Hybrid Sealants Market Size (2024 – 2030)

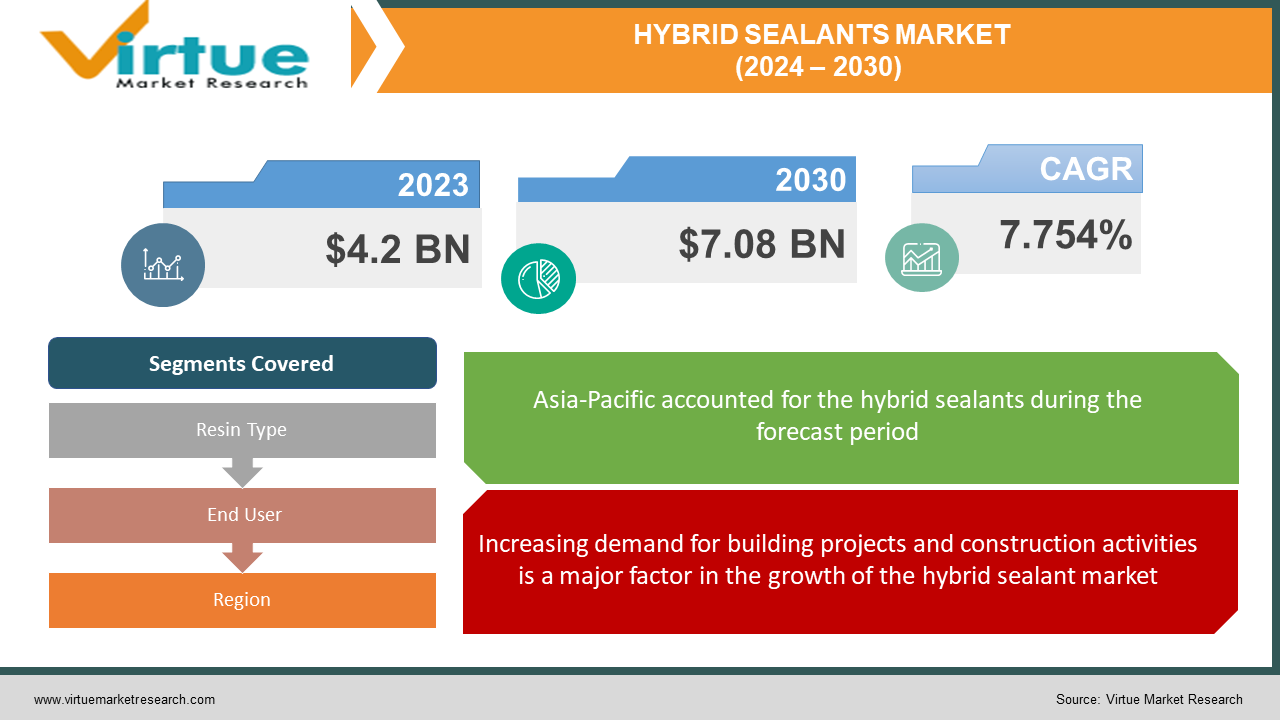

The global hybrid sealant market was valued at USD 4.2 billion in 2023 and is projected to reach a market size of USD 7.08 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 7.754%.

Hybrid sealants are an integration of two or more different types of resins, such as epoxy, acrylic, silyl-modified polyether, silyl-modified urethane, and urethanes. These hybrid sealants are known for their ability to have characteristics of both types of materials and improve performance. They are preferred over traditional sealants due to their enhanced adhesion and sealing ability, exceptional mechanical and electrical insulating properties, and chemical and heat resistance. These are used in a variety of industries, such as construction, aerospace, automotive, and manufacturing.

Key Market Insights:

In terms of regional dynamics, Asia-Pacific continues to dominate the hybrid sealant market. The dominant position of Asia-Pacific is primarily due to rising demand in countries like India, China, and Japan. The growth of aerospace and defense manufacturing in India is a major factor in the demand for hybrid sealants. China is witnessing major growth in its residential sector and property investment, contributing to demand in the region.

