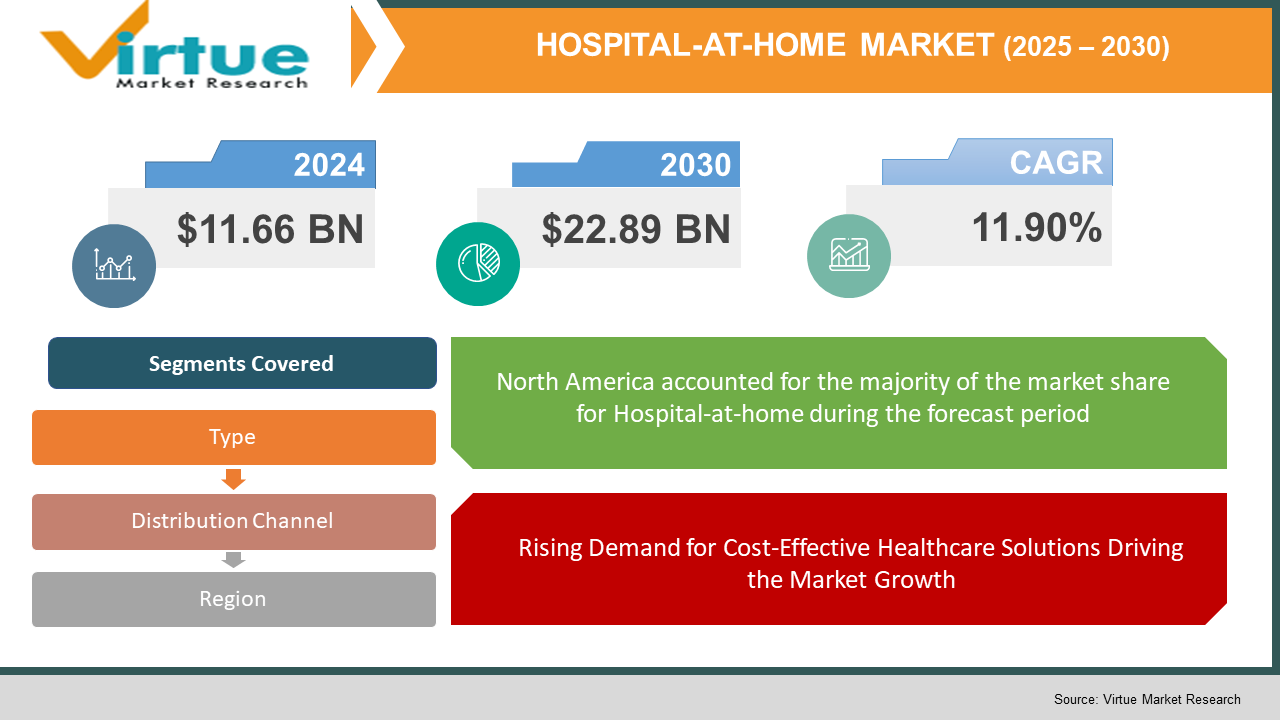

Hospital-at-home Market Size (2025-2030)

The Hospital-at-home Market was valued at USD 11.66 Billion in 2024 and is projected to reach a market size of USD 22.89 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.90%.

The hospital-at-home market represents a transformative shift in the healthcare landscape, blending traditional clinical care with innovative home-based solutions. This approach enables patients to receive hospital-level care within the comfort of their homes, leveraging advanced technology, medical equipment, and professional expertise to ensure outcomes comparable to in-hospital treatment. The increasing demand for personalized healthcare, cost efficiency, and improved patient experiences has propelled this market into the spotlight, redefining how acute and chronic conditions are managed globally.

Key Market Insights:

- Over 4.8 million patients globally were treated under hospital-at-home programs in 2023. The average cost reduction per patient treated at home compared to traditional hospital care was 30%.

- Approximately 65% of hospital-at-home users reported higher satisfaction than in-hospital care. Over 70% of healthcare systems globally incorporated telemedicine into hospital-at-home services. Remote monitoring devices used in hospital-at-home programs saw a 45% increase in adoption.

- Around 25% of post-operative recovery cases were managed through hospital-at-home services.

- Wearable technology contributed to 18% of patient monitoring in hospital-at-home care.

- Hospital-at-home services reduced readmission rates by 20% for chronic disease patients. Hospital-acquired infection rates dropped by 10% in regions utilizing hospital-at-home care.

- Over $15 billion was saved globally in healthcare costs through hospital-at-home initiatives.

Market Drivers:

Rising Demand for Cost-Effective Healthcare Solutions Driving the Market Growth

The growing emphasis on cost containment in healthcare is a significant driver of the hospital-at-home market. Traditional hospital care, with its associated overheads like infrastructure, staffing, and inpatient services, can be prohibitively expensive. In contrast, hospital-at-home programs provide comparable quality of care at a fraction of the cost. By shifting care delivery to patients' homes, these programs eliminate expenses tied to hospital facilities while improving patient outcomes and satisfaction. The alignment of hospital-at-home solutions with value-based care initiatives has further accelerated adoption, with governments and insurers actively promoting this model as a viable alternative to traditional inpatient care.

