HVAC Sensor Market Size (2024 – 2030)

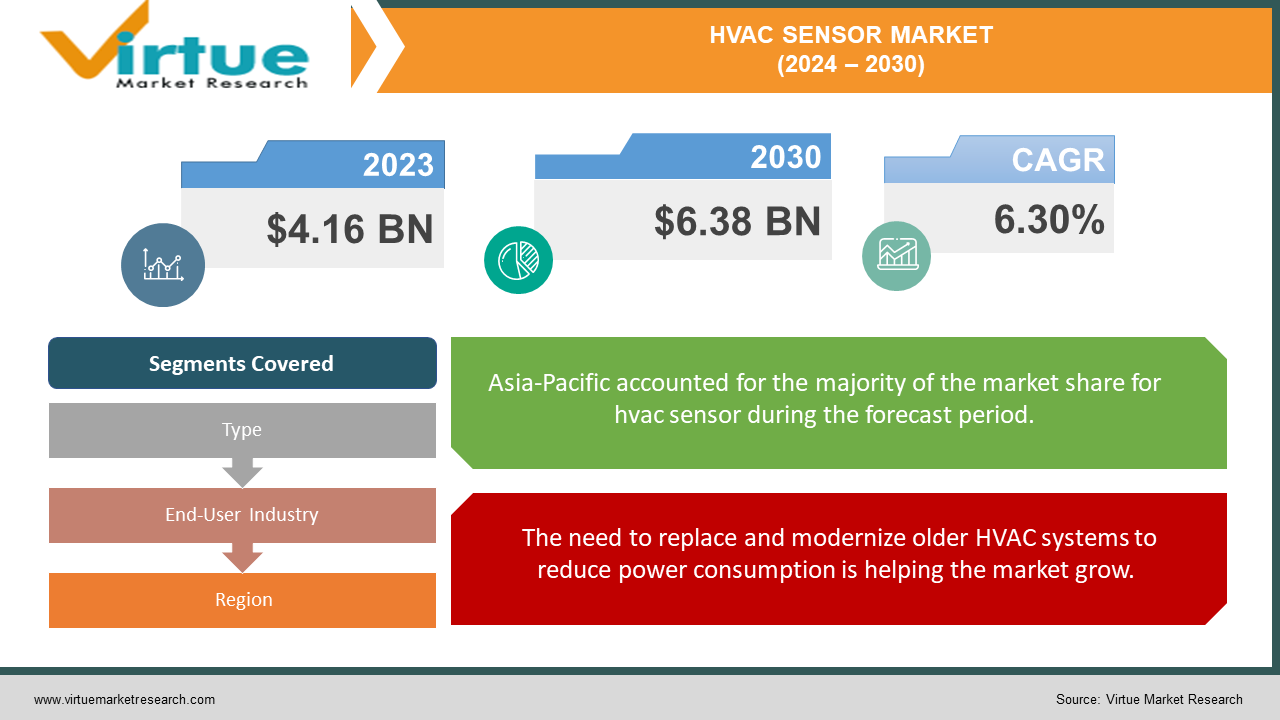

The HVAC sensor market was valued at USD 4.16 billion in 2023 and is projected to reach a market size of USD 6.38 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.30%.

The presence of prominent manufacturers in the HVAC sensor market is expected to increase the competitive landscape during the forecast period.

Key Market Insights:

The HVAC sensor market is projected to expand at a compound annual growth rate of over 6.30% in the upcoming 5 years, propelled by the rising need for lightweight, energy-efficient materials. According to RAP (Regulatory Assistance Project), heat pump installations in the country reduced CO2 emissions by 81 million metric tons. RAP calculated that with every 1% increase in heat pump uptake in China's buildings, an additional 7.1 Mt of CO2 may be avoided each year. Presently, just 3.4% of the building area in China uses heat pumps for space heating, indicating a considerable possibility to grow deployment and reduce CO2 emissions countrywide.

HVAC Sensor Market Drivers:

The need to replace and modernize older HVAC systems to reduce power consumption is helping the market grow.

