Global Hotel and Other Travel Accommodation Market Size (2024 – 2030)

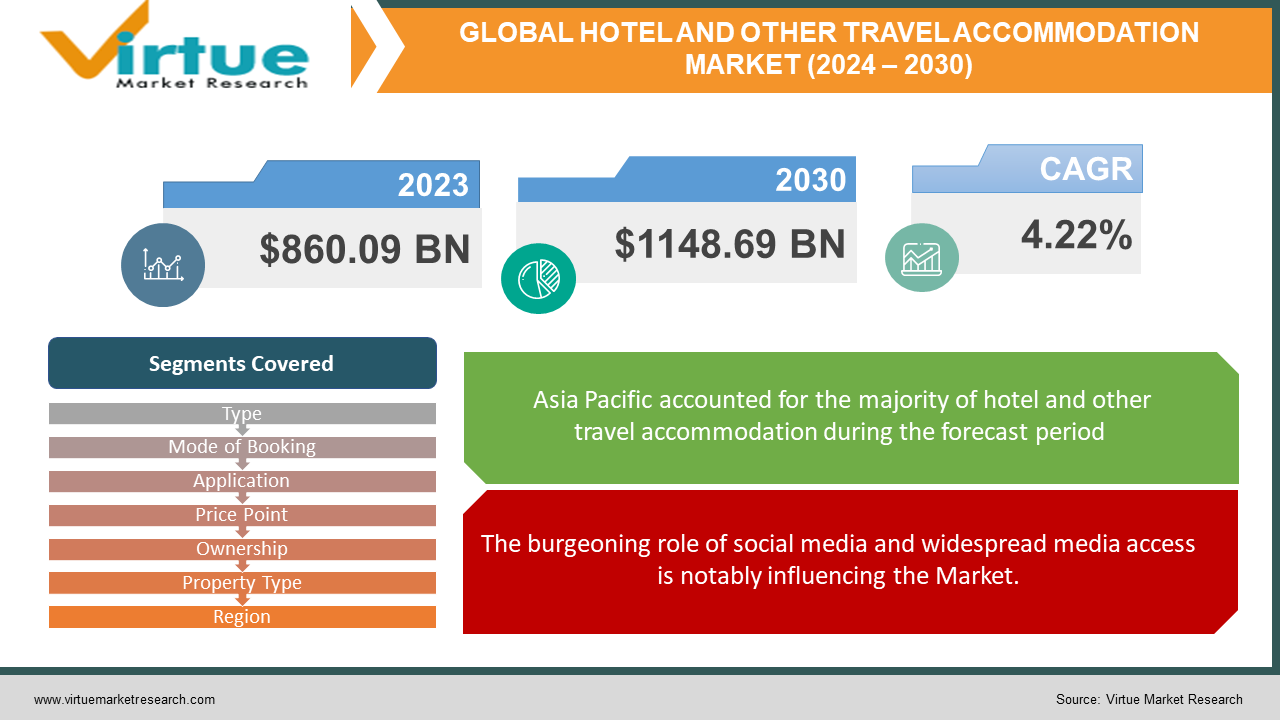

The Global Hotel and Other Travel Accommodation Market is expected to grow from USD 860.09 billion in 2023 to reach a valuation of USD 1148.69 billion by 2030 at a compound annual growth rate (CAGR) of 4.22% between 2024-2030.

The market for hotel and other travel accommodations encompasses the provision of short-term lodging services by various entities, such as organizations, sole proprietorships, or partnerships. It is divided into segments, including hotels and motels, hotels with a casino, guest rooms, and various other lodging options for travelers.

One contributing factor is that budget-friendly hotels exhibit greater adaptability to capitalize on demand segments that remain robust despite travel constraints, including truck drivers and guests with extended stays. Revenue across all hotels is contingent on factors such as the average daily rate, room count, occupancy rates, and, where applicable, food and beverage services. For proprietors contemplating closure, variable and semi-fixed costs become pivotal considerations, with fixed costs remaining constant regardless of circumstances. The prospect of a swifter recovery for budget hotels aligns with historical patterns observed during previous crises. Nonetheless, there may be pockets of resilience and recuperation within the market.

