Household Fridge Market size (2025-2030)

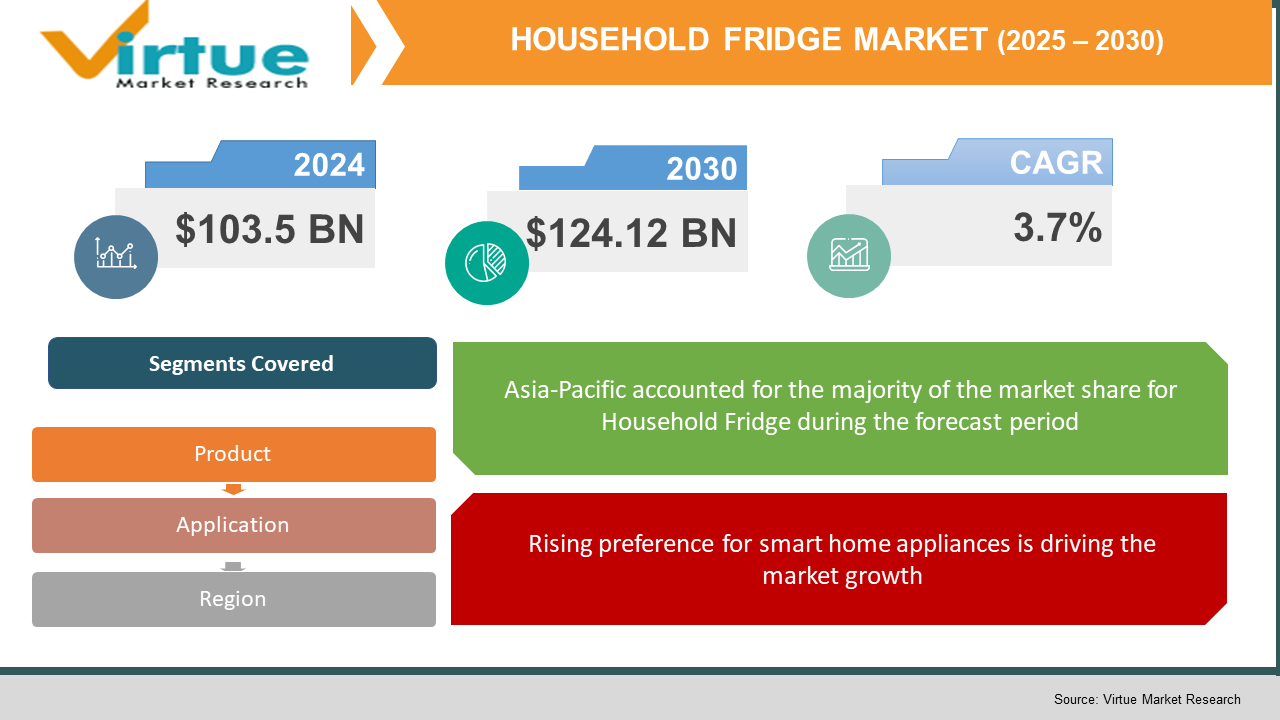

The Global Household Fridge Market was valued at USD 103.5 billion in 2024 and is expected to grow at a CAGR of 3.7% from 2025 to 2030. The market is projected to reach USD 124.12 billion by the end of 2030.

This market comprises refrigerators designed for home use, ranging from compact single-door units to large multi-door smart fridges. The demand is largely driven by urbanization, rising disposable incomes, increased focus on food preservation, and the growing preference for energy-efficient and technologically advanced appliances. With more consumers shifting toward sustainable living and connected homes, household refrigerators are evolving rapidly in form, function, and efficiency.

Key market insights:

Double-door refrigerators account for the majority of global sales due to their larger capacity and advanced cooling features.

Urban households are replacing refrigerators more frequently, with an average lifecycle of 8 to 10 years, boosting consistent demand.

The emergence of smart fridges with internal cameras, temperature zoning, and voice integration has influenced premium product sales.

Compact fridges are gaining popularity in micro-apartments and rental homes, especially in dense urban regions.

Asia-Pacific accounts for the highest market share due to a growing middle class and widespread electrification in rural areas.