Housing is estimated to account for nearly a third of global energy consumption and nearly 40% of energy-related carbon dioxide emissions, according to the Economic Forum. According to the Global Green Building Council, the energy required to build a building, such as heating, cooling, and maintaining the structure, accounts for about one-third of these costs. Iota Communications reports that the annual energy costs of office buildings are around $30,000. HVAC systems consume the most energy in commercial buildings. The United States Department of Energy estimates that HVAC systems typically consume 35% of a home's energy. An older HVAC system will not work properly because it will consume too much energy and break down quickly. BEMS is a sophisticated system for monitoring and controlling building energy needs. During the pandemic, the demand for HVAC systems with air purification features has increased. Recycled ventilation systems play an important role in public health by filtering air and reducing air pollution, including particulate matter.

The increasing popularity of smart homes is elevating demand.

Smart homes use devices connected to the Internet to facilitate monitoring and control of systems such as heating, air conditioning, lighting, etc. The benefits of smart homes are energy efficiency, design, and ease of use. Smart home technology increases reliability and accuracy. The total energy consumption, CO2 footprint, and operating costs of residential, commercial, and industrial buildings directly depend on the quality of the HVAC installation and its integration into the sensor network. According to the US DoE, smart home technology can reduce energy consumption by more than 60% in residential homes and up to 59% in commercial buildings. In addition, investing in AI-based smart home technology that provides indoor quality standards has been shown to improve employee productivity and intelligent home services by more than 10%. Therefore, the growing popularity of smart homes is driving the demand for HVAC sensors.

The growing adoption of building energy management systems (BEMS) is accelerating the growth rate.

Residential HVAC systems are expensive and a vital component of a house. A typical HVAC system uses between 40% and 70% of the energy consumed in a home overall, according to the Australian Department of Climate Change, Energy, Environment, and Water. A home energy management system (BEMS) is a computerized automated system that monitors and controls all energy-related systems, from mechanical and electrical equipment in a home. Energy management protects companies from unnecessary energy expenditure by enabling accurate and automatic management of energy and supply systems. According to Radio Crafts, BEMS can help an organization save up to 10–30% of its current energy consumption. Due to the war between Russia and Ukraine, energy prices are rising in the EU. Thus, the growing adoption of BEMS is the driving force for the HVAC sensor market.

HVAC Sensor Market Restraints and Challenges:

The high cost of sensors is a major barrier.

The proper operation of the HVAC system depends on the correct selection, configuration, and installation of sensors. Sensors can be installed to measure many different parameters, such as population, temperature, humidity, carbon dioxide, etc. The selected sensor must be able to detect the quantity being studied (temperature, humidity, CO2, etc.), the expected values must be within the detection range of the sensor, and the sensor have good sense and the right mind. For example, temperature and humidity sensors should not be exposed to direct sunlight or placed near hot areas. Such factors may hinder the growth of the HVAC sensor market.

Phasing out certain refrigerants may result in lower demand for toxicity sensors.

Despite their low toxicity, refrigerants can trap oxygen in large concentrations, which can cause sudden injury or even death from a lack of oxygen. Toxicity sensors reduce the likelihood of release from early detection. Activating a sensor, for example, can trigger an alarm and cause the HVAC system to stop and the damper control to work to prevent the spread of toxic gases. R22 is a common refrigerant used in air conditioners and heat pumps. The United States Environmental Protection Agency (EPA) banned the production and import of R22 due to its harmful effects on the ozone layer when released into the atmosphere. The removal of R22 refrigerant may lead to a reduction in the number of toxic sensors and thus affect the HVAC sensor market.

HVAC Sensor Market Opportunities:

The growing need for energy-efficient heating, ventilation, and air conditioning systems is driving the market for HVAC sensors, which offers substantial prospects. In residential, commercial, and industrial buildings, the use of sensors for temperature, humidity, air quality, and occupancy detection is increasing due to the increased awareness of environmental issues and the necessity of monitoring indoor air quality. Furthermore, better HVAC systems that provide increased comfort, energy savings, and predictive maintenance capabilities are becoming possible because of developments in sensor technology, including wireless connectivity and Internet of Things integration. The HVAC sector is likely to witness a surge in demand for novel sensor technologies as it moves towards sustainability and smart solutions. This will present lucrative prospects for market players to capitalize on.

