Hot Dog and Sausages Market Size (2025 – 2030)

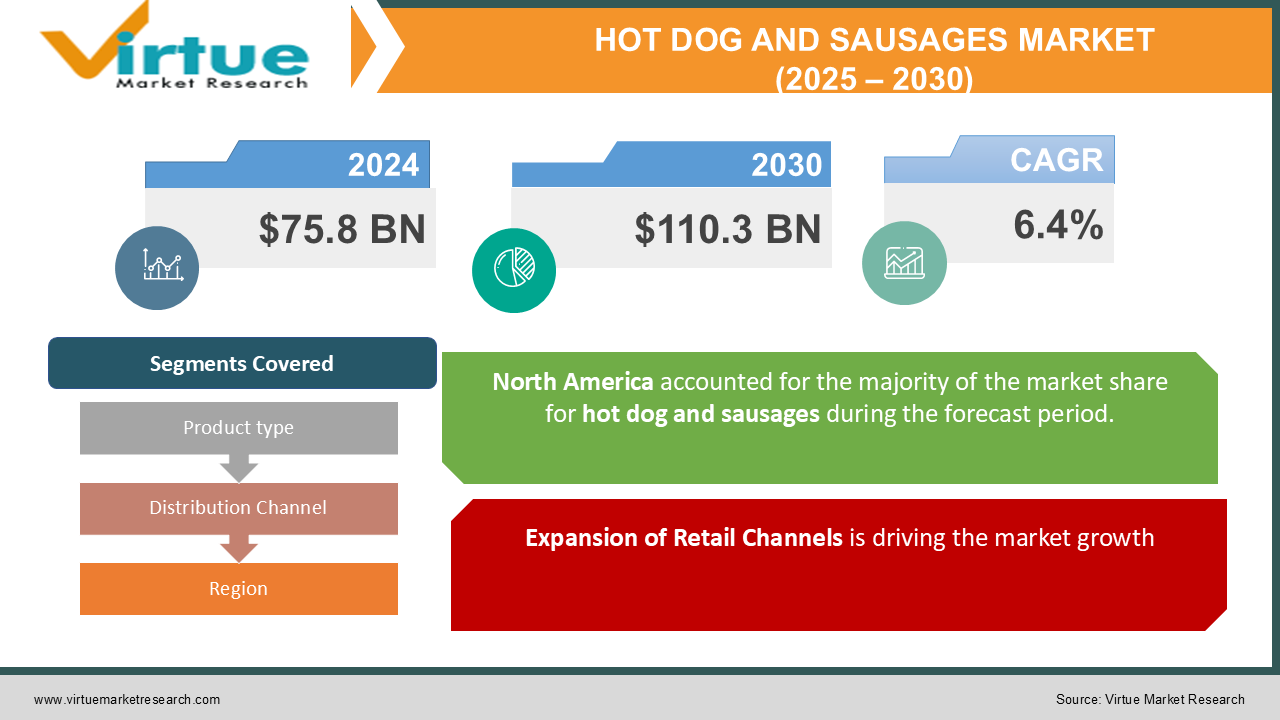

The Global Hot Dog and Sausages Market was valued at USD 75.8 billion in 2024 and is projected to reach approximately USD 110.3 billion by 2030, growing at a CAGR of 6.4% during the forecast period (2025–2030).

Hot dogs and sausages are popular processed meat products consumed globally due to their convenience, affordability, and taste. These products are integral to quick-service restaurants (QSRs), street food culture, and household meals, contributing significantly to their global demand.

Urbanization, lifestyle changes, and the rising popularity of ready-to-eat (RTE) and convenience foods are major growth drivers for the market. With increasing global populations and changing dietary preferences, the demand for a variety of hot dogs and sausages, including plant-based options, is surging. Technological advancements in meat processing and packaging are also enhancing the shelf-life and quality of these products, further driving market growth.

Key Market Insights

-

Pork-based sausages dominated the market in 2024, accounting for 40% of total revenue, followed by beef and chicken variants.

-

The supermarkets/hypermarkets segment held the largest distribution channel share at 45% in 2024, driven by accessibility and diverse product offerings.

-

Plant-based hot dogs and sausages are gaining significant traction, growing at a CAGR of 8.5%, reflecting the global shift towards sustainable and healthier food options.

-

Technological advancements in packaging, including vacuum-sealing and modified atmosphere packaging, are improving product shelf-life, ensuring consistent quality.

-

Consumers are increasingly opting for premium and gourmet sausage options, which feature unique flavors, organic ingredients, and artisanal preparations.

-

Rising health consciousness is driving demand for low-fat, low-sodium, and organic sausage varieties, encouraging manufacturers to innovate their product offerings.