Manufacturers are focusing on environmentally friendly refrigerants and recyclable materials to comply with global sustainability goals.

Global Household Fridge Market Drivers

Rising preference for smart home appliances is driving the market growth

The global shift toward smart living is significantly impacting the household fridge market. As consumers become more inclined toward intelligent home appliances, refrigerators equipped with features such as Wi-Fi connectivity, touchscreen interfaces, voice assistant compatibility, and real-time temperature controls are in demand. These fridges allow users to monitor their contents remotely, receive expiration alerts, and adjust temperature settings through mobile apps. This transformation is not just a trend but a consumer expectation, especially among younger urban buyers. Manufacturers are prioritizing innovation in digital integration to differentiate their offerings. Smart fridges are also being paired with home automation systems, creating a seamless kitchen ecosystem. The convenience, data insights, and interconnectivity offered by these advanced appliances are expected to significantly boost adoption rates over the forecast period.

Growing urbanization and lifestyle changes is driving the market growth

As more people migrate to urban centers and adopt modern lifestyles, the demand for efficient and space-optimized home appliances like refrigerators is growing. Urban households tend to have a higher frequency of grocery purchases and need reliable refrigeration to store perishable items. With dual-income families, the trend of weekly shopping trips instead of daily grocery runs is increasing, leading to the need for larger storage capacity in fridges. Furthermore, the popularity of meal prepping, frozen foods, and healthy eating habits also adds pressure on consumers to own refrigerators with multi-compartment storage and temperature-controlled zones. The market is responding with a wide range of options tailored for studio apartments, shared housing, and small kitchens.

Increasing focus on energy efficiency and sustainability is driving the market growth

Energy efficiency has become a key decision factor for buyers across the globe. Rising electricity costs and heightened environmental awareness have pushed consumers toward appliances that consume less energy. Household fridges now come equipped with inverter compressors, thermal insulation technology, and energy-star ratings. These features help reduce electricity bills while minimizing carbon footprints. Many governments are also offering incentives, rebates, or tax credits to households purchasing eco-friendly appliances, encouraging a shift from older, energy-hungry models. Moreover, there is increasing attention on refrigerators that use natural refrigerants with low environmental impact, aligning with global climate goals. This driver is anticipated to become even more prominent as climate policies become stricter and consumers grow more environmentally conscious.

Global Household Fridge Market Challenges and Restraints

High cost of advanced refrigeration technologies is restricting the market growth

One of the primary challenges in the household fridge market is the relatively high price of advanced models equipped with smart features and energy-saving technologies. While smart fridges offer long-term benefits, including better control over food storage and energy consumption, the initial investment required can be a deterrent for middle and lower-income households. In regions where the majority of consumers are price-sensitive, the adoption of such products remains limited. Manufacturers often struggle to balance high-tech features with affordability. Additionally, ongoing innovation increases the production cost, which must either be absorbed by manufacturers or passed on to consumers. In emerging economies, despite rising aspirations, affordability remains a significant barrier to widespread smart appliance adoption. This cost sensitivity limits the penetration of premium refrigerators and forces companies to rely on standard models for volume sales.

Saturation in mature markets is restricting the market growth

Developed markets like North America, Europe, and parts of East Asia are nearing saturation in terms of fridge ownership, with most households already owning at least one refrigerator. This saturation slows down the rate of new product adoption, especially for basic or entry-level models. Growth in these regions is now mostly driven by replacement demand rather than new installations. As product lifespans extend due to better durability and technology, the replacement cycle has also lengthened slightly. In such mature markets, only a limited segment is actively upgrading to smart or high-capacity models. To stimulate growth, companies must focus on differentiation through innovation, design, or sustainability. However, given that consumer expectations are already high in these regions, meeting them requires substantial R&D investment. Thus, market saturation creates pricing pressures and narrows opportunities for volume expansion.