In terms of resin type, the MS polymer hybrid segment holds the dominant position in the hybrid sealant market. MS polymer sealants, often referred to as hybrid or modified silicone sealants, are a blend of PU adhesives and silicone sealants. Rather than the urethane-based polymer system utilized in polyurethane sealants or the synthetic polymer foundation of silicone, they feature a modified silane polymer base.

Market Drivers:

Increasing demand for building projects and construction activities is a major factor in the growth of the hybrid sealant market.

The hybrid sealant market is experiencing significant growth due to the increasing demand for building and construction projects. Hybrid sealants are widely used in building and construction applications like bonding and sealing of facades, windows, doors, and roofs. They are widely preferred due to their improved adhesion and sealing properties, durability, and flexibility in various applications. Hybrid sealants have become an indispensable material in the construction industry, commercial building construction, renovation projects, residential housing projects, and infrastructure development.

Growing demand for lightweight automotive has boosted demand for hybrid sealants.

The demand for hybrid sealants is growing due to their ability to bond with a variety of materials. As the automotive industry thrives due to speed, fuel efficiency, and performance, hybrid sealants that can bond with lightweight materials have become an ideal choice to bond with lighter materials like aluminum, which will replace traditional steel-made components. These are widely used in the growing electric vehicle and hybrid electric vehicle markets. Hybrid sealants are used in automobiles to have strong bonding ability, noise reduction due to vibration absorption ability, and aerodynamics due to bonding with lightweight materials.

High Prevalence of Hybrid Sealants in the Aerospace Industry.

Hybrid sealants are becoming popular in the aerospace industry due to their ability to provide enhanced characteristics compared to traditional sealants. They are increasingly used for aircraft and aerospace construction components. These hybrid sealants are also preferred due to increased safety standards like being able to withstand high temperatures, atmospheric pressure volatility, and exposure to harsh chemicals due to being durable and flexible. They also help in reducing the aircraft’s weight due to bonding with lightweight materials, which helps in fuel efficiency, reducing emissions, and improving overall performance.

Market Restraints and Challenges:

The complex formulation of hybrid sealants is a major challenge in the industry.

One of the key challenges facing the hybrid sealant market is its complexity. Hybrid sealants are formed by blending two or more types of resins, providing the improved properties of both, but the formulation of these two components poses huge complexity. Hybrid sealant manufacturers face many problems in this integration process, such as the right proportion of both chemical components for achieving specific performance requirements and maintaining consistency and quality of the formulation. Avoiding effects on chemical resistance, adhesion and bonding strength, time to cure, and other factors is also a challenge.

The increasing cost of raw materials is a major restraint for manufacturers and end users.

The growth of the hybrid sealant market is hindered due to the rising costs of the raw materials used in its composition. The cost of raw materials like resins, solvents, and curing agents is on the rise. The prices of raw materials are facing volatility due to various factors like the disruption of the supply chain, geopolitics, and the shift in people's preferences towards eco-friendly alternatives. This is leading to increasing production costs and a struggle to maintain competitive prices. To solve this problem, companies are using various strategies like supply chain optimization and managing the cost of raw materials effectively.

Market Opportunities:

The demand for eco-friendly and sustainable solutions in the industry is creating opportunities for market expansion.

The hybrid sealant market is witnessing a huge demand for sustainable and eco-friendly solutions in industries like construction, automotive, and packaging. Manufacturers are investing in the research and development of new hybrid sealant formulations that not only offer enhanced properties of both components and sustainability but are also eco-friendly by using bio-based components. Bio-based components are derived from renewable resources like natural oils and plant-based polymers, which offer improved adhesion and flexibility. As industries and governments worldwide are adopting eco-friendly practices, the growth of eco-friendly hybrid sealants seems promising.