Global Hot Dog and Sausages Market Drivers

Urbanization and Rising Demand for Convenience Foods is driving the market growth

The rapid urbanization across developed and developing regions has profoundly influenced consumer lifestyles and eating habits. With hectic schedules, consumers are gravitating towards convenient and ready-to-cook (RTC) food options, including hot dogs and sausages. These products require minimal preparation and can be consumed as standalone meals or snacks, making them ideal for urban consumers. Quick-service restaurants (QSRs) and street vendors have further popularized hot dogs and sausages as convenient and affordable fast-food options. For instance, in the United States, hot dogs remain a staple food at sporting events, while in Germany, sausages are an integral part of street food culture. This widespread acceptance underscores the significant role of convenience in driving the market.

Expansion of Retail Channels is driving the market growth

The global expansion of organized retail channels, including supermarkets, hypermarkets, and online platforms, has significantly enhanced product accessibility. Retailers offer a wide variety of hot dog and sausage products, catering to diverse consumer preferences, including traditional, premium, and plant-based options. Online platforms, in particular, are witnessing rapid growth, allowing consumers to browse and purchase their preferred products from the comfort of their homes. For example, e-commerce platforms like Amazon Fresh and Walmart are offering exclusive deals and home delivery services, contributing to the growing demand for these products.

Rising Popularity of Plant-Based and Healthier Alternatives is driving the market growth

As consumer preferences shift toward healthier and sustainable food options, the demand for plant-based hot dogs and sausages is rising. These products cater to vegetarians, vegans, and flexitarians, offering protein-rich alternatives that mimic the texture and flavor of traditional meat products. Major brands like Beyond Meat and Impossible Foods are expanding their plant-based sausage offerings, appealing to a broader audience. Additionally, health-conscious consumers are increasingly opting for low-fat, low-sodium, and organic sausages, encouraging manufacturers to innovate their product lines.

Global Hot Dog and Sausages Market Challenges and Restraints

Health Concerns Associated with Processed Meats is restricting the market growth

The consumption of processed meats, including hot dogs and sausages, has been linked to various health concerns such as obesity, cardiovascular diseases, and certain types of cancer. The presence of additives like nitrates and high sodium content in traditional sausages has drawn scrutiny from health organizations and regulatory bodies. Consumers are becoming more aware of the potential health risks associated with processed meats, leading to a gradual shift toward plant-based and organic alternatives. However, this poses a challenge for traditional hot dog and sausage manufacturers, who must reformulate their products to meet evolving consumer expectations without compromising on taste or quality.

Stringent Regulatory Environment is restricting the market growth

The hot dog and sausages market is subject to strict food safety and labeling regulations, which vary across regions. Regulatory bodies like the FDA in the United States and the European Food Safety Authority (EFSA) in Europe impose stringent guidelines on the use of additives, preservatives, and labeling claims for processed meat products. Compliance with these regulations requires significant investment in quality assurance and certification processes, which can increase production costs. Additionally, non-compliance risks product recalls, legal penalties, and reputational damage, posing a challenge for market players.

Market Opportunities

The global shift toward sustainability and health consciousness presents a significant opportunity for manufacturers in the hot dog and sausages market. Plant-based and organic alternatives are gaining traction, supported by advancements in food technology that improve their taste, texture, and nutritional profile. Companies investing in innovative formulations and sustainable packaging solutions can capture a larger share of this growing segment. Emerging markets in Asia-Pacific, Africa, and Latin America also offer lucrative opportunities, driven by rising disposable incomes, urbanization, and changing dietary patterns. As consumers in these regions embrace Western food culture, the demand for hot dogs and sausages is expected to surge. Additionally, the increasing popularity of gourmet and artisanal sausages, which feature unique flavors and premium ingredients, provides a pathway for manufacturers to target niche markets. Collaborations with retailers and foodservice providers can further enhance product visibility and consumer reach.

HOT DOG AND SAUSAGES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tyson Foods, Inc., WH Group Limited, Nestlé S.A., Hormel Foods Corporation, Beyond Meat, Johnsonville, LLC, Smithfield Foods, Inc., The Kraft Heinz Company, Danish Crown A/S, Maple Leaf Foods Inc. |

Hot Dog and Sausages Market Segmentation - By Product Type

-

Pork

-

Beef

-

Chicken

-

Others (Plant-Based, Turkey, Lamb)

Pork-based sausages hold a dominant position in the market due to their deep-rooted cultural significance and widespread popularity. 1 Across various cuisines, pork sausages have become a staple ingredient, celebrated for their versatility and robust flavor. 2 From traditional European dishes to Asian street food, pork sausages are a versatile and beloved food item. Their rich history, coupled with the availability and affordability of pork meat, has contributed to their widespread consumption. Whether enjoyed grilled, fried, or boiled, pork sausages offer a satisfying and flavorful experience, making them a perennial favorite among consumers worldwide.