Market opportunities

The household fridge market is full of potential for players willing to innovate, diversify, and localize their offerings. One of the strongest opportunities lies in developing fridges tailored to regional needs and lifestyles. In many emerging economies, small- to mid-sized households are looking for energy-efficient fridges that offer core functionalities without unnecessary extras. Customizing features based on food habits, weather conditions, and space constraints can unlock significant market share. Modular fridges, for example, can allow customers to add or remove compartments based on their requirements. Another major opportunity lies in building ecosystems around smart fridges. Features like automatic grocery replenishment, recipe suggestions based on inventory, and food expiry tracking could turn fridges into central components of the connected kitchen. This not only drives hardware sales but also opens doors to subscription models and partnerships with grocery platforms. Sustainability offers another strong route for differentiation. As awareness of climate change increases, consumers are actively seeking products that align with environmental values. Fridges made from recycled materials, with low-impact refrigerants, and longer lifespans can stand out in a competitive market. Brands that integrate product take-back schemes or carbon-neutral manufacturing practices are likely to resonate well, especially in Europe and North America. Finally, the rise of e-commerce and digital retail platforms presents immense scope for reaching new customers. Offering customizable options, virtual showroom experiences, and simplified delivery/installation can transform the buying experience. Coupled with flexible financing, these strategies can make premium refrigerators more accessible to a broader audience. Over the next five years, brands that capitalize on these opportunities will emerge as clear market leaders.

HOUSEHOLD FRIDGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.7% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung, LG, Whirlpool, Haier, Electrolux, Panasonic, and Bosch. |

Household Fridge Market segmentation

Household Fridge Market Segmentation By Product:

• Single-door

• Double-door

• Side-by-side

• French door

• Mini/Compact fridges

• Built-in/integrated units

The double-door refrigerator segment holds the dominant position due to its balance between size, price, and functionality. These fridges typically offer separate freezer and refrigerator compartments, increased storage space, and advanced features like frost-free operation and adjustable shelves. They appeal to a wide demographic, including medium to large families, making them the most popular choice in both urban and suburban homes. As kitchen sizes vary globally, the adaptability of double-door fridges contributes significantly to their continued dominance in the market. (120 words)

Household Fridge Market Segmentation By Application:

• Residential

• Small-scale commercial (e.g., home-based food businesses, shared kitchens)

The residential segment clearly dominates the household fridge market. With the growing global population and increasing household formation, the demand for personal refrigeration units is consistently high. In residential settings, refrigerators are considered essential appliances, and consumer expectations continue to rise in terms of storage flexibility, energy consumption, and design. New home purchases, rental turnovers, and lifestyle upgrades fuel consistent demand. While commercial usage exists, it forms a very small portion of total sales, reinforcing residential use as the market's primary focus.

Household Fridge Market Regional Segmentation

• North America

• Europe

• Asia-Pacific

• South America

• Middle East and Africa

Asia-Pacific stands out as the dominant region in the household fridge market and is expected to maintain its lead through 2030. This dominance is fueled by several critical factors. Rapid urbanization across countries like China, India, Indonesia, and Vietnam is leading to an increasing number of households requiring essential appliances, with refrigerators being among the first purchases. The rise in disposable incomes allows consumers to upgrade from basic models to more advanced units with better energy efficiency and storage features. Governments across the region are also pushing for higher energy efficiency standards, which is accelerating the replacement of outdated units. Moreover, local manufacturing bases in Asia reduce production and distribution costs, making fridges more accessible to a broader population. The presence of both global and local manufacturers ensures a wide range of choices in terms of size, price, and functionality. Additionally, ongoing electrification in rural areas is opening up entirely new consumer bases for basic refrigeration units. Countries in this region are also witnessing the rise of aspirational middle classes that are interested in premium and smart appliances. The growth of e-commerce platforms and digital payment systems further simplifies the buying process, driving volumes. Taken together, these dynamics position Asia-Pacific as the key revenue and volume contributor in the global household fridge market.