HVAC SENSOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.30% |

|

Segments Covered |

By Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, Emerson Electric Co., Honeywell International Inc., Schneider Electric, Johnsons Controls Inc., Sensirion AG, Sensata Technologies Holding plc, Texas Instruments Inc., Infineon Technologies AG, STMicroelectronics NV |

HVAC Sensor Market Segmentation: By Type

-

Temperature Sensor

-

Humidity Sensor

-

Pressure and Flow Sensor

-

Motion Sensor

-

Smoke and Gas Sensor

The temperature sensor is the largest growing segment. This plays an important role in the operation of the HVAC system, serving as the cornerstone for maintaining good thermal comfort and energy efficiency in different environments. The global HVAC sensor market is experiencing significant growth due to several reasons. First, the growing awareness in planning projects about energy conservation and indoor comfort is driving the demand for advanced heat detection technology. Second, the implementation of the Internet of Things (IoT) in smart home solutions requires the integration of temperature sensors for data-driven decision-making and automation. In addition, a growing focus on sustainable practices in green buildings is increasing the adoption of temperature sensors to achieve energy savings and reduce carbon footprints. However, challenges such as technological complexity and the need for interoperability pose barriers to market expansion. Nevertheless, advancements in sensor technology, along with changing consumer preferences, are expected to continue to drive the growth of the global HVAC sensor market in the foreseeable future. Pressure and flow sensors are the fastest-growing segment. They play a key role in the efficiency and effectiveness of HVAC systems, and their importance is only growing in today's rapidly changing market. Factors such as growing awareness of energy conservation, stricter indoor air quality standards, and the proliferation of smart HVAC solutions are driving the demand for high-pressure and water management technology. These sensors enable monitoring and control of air and water flow in the HVAC system, thereby increasing efficiency and reducing energy consumption and operating costs. In addition, the integration of the Internet of Things (IoT) and artificial intelligence (AI) technology increases the power of pressure and flow sensors, enabling system automation and predictive maintenance. In the global HVAC sensor market, the increase in pressure and flow solutions is expected to accelerate market growth. As companies and consumers prioritize efficiency, durability, and comfort, the demand for new sensor technology will continue to increase, shaping the future of the HVAC industry.

HVAC Sensor Market Segmentation: By End-User Industry

-

Residential

-

Industrial

-

Commercial

The commercial sector is the largest growing end-user industry. In this dynamic landscape, the demand for HVAC sensor technology has increased, which has led to many growing factors. Rapid development, especially in emerging economies, has led to the expansion of factories, warehouses, and factories, all of which require efficient air conditioning systems for optimal performance. In addition, growing awareness about environmental sustainability and energy efficiency has led companies to adopt impact-based HVAC systems to reduce carbon footprints and operating costs. In addition, strict regulations aimed at improving indoor air quality and ensuring worker safety have promoted the adoption of advanced sensor technology in industrial environments. These factors are contributing to a significant impact on the global HVAC sensor market, driving strong growth and innovation as companies look for better ways to meet their changing needs and legal principles. The industrial sector is the fastest-growing segment. Factors such as increasing urbanization, expanding infrastructure services, and increasing demand for energy-efficient solutions have led to the adoption of HVAC sensors in commercial spaces worldwide. By contributing significantly to the enhancement of energy efficiency, indoor air quality, and occupant comfort, these sensors meet regulatory and industry sustainability requirements. In addition, the advent of smart home technology and the Internet of Things (IoT) has enabled the integration of advanced sensor systems with commercial HVAC equipment, enabling remote monitoring, predictive maintenance, and timely maintenance for optimal performance.

HVAC Sensor Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is the largest and fastest-growing market. Rapid urbanization, growing industrialization, and growing awareness about energy efficiency and indoor air quality have fueled the demand for HVAC systems and sensors across the region. Countries such as China, India, Japan, and South Korea are seeing significant investment in infrastructure development, real estate, and smart city planning, fostering an environment for deploying advanced HVAC sensor technology. Additionally, strict regulations and government initiatives to reduce carbon emissions and promote sustainable building practices are increasing the adoption of HVAC sensors.

