Hot Mix Asphalt Additives Market Size (2024 – 2030)

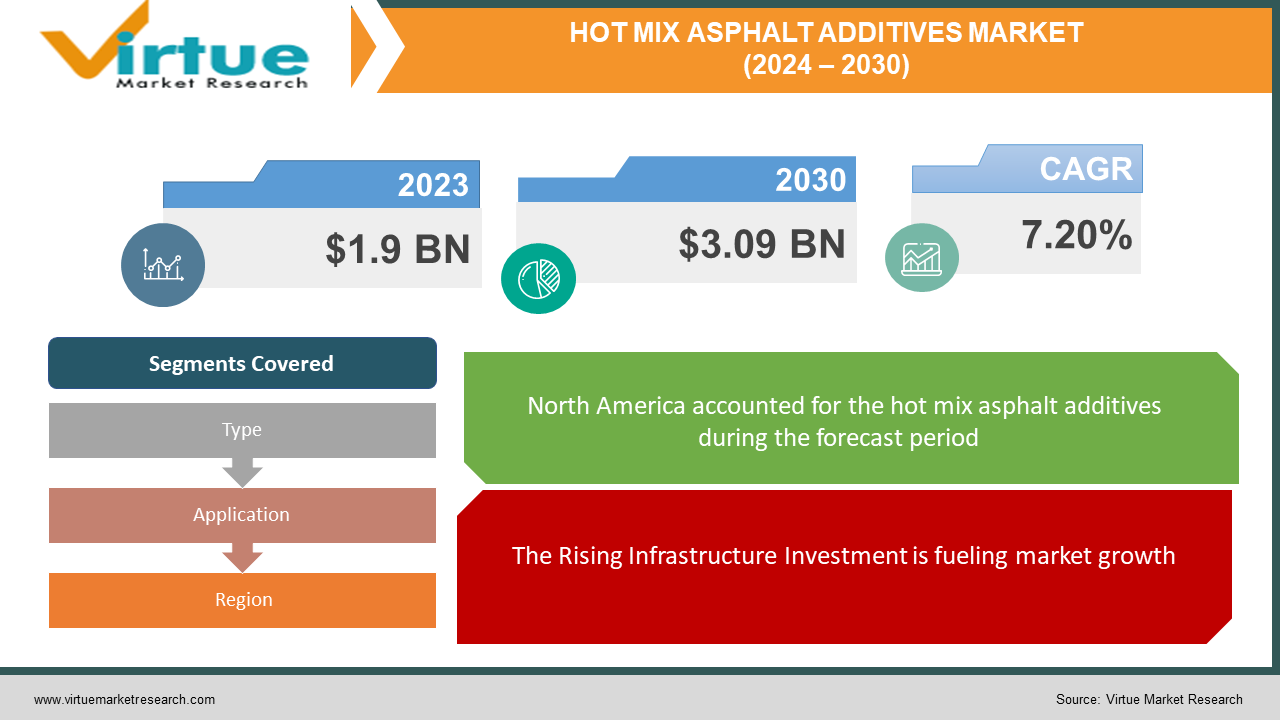

The Global Hot Mix Asphalt Additives Market was valued at USD 1.9 billion in 2023 and is projected to reach a market size of USD 3.09 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 7.20%.

Key Market Insights:

The Global Hot Mix Asphalt Additives Market is witnessing high growth. This growth is driven by factors like increasing investments in infrastructure projects, rising demand for durable and long-lasting pavements, and growing awareness of environmental sustainability.

The growing focus on sustainability is pushing manufacturers to develop eco-friendly and recyclable additives that minimize environmental impact throughout the asphalt life cycle.

Market Drivers:

The Rising Infrastructure Investment is fueling market growth.

Governments around the world are increasingly investing in infrastructure development, including road construction and maintenance. This surge in investment fuels the demand for durable and long-lasting pavements that hot mix asphalt (HMA) additives can help achieve growth.

Focus on Pavement Performance

Modern transportation systems require pavements that can withstand heavy traffic loads, and harsh weather conditions, and resist various types of damage like cracking and rutting. Hot Mix Asphalt additives enhance the properties of asphalt, leading to improved pavement performance, which translates to lower maintenance costs and longer lifespan.

Recyclability of Asphalt

Sustainability is becoming a crucial factor in the construction industry. HMA additives can enable the effective recycling of asphalt pavements, reducing the need for virgin materials and minimizing environmental impact. This aspect is particularly appealing as concerns about resource depletion and waste generation grow.

Market Restraints and Challenges:

Cost Considerations

While HMA additives offer numerous benefits, their higher initial cost compared to traditional asphalt can be a significant deterrent for some road construction projects, especially in budget-constrained situations. This can hinder wider adoption, particularly in developing economies with limited resources.

Standardization and Regulations

The lack of standardized testing methods and regulations for HMA additives can create uncertainty among end-users about their efficacy and performance. This can lead to hesitation in adopting new or unfamiliar additives, hindering market growth.