Key Market Insights:

In the expansive realm of the hospitality industry, the market for hotels and other travel accommodations represents a dynamic and varied sector, housing a multitude of enterprises catering to lodging and related services for tourists. This sector addresses the diverse demands of individuals, families, and business clients seeking short-term accommodations outside their primary residences.

Characterized by a diverse array of lodging options, including bed & breakfasts, hostels, resorts, motels, and vacation rentals, this market thrives on the fundamental human need for comfort and shelter during travel. The primary objective of these establishments is to offer guests a home-away-from-home experience, presenting a range of lodging choices that cater to different preferences, budget constraints, and vacation requirements.

Moreover, the digital landscape plays a pivotal role, as technology-driven solutions and online booking platforms significantly influence how customers discover, reserve, and enjoy lodging. Sustaining success in the hotel and other travel accommodation markets necessitates an embrace of innovations such as contactless check-ins, personalized services, and environmentally friendly practices, all while adapting to evolving customer habits and preferences. This industry essentially arises from the convergence of consumer preferences, travel, and hospitality, creating a dynamic ecosystem to meet the diverse demands of a mobile and global populace.

Global Hotel and Other Travel Accommodation Market Drivers:

The burgeoning role of social media and widespread media access is notably influencing the Market.

The trend of tourists sharing their journey experiences, images, and videos on social platforms is heightening global awareness about various tourist destinations and the leisure opportunities offered by countries worldwide. For example, a report by Kepios Pte. Ltd., a Singapore-based digital reference library, highlighted that social media users surged by 227 million over the last year, totaling 4.70 billion by early July 2022. This marks a year-over-year growth of over 5% in the global social media user base, now representing 59 percent of the global population. The world collectively spends upwards of 10 billion hours on social media daily, equivalent to about 1.2 million years of human time. Consequently, this rising engagement with social media and broader media access is fueling demand in the hotel and travel accommodation market.

The shift in consumer preferences towards bespoke and distinctive experiences is driving market growth.

There has been a notable transformation in consumer behavior, steering the Hotel and Other Travel Accommodation Market towards more unique and tailored experiences. Today's travelers increasingly prefer accommodations that resonate with their interests and styles. This trend has popularized boutique hotels, homestays, and vacation rentals, known for their unique ambiance and local character. These alternatives to conventional hotels appeal to travelers seeking authentic and immersive experiences. The rising demand for customized services, local gastronomy, and culturally rich environments has prompted accommodation providers to expand and diversify their offerings. Consequently, the market is experiencing the introduction of innovative lodging concepts that not only satisfy a range of preferences but also contribute significantly to the sector's growth and dynamic nature.

Global Hotel and Other Travel Accommodation Market Restraints and Challenges:

Constrained market expansion due to escalating inflation.

According to expert projections, the world is heading toward a period of recession and high inflation, anticipated to commence around May or June of 2023. This economic scenario could severely impede global market growth, as individuals may be disinclined to travel for leisure purposes to shield themselves from the impact of high inflation. As of 2022, the inflation rate in the United States reached its highest level since the 1980s. Multiple factors contribute to this surge, and the global market may witness substantial losses, particularly in underdeveloped economies already grappling with poverty and recurrent natural disasters. Currently, over 18 million people in South Africa are living in extreme financial poverty, with a daily threshold of approximately USD 2.

Emerging cyber-attacks as a significant challenge.

One of the primary challenges confronting players in the global hotel and other travel accommodation markets is the management of cyber and online attacks targeting the data stored on the servers of hotels and other lodging facilities. In September 2022, the management of the Intercontinental Hotels Group (IHG) reported that the company had recently fallen victim to a cyber-attack.

Global Hotel and Other Travel Accommodation Market Opportunities:

The growing impact of social media and increased media exposure is positively influencing the tourism and hospitality sectors. The trend of travelers posting their journey details, images, and videos on social platforms is heightening global awareness about diverse tourist destinations and leisure activities offered by countries across the globe. A study by We Swap found that 37% of millennials are influenced by content on social media, and 61% of travelers are eager to share their travel experiences online. Furthermore, social media plays a crucial role in enabling countries to promote tourism by showcasing their culture. This increased awareness is mirrored in the rising number of international travelers and is expected to propel growth in the hospitality and other tourist accommodation sectors in the forthcoming period.