Hot Dog and Sausages Market Segmentation - By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others (Specialty Stores, Foodservice)

The supermarkets/hypermarkets segment continues to dominate the retail landscape, driven by its strategic advantages. These large-format stores offer a comprehensive range of products, catering to diverse consumer needs and preferences. From fresh produce and groceries to household items and electronics, supermarkets provide a one-stop shopping experience, saving consumers time and effort. Additionally, these stores employ a variety of promotional activities, such as discounts, loyalty programs, and bundled offers, to attract customers and boost sales. These initiatives not only incentivize purchases but also foster customer loyalty and brand affinity. By effectively leveraging their scale, product diversity, and promotional strategies, supermarkets/hypermarkets remain a dominant force in the retail industry.

Hot Dog and Sausages Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America held the largest market share in 2024, driven by high per capita consumption of hot dogs and sausages in the United States and Canada. The region's well-established foodservice industry and widespread availability of premium and gourmet sausage varieties contribute to its market dominance. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, with countries like China, India, and Japan witnessing increasing demand for processed meat products. The growing adoption of Western food habits and rising disposable incomes are key factors driving regional growth

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the global hot dog and sausages market, with supply chain disruptions and lockdown restrictions affecting production and distribution. Foodservice channels, including QSRs and street vendors, experienced a sharp decline in demand due to reduced consumer mobility. However, retail sales of hot dogs and sausages witnessed a surge as consumers turned to convenience foods during lockdowns. Post-pandemic recovery has been robust, driven by the reopening of foodservice outlets and increased consumer spending on leisure activities. The demand for plant-based and premium sausage options has also gained momentum, reflecting changing consumer preferences in the wake of the pandemic.

Latest Trends/Developments

The plant-based food industry is experiencing a remarkable surge, driven by a growing consumer interest in health, sustainability, and ethical consumption. Companies are rapidly expanding their plant-based product lines, particularly in the realm of sausages and hot dogs, to cater to this burgeoning demand. Innovative flavor profiles and premium ingredients are being introduced to meet the expectations of discerning consumers who seek gourmet alternatives to traditional meat products. Simultaneously, the focus on sustainable packaging solutions is gaining momentum, as companies strive to minimize their environmental impact. E-commerce platforms are playing a pivotal role in this trend, offering convenient online shopping experiences and exclusive deals for plant-based hot dogs and sausages. Moreover, technological advancements in meat processing and packaging are significantly enhancing product quality and shelf life, ensuring consistent consumer satisfaction. This confluence of factors is propelling the plant-based meat industry to new heights, offering a diverse range of delicious, healthy, and environmentally friendly options for consumers worldwide.

Key Players

-

Tyson Foods, Inc.

-

WH Group Limited

-

Nestlé S.A.

-

Hormel Foods Corporation

-

Beyond Meat

-

Johnsonville, LLC

-

Smithfield Foods, Inc.

-

The Kraft Heinz Company

-

Danish Crown A/S

-

Maple Leaf Foods Inc.

Chapter 1. Hot Dog and Sausages Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hot Dog and Sausages Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hot Dog and Sausages Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hot Dog and Sausages Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hot Dog and Sausages Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hot Dog and Sausages Market – By Product

6.1 Introduction/Key Findings

6.2 Pork

6.3 Beef

6.4 Chicken

6.5 Others (Plant-Based, Turkey, Lamb)

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Hot Dog and Sausages Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Online Retail

7.5 Others (Specialty Stores, Foodservice)

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Hot Dog and Sausages Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Hot Dog and Sausages Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Tyson Foods, Inc.

9.2 WH Group Limited

9.3 Nestlé S.A.

9.4 Hormel Foods Corporation

9.5 Beyond Meat

9.6 Johnsonville, LLC

9.7 Smithfield Foods, Inc.

9.8 The Kraft Heinz Company

9.9 Danish Crown A/S

9.10 Maple Leaf Foods Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 75.8 billion in 2024 and is projected to reach USD 110.3 billion by 2030, growing at a CAGR of 6.4%.

Key drivers include urbanization, the expansion of retail channels, and the rising demand for plant-based and healthier alternatives.

Segments include Product Type (Pork, Beef, Chicken, Others) and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others).

North America leads the market, driven by high per capita consumption and a well-established foodservice industry.

Major players include Tyson Foods, Inc., WH Group Limited, Nestlé S.A., and Hormel Foods Corporation.