COVID-19 Impact Analysis on the Household Fridge Market

The COVID-19 pandemic had a complex and lasting impact on the household fridge market. In the initial phase, supply chain disruptions caused temporary shortages of key components, leading to production slowdowns and increased prices. Logistics bottlenecks, container shortages, and lockdown restrictions made it difficult for manufacturers to meet rising demand. At the same time, consumer behavior began to shift dramatically. With lockdowns in place and people spending more time at home, food storage became a higher priority. Households began cooking more frequently, stocking up on perishables, and reducing their reliance on dining out. This led to a surge in demand for refrigerators across all segments. Consumers prioritized appliances that could help them manage groceries more efficiently and reduce trips to the store. Another notable trend was the acceleration of e-commerce. With physical retail stores closed or operating at reduced capacity, buyers turned to online platforms to purchase appliances, including refrigerators. Many brands adapted quickly by enhancing their digital presence and offering home delivery and installation services. The pandemic also shifted preferences toward hygiene-focused features, such as antibacterial interiors, touchless controls, and air purification systems within fridges. As a result, product innovation saw a spike, even amidst supply chain constraints. Governments in several regions introduced stimulus programs and incentives for purchasing energy-efficient appliances, which helped boost recovery in the latter half of 2021 and 2022. Overall, while the pandemic disrupted operations temporarily, it ultimately heightened the importance of home appliances and accelerated long-term consumer trends like online buying and interest in advanced features. The household fridge market emerged stronger, more digitalized, and more customer-centric in its aftermath.

Latest trends/Developments

The household fridge market is undergoing rapid transformation driven by evolving consumer preferences, technology integration, and sustainability concerns. New models now feature internal cameras, touchscreens, voice assistance, and inventory tracking that help users manage groceries, track expiration dates, and plan meals. These smart features are becoming standard in mid- to high-end models and are especially appealing to tech-savvy and health-conscious consumers. Energy efficiency is another major development area. Manufacturers are focusing on fridges with inverter compressors, multi-layer insulation, and low-emission refrigerants. There is also a growing shift toward appliances that can operate efficiently in power-constrained environments, especially in emerging markets. Sustainability doesn’t stop at energy usage; many companies are also incorporating recycled materials into the design and offering product take-back programs to minimize environmental impact. Design innovation is gaining momentum as well. Consumers now look for fridges that not only function well but also complement modern kitchen aesthetics. Matte finishes, customizable panels, modular units, and built-in configurations are rising in popularity. These aesthetic upgrades allow refrigerators to blend seamlessly with the home’s interior design. Another emerging trend is the miniaturization and specialization of refrigerators. As urban living spaces shrink, compact and specialized fridges for beverages, cosmetics, and frozen snacks are gaining traction. E-commerce continues to redefine the retail landscape, allowing brands to offer virtual demos, AR previews, and easy installation scheduling online. These trends point toward a future where household fridges are intelligent, sustainable, and tailored to individual lifestyles.

Key Players:

- Samsung

- LG Electronics

- Whirlpool Corporation

- Panasonic

- Haier

- Electrolux

- Bosch

- Midea

- Hisense

Chapter 1. Household Fridge Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. HOUSEHOLD FRIDGE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. HOUSEHOLD FRIDGE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. HOUSEHOLD FRIDGE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. HOUSEHOLD FRIDGE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. HOUSEHOLD FRIDGE MARKET – By Product

6.1 Introduction/Key Findings

6.2 Single-door

6.3 Double-door

6.4 Side-by-side

6.5 French door

6.6 Mini/Compact fridges

6.7 Built-in/integrated units

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. HOUSEHOLD FRIDGE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Small-scale commercial (e.g., home-based food businesses, shared kitchens)

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. HOUSEHOLD FRIDGE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. HOUSEHOLD FRIDGE MARKET – Company Profiles – (Overview, Product Type , Portfolio, Financials, Strategies & Developments)

9.1 Samsung

9.2 LG Electronics

9.3 Whirlpool Corporation

9.4 Panasonic

9.5 Haier

9.6 Electrolux

9.7 Bosch

9.8 Midea

9.9 Hisense

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 103.5 billion in 2024 and is projected to reach USD 124.12 billion by 2030.

Key drivers include smart technology adoption, rising urbanization, and a strong push for energy efficiency.

The market is segmented by product (e.g., single-door, double-door) and application (residential, commercial).

Asia-Pacific is the dominant region due to rapid urban growth and rising middle-class spending

Leading players include Samsung, LG, Whirlpool, Haier, Electrolux, Panasonic, and Bosch.