Counterfeit Additives and Quality Concerns

The presence of substandard and counterfeit HMA additives in the market can raise concerns about product quality and safety. This can damage the reputation of legitimate manufacturers and discourage potential users from adopting these additives, posing a challenge to market growth and consumer trust.

Market Opportunities:

Development of Eco-Friendly and Bio-Based Additives

The growing focus on sustainability presents a significant opportunity for the development of eco-friendly and bio-based HMA additives. These additives can be derived from renewable resources and offer similar performance benefits to traditional additives while minimizing environmental impact throughout the life cycle. This aligns with the increasing demand for sustainable construction practices and can attract environmentally conscious users.

Expansion into Emerging Markets

The HMA additives market holds considerable growth potential in emerging economies with rapid infrastructure development and growing road networks. These regions often lack established infrastructure, presenting an opportunity for cost-effective HMA solutions that balance performance and affordability. Manufacturers can focus on developing application-specific additives catering to the unique needs and challenges of these emerging markets.

HOT MIX ASPHALT ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.20% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nouryon, Dow, Arkema, Honeywell International Inc., Evonik Industries, Huntsman Corporation, Kraton Corporation, Ingevity Corporation, BASF SE, Sasol Limited |

Hot Mix Asphalt Additives Market Segmentation: By Type

-

Polymer Modifiers

-

Anti-Strip & Adhesion Promoters

-

Emulsifiers

-

Chemical Modifiers

-

Rejuvenators

-

Fibers

-

Flux Oil

-

Colored Asphalt

The hot mix asphalt additives market is segmented by type, catering to various functionalities that enhance asphalt performance and address specific needs. Among these, polymer modifiers currently dominate the market, accounting for the largest share of around 40-45%. These additives improve flexibility, fatigue resistance, and crack prevention.

Another crucial segment is anti-strip and adhesion promoters, holding a share of approximately 15-20%. They prevent moisture damage, a significant threat to pavement integrity. Additionally, emulsifiers (10-15%) facilitate the creation of asphalt emulsions used in various applications like waterproofing and seal coats. Other segments like chemical modifiers, rejuvenators, fibers, and flux oil cater to specific purposes such as asphalt modification, pavement rejuvenation, reinforcement, and viscosity adjustment, collectively contributing to the remaining market share. The market is expected to witness continued growth in the polymer modifiers and anti-strip & adhesion promoters segments due to their critical role in enhancing pavement performance and durability.

Hot Mix Asphalt Additives Market Segmentation: By Application

-

Road construction

-

Road Paving

-

Airport Runways

-

Parking Lots

-

Roofing

The hot mix asphalt (HMA) additives market is segmented by application, reflecting the diverse uses of asphalt in various infrastructure and construction projects. Road construction and paving account for the largest share of the market, at around 60-65%, driven by the extensive use of HMA in building and maintaining roads and highways. This segment benefits from the growing investments in infrastructure development globally.

Airport runways represent another significant application, holding a share of approximately 10-15%. HMA additives play a critical role in ensuring the safety and durability of airport pavements, which are subjected to heavy traffic loads and demanding performance requirements. Additionally, parking lots and roofing applications contribute a combined share of around 15-20%, highlighting the versatility of HMA in diverse construction projects.

The future growth of the HMA additives market by application is expected to be influenced by several factors. Increasing urbanization and expanding transportation networks are likely to drive demand for HMA in road construction and airport runway development. Furthermore, the growing focus on sustainable construction practices could lead to the increased use of recycled asphalt pavements in various applications, creating opportunities for specific HMA additives that enhance the performance of recycled materials.

Hot Mix Asphalt Additives Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

The hot mix asphalt (HMA) additives market is segmented by region, reflecting the diverse economic development, infrastructural needs, and regulatory landscapes across different parts of the world. Currently, Asia-Pacific dominates the market with a significant share of over 40% driven by factors like rapid urbanization, growing economies, and increasing government investments in infrastructure development, particularly in China and India.

North America and Europe follow closely, holding a combined share of around 30-35%. These regions have established infrastructure networks but require ongoing maintenance and upgrades, presenting a steady demand for HMA additives. However, stricter regulations and environmental considerations in these regions may influence the adoption of specific additives, favoring those with eco-friendly properties.

South America, the Middle East, and Africa collectively hold a smaller share of the market (around 20-25%). While these regions show potential for growth due to increasing infrastructure development, factors like limited financial resources, lack of established regulations, and political instability can pose challenges for market expansion. Additionally, the specific needs and priorities of these regions may necessitate tailored HMA additive solutions that cater to their unique climatic conditions and infrastructure challenges.

The future growth of the HMA additives market by region is expected to be influenced by various factors. Continued economic development and infrastructure investments in emerging economies like those in Asia are likely to drive market expansion. Additionally, growing awareness of sustainability and stricter environmental regulations may lead to a shift towards eco-friendly and recyclable HMA additives in all regions, shaping the future landscape of this market.