HYBRID SEALANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.754% |

|

Segments Covered |

By Resin Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Corporation, Bostik (Arkema S.A), DL Chemical Co., Ltd. (DL Holdings Co., Ltd.), Hermann Otto GmbH, Mapei S.p.A., Henkel AG & Co. KGaA, McCoy Soudal Sealants Adhesives and Foams Pvt. Ltd, Permabond LLC, Sika Corporation (Sika AG) |

Hybrid Sealants Market Segmentation: By Resin Type

-

MS Polymer Hybrid

-

Epoxy-Polyurethane

-

Epoxy-Cyanoacrylate

-

Others

MS polymer hybrid is the largest segment in this market. They minimize the drawbacks of each material separately. MS Polymer Hybrids combine the finest qualities of silicone and polyurethane to create what is known as hybrid molecules. MS polymer sealants offer a high level of durability and weather resistance in addition to their abrasion resistance and UV stability, which are comparable to polyurethanes. MS polymer sealants provide a high degree of chemical resistance because, like silicone, they are chemically inert (non-reactive). In the hybrid sealant market, the epoxy-cyanoacrylate segment is the fastest-growing segment. Throughout the projection period, the epoxy-cyanoacrylate sector is anticipated to experience considerable expansion. In terms of performance, the product outperforms other hybrid adhesives. Products based on epoxy-cyanoacrylate are very effective because they combine the benefits of both cyanoacrylate and epoxy. The demand for epoxy-cyanoacrylate is growing significantly compared to other types like epoxy-polyurethane, MS polymer hybrid, acrylic, polyvinyl acetate, and others that have characteristics like being corrosion-resistant, sustainable, and eco-friendly. The demand for epoxy-cyanoacrylate is expected to rise due to its rising demand in industries like aerospace, automotive, construction, transportation, and others.

Hybrid Sealants Market Segmentation: By End User

-

Building and Construction

-

Automotive and Transportation

-

Industrial Assembly

-

Others

According to End User, the building and construction sector holds the largest market share. The rising construction sector globally is boosting the demand for hybrid sealants for various applications like windows, walls, flooring substrates, and roofing, thus fueling the growth of the hybrid sealant market. It holds around 45% of the market share.

The demand for fuel efficiency and stricter emission regulations is likely to speed up the growth of the lightweight material automobile component manufacturing industry. The automotive and transportation segment is the fastest-growing end user. Hybrid sealants are widely used for lightweight material bonding in the automobile industry. By reducing the weight of the vehicle, fuel efficiency is increased. The increase in infrastructure, construction, and development in emerging economies has paved the way for the growth of the hybrid sealant market. In the automotive and transportation industries, hybrid sealants are used for window sealing and automobile part bonding. They provide minimal shrinkage, excellent adhesion, durability, and resistance to chemicals and temperatures.

Hybrid Sealants Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The largest market share in the hybrid sealants market is in the Asia-Pacific region, which includes major automotive countries like China, India, Japan, and South Korea. This is also the fastest-growing area, holding a share exceeding 45% in 2023. The expansion of the region's economy, infrastructure, industrialization, and population all contribute to the market's growth. North America and Europe are also experiencing consistent growth. In the North American region, the USA accounts for more than 80% of the market share.

In the Asia-Pacific region, China is continuously developing its technology for building MS Polymer Hybrid Sealants, and its share in the international market is on the rise. "Made in China 2025" anticipates China to supply more than 10% of its domestically manufactured commercial aircraft by 2025. India is also witnessing high demand in its housing market. It is anticipated that India will witness USD 1.3 trillion in housing over the next seven years. The “Make in India” initiative of India is also growing demand in the manufacturing sector. A strong manufacturing base, high demand, and supportive policies are key drivers of growth in the Asia-Pacific market.

