, though promising, faces some hurdles. High manufacturing and maintenance costs are a concern. The intricate engineering and metalwork involved in creating hydraulic equipment translates to a hefty initial investment. Additionally, these systems require regular maintenance, adding to the overall operational expenditure.

Leakage is another challenge. Hydraulic systems are susceptible to leaks, which can be environmentally damaging and lead to operational inefficiencies. Manufacturers are constantly striving to develop leak-proof designs to address this issue. The emergence of substitute technologies like electric and pneumatic systems in some applications can also pose a threat. To stay competitive, hydraulic component manufacturers need to emphasize the specific advantages of hydraulics in different applications.

Finally, stricter environmental regulations are placing pressure on the industry to minimize energy consumption and waste disposal. Hydraulic component manufacturers need to adapt by developing eco-friendly solutions that meet these evolving regulations. By addressing these challenges through innovation and adaptation, the hydraulic components market can ensure its continued growth and success.

The Hydraulic Components Market Opportunities:

The future of the hydraulic components market is abuzz with exciting opportunities. A growing focus on environmental responsibility is driving the development of "green" hydraulic solutions, with leak-proof designs, bio-degradable fluids, and energy-efficient components leading the charge. The integration of Internet of Things (IoT) technology with hydraulic systems presents another avenue for growth, enabling real-time performance monitoring, predictive maintenance, and remote diagnostics for smoother operation and reduced downtime. Miniaturization is also a key trend, particularly relevant in aerospace and mobile equipment sectors, as the demand for compact and lightweight machinery creates a need for smaller hydraulic components. The ever-increasing number of machines in operation globally, or the machinery parc, presents a significant aftermarket opportunity for hydraulic components. Manufacturers that can provide readily available replacement parts and efficient maintenance services will be well-positioned to capture this market share. Finally, the rapid industrialization of regions like the Asia Pacific offers vast potential for hydraulic component manufacturers. By understanding the specific needs and regulations of these emerging markets, companies can establish a strong presence and capitalize on this exciting growth opportunity.

HYDRAULIC COMPONENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Product type, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bosch Rexroth AG,. Parker Hannifin Corporation, Eaton Corporation PLC, Kawasaki Heavy Industries, Ltd., Danfoss, Hydac International GmbH, SMC Corporation, Caterpillar Inc., Komatsu Ltd., DY Power Corporation |

Hydraulic Components Market Segmentation: By Product Type

-

Pumps

-

Motors

-

Valves

-

Cylinders

-

Accumulators

-

Filters

The dominant segment in the hydraulic components market by product type is likely valves. Valves control and regulate fluid flow, making them essential for any hydraulic system. The fastest-growing segment is expected to be miniaturized hydraulic components. This is driven by the increasing demand for compact and lightweight machinery, particularly in the aerospace and mobile equipment sectors.

Hydraulic Components Market Segmentation: By Application

-

Construction

-

Agriculture

-

Material Handling

-

Manufacturing

-

Mining

-

Aerospace & Defense

The construction segment reigns supreme in the hydraulic components market by application, driven by the high demand for heavy machinery like excavators and cranes. However, the Asia Pacific region is anticipated to be the fastest-growing segment due to its rapid industrialization, which spurs the need for hydraulic equipment across various industries.

Hydraulic Components Market Segmentation: By End-Use Industry

-

Original Equipment Manufacturers (OEMs)

-

Aftermarket

The construction industry is currently the dominant segment for hydraulic components due to its extensive use in heavy machinery. However, the Asia Pacific region is expected to experience the fastest growth, driven by its rapid industrialization and the surge in demand for hydraulic equipment in various industries.

Hydraulic Components Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America currently reigns supreme in terms of market share. This dominance stems from its well-established industrial base and the strong presence of major construction and manufacturing companies. These factors translate to a high demand for hydraulic components across various industries.

Asia Pacific region is poised for explosive growth, fueled by the relentless pace of industrialization. Rapidly developing economies, coupled with increasing infrastructure projects and a rising demand for construction and mining equipment, are propelling the demand for hydraulic components in Asia Pacific. This region is expected to be the frontrunner in terms of growth within the global hydraulic components market.

COVID-19 Impact Analysis on the Hydraulic Components Market:

The COVID-19 pandemic undeniably impacted the hydraulic components market. Lockdowns and travel restrictions disrupted global supply chains, causing shortages of raw materials and finished components. This led to production delays and extended project timelines for manufacturers of hydraulic equipment. Additionally, the pandemic triggered a global economic slowdown, resulting in a decline in demand for construction equipment, mining machinery, and other applications that rely heavily on hydraulics. As businesses grappled with the immediate crisis, investments in new machinery and infrastructure projects were put on hold, further dampening the demand for hydraulic components.