COVID-19 Impact Analysis on the Global Hot Mix Asphalt Additives Market:

The COVID-19 pandemic caused a temporary disruption to the hot mix asphalt additives market. Lockdowns and restrictions on movement hampered construction activities globally in 2020, leading to a decline in demand for HMA additives. This was due to several factors: -

Project Delays and Cancellations: Many infrastructure projects faced postponements or cancellations due to budget constraints and logistical challenges during the pandemic. This directly impacted the demand for construction materials, including asphalt and its additives.

Supply Chain Disruptions: Lockdowns and travel restrictions disrupted the global supply chain for raw materials and manufactured goods. This caused shortages and delays in the production and transportation of HMA additives, impacting project timelines and costs.

Labor Shortages: Social distancing measures and worker safety concerns limited the availability of labor for construction projects. This slowdown in construction activity further reduced the demand for HMA additives.

However, the impact of COVID-19 is considered temporary. As the global economy recovers and infrastructure projects resume, the demand for HMA additives is expected to rebound. Additionally, government stimulus packages and a renewed focus on infrastructure development in some regions could accelerate the market's recovery in the coming years

Latest Trends/Developments:

Focus on Sustainable and Bio-based Additives: As environmental concerns rise, the demand for eco-friendly and bio-based HMA additives is increasing. These additives are derived from renewable resources like recycled plastic, vegetable oils, and cellulose, offering similar performance benefits as traditional additives while minimizing environmental impact throughout the asphalt life cycle. This trend aligns with the growing focus on sustainable construction practices and attracts environmentally conscious users.

Growing Adoption of Warm Mix Asphalt (WMA) Technology: WMA technology allows for lower production temperatures compared to traditional HMA, resulting in reduced energy consumption, greenhouse gas emissions, and worker exposure to harmful fumes. This has led to an increasing demand for WMA-compatible additives, which are specially formulated to function effectively at lower temperatures. This trend is expected to have a significant impact on the HMA additives market, potentially shifting the market dynamics towards WMA-specific solutions.

Increased Focus on Performance and Durability: With growing traffic volumes and demands on infrastructure, there is a growing focus on enhancing the performance and durability of asphalt pavements. This trend is driving the development of advanced HMA additives that offer improved properties like better resistance to cracking, rutting, and fatigue. Additionally, additives that promote better bonding between asphalt and aggregate are gaining traction to ensure long-lasting pavement performance and minimize maintenance costs. These advancements cater to the evolving needs of the construction industry and are likely to shape the future of the HMA additives market.

Key Players:

-

Nouryon

-

Dow

-

Arkema

-

Honeywell International Inc.

-

Evonik Industries

-

Huntsman Corporation

-

Kraton Corporation

-

Ingevity Corporation

-

BASF SE

-

Sasol Limited

In April 2023, the Sasol Chemicals division of Sasol Ltd partnered with Mission Possible Partnership (MPP) to work on projects for Sasol’s sustainability hub located in Lake Charles Louisiana.

Chapter 1. Hot Mix Asphalt Additives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hot Mix Asphalt Additives Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hot Mix Asphalt Additives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hot Mix Asphalt Additives Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hot Mix Asphalt Additives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hot Mix Asphalt Additives Market – By Type

6.1 Introduction/Key Findings

6.2 Polymer Modifiers

6.3 Anti-Strip & Adhesion Promoters

6.4 Emulsifiers

6.5 Chemical Modifiers

6.6 Rejuvenators

6.7 Fibers

6.8 Flux Oil

6.9 Colored Asphalt

6.10 Y-O-Y Growth trend Analysis By Type

6.11 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Hot Mix Asphalt Additives Market – By Application

7.1 Introduction/Key Findings

7.2 Road construction

7.3 Road Paving

7.4 Airport Runways

7.5 Parking Lots

7.6 Roofing

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Hot Mix Asphalt Additives Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Hot Mix Asphalt Additives Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Nouryon

9.2 Dow

9.3 Arkema

9.4 Honeywell International Inc.

9.5 Evonik Industries

9.6 Huntsman Corporation

9.7 Kraton Corporation

9.8 Ingevity Corporation

9.9 BASF SE

9.10 Sasol Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hot Mix Asphalt Additives Market was valued at USD 1.9 billion in 2023 and is projected to reach a market size of USD 3.09 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 7.20%.

Key drivers include the Rising Infrastructure Investment, Focus on Pavement Performance, and Recyclability of Asphalt.

Road construction and paving companies, Airport construction and maintenance companies, Civil engineering firms, Roofing contractors, and Others are end users of the Global Hot Mix Asphalt Additives Market.

Asia-Pacific dominates the market with a significant share of over 40% driven by factors like rapid urbanization, growing economies, and increasing government investments in infrastructure development, particularly in China and India.

Nouryon, Dow, Arkema, Honeywell International Inc., Evonik Industries, and Huntsman Corporation are some leading players in the Global Hot Mix Asphalt Additives Market.