Technological Advancements in Remote Healthcare Feuling the Market Growth

Technological innovations have been pivotal in transforming the hospital-at-home concept into a practical and scalable healthcare solution. Remote monitoring devices, wearable health trackers, and telemedicine platforms enable real-time communication and data exchange between patients and healthcare providers. Artificial intelligence and predictive analytics tools are enhancing diagnostic accuracy and enabling early detection of potential complications, ensuring timely interventions. These advancements not only improve the quality of care but also foster patient trust in hospital-at-home programs. As technology continues to evolve, the hospital-at-home model is becoming increasingly robust, versatile, and widely accepted.

Market Restraints and Challenges:

Despite its transformative potential, the hospital-at-home market is not without its limitations and challenges. One of the most pressing concerns is the infrastructure required to implement these programs effectively. Establishing a reliable network of remote monitoring tools, medical devices, and telemedicine platforms demands significant investment, which may be a barrier for smaller healthcare providers. Additionally, ensuring uninterrupted connectivity in rural or underdeveloped regions presents logistical hurdles, potentially leaving underserved populations unable to benefit from hospital-at-home programs. Regulatory hurdles also pose significant challenges. Variations in policies and standards across regions complicate the establishment of uniform practices for hospital-at-home care. Licensing and credentialing of healthcare professionals, data privacy regulations, and requirements for home care environments are often cumbersome and inconsistent. Such complexities can deter healthcare providers from adopting these models on a large scale. Another challenge is the reluctance of patients and families to embrace home-based care, often stemming from misconceptions about its efficacy compared to traditional hospital settings. Overcoming this skepticism requires robust education campaigns and demonstrable success stories, which may take time to achieve. Additionally, training healthcare professionals to adapt to the nuances of home-based care delivery remains an ongoing challenge. Workforce limitations also contribute to the market's challenges. A shortage of skilled healthcare workers trained to deliver hospital-level care at home can lead to inefficiencies and compromise patient outcomes. Ensuring that the workforce is adequately prepared for this shift in care delivery necessitates comprehensive training programs and ongoing professional development initiatives. Finally, reimbursement policies for hospital-at-home programs remain inconsistent. While some insurance providers are beginning to recognize the cost-effectiveness of home-based care, others remain reluctant to include these services under their coverage. This lack of uniformity in reimbursement frameworks limits the scalability and accessibility of hospital-at-home programs, particularly in regions with stringent healthcare payment systems.

Market Opportunities:

The hospital-at-home market presents a wealth of opportunities driven by shifts in healthcare delivery paradigms and technological advancements. The increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions underscores the need for more personalized and continuous care models. Hospital-at-home programs offer a unique opportunity to address this need by enabling patients to receive treatment in familiar, comfortable settings, fostering improved compliance and better outcomes. Advancements in artificial intelligence and predictive analytics are unlocking new opportunities for early diagnosis and personalized treatment plans in hospital-at-home programs. AI-powered tools can analyze vast amounts of patient data to identify patterns and predict complications before they occur. These insights allow healthcare providers to intervene proactively, reducing hospital readmissions and improving the overall effectiveness of care. Expanding partnerships between technology providers and healthcare organizations also represent a significant growth avenue. Collaboration in developing and deploying state-of-the-art remote monitoring devices, telemedicine platforms, and digital health ecosystems can drive the adoption of hospital-at-home solutions. The integration of Internet of Things (IoT) devices into these programs is another promising area, enabling seamless connectivity and real-time data sharing between patients and care teams. The growing trend toward value-based care models presents an opportunity for hospital-at-home programs to align with payer and provider goals. These models focus on delivering quality outcomes at reduced costs, and hospital-at-home initiatives naturally complement this approach. By demonstrating their ability to improve patient satisfaction, reduce healthcare costs, and deliver superior clinical outcomes, hospital-at-home programs can secure increased support from governments, insurers, and private stakeholders. Lastly, demographic changes, including aging populations in many regions, are creating a surge in demand for home-based healthcare solutions. Elderly patients often require long-term management of multiple conditions, making hospital-at-home programs an ideal solution. By addressing the specific needs of this demographic, providers can capitalize on a growing segment of the market while alleviating pressure on traditional healthcare facilities.

HOSPITAL-AT-HOME MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.90% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medically Home, Dispatch Health, Contessa Health, HealthCall, Landmark Health, Phillips Healthcare, Biofourmis, Current Health, Vital Connect, Bayada Home Health Care |

Hospital-at-home Market Segmentation:

Hospital-at-home Segmentation by Type:

- Acute Care Services

- Post-Surgical Care Services

- Chronic Disease Management Services

- Palliative Care Services

- Rehabilitation Services

With the increasing global prevalence of chronic conditions such as diabetes, heart disease, and respiratory disorders, chronic disease management services are experiencing rapid growth. Hospital-at-home programs specializing in managing chronic illnesses offer patients continuous care while reducing healthcare costs, making them a preferred choice for both patients and providers.

