Hospital Decision Support Market Size (2023– 2030)

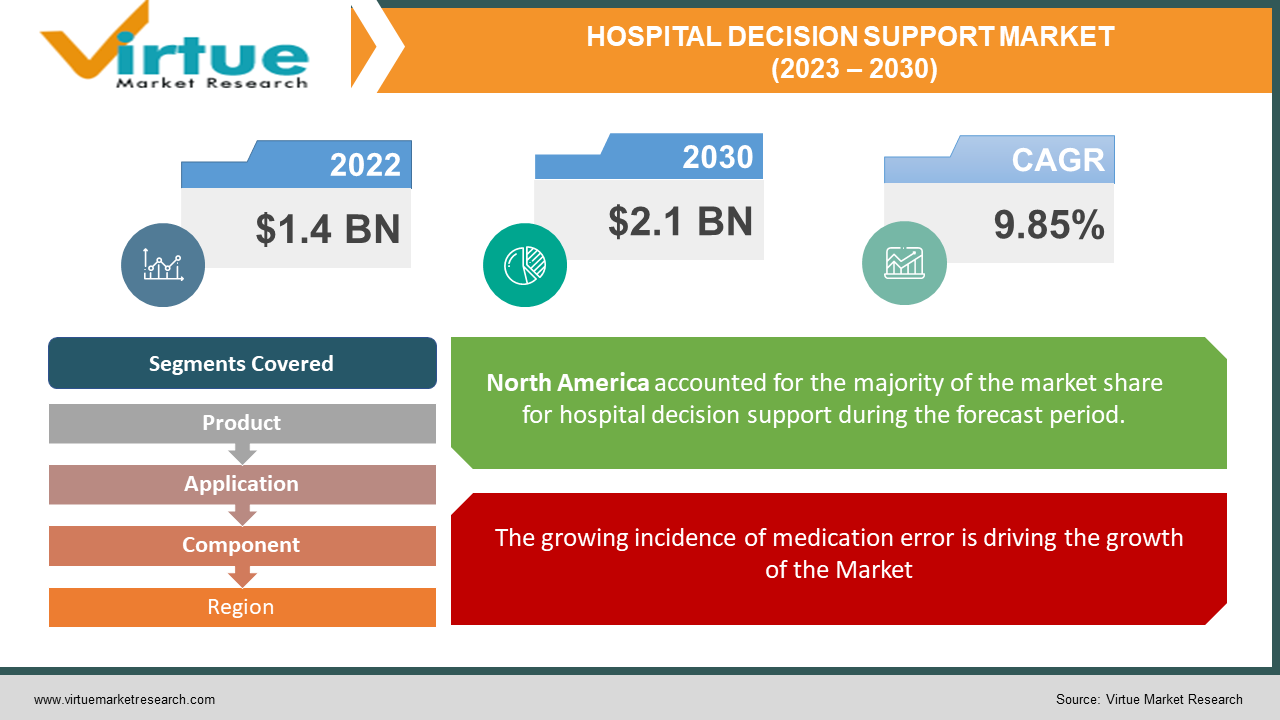

The global Hospital Decision Support Market size was USD 1.4 billion in 2022 and is estimated to grow to USD 2.1 billion by 2030. This market is witnessing a healthy CAGR of 9.85% from 2023 - 2030. The implementation of government regulations and initiatives to promote the adoption of HIT solutions, increasing adoption of CDSS-enabled EHRs, an increasing number of collaborations and partnerships between stakeholders, growing incidence of medication errors, and the rising prominence of mHealth and big data tools are majorly driving the growth of the industry.

Industry Overview:

Rapid advances in biotechnology and bioinformatics are driving the improvement and optimization of data storage, management, and analytics platforms. After an R & D project backed by the investment of a large company, the market is expected to experience a lot of innovation. Integrating cloud computing and interoperability platforms into different systems further facilitates smooth functionality and seamless data flow, accelerating the adoption of CDSS.

In recent years, the number of hospitals and medical facilities that have introduced various types and levels of clinical decision support systems has increased significantly, indicating that it is very likely that they will be introduced in the near future. In industrial areas, the demand for decision support based on facts and real-time knowledge is rapidly increasing. CDSS facilitates physical order entry by allowing physicians to select from a prescription database. As the number of patients visiting clinics and hospitals increases, it becomes more difficult to track and manage their data.

In recent years, the development of cooperation between CDSS providers and hospitals has experienced a significant rise. Government approvals and initiatives to facilitate the adoption of CDSS and EHR systems should further drive demand. Integration with Electronic Health Records (EHR) reduces the time it takes to retrieve a patient's medical history and clinical records, improving the efficiency of clinical care. In addition, the US Government's Health and Medicare Acts approve CDSS, and there is a financial reward for integrating CDS with EHR (Electronic Health Records). In 2013, about 41% of US hospitals with EHR also had CDSS, while in 2017 40.2% of US hospitals had state-of-the-art CDS capabilities. In addition, companies are involved in partnerships to develop and deliver software that is updated with the latest information.

