Humanoid Robot Market Size (2024 – 2030)

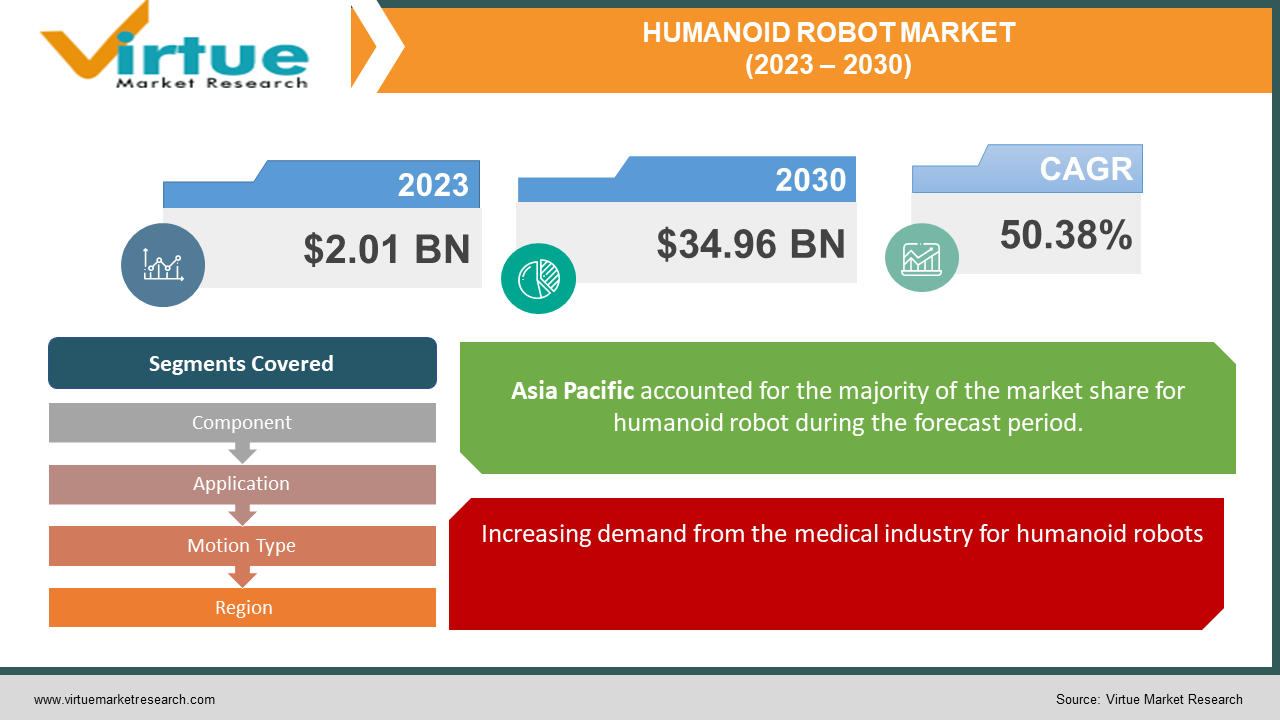

The Global Humanoid Robot Market was valued at USD 2.01 billion and is projected to reach a market size of USD 34.96 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 50.38%.

Humanoid robots possess characteristics that resemble humans both in appearance and behavior. They provide benefits, such, as increased productivity, secure handling of materials, accurate task execution, and the capability to accomplish tasks in a timeframe. These robots find applications, in fields, such, as scientific experiments, human interaction, and automation of industrial processes. Moreover, they are widely used in the assistance, education, and entertainment industries. Notably humanoid robots excel in providing assistance by performing caregiving responsibilities like administering medication monitoring signs and assisting with feeding routines.

Key Market Insights:

According to a report titled "World Robotics 2022. Service Robots”, by the International Federation of Robotics (IFR) there was a rise of 37% in the sales of service robots. Europe experienced the growth accounting for 38% of the market share followed by North America at 32% and Asia at 30%. Concurrently there was also an increase of 9% in sales, for consumer service robots.

As, per the data from the Office for National Statistics (ONS) 1.5 million individuals residing in England face an increased vulnerability of job loss in 2019 owing to automation. This poses a challenge, to the growth of the humanoid robot sector as it brings about concerns regarding unemployment.

The field of Robotics is currently undergoing a transformation and development as shown by the rise, in investment the entry of international players the decrease, in hardware cost, and the increasing popularity of existing robots.

Japan is introducing robots in settings such, as offices, schools, and nursing homes to address the challenges posed by an aging population and a shrinking workforce. The World Economic Forum reports that almost a third of Japan's population is over the age of 65 with around 2.3 billion individuals, in their seventies.

Humanoid Robot Market Drivers:

Increasing demand from the medical industry for humanoid robots.