GLOBAL HOTEL AND OTHER TRAVEL ACCOMMODATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.22% |

|

Segments Covered |

By Type, Mode of Booking, Application, Price Point, Ownership, Property Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Marriott International, Hilton Worldwide, AccorHotels, Wyndham Corporation, Hyatt Hotels Corporation, Four Seasons Hotels |

Global Hotel and Other Travel Accommodation Market Segmentation:

Global Hotel and Other Travel Accommodation Market Segmentation: By Type:

-

Hotel and Motel

-

Casino Hotels

-

Bed and Breakfast Accommodation

-

All Other Traveler Accommodation

The market for hotels and other travel accommodations is categorized by type into various segments, including hotels and motels, casino hotels, bed and breakfast establishments, and a range of other accommodations for travelers. In 2023, the hotels and motels segment represented the largest portion of this market, constituting 68.9% of the overall market share. Looking ahead, this segment is anticipated to experience the most rapid growth within the market. Specifically, the hotels and motels category is projected to expand at a Compound Annual Growth Rate (CAGR) of 13.6% from 2024 to 2030.

Global Hotel and Other Travel Accommodation Market Segmentation: By Mode of Booking:

-

Online Bookings

-

Direct Bookings

-

Other Modes of Booking

The market for hotels and other travel accommodations is divided based on the method of booking, encompassing online bookings, direct bookings, and other booking methods. In 2023, direct bookings dominated this market, representing 49.7% of the total market share. Looking ahead, the segment for online bookings is projected to witness the most rapid growth in the hotel and other travel accommodation markets. This segment is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 18.2% from 2024 to 2030.

Global Hotel and Other Travel Accommodation Market Segmentation: By Application:

-

Tourist Accommodation (Leisure)

-

Official Business (Professional)

The market for hotels and other travel accommodations is categorized by application, distinguishing between tourist accommodation (leisure) and official business (professional). In 2023, the official business (professional) segment constituted the largest share of the market, encompassing 64.1% of the total. Looking forward, the official business (professional) market is anticipated to experience the most rapid growth within the segmented applications of the hotel and other travel accommodation markets. Specifically, this segment is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.7% during the period from 2024 to 2030.

Global Hotel and Other Travel Accommodation Market Segmentation: By Price Point:

-

Economy

-

Mid-Range

-

Luxury

The market for hotels and other travel accommodations is categorized according to price points, which include economy, mid-range, and luxury segments. In 2023, the mid-range segment held the largest share of this market, accounting for 63.5% of the overall market. Moving forward, the luxury segment is projected to be the fastest-growing category within the hotel and other travel accommodation market segmented by price point. This segment is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 13.1% from 2024 to 2030.

Global Hotel and Other Travel Accommodation Market Segmentation: By Ownership

-

Chained

-

Standalone

The market for hotels and other travel accommodations is divided based on ownership into two segments: chained and standalone establishments. In 2023, standalone establishments represented the larger segment in this market, comprising 68.4% of the total market share. Looking ahead, the segment consisting of chained establishments is anticipated to be the most rapidly growing sector in the hotel and other travel accommodation market, segmented by ownership. This chained market segment is expected to expand at a Compound Annual Growth Rate (CAGR) of 14.5% from the year 2024 to 2030.

Global Hotel and Other Travel Accommodation Market Segmentation: By Property Type:

-

Hotels

-

Serviced Residences

-

Apartment Hotels

-

Co-Living

-

Other Property Types

The market for hotels and other travel accommodations is categorized by property type, including hotels, serviced residences, apartment hotels, co-living, and other property types. In 2023, the largest segment within this market was hotels, constituting 54.2% of the total market share. Looking ahead, the hotel segment is anticipated to be the fastest-growing category within the hotel and other travel accommodation market, segmented by property type. Specifically, this segment is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.0% from 2024 to 2030.