Acute care services dominate the market due to the wide range of medical conditions that can be effectively treated at home. Patients benefit from advanced monitoring technologies and tailored care plans that ensure optimal recovery outcomes while avoiding hospital stays.

Hospital-at-home Segmentation by Distribution Channel:

- Direct Service Providers

- Third-Party Service Providers

Third-party providers are gaining traction as they offer specialized expertise and resources for setting up and managing hospital-at-home programs. Partnerships with healthcare systems allow these providers to streamline operations and scale services efficiently.

Direct service providers, such as hospitals and healthcare systems, remain the dominant channel due to their established trust with patients and the ability to seamlessly integrate hospital-at-home programs into existing care models.

Hospital-at-home Segmentation by Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

North America leads the market due to well-established healthcare infrastructure, early adoption of advanced technologies, and supportive reimbursement frameworks. The region’s strong focus on value-based care further bolsters its dominance.

Asia Pacific is witnessing rapid growth, driven by rising healthcare demands in emerging economies, increasing prevalence of chronic diseases, and the growing adoption of digital health technologies.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly accelerated the adoption of hospital-at-home programs, highlighting the importance of decentralized healthcare delivery models. As hospitals faced overwhelming patient volumes, home-based care emerged as a practical solution to alleviate strain on traditional facilities. Additionally, the need to minimize exposure to the virus for vulnerable populations reinforced the value of hospital-at-home programs. Telemedicine platforms, remote monitoring tools, and wearable devices saw unprecedented adoption during this period, laying a robust foundation for the future growth of this market.

Latest Trends and Developments:

The hospital-at-home market is experiencing rapid evolution fueled by cutting-edge technologies and innovative care models. Integration of IoT devices into home-based care systems allows for real-time monitoring of patient health, providing clinicians with actionable data. AI-driven predictive analytics further enhance patient care by enabling early detection of potential complications. Telemedicine platforms are becoming more sophisticated, offering seamless virtual consultations, diagnostics, and treatment adjustments. The rise of personalized care plans tailored to individual patient needs is also gaining traction, supported by wearable technology that provides continuous health insights. As partnerships between healthcare providers and technology companies deepen, the market is poised for sustained innovation and growth.

Key Players in the Market:

- Medically Home

- Dispatch Health

- Contessa Health

- HealthCall

- Landmark Health

- Phillips Healthcare

- Biofourmis

- Current Health

- Vital Connect

- Bayada Home Health Care

Chapter 1. GLOBAL HOSPITAL-AT-HOME MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL HOSPITAL-AT-HOME MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL HOSPITAL-AT-HOME MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL HOSPITAL-AT-HOME MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL HOSPITAL-AT-HOME MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL HOSPITAL-AT-HOME MARKET– BY Type

6.1. Introduction/Key Findings

6.2. Acute Care Services

6.3. Post-Surgical Care Services

6.4. Chronic Disease Management Services

6.5. Palliative Care Services

6.6. Rehabilitation Services

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. GLOBAL HOSPITAL-AT-HOME MARKET– BY DISTRIBUTION CHANNEL

7.1. Introduction/Key Findings

7.2. Direct Service Providers

7.3. Third-Party Service Providers

7.4. Y-O-Y Growth trend Analysis By DISTRIBUTION CHANNEL

7.5. Absolute $ Opportunity Analysis By DISTRIBUTION CHANNEL , 2024-2030

Chapter 8. GLOBAL HOSPITAL-AT-HOME MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channel

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channel

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channel

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channel

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL HOSPITAL-AT-HOME MARKET – Company Profiles – (Overview, Product Product TypeProduct Product Type s Portfolio, Financials, Strategies & Development

9.1. Medically Home

9.2. Dispatch Health

9.3. Contessa Health

9.4. HealthCall

9.5. Landmark Health

9.6. Phillips Healthcare

9.7. Biofourmis

9.8. Current Health

9.9. Vital Connect

9.10. Bayada Home Health Care

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The hospital-at-home market is driven by rising chronic disease prevalence, advancements in remote monitoring technologies, increasing healthcare costs, a shift toward value-based care, aging populations, and growing patient preference for personalized, convenient, and cost-effective healthcare solutions delivered at home.

The main concerns about the hospital-at-home market include high initial infrastructure costs, regulatory complexities, workforce shortages, inconsistent reimbursement policies, patient skepticism, data security risks, and challenges in providing seamless care in rural or underserved areas.

Medically Home, Dispatch Health, Contessa Health, HealthCall, Landmark Health, Phillips Healthcare.

North America currently holds the largest market share, estimated at around 35%.

Asia Pacific has shown significant room for growth in specific segments.