The healthcare industry has seen a growing demand, for robots because they can assist professionals and improve patient care. These robots are widely used in hospitals and medical centers where they perform tasks. One important application is gathering information allowing the humanoid robots to interact with patients and collect data. This reduces the need for contact, which helps lower the risk of infections and keeps both patients and healthcare providers safe. Moreover, these robots can be programmed to deliver items like supplies and food, to patients, which helps ease the workload of healthcare staff and promotes social distancing measures.Extremely adaptable and mobile nature of these robots are driving demand in various sectors.

Robots possess mobility and are equipped with legs that enable swift and versatile movement in various directions. As a result, these humanoid machines can effortlessly transition between responsibilities both at work and, in settings efficiently executing a wide range of tasks that were once exclusive to humans. Additionally, their design is specifically tailored to imitate behavior. Consequently, certain robotic counterparts are exceptionally well suited for demanding duties like space exploration, mining operations, and deep sea ventures. Moreover, humanoid robots play a role, in attending to the needs of the sick and elderly while also adeptly operating vehicles and machinery.

Humanoid Robot Market Restraints and Challenges:

Safety concerns pose a challenge when it comes to adopting robots, in human environments. Since these robots work alongside humans it's crucial to ensure their interactions are safe and minimize the risk of accidents or malfunctions that could harm people or property. If accidents involving robots occur they can cause injuries or damage which raises concerns from bodies and creates hesitancy towards their widespread use. Humanoid robots are machines with moving parts, sensors, and capabilities. The potential risks associated with operating them include collisions, falls, entanglement, or unintentional physical contact with humans. To ensure the safety of robots robust safety features need to be implemented such as collision detection and avoidance systems emergency stop mechanisms and compliance, with safety standards.

Humanoid Robot Market Opportunities:

One of the goals when employing robots, for rescue missions is to empower them to function in environments or situations that are deemed perilous for human intervention. The applications of search and rescue operations have been expanding, thanks to the increasing use of rescue systems. By incorporating robots into these operations we can save lives and significantly enhance the safety of such endeavors worldwide. The frequency and impact of disasters like earthquakes, hurricanes, floods, etc. are on the rise, which highlights the necessity for robot-led rescue efforts across all stages of a disaster.

Boston Dynamics has created a robot called Atlas, which is designed to resemble a human and walk on two legs. This remarkable creation has received funding, from the Defense Advanced Research Projects Agency (DARPA). Atlas is primarily built to carry out search and rescue operations, including navigating through debris manipulating valves, and accessing doors.

HUMANOID ROBOT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

50.38% |

|

Segments Covered |

By Component, Application, Motion Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

WowWee Group, Ubtech Robotics, Toyota Motor Corporation, Honda Motor Co. Ltd., Toshiba, SoftBank Corporation, Samsung Electronics, ROBOTICS, Robo Garage Co., Qihan Technology Co |

Humanoid Robot Market Segmentation: By Component

-

Hardware

-

Software

The component segment can be categorized into two parts; software, and hardware. In 2023 the hardware segment held the market share at 39%. Hardware components play a role, in enhancing the capability of robots to interact with people. One of the sub-components of a robot is its control system, which receives and processes data, from sensors and utilizes actuators to respond based on decision-making outcomes. In contrast, the software sector experienced growth, with a compound annual growth rate throughout the projected timeframe. Humanoid robots incorporate software capabilities that enable them to perform tasks and engage with their surroundings. Looking ahead to the market duration, for robots we can anticipate witnessing an increasing array of sophisticated and intricate software applications.

Humanoid Robot Market Segmentation: By Application

-

Search and rescue

-

Education and Entertainment

-

Personal assistance and caregiving

-

Public relations

-

Research & space exploration

-

Others

Based on the application segment, the personal assistance and caregiving sector emerged as the player in the market capturing around 20% of market share in 2023. Particularly during the coronavirus outbreak, humanoid robots gained attention as they remained unaffected by the virus. Their ability to conduct patient monitoring and provide services without human intervention proved invaluable. Consequently, there has been an adoption of these machines further enhancing their value. In the future, these robots might have the potential to carry out responsibilities with a focus, on reducing risks, for human doctors. However, it is worth noting that the education and entertainment sector is projected to experience growth rate with an annual growth rate (CAGR) of 23.9%, during the forecast period. In the field of education, humanoid robots are being utilized to enhance learning opportunities, for students.

Humanoid Robot Market Segmentation: By Motion Type

-

Wheel drive

-

Biped channel

The motion type category is divided into two segments; wheel drive and biped channel. The wheel drive segment currently holds the majority market share accounting for 58%, in 2023. Wheel-drive robots are known for their ease of design and ability to navigate their surroundings based on programmed instructions. There is a growing demand for wheel-type robots in army and defense applications due to their advantages. Additionally, humanoid robots with wheel drive capabilities are being used as sources of entertainment, at science events theme parks, and amusement parks. These factors are expected to contribute to the growth of the market in the coming years. The wheel-type robots are expected to experience a compound growth rate (CAGR) of 21.6% throughout the projected timeframe. This increase, in popularity can be attributed to their advantages in military and defense applications.