Clinical decision-making is a complex task that requires a knowledgeable physician, a supportive environment, and reliable information. The challenges faced by healthcare organizations in making quality clinical decisions can be addressed by implementing CDSS as a support tool. The advent of CDSS is recognized as an important tool for overcoming the challenges of providing quality patient care by improving and streamlining the quality of health care.

COVID-19 impact on Hospital Decision Support Market

Due to the COVID19 outbreak, healthcare facilities of all sizes are under tremendous pressure, and healthcare facilities around the world have been overwhelmed by the sheer number of patients that come in daily. The emergence of this pandemic has led to a demand for precise diagnostic and therapeutic devices in several countries around the world. In this regard, clinical decision support systems have proven to be very useful, as they enable healthcare providers to monitor patients using connected devices. noninvasive digital connections, such as home blood pressure monitors and pulse oximeters. Furthermore, the rapid spread of the disease worldwide has resulted in a shortage of hospital beds and medical staff.

This has fueled the need for connected medical devices to monitor vital signs. The COVID19 pandemic has also increased the need for social distancing between doctors and patients, which has fueled the need for remote patient monitoring and telehealth solutions and the need to exchange Accurate and timely health records of patients. Various players in this marketplace have incorporated COVID19-related features into their existing EHRs, which are freely available to users.

Due to the growing number of patients, the need for EMR and EHR platforms to manage complex patient data has increased. As a result, hospitals are increasingly focusing on enhancing their capacity by integrating disparate hospital systems with EHRs.

MARKET DRIVERS:

The growing incidence of medication error is driving the growth of the Market

Dosing mistakes are unintended errors in the drug treatment process that can affect the health of the patient. Misprescribing, dispensing, storage, preparation, and administration of medicines are the most common preventable causes of adverse events and are a major public health burden. Proper care is guaranteed if patients and healthcare providers have access to complete and accurate EHR. Includes a comprehensive medical history of the patient. Such records can improve diagnosis, avoid errors, save time, and even reduce patient wait times. Successful implementation and use of CDSS and its complementary systems to achieve quality care is essential for hospitals and physicians and is accelerating adoption worldwide.

MARKET RESTRAINTS:

Data security concerns related to a cloud-based system is Restraining the Growth of the Market

The main concern with cloud-based CDSS is that provider-hosted data is not as secure as on-premises data. Patient information is considered sensitive and must maintain a high level of privacy so that only authorized users can access this information. Patient information was scrutinized by the legal framework in all countries. B. Data protection requirements are legally regulated by HIPAA (Health Insurance Portability and Accountability Act). Similarly, the European Union has introduced the EU General Data Protection Regulation, which affects the protection of sensitive health information. In many countries, patient-protected health information (PHI) cannot be transferred from the country of origin. Public clouds are not recommended as they face the same security issues as traditional IT systems. Private clouds offer more access protocols and systems, but the medical industry is not convinced of their effectiveness.

HOSPITAL DECISION SUPPORT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.85% |

|

Segments Covered |

By Product, Application, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

McKesson Corporation, Cerner Corporation, Siemens Healthinners GmbH, Allscripts Healthcare, LLC, Athenahealth, Inc., Nextgen Healthcare, IBM corporation, AGFA-Gavaert Group, and Wolters Kluwer N.V and others are playing a pivotal role in the market. |

This research report on the Hospital Decision Support Market has been segmented and sub-segmented based on Product, Application, Component, and region.

Hospital Decision Support Market - By Product:

- Standalone CDSS

- Integrated CPOE with CDSS

- Integrated E.H.R. with CDSS

- Integrated CDSS with CPOE & E.H.R.

Based on the Product, Stand-alone CDSS was widely adopted because of its low cost and simplicity, so it accounted for the largest revenue share in 2021 and exceeded 30.0%. Ease of use in hospitals and clinical settings contributes to its growth. The standalone segment will continue to dominate the market during the forecast period. CDSS products can be used standalone, or integrated with EHR and/or CPOE.

EHRs integrated with the CDSS segment are expected to witness favorable growth over the forecast period. Increasing awareness and acceptance of EHR by multiple specialized healthcare institutions will impact the growth of EHR integrated with the CDSS segment. When integrated with EHR, the CDS system provides the patient database and history to CDSS. This automates clinical workflows by providing clinical solutions and suggesting medications to doctors. CDSS and EHR are often integrated to streamline workflows and leverage existing datasets. An increasing number of CDSS features integrated with EHR systems are expected to support segment growth.

Hospital Decision Support Market - By Application:

- Drug-drug Interactions

- Drug Allergy Alerts

- Clinical Reminders

- Clinical Guidelines

- Drug Dosing Support

- Others

Based on application, the teleradiology segment is dominating the market due to the increasing number of patients with cardiovascular problems. The rise in the e-visits number due to this infection is also greatly influencing the demand of the market.

