HOSTELS MARKET (2024 - 2030)

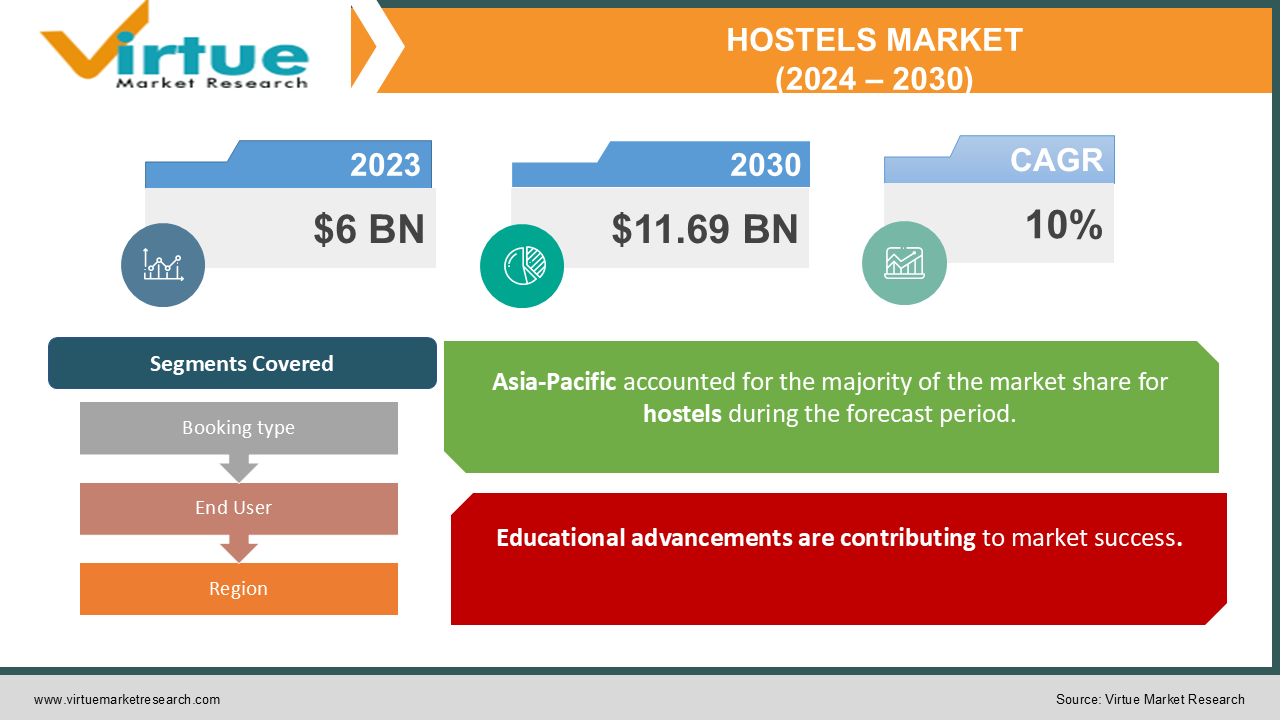

In 2023, the Global Hostels Market was valued at $6 billion, and is projected to reach a market size of $11.69 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 10%.

A hostel is a type of inexpensive inn that provides simple communal lodging. Hostels usually have a common kitchen, a big room with individual beds, and a shared bathroom. In the past, this was a niche market with limited revenue. Only a few people were able to use this privilege. However, at present, with economic developments, market expansion, tourism, and digital transformation, this market has seen good growth. In the future, with the growing population, demand, sustainability, and globalization, this market is anticipated to expand tremendously. During the forecast period, a considerable growth rate is expected.

Key Market Insights:

- According to the findings of a survey conducted throughout India, there were around 26,000 female hostels overall in the 2020–2021 academic year.

- Cloudbeds' PMS is the industry leader in hostel software, with a 41% market share.

- Of all the countries in the world, Iceland has the highest hostel density rate (1:8,500).

- Between 2010 and 2022, Italy had a steady rise in the number of youth hostels, accounting for a 55 percent increase. The total number of these institutions in the nation reached a peak of 707 in 2022, up from 699 the year before.

- Approximately 19.2% of hostels in 2020 won't have a website, making it one in five. To tackle this, organizations in this industry are working on creating an online presence through social media pages and websites. Since most of the hostels can secure their bookings and accommodations through virtual mode, this has become a top priority.

Hostels Market Drivers:

Educational advancements are contributing to market success.

