Hose Pipe Market Size (2024 – 2030)

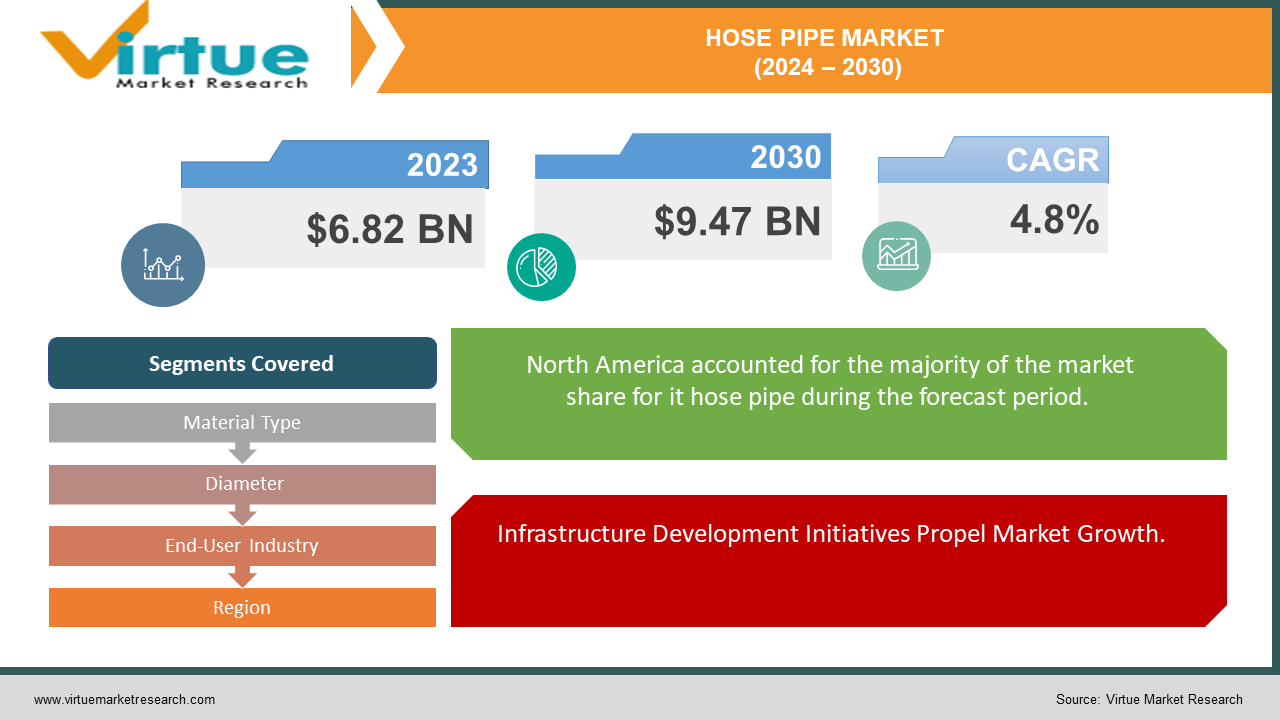

The global hose pipe market is projected to grow from an estimated USD 6.82 billion in 2023 to USD 9.47 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 4.8% over the forecast period of 2024-2030.

The hose pipe market represents a crucial segment within the broader industrial and infrastructure landscape, catering to diverse applications across multiple sectors. Characterized by a wide array of materials, diameters, and end-use industries, the market serves essential functions ranging from water distribution and irrigation to firefighting, oil & gas transfer, and automotive fluid management. As urbanization, industrialization, and infrastructure development continue to drive demand, the market witnesses sustained growth, supported by evolving regulatory standards, technological advancements, and increasing emphasis on efficiency and sustainability. Manufacturers, leveraging innovative materials and manufacturing processes, strive to meet the diverse needs of customers while addressing challenges such as cost competitiveness, raw material availability, and environmental considerations. With a global reach spanning various regions and industries, the hose pipe market remains dynamic, offering opportunities for growth and innovation in the years ahead.

Key Insights:

Rising investments in infrastructure development, particularly in emerging economies like India and China, are expected to drive significant growth in the construction segment, with a projected CAGR of 7% from 2023 to 2030.

Technological advancements in hose pipe materials, such as the increasing adoption of reinforced thermoplastic hoses for high-pressure applications, are anticipated to fuel growth in the industrial sector, with a forecasted CAGR of 8% during the forecast period.

The automotive segment is poised to witness substantial growth, with the increasing demand for automotive hoses driven by the expansion of the automotive industry and stringent emission regulations. The market is projected to achieve a CAGR of 5.8% from 2023 to 2030.

Global Hose Pipe Market Drivers:

Infrastructure Development Initiatives Propel Market Growth.