COVID-19 Impact Analysis on the Global Hybrid Sealants Market:

Due to the COVID-19 pandemic, the hybrid sealant market experienced a significant impact, resulting in slower growth. Supply chain disruptions, temporary manufacturing facility closures, and reduced end-user product demand all contributed to this. The COVID-19 epidemic also affected the hybrid sealant market, with delays in several industries, such as automotive, aerospace, and other sectors. However, the market is starting to recover as businesses resume operations and economic activity increases. To avoid future disruptions, manufacturers are prioritizing safety measures, ensuring the supply chain remains functional, and exploring automation and digitization opportunities.

Latest Trends/Developments:

The hybrid sealant market is witnessing a rise in sustainable production techniques. Regulations and environmental concerns have forced manufacturers to use eco-friendly chemicals and cleaner production methods that do not harm the environment or people's health. Bio-based hybrid sealants are driving significant growth in the hybrid sealant market. Bio-based hybrid sealants are made from renewable resources like plant-based polymers and natural oils. This development is in line with the larger sustainability goals of industries like construction, packaging, aerospace, and automotive, where eco-friendly supply chains are becoming increasingly important.

Key Players:

-

3M Corporation

-

Bostik (Arkema S.A)

-

DL Chemical Co., Ltd. (DL Holdings Co., Ltd.)

-

Hermann Otto GmbH

-

Mapei S.p.A.

-

Henkel AG & Co. KGaA

-

McCoy Soudal Sealants Adhesives and Foams Pvt. Ltd

-

Permabond LLC

-

Sika Corporation (Sika AG)

In October 2023, Sika, a sealant, adhesive, and construction solution provider, participated as an exhibitor at the 2023 IBEX Conference and Exhibition at the Tampa Convention Center in Tampa, FL. Sika debuted a new hybrid sealant in the exhibition.

In January 2022, DAP unveiled the launch of its latest hybrid sealants that outperform the silicon type and combine the features of polyurethane and silicone to provide enhanced features like the ability to withstand temperatures.

Chapter 1. HYBRID SEALANTS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. HYBRID SEALANTS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. HYBRID SEALANTS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. HYBRID SEALANTS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. HYBRID SEALANTS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. HYBRID SEALANTS MARKET – By Resin Type

6.1 Introduction/Key Findings

6.2 MS Polymer Hybrid

6.3 Epoxy-Polyurethane

6.4 Epoxy-Cyanoacrylate

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Resin Type

6.7 Absolute $ Opportunity Analysis By Resin Type, 2024-2030

Chapter 7. HYBRID SEALANTS MARKET – By End User

7.1 Introduction/Key Findings

7.2 Building and Construction

7.3 Automotive and Transportation

7.4 Industrial Assembly

7.5 Others

7.6 Y-O-Y Growth trend Analysis By End User

7.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. HYBRID SEALANTS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Resin Type

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Resin Type

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Resin Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Resin Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. HYBRID SEALANTS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M Corporation

9.2 Bostik (Arkema S.A)

9.3 DL Chemical Co., Ltd. (DL Holdings Co., Ltd.)

9.4 Hermann Otto GmbH

9.5 Mapei S.p.A.

9.6 Henkel AG & Co. KGaA

9.7 McCoy Soudal Sealants Adhesives and Foams Pvt. Ltd

9.8 Permabond LLC

9.9 Sika Corporation (Sika AG)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global hybrid sealant market was valued at USD 4.2 billion and is projected to reach a market size of USD 7.08 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 7.754%.

Key drivers include the demand for lightweight materials in the automotive sector and the growing demand for building and construction activities.

MS polymer hybrids, epoxy-polyurethane, epoxy-cyanoacrylate, and others are prominently used in the market.

Asia-Pacific held the largest market share, estimated at 45%, in the hybrid sealant market. This dominant position can be attributed to the region's rising demand for housing construction, rapid industrialization, and diverse manufacturing sectors.

3M Corporation, Bostik (Arkema S.A.), Hermann Otto GmbH, and Sika Corporation (Sika AG) are some of the key players in the global hybrid sealant market.