Global Hotel and Other Travel Accommodation Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, the Asia Pacific region held the dominant position in the global hotel and other travel accommodation market, contributing 35.8% to the overall market. This region was succeeded by North America and Western Europe, along with other regions worldwide. Looking ahead, Africa and South America are poised to become the most rapidly expanding markets in the hotel and travel accommodation sector. From 2024 to 2030, these regions are expected to experience growth at Compound Annual Growth Rates (CAGRs) of 20.1% and 16.0%, respectively.

COVID-19 Impact Analysis on the Global Hotel and Other Travel Accommodation Market:

The COVID-19 pandemic significantly impeded the hotel and other travel accommodation market in 2020. Worldwide government-imposed travel restrictions, both domestic and international, substantially reduced the demand for services provided by these sectors. Originating in Wuhan, Hubei province, China in 2019, COVID-19 rapidly spread to regions including Western Europe, North America, and Asia, presenting flu-like symptoms such as fever and cough. The consequential lockdowns led to economic downturns, affecting businesses well into 2021. Nonetheless, it is anticipated that the hotel and travel accommodation sectors will recuperate from this unforeseen downturn over the upcoming years, as the situation is considered a "black swan" event, not indicative of persistent or underlying market or economic flaws.

Recent Trends and Developments in the Hotel and Other Travel Accommodation Market:

- To enhance their sales, travel agencies and hotels are introducing innovative offerings. These include exclusive bubble vacations that assure personalized services from beginning to end and 72-hour flash sales providing complimentary nights and discounts of up to 40% on selected five-star hotels. With the approach of the holiday season, various chains and travel agents are implementing additional promotional strategies.

- As the travel industry undergoes recovery during the Christmas season post-pandemic, Leisure Hotels Group, a prominent chain of experimental resorts situated in scenic locations across North India and Goa, has unveiled The Hideaway Bedzzz in Rishikesh. This marks their inaugural property in the alternative accommodation segment.

Key Players:

-

Marriott International

-

Hilton Worldwide

-

AccorHotels

-

Wyndham Corporation

-

Hyatt Hotels Corporation

-

Four Seasons Hotels

- In August 2023, Hilton expanded its portfolio by signing agreements for two new properties under its flagship Hilton Hotels & Resorts and the lifestyle-oriented Canopy by Hilton brands: Hilton the Point Residences and Canopy by Hilton the Point.

- Furthermore, in August 2023, Accor declared plans to inaugurate 20 new hotels across India, signifying a substantial expansion in their presence within the market.

Chapter 1. Hotel and Other Travel Accommodation Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hotel and Other Travel Accommodation Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hotel and Other Travel Accommodation Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hotel and Other Travel Accommodation Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hotel and Other Travel Accommodation Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hotel and Other Travel Accommodation Market – By Type

6.1 Introduction/Key Findings

6.2 Hotel and Motel

6.3 Casino Hotels

6.4 Bed and Breakfast Accommodation

6.5 All Other Traveler Accommodation

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Hotel and Other Travel Accommodation Market – By Mode of Booking

7.1 Introduction/Key Findings

7.2 Online Bookings

7.3 Direct Bookings

7.4 Other Modes of Booking

7.5 Y-O-Y Growth trend Analysis By Mode of Booking

7.6 Absolute $ Opportunity Analysis By Mode of Booking, 2023-2030

Chapter 8. Hotel and Other Travel Accommodation Market – By Application

8.1 Introduction/Key Findings

8.2 Tourist Accommodation (Leisure)

8.3 Official Business (Professional)

8.4 Y-O-Y Growth trend Analysis By Application

8.5 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 9. Hotel and Other Travel Accommodation Market – By Price Point

9.1 Introduction/Key Findings

9.2 Economy

9.3 Mid-Range

9.4 Luxury

9.5 Y-O-Y Growth trend Analysis By Price Point

9.6 Absolute $ Opportunity Analysis By Price Point, 2023-2030

Chapter 10. Hotel and Other Travel Accommodation Market – By Ownership

10.1 Introduction/Key Findings

10.2 Chained

10.3 Standalone

10.4 Y-O-Y Growth trend Analysis Construction

10.5 Absolute $ Opportunity Analysis Construction, 2023-2030

Chapter 11. Hotel and Other Travel Accommodation Market – By Property Type

11.1 Introduction/Key Findings

11.2 Hotels

11.3 Serviced Residences

11.4 Apartment Hotels

11.5 Co-Living

11.6 Other Property Types

11.7 Y-O-Y Growth trend Analysis By Property Type

11.8 Absolute $ Opportunity Analysis By Property Type, 2023-2030

Chapter 12. Hotel and Other Travel Accommodation Market, By Geography – Market Size, Forecast, Trends & Insights