Tele-cardiology and telepathology segments have a prominent growth rate with the rise in smartphone users and the growing demand for the internet of things across the world.

Others like teledermatology, teleneurology, emergency care, and home health care perform well during the forecast period. Allergy warnings had the largest share of sales in 2021 with over 25.0%. Some people are allergic to certain medicines, so it is important to have a system that provides allergy warnings. The burden of allergies, or drug allergies, is increasing. When prescribing, dispensing, or administering a drug, medical malpractice can occur and cause side effects such as: For example, a drug can be given to a patient who has a recorded allergy to the drug.

The clinical guidelines segment is expected to witness favorable growth during the forecast period. The CDS system provides treatment and diagnostic guidelines. It takes data from the knowledge base and uses it in treatment to provide physicians with clinical guidelines to follow during the course of treatment and improve the quality of treatment.

Hospital Decision Support Market - By Component:

- Hardware

- Software

- Services

Based on delivery modes, The service sector had the largest share of sales in 2021 with more than 40.0%. This is due to the timely software updates and the available knowledge base. CDSS services include maintenance of components and their accessories. Includes hardware and software upgrades to provide a knowledge base for the latest innovations and current dosing.

The software segment is expected to witness favorable growth during the forecast period. CDSS software, when used in conjunction with CPOE and EHR software, improves decision support by producing specific patient-tuned results. New innovations for technical support and software interoperability are expected to drive the market during the forecast period.

Hospital Decision Support Market - By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East

- Africa

Geographically, North America dominated the global CDSS market in 2021 with a revenue share of over 45.0%. This is due to the growing demand for healthcare IT solutions in the medical field. Rapid technological advances and the growing importance of providing quality healthcare services are further contributing to the market growth in the region.

The Asia Pacific region is projected to be the fastest-growing regional market during the forecast period. This is due to increased investment in the medical sector in countries such as Australia, China, India, and Japan. The Asia-Pacific market shows high potential as R & D spending by governments of major economies is increasing to increase the penetration of information technology in the medical field. In addition, the growing elderly population may serve as a key driver of the Asia-Pacific market.

Hospital Decision Support Market Share by company

Companies like

- McKesson Corporation

- Cerner Corporation

- Siemens Healthinners GmbH

- Allscripts Healthcare, LLC

- Athenahealth, Inc.,

- Nextgen Healthcare

- IBM corporation

- AGFA-Gavaert Group

- Wolters Kluwer N.V

And others are playing a pivotal role in the market.

Recently The market is characterized by the presence of the most prominent participants along with other clinical decision support system vendors. These players are involved in new product launches, product innovations, acquisitions, and partnerships to provide a mutual competitive advantage.

For example, Change Healthcare announced InterQual 2021, the latest version of its flagship CDS solution. This release includes four innovative Medicare criteria and a number of evidence-based content updates and improvements, including new guidance for COVID19 patients, social health determinants of health, and proper use of telemedicine. It has been.

In addition, DH India announced a partnership with EHRC @ IIITB & HealtheLife to develop a CDSS for screening COVID 19. The partnership also included setting up a minimal triage application for frontline physicians.

Suppliers invest in research and development to develop technologically advanced systems that give them a competitive advantage over other providers and provide an economic benefit to the industry. The industry is expected to see several mergers and acquisitions over the next few years. Companies are taking proactive steps to gain market share and provide a diversified product portfolio.

NOTABLE HAPPENINGS IN THE HOSPITAL DECISION SUPPORT MARKET IN THE RECENT PAST:

Product Launch - In April 2020 Epic and OCHIN launched the COVID-19 Preparedness Screening app, which helped improve interoperability, care coordination, and overall clinical readiness in the state of Washington, US.

Collaboration - In April 2020, DHIndia announced a partnership with EHRC@IIITB & HealtheLife to develop a CDSS for the screening of COVID-19. The partnership also included the formation of a minimal triage application for front-line doctors.

Chapter 1.Hospital Decision Support Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Hospital Decision Support Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Hospital Decision Support Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Hospital Decision Support Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.Hospital Decision Support Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Hospital Decision Support Market – By Product

6.1. Standalone CDSS

6.2. Integrated CPOE with CDSS

6.3. Integrated E.H.R. with CDSS

6.4. Integrated CDSS with CPOE & E.H.R.

Chapter 7.Hospital Decision Support Market – By Component

7.1. Hardware

7.2. Software

7.3. Services

Chapter 8.Hospital Decision Support Market – By Application

8.1. Hardware

8.2. Software

8.3. Services

Chapter 9. Automotive Miniweb Radar Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.Hospital Decision Support Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. McKesson Corporation

10.2. Cerner Corporation

10.3. Siemens Healthinners GmbH

10.4. Allscripts Healthcare, LLC

10.5. Athenahealth, Inc.,

10.6. Nextgen Healthcare

10.7. IBM corporation

10.8. AGFA-Gavaert Group

10.9. Wolters Kluwer N.V

Download Sample

Choose License Type

2500

4250

5250

6900