Humanoid Robot Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region has been identified as the leading market, for robots globally capturing a 35.8% share of the market revenue in 2023. This can be attributed to countries like China, India, and Japan where there is a demand for robots. As a result, the market is expected to experience growth with support from influential players, in these nations. North America is expected to experience a compound growth rate (CAGR) of 21.7% during the projected timeframe. This region is home, to leading companies and research institutions that have played a role in advancing humanoid robot technology.

COVID-19 Impact Analysis on the Global Humanoid Robot Market:

The production and distribution of these robots have been negatively impacted by COVID-19. The global supply chain disruptions caused by the pandemic have affected industries, including the growth of the market, for robots. This has led to delays in robot production as components and materials faced supply disruptions. Manufacturers have been forced to either halt production or reduce output resulting in an adoption rate, for these robots. The disturbances, in supply chains have also resulted in a rise, in the prices of materials and components required for constructing robots. As a result businesses and organizations find it more costly to obtain these robots.

Latest Trends/ Developments:

Like robots are increasingly being utilized in customer engagement roles due, to their capabilities in facial recognition speech recognition, and emotion detection. This surge in technology coincides with the dominance of smartphones the web and social media as channels for customer interaction. These robots have seen adoption across fields, including education, entertainment, and more.

To illustrate this trend in February 2019 two humanoid robots—the CNRS LIRMMs position-controlled HRP 4 and DLRs torque-controlled TORO—were achieved by accessing the Airbus civilian airliner manufacturing plant in Saint Nazaire, France. This demonstration was part of the EU project Comanoid1. Comanoid aims to explore the feasibility and viability of using robotic technology for automating non-value-added tasks in aircraft manufacturing operations. Such advancements demonstrate the willingness of end users and researchers to develop ready industry solutions, for market implementation.

Key Players:

-

WowWee Group

-

Ubtech Robotics

-

Toyota Motor Corporation

-

Honda Motor Co. Ltd.

-

Toshiba

-

SoftBank Corporation

-

Samsung Electronics

-

ROBOTICS

-

Robo Garage Co.

-

Qihan Technology Co

-

In January 2023 Samsung Electronics Co. revealed their plan to invest 59 billion won ($46.2 million) in Rainbow Robotics, a company specializing in the development of robots. This strategic move aims to enhance Samsung's capabilities in the fields of intelligence (AI) and humanoid robots.

-

In November 2022 Honda Motor embarked on a project called "Avatar Robot" to develop capabilities that can assist and support humans during emergencies. The ultimate goal of this initiative is to enhance and broaden the range of care provided to people.

-

PAL Robotics introduced TALOS, a humanoid robot designed for tackling tasks in the industrial sector in July 2022.

Chapter 1. Humanoid Robot Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Humanoid Robot Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Humanoid Robot Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Humanoid Robot Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Humanoid Robot Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Humanoid Robot Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Humanoid Robot Market – By Application

7.1 Introduction/Key Findings

7.2 Search and rescue

7.3 Education and Entertainment

7.4 Personal assistance and caregiving

7.5 Public relations

7.6 Research & space exploration

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Humanoid Robot Market – By Motion Type

8.1 Introduction/Key Findings

8.2 Wheel drive

8.3 Biped channel

8.4 Y-O-Y Growth trend Analysis By Motion Type

8.5 Absolute $ Opportunity Analysis By Motion Type, 2024-2030

Chapter 9. Humanoid Robot Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Motion Type

9.1.4 By Component

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Motion Type

9.2.4 By Component

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Motion Type

9.3.4 By Component

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Motion Type

9.4.4 By Component

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Motion Type

9.5.4 By Component

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Humanoid Robot Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 WowWee Group

10.2 Ubtech Robotics

10.3 Toyota Motor Corporation

10.4 Honda Motor Co. Ltd.

10.5 Toshiba

10.6 SoftBank Corporation

10.7 Samsung Electronics

10.8 ROBOTICS

10.9 Robo Garage Co.

10.10 Qihan Technology Co

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Humanoid Robot Market was valued at USD 2.01 billion and is projected to reach a market size of USD 34.96 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 50.38%.

Increasing demand from the medical industry for humanoid robots that are extremely adaptable and mobile.

Based on Components, the Global Humanoid Robot Market is segmented into software and hardware.

Asia Pacific is the most dominant region for the Global Humanoid Robot Market.

WowWee Group, Ubtech Robotics, Toyota Motor Corporation, Honda Motor Co. Ltd., Toshiba, SoftBank Corporation, Samsung Electronics, and ROBOTIS are the key players operating in the Global Humanoid Robot Market.