12.1 North America

12.1.1 By Country

12.1.1.1 U.S.A.

12.1.1.2 Canada

12.1.1.3 Mexico

12.1.2 By Mode of Booking

12.1.2.1 By Mode of Booking

12.1.3 By Application

12.1.4 By Ownership

12.1.5 Countries & Segments - Market Attractiveness Analysis

12.2 Europe

12.2.1 By Country

12.2.1.1 U.K

12.2.1.2 Germany

12.2.1.3 France

12.2.1.4 Italy

12.2.1.5 Spain

12.2.1.6 Rest of Europe

12.2.2 By Mode of Booking

12.2.3 By Mode of Booking

12.2.4 By Application

12.2.5 By Price Point

12.2.6 By Ownership

12.2.7 By Property Type

12.2.8 Countries & Segments - Market Attractiveness Analysis

12.3 Asia Pacific

12.3.1 By Country

12.3.1.1 China

12.3.1.2 Japan

12.3.1.3 South Korea

12.3.1.4 India

12.3.1.5 Australia & New Zealand

12.3.1.6 Rest of Asia-Pacific

12.3.2 By Mode of Booking

12.3.3 By Mode of Booking

12.3.4 By Application

12.3.5 By Price Point

12.3.6 By Ownership

12.3.7 By Property Type

12.3.8 Countries & Segments - Market Attractiveness Analysis

12.4 South America

12.4.1 By Country

12.4.1.1 Brazil

12.4.1.2 Argentina

12.4.1.3 Colombia

12.4.1.4 Chile

12.4.1.5 Rest of South America

12.4.2 By Mode of Booking

12.4.3 By Mode of Booking

12.4.4 By Application

12.4.5 By Price Point

12.4.6 By Ownership

12.4.7 By Property Type

12.4.8 Countries & Segments - Market Attractiveness Analysis

12.5 Middle East & Africa

12.5.1 By Country

12.5.1.1 United Arab Emirates (UAE)

12.5.1.2 Saudi Arabia

12.5.1.3 Qatar

12.5.1.4 Israel

12.5.1.5 South Africa

12.5.1.6 Nigeria

12.5.1.7 Kenya

12.5.1.8 Egypt

12.5.1.9 Rest of MEA

12.5.2 By Mode of Booking

12.5.3 By Mode of Booking

12.5.4 By Application

12.5.5 By Price Point

12.5.6 By Ownership

12.5.7 By Property Type

12.5.8 Countries & Segments - Market Attractiveness Analysis

Chapter 13. Hotel and Other Travel Accommodation Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

13.1 Marriott International

13.2 Hilton Worldwide

13.3 AccorHotels

13.4 Wyndham Corporation

13.5 Hyatt Hotels Corporation

13.6 Four Seasons Hotels

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hotel and Other Travel Accommodation Market size is valued at USD 860.09 billion in 2023.

The worldwide Global Hotel and Other Travel Accommodation Market growth is estimated to be 4.22% from 2024 to 2030.

The Global Hotel and Other Travel Accommodation Market is segmented By Type, By Mode of Booking, By Application, By Price Point, By Ownership, and By Property Type.

The Global Hotel and Other Travel Accommodation Market are positioned for transformational development, fueled by digital innovation, sustainable practices, personalised experiences, and wellness tourism. Opportunities include using technology for seamless service and capitalising on the growing desire for eco-friendly, health-focused retreats.

The COVID-19 epidemic devastated the Global Hotel and Other Travel Accommodation Market, producing widespread disruptions, closures, and decreased travel demand. Recovery measures will include improved hygiene protocols, digital transformation, and adjusting to changing traveller expectations for safety and flexibility.