Over the years, the educational sector has achieved significant milestones. There are many prestigious institutions across the world offering science, commerce, and humanity streams. Besides, certain courses and degrees are available at a few colleges and universities. These institutions receive funding from governmental institutions and alumni, due to which they are equipped with top facilities, which may include labs, libraries, sports, books, and many more. Moreover, they provide placement opportunities with good income and benefits. These factors make the campus an attractive choice, thereby facilitating the enrollment of students in various hostels to receive knowledge and excel in various fields.

An increasing desire for travel is fueling the growth.

In 2023, the travel and tourism industry is expected to generate US$854.70 billion in revenue, as per Statista. This industry has witnessed remarkable growth over the past decade. Governmental bodies have taken various measures by building architectural monuments, hotels, hostels, and other necessities. Besides, the travel and tourism industry helps in the generation of revenue for countries, thereby strengthening the economy. Hostels have become the go-to option for travelers. They are affordable and safe. A hygienic environment is maintained, along with internet connections and food. They are a convenient option for students as they are budget-friendly. Besides, content creation is one of the new careers in which people can monetize money by uploading content on social media platforms. Influencers endorse various hostels and companies because of which they have gained fame. Furthermore, solo travel is the new trend, aiding the market to garner more profits.

Hostels Market Restraints and Challenges:

Competition, prejudice, seasonal demand, and consistency are the main issues that the market is experiencing.

Hostels face heavy competition from other accommodations like Airbnb and tents. They are more cost-effective and are usually located amidst scenic views, making them an appealing option. Secondly, these lodging facilities are subject to many misconceptions. People often assume that the food quality is bad, the environment is unhygienic, and it is unsafe for tourists. This leads to hesitation and fear, causing losses for the market. Thirdly, these places may face seasonal demand. Certain regions are meant to be visited during a particular season to experience the joy. This can hinder growth, leading to a decline in certain months. Furthermore, student hostels must constantly ensure that safety is prioritized. Any negligence by the ward and the staff can cause damage and lead to negative reviews.

Hostels Market Opportunities:

Eco-friendly practices have been providing the market with an ample number of opportunities. There has been a rising awareness about protecting our environment and living a sustainable life. To promote this, hostels are coming up with innovative solutions. This includes options for vegan-based food, beds made out of recyclable materials, areas surrounded by trees and greenery, planting initiatives, etc. Secondly, to enhance the customer experience, hostels are hosting various activities. This includes the conduct of yoga sessions, sports clubs, painting classes, massages, and many more. Thirdly, the residence is ensuring that all areas have stable internet connectivity. People are being given the option to work from anywhere. Many of them prefer to work in regions surrounded by mountains and beaches. Furthermore, technological integration has been a boon. Smart solutions like card systems, mobile check-ins, and app ordering are being implemented.

HOSTELS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10 % |

|

Segments Covered |

By Booking type, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hostelling International (HI, Generator Hostels, Selina, Accor's Jo&Joe, YHA (Youth Hostel Association), Meininger Hotels, A&O Hotels and Hostels, Clink Hostels, Wombats Hostels, St Christopher's Inns |

Hostels Market Segmentation:

Market Segmentation: By Booking Type:

-

Online

-

Offline

Online booking is considered to be both the largest and fastest-growing booking type in the global hostel market. This is because customers can see the availability, price, discounts, and reviews. Additionally, some hostels provide a virtual home tour so that individuals can get a glimpse of the place, room, and other amenities. Besides, the pandemic has created a new norm of digitalization. This has made online transactions easier, faster, and more secure. During the forecast period, this segment is expected to show rapid growth. Offline booking is mainly used by travelers who plan spontaneous trips. Furthermore, it is used by people if there is an emergency.

Market Segmentation: By End User:

-

Students

-

Workers

-

Travelers

-

Others

Based on end users, travelers are the largest segment in the market in 2023. This segment includes backpackers, hikers, locals, foreigners, solo travelers, and other budget-friendly tourists. The growth of this category is due to an increase in travel, demand, and content creation. Hostels are cost-effective, making them a convenient option. Students who go on group trips often dwell in these accommodations for safety. Furthermore, technological advancements, innovations, and aesthetic views are contributing to the success. Students are one of the fastest-growing segments owing to educational advancements, safe facilities, an increase in the number, economic stability, rising income, and friendly staff. The worker segment is also growing rapidly owing to the increasing adoption of digital nomads. Besides, research and surveys show that people who work in nature tend to have a healthier life and less stress. During the forecast period, this segment is predicted to grow more.

Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest market based on region with a rough share of 35%. This is because of the huge population, demand, education, advancements, economic developments, demand, and presence of key companies. Additionally, many Southeast Asian countries are popular tourist hotspots. Due to their affordability, a greater number of tourists prefer staying at these places. Countries like Thailand, Vietnam, Australia, and Japan are the leaders. Europe is considered to be the second largest market owing to the rising popularity of travel and tourism. Countries like Spain, Italy, and France are the notable ones. North America is the fastest-growing region, with a share of around 25%. A lot of students are interested in pursuing their education at prestigious universities that are located in North America. This is the main reason for the flourishing of this category. Apart from this, the rising economic growth in many countries has made a few destinations in America popular tourist spots. The United States and Canada stand at the forefront.

COVID-19 Impact Analysis on the Global Hostels Market:

The outbreak of the virus hurt the market. Lockdowns, movement restrictions, and social isolation were the new norm. This led to disruptions in logistics. There were many cases and reports about the spreading of the virus amongst roommates, thereby causing a threat to the entire space since there were many common areas that were shared by individuals. People started to move back to their homes as soon as they were able to book trains, buses, and flights. The travel and tourism industry was shut down due to protocols and guidelines. This caused huge losses to the hostel market. As per Statista, as of May 2020, 46% of the US respondents said that they were comfortable staying in hostels after this point. Besides this, there were financial restraints, and people were losing their jobs. Due to this, they were not able to spend their money on stays and accommodations. Furthermore, many funds from the government were shifted towards healthcare applications. All these reasons took a toll on the market. However, post-pandemic, with the upliftment of lockdowns and the relaxation of guidelines, the market has slowly started to pick up. The emphasis on travel and education has been aiding progress.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing technologies while maintaining competitive pricing. This has further resulted in increased enlargement.

Pet-friendly hostels have been rising, which has led to market expansion. There has been a rise in the adoption of pets, especially dogs. Couples and other travelers prefer to travel with their pets. To keep up with this trend, companies in this market have been working on implementing pet food, pet-friendly practices, games, and activities.

Key Players:

- Hostelling International (HI)

- Generator Hostels

- Selina

- Accor's Jo&Joe

- YHA (Youth Hostel Association)

- Meininger Hotels

- A&O Hotels and Hostels

- Clink Hostels

- Wombats Hostels

- St Christopher's Inns

In September 2023, Feel At Home launched hostel services in Australia. The need for pre-assembled, customized housing has increased in tandem with the rise in student travel overseas. When they get to their destinations, they frequently have trouble finding lodging that is both reasonable and satisfactory. Feel At Home aims to close this gap by providing them with reasonably priced, hygienic, secure, and convenient lodging.

In August 2023, Banaras Hindu University's (BHU) Student Wellness Cell initiated an outreach project for dormitory counseling. Counseling sessions and workshops on a range of topics, such as mindfulness, managing exam stress, self-care, and mental health, would be held in hostels as part of the curriculum for hostel counseling.

In December 2020, a $50 million fundraising round was secured by the hospitality firm Selina for its hotels and hostels in Latin America. The Inter-American Development Bank Group's investment arm, IDB Invest, contributed $35 million to the financing round, while Blue Like, an Orange Sustainable Capital contributed $15 million. With this additional investment, Selina hopes to solidify its position in Panama and broaden its reach throughout the Caribbean and Latin America.

Chapter 1. GLOBAL HOSTELS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL HOSTELS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL HOSTELS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL HOSTELS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL HOSTELS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL HOSTELS MARKET – By Booking Type

6.1. Online

6.2. Offline

Chapter 7. GLOBAL HOSTELS MARKET – By End User

7.1.Students

7.2. Workers

7.3. Travelers

7.4. Others

Chapter 8. GLOBAL HOSTELS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Booking Type

8.1.3. By End User

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Booking Type

8.2.3. By End User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Booking Type

8.3.3. By End User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Booking Type

8.4.3. By End User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Booking Type

8.5.3. By End User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL HOSTELS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Hostelling International (HI)

9.2. Generator Hostels

9.3. Selina

9.4. Accor's Jo&Joe

9.5. YHA (Youth Hostel Association)

9.6. Meininger Hotels

9.7. A&O Hotels and Hostels

9.8. Clink Hostels

9.9. Wombats Hostels

9.10. St Christopher's Inns.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global Hostels Market was valued at $6 billion, and is projected to reach a market size of $11.69 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 10%.

Educational advancements and an increasing desire for travel are the main drivers propelling the Global Hostels Market.

Based on End Users, the Global Hostels Market is segmented into Students, Workers, Travelers, and Others.

Asia-Pacific is the most dominant region for the Global Hostels Market.

Hostelling International (HI), Generator Hostels, and Selina are the key players operating in the Global Hostels Market.