The global hose pipe market is experiencing significant growth driven by infrastructure development initiatives worldwide. With increasing urbanization and industrialization, governments and private sectors are investing heavily in infrastructure projects such as water distribution networks, sewage systems, and transportation networks. The demand for hose pipes in these projects, particularly for water distribution and drainage applications, is witnessing a notable upsurge, thereby fueling market expansion.

Technological Advancements Enhance Product Performance and Durability.

Technological advancements in hose pipe materials and manufacturing processes are playing a pivotal role in driving market growth. Manufacturers are continuously innovating to develop hoses with superior performance characteristics, including higher pressure ratings, improved flexibility, and enhanced resistance to abrasion and chemical corrosion. Additionally, advancements in reinforcement techniques and material compositions are increasing the durability and longevity of hose pipes, catering to the evolving needs of various end-user industries.

Increasing Adoption in Automotive and Aerospace Industries Boosts Demand.

The automotive and aerospace industries are emerging as key drivers of growth in the hose pipe market. In the automotive sector, stringent emission regulations and the shift towards electric vehicles are driving the demand for hoses used in fuel systems, cooling systems, and emissions control. Similarly, in the aerospace industry, the demand for lightweight and high-performance hoses for aircraft fuel systems, hydraulic systems, and pneumatic systems is on the rise. The increasing adoption of advanced hose pipe solutions in these industries is contributing significantly to market expansion.

Global Hose Pipe Market Restraints and Challenges:

Rising Environmental Concerns Drive Demand for Eco-Friendly Alternatives.

Increasing environmental consciousness among consumers and stringent regulatory frameworks aimed at reducing carbon emissions are propelling the demand for eco-friendly hose pipe materials. Companies are investing in research and development to innovate sustainable alternatives to traditional materials, such as bio-based polymers and recyclable compounds, to address environmental concerns and meet evolving regulatory requirements. This shift towards eco-friendly solutions not only aligns with corporate sustainability goals but also presents opportunities for market differentiation and growth in the hose pipe industry.

Impact of Supply Chain Disruptions on Market Dynamics.

The global hose pipe market is experiencing the reverberations of supply chain disruptions caused by events such as natural disasters, geopolitical tensions, and the COVID-19 pandemic. These disruptions have led to challenges in raw material sourcing, manufacturing delays, and logistics bottlenecks, affecting production schedules and product availability. As companies navigate these uncertainties, there is a growing emphasis on building resilient and agile supply chains through diversification of suppliers, localization of production, and adoption of digital technologies for real-time supply chain monitoring and risk management.

Global Hose Pipe Market Opportunities:

Embrace of Sustainable Materials Opens New Avenues.

The increasing focus on sustainability and environmental stewardship is creating opportunities for the adoption of eco-friendly hose pipe materials. With rising awareness about the environmental impact of traditional materials such as PVC and rubber, there is a growing demand for alternatives that offer reduced carbon footprint and enhanced recyclability. Bio-based polymers, recycled plastics, and other sustainable materials are gaining traction in the market, driven by consumer preferences and regulatory mandates. Companies that embrace these sustainable materials and incorporate them into their product portfolios stand to capitalize on the growing demand for environmentally responsible solutions and gain a competitive edge in the global hose pipe market.

HOSE PIPE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Material Type, Diameter, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Eaton Corporation plc, Gates Corporation , Parker Hannifin Corporation , Bridgestone Corporation , Continental AG , Alfagomma Spa, Flex Ltd., Trelleborg AB , Kuriyama of America, Inc. , Semperit AG Holding , Sumitomo Riko Company Limited ,Colex International Limited |

Hose Pipe Market Segmentation: By Material Type

-

PVC

-

Rubber

-

Polyurethane

-

Silicone

-

Metal

Among the diverse material types in the global hose pipe market, rubber emerges as one of the most effective choices due to its versatility and wide-ranging applications. Rubber hoses offer exceptional flexibility, durability, and resistance to abrasion, making them suitable for various demanding environments and industries. From automotive coolant hoses to industrial hydraulic hoses and firefighting hoses, rubber-based solutions excel in providing reliable performance in critical applications. Additionally, rubber hoses exhibit excellent sealing properties, ensuring leak-free fluid transfer and enhancing operational efficiency. Their ability to withstand high temperatures and harsh chemicals further enhances their appeal across a spectrum of industries, including automotive, construction, manufacturing, and oil & gas. As a result, rubber remains a preferred material for hose pipes, offering a compelling combination of performance, durability, and cost-effectiveness in the global market.

Hose Pipe Market Segmentation: By Diameter

-

Small

-

Medium

-

Large

Among the segmentation categories based on diameter in the hose pipe market, medium-sