HVAC Equipment Market Size (2025 – 2030)

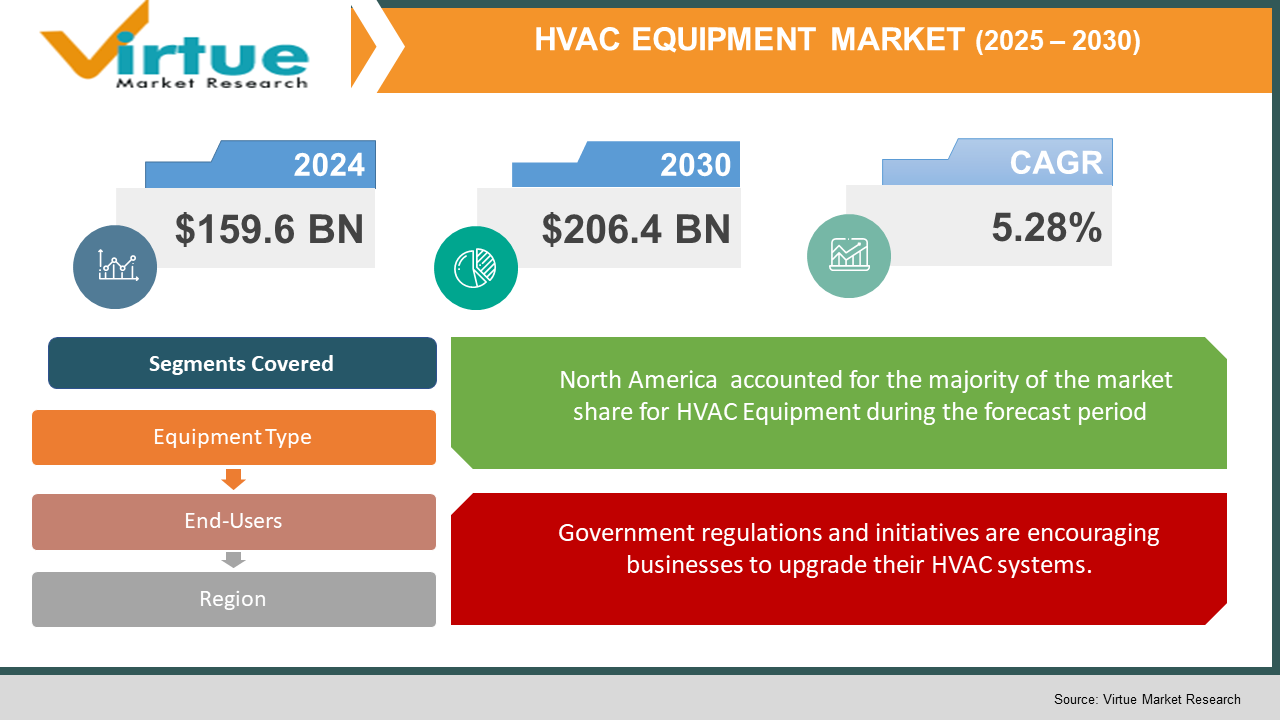

The Global HVAC Equipment Market was valued at USD 159.6 billion and is projected to reach a market size of USD 206.4 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.28%.

Rising demand for energy-efficient systems, technological developments, and expanding construction activity across residential, commercial, and industrial sectors will drive the great expansion of the worldwide market for heating, ventilation, and air conditioning (HVAC) equipment from 2025 to 2030. Good government regulations supporting sustainable construction methods and the integration of smart technologies help to further drive the market's growth. The increasing demand for affordable and energy-efficient climate control options, along with technological developments improving system output and user comfort, contribute to this growth.

Key Market Insights:

- Energy-efficient HVAC systems are increasingly being promoted to cut environmental impact and running expenses. Governments globally are legislating rules and providing incentives to promote the use of environmentally friendly HVAC systems. Increasing inclusion of Internet of Things (IoT) technology in HVAC systems is permitting improved control and connectivity. This pattern should present market expansion chances.

- Expected to grow annually at a 6.2% cumulative average rate of growth throughout the forecast period, the HVAC systems market is important in the Asia-Pacific area. Growing air conditioning will, according to the International Energy Agency, dramatically affect world electricity needs over the next decade.

HVAC Equipment Market Drivers:

Urbanization and Infrastructure development are the main reasons behind the boost in the demand for HVAC systems.

The growing need for HVAC systems is being driven by fast urbanization and commercial space development. The United States For example, the commercial construction industry is forecast to be worth USD 203.50 billion by 2029, therefore boosting HVAC sales.

Government regulations and initiatives are encouraging businesses to upgrade their HVAC systems.

Strict energy efficiency rules set by governments are causing companies and homeowners to replace their HVAC systems. New rules connected to energy efficiency in the United States include the January 2023 SEER2 (Seasonal Energy Efficiency Ratio), which is beginning to affect market dynamics.

Tax deductions implemented by the government are encouraging people to adopt HVAC systems.

Incentives and tax credits are being provided by governments across the world to promote the installation of energy-efficient heating, ventilation, and air-conditioning systems. Reducing energy use and supporting environmental sustainability will help to boost the demand for sophisticated HVAC systems.

Technological advancements in HVAC systems lead to enhancement in energy efficiency and performance.

Including Artificial Intelligence (AI) and Internet of Things (IoT) technologies in HVAC systems is helping to improve performance as well as energy efficiency. For example, artificial intelligence-powered systems can use current data to perfect temperature control therefore, major savings in energy are achieved. For instance, 45 Broadway in Manhattan reduced by 15.8 percent their HVAC-related energy use by means of artificial intelligence technology.

HVAC Equipment Market Restraints and Challenges:

The high initial investment can act as a barrier for many individuals and businesses.

For some consumers, the front cost of energy-efficient HVAC systems can be a roadblock, even given the long-term advantages.

A lack of skilled labor force can heavily impact the HVAC Equipment market.

A lack of knowledgeable technicians in the HVAC business can affect maintenance and installation services. Roughly 42,500 employment opportunities for HVAC technicians and installers are projected annually, so great labor is in demand.

The problem of supply chain disruption affects the affordability of HVAC systems and impacts the delivery time.

Rising worldwide demand for raw materials, including aluminum, copper, and semiconductors, is causing the HVAC sector substantial supply chain problems. HVAC equipment's higher costs and longer lead times caused by these disturbances affect the affordable and on-time delivery of goods.

The need to comply with the regulations leads to an increase in production costs affecting the HVAC Equipment Market.

New environmental laws call for HVAC systems to use eco-friendly refrigerants, therefore pushing construction costs up. For HVAC systems, these regulatory changes have meant a 30-50% price increase from six months ago. Therefore, both producers and customers find themselves in financial straits.

HVAC Equipment Market Opportunities:

The use of IoT-enabled devices to increase the adoption level of HVAC systems.

Due to the rise in the availability of IoT-powered devices, HVAC systems are more likely to be adopted due to better control and management of energy consumption.

Growth in the popularity of integration of renewable energy.

Interest in renewable energy technologies such as geothermal heat pumps is growing. By 2030, the geothermal heat pump business is projected to reach 21.5 billion, indicating increasing investment in eco-friendly methods of heating and cooling.

Rise in the integration of Artificial Intelligence (AI) in the HVAC systems.

The application of AI technologies in HVAC is transforming the business with the introduction of advanced maintenance, energy efficiency, and user comfort. The AI offers predictive maintenance, significantly lessening the hours dedicated to repairs. Moreover, AI can use real-time data to modify HVAC settings based on the current need, therefore effectively conserving energy.

The ever-expanding data centers are leading to a growth in the need for advanced cooling solutions.

The escalating demand for cloud services and storage is prompting the proliferation of data centers, which results in new opportunities for the HVAC sector. The servers and other hardware fitted in a data center need a sophisticated cooling system, which enables their optimum functioning. As the use of data centers grows, the global data center cooling market is expected to expand, with HVAC personnel creating new energy-saving, dependable, and effective cooling systems.

HVAC EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.28% |

|

Segments Covered |

By Equipment Type, end users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Carrier Global Corporation, Johnson Controls – Hitachi Air Conditioning, Daikin Industries, Ltd. |

HVAC Equipment Market Segmentation:

HVAC Equipment Market Segmentation: By Equipment Type:

- Heating Equipment

- Ventilation Equipment

- Air Conditioning Equipment

Heat Pumps Devices that transfer heat energy from a source to a destination, delivering both heating and cooling functions. Furnace appliances that heat air and distribute it through tubes to various spaces. Boilers Systems that warm water for steam or hot water heating systems. Unitary Heaters Self-contained heating units are generally used in commercial or industrial settings.

Air Handling Units (AHUs) are Devices that condition and circulate air as part of an HVAC system. Ventilation Fans are designed to move air and ensure proper ventilation in spaces. Air Purifiers Devices that remove pollutants from the air to ameliorate inner air quality. Dehumidifiers and humidifier equipment independently remove or add humidity to the air to maintain moisture situations.

Air Conditioners Systems that cool inner air, ranging from window units to central air systems. Chillers are Machines that remove heat from a liquid via a vapor-contraction or immersion refrigeration cycle. Cooling Towers Heat rejection devices that release waste heat to the atmosphere through the cooling of water aqueducts.

HVAC Equipment Market Segmentation: By End-Users

- Residential

- Commercial

- Industrial

In the residential sector, Single-family homes, apartments, and other living spaces demand HVAC solutions for individualized comfort.

In the commercial sector, Office structures, retail stores, hotels, hospitals, schools, and other establishments serve business or public functions.

In the industrial sector, Manufacturing factories, storages, data centers, and other installations where HVAC systems support artificial processes and equipment cooling.

HVAC Equipment Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the leader in this market with a market share of 35%, followed by Europe with 30%. South America and MEA are emerging markets in this sector.

The U.S. HVAC systems market was valued at roughly USD 30.41 billion in 2023, with a projected CAGR of 7.4 from 2024 to 2030.

In 2024, heat pump deals in Europe endured a 23 decline, returning to pre-Ukraine war situations.

The Asia-Pacific region is the second largest shareholder in the global HVAC systems request, with an estimated CAGR of 6.2 during the cast period.

COVID-19 Impact Analysis on the Global HVAC Equipment Market:

The COVID-19 epidemic has profoundly impacted the HVAC (Heating, Ventilation, and Air Conditioning) equipment market, impacting both supply and demand dynamics. The epidemic led to significant supply chain challenges, including product bottlenecks and material dearths. Original Equipment Manufacturers (OEMs) faced difficulties due to constrained global supply chains, resulting in delays and increased costs for HVAC equipment.

In summary, while the COVID-19 epidemic introduced several challenges to the HVAC equipment market, including supply chain dislocations and labor dearths, it also stressed the critical part of HVAC systems in maintaining healthy inner surroundings, paving the way for invention and growth in the industry.

Latest Trends/ Developments:

Europe is witnessing a drop in the sales of heat pumps.

In 2024, heat pump deals in Europe dropped by 23%, returning to pre-Ukraine war situations. This decline is attributed to political misgivings, changes in support schemes, and a sluggish frugality. Despite high gas prices and security enterprises, roughly two million units were vended, mirroring the 2021 numbers.

The HVAC system market is said to see good growth in the coming years.

This growth is driven by the added demand for energy-effective systems and technological advancements.

Integration of Artificial Intelligence (AI) has led to the enhancement of HVAC system efficiency.

Companies like Carrier Global are fastening on AI-driven results to enhance HVAC system effectiveness. Carrier's data-center HVAC request is anticipated to grow from $ 7 billion in 2023 to as important as $ 20 billion by 2027, driven by the need for advanced cooling results for Artificial Intelligence (AI) chips.

Key Players:

- Carrier Global Corporation

- Johnson Controls – Hitachi Air Conditioning

- Daikin Industries, Ltd.

Carrier Global Corporation is a leading provider of HVAC results; Carrier has expanded its portfolio by acquiring Germany's Viessmann Climate results for $ 13 billion. The company is also investing in AI-driven cooling results for data centers, anticipating significant request growth in this sector.

Johnson Controls – Hitachi Air Conditioning, this common adventure focuses on developing domestic and marketable air exertion results. In October 2019, they invested USD 22.5 million to open a state-of-the-art development installation in Gujarat, India, aiming to serve requests in India, the Middle East, Southeast Asia, and Europe.

Daikin Industries, Ltd. is a prominent HVAC manufacturer, Daikin offers a wide range of heating and cooling results. The company emphasizes energy-effective products and has a significant presence in both domestic and marketable requests.

Chapter 1. HVAC EQUIPMENT MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. HVAC EQUIPMENT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. HVAC EQUIPMENT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. HVAC EQUIPMENT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. HVAC EQUIPMENT MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. HVAC EQUIPMENT MARKET – By Equipment Type

6.1 Introduction/Key Findings

6.2 Heating Equipment

6.3 Ventilation Equipment

6.4 Air Conditioning Equipment

6.5 Y-O-Y Growth trend Analysis By Equipment Type

6.6 Absolute $ Opportunity Analysis By Equipment Type , 2025-2030

Chapter 7. HVAC EQUIPMENT MARKET – By End-Users

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By End-Users

7.6 Absolute $ Opportunity Analysis By End-Users, 2025-2030

Chapter 8. HVAC EQUIPMENT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Equipment Type

8.1.3. By End-Users

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Equipment Type

8.2.3. By End-Users

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Equipment Type

8.3.3. By End-Users

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Equipment Type

8.4.3. By End-Users

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Equipment Type

8.5.3. By End-Users

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. HVAC EQUIPMENT MARKET– Company Profiles – (Overview, Equipment Type Portfolio, Financials, Strategies & Developments)

9.1 Carrier Global Corporation

9.2 Johnson Controls – Hitachi Air Conditioning

9.3 Daikin Industries, Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global HVAC Equipment Market was valued at USD 159.6 billion and is projected to reach a market size of USD 206.4 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.28%.

It's recommended to change your air filter every 1- 3 months, depending on operation and air quality.

Regular conservation, timely filter replacement, sealing conduit leaks, and installing a programmable thermostat can enhance the effectiveness of the HVAC system

Generally, HVAC systems last between 10 to 15 years. With proper conservation, they can last up to 20- 25 years.

Urbanization and Infrastructure development are the main reasons behind the boost in the demand for HVAC systems.