However, the market has exhibited signs of resilience. With the easing of restrictions and a gradual economic recovery, the demand for hydraulic components has begun to rebound. Reports suggest a return to pre-pandemic growth rates, driven by pent-up demand and renewed infrastructure projects. The pandemic has also accelerated the adoption of automation in various industries, which is a positive sign for the hydraulic components market since automated systems heavily rely on efficient hydraulics. Looking ahead, the importance of supply chain diversification and local manufacturing capabilities may lead to a shift in the regional landscape of the hydraulic components market. In conclusion, while the COVID-19 pandemic presented a significant challenge, the hydraulic components market has shown its ability to adapt and rebound. The future holds promise for continued growth, fuelled by factors like infrastructure development, the rise of automation, and a growing focus on environmental sustainability.

Latest Trends/ Developments:

The hydraulic components market is constantly innovating to stay ahead of the curve. One exciting trend is the rise of "smart hydraulics," which integrates sensors and Internet of things (IoT) technology into hydraulic systems. This allows for real-time monitoring of performance, predictive maintenance, and remote diagnostics, ultimately leading to smoother operation and less downtime. Another trend to watch is the focus on electrification. While hydraulics remain king, hybrid or electro-hydraulic systems are gaining traction. These systems combine the power and versatility of hydraulics with the efficiency and environmental benefits of electric motors. Sustainability is also a major focus, with development underway for biodegradable hydraulic fluids and components made from eco-friendly materials. Additive manufacturing, also known as 3D printing, is another potential game-changer. This technology could enable the creation of lighter and more complex hydraulic components, potentially improving fuel efficiency in machinery. Finally, the COVID-19 pandemic has highlighted the importance of resilient supply chains. This could lead to a trend of increased regional production of hydraulic components, particularly in fast-growing markets like Asia Pacific. By embracing these advancements and focusing on sustainability and efficiency, manufacturers in the hydraulic components market can position themselves for continued success in the years to come.

Key Players:

-

Bosch Rexroth AG

-

Parker Hannifin Corporation

-

Eaton Corporation PLC

-

Kawasaki Heavy Industries, Ltd.

-

Danfoss

-

Hydac International GmbH

-

SMC Corporation

-

Caterpillar Inc.

-

Komatsu Ltd.

-

DY Power Corporation

Chapter 1. Hydraulic Components Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hydraulic Components Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hydraulic Components Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hydraulic Components Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hydraulic Components Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hydraulic Components Market – By Product Type

6.1 Introduction/Key Findings

6.2 Pumps

6.3 Motors

6.4 Valves

6.5 Cylinders

6.6 Accumulators

6.7 Filters

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Hydraulic Components Market – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Original Equipment Manufacturers (OEMs)

7.3 Aftermarket

7.4 Y-O-Y Growth trend Analysis By End-Use Industry

7.5 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 8. Hydraulic Components Market – By Application

8.1 Introduction/Key Findings

8.2 Construction

8.3 Agriculture

8.4 Material Handling

8.5 Manufacturing

8.6 Mining

8.7 Aerospace & Defense

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Hydraulic Components Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-Use Industry

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-Use Industry

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-Use Industry

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-Use Industry

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-Use Industry

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Hydraulic Components Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bosch Rexroth AG

10.2 Parker Hannifin Corporation

10.3 Eaton Corporation PLC

10.4 Kawasaki Heavy Industries, Ltd.

10.5 Danfoss

10.6 Hydac International GmbH

10.7 SMC Corporation

10.8 Caterpillar Inc.

10.9 Komatsu Ltd.

10.10 DY Power Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Hydraulic Components Market was valued at USD 69.22 billion in 2023 and is projected to reach a market size of USD 99.36 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.3%.

Booming Infrastructure Development, Manufacturing Automation on the Rise, Environmental Responsibility Takes Centre Stage, Emerging Markets Poised for Growth and efficiency Through Innovation.

Construction, Agriculture, Material Handling, Manufacturing, Mining, Aerospace & Defense.

North America holds the largest market share in the Hydraulic Components Market due to its well-established industrial base and strong presence of construction and manufacturing companies.

Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation PLC, Kawasaki Heavy Industries, Ltd., Danfoss, Hydac International GmbH, SMC Corporation, Caterpillar Inc., Komatsu Ltd., DY Power Corporation.