COVID-19 Impact Analysis on the HVAC Sensor Market:

The COVID-19 pandemic has affected various industries, and the HVAC sensor market is no exception. As the pandemic has led to widespread lockdowns and strict health measures, commercial and residential spaces have experienced major changes in living styles and usage patterns. This led to a marked shift in demand for HVAC systems and related sensors. While some industries, such as healthcare and data centers, have seen an increase in demand for advanced HVAC systems to ensure indoor air quality and safety, others, such as hospitality and retail sales, have experienced a decline due to reduced foot traffic and accommodation. Additionally, supply chain disruptions, labor shortages, and economic uncertainty have increased the challenges faced by HVAC sensor manufacturers. As the world moves forward due to the pandemic, the HVAC sensor market is ready to recover, but with new recovery, resilience, support, and technology to meet the needs of customers and clients.

Latest Trends/ Developments:

In recent years, the HVAC sensor market has undergone significant changes, fueled by technological advances and a growing focus on energy efficiency and indoor comfort. Notable is the integration of IoT (Internet of Things) technology, enabling monitoring and control of HVAC systems through connected sensors. This connection not only improves operational efficiency but also simplifies policy management, reduces downtime, and improves process efficiency. In addition, there is a growing demand for smart sensors that can monitor various environmental parameters, such as temperature, humidity, and air quality, in real-time. These sensors enable the building control system to dynamically adjust HVAC parameters, achieving optimal comfort levels and reducing energy consumption. In addition, the adoption of air sensor networks and advances in sensor miniaturization have expanded the application of HVAC sensors in a variety of settings, from residential buildings to commercial and industrial facilities. As sustainability concerns continue to drive innovation, the HVAC sensor market is poised for growth and innovation.

Key Players:

-

Siemens AG

-

Emerson Electric Co.

-

Honeywell International Inc.

-

Schneider Electric

-

Johnsons Controls Inc.

-

Sensirion AG

-

Sensata Technologies Holding plc

-

Texas Instruments Inc.

-

Infineon Technologies AG

-

STMicroelectronics NV

-

In March 2023, Sensirion announced the release of the SHT40I-Analog humidity sensor, which is intended for demanding industrial applications and severe settings where high noise levels may make digital solutions ineffective. The novel sensor allows for simple design and customer-specific output characteristics for high-volume applications.

-

In April 2022, Trane Technologies PLC announced a strategic continuing collaboration to achieve higher energy efficiency using Air-Fi wireless sensors for Trane and Mitsubishi Electric City Multi VRF and improvements to the IntelliPak 1 HVAC Rooftop Unit. The upgrades give building owners technology, data, and controls to help them satisfy efficiency standards, achieve decarbonization targets, and make retrofits easier and more cost-effective.

Chapter 1. HVAC Sensor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. HVAC Sensor Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. HVAC Sensor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. HVAC Sensor Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. HVAC Sensor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. HVAC Sensor Market – By Type

6.1 Introduction/Key Findings

6.2 Temperature Sensor

6.3 Humidity Sensor

6.4 Pressure and Flow Sensor

6.5 Motion Sensor

6.6 Smoke and Gas Sensor

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. HVAC Sensor Market – By End-User Industry

7.1 Introduction/Key Findings

7.2 Residential

7.3 Industrial

7.4 Commercial

7.5 Y-O-Y Growth trend Analysis By End-User Industry

7.6 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. HVAC Sensor Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By End-User Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By End-User Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By End-User Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By End-User Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End-User Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. HVAC Sensor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Siemens AG

9.2 Emerson Electric Co.

9.3 Honeywell International Inc.

9.4 Schneider Electric

9.5 Johnsons Controls Inc.

9.6 Sensirion AG

9.7 Sensata Technologies Holding plc

9.8 Texas Instruments Inc.

9.9 Infineon Technologies AG

9.10 STMicroelectronics NV

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The HVAC sensor market was valued at USD 4.16 billion and is projected to reach a market size of USD 6.38 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.30%.

The need to replace and modernize older HVAC systems to reduce power consumption, the increasing popularity of smart homes, and the growing adoption of building energy management systems (BEMS) are the main factors driving the growth of the HVAC sensor market.

Based on type, the HVAC sensor market is segmented into temperature sensors, humidity sensors, pressure and flow sensors, motion sensors, and smoke and gas sensors.

Asia-Pacific is the most dominant region for the HVAC sensor market.

Siemens AG, Emerson Electric Co., Honeywell International Inc., Schneider Electric, and Johnsons Controls Inc. are the major players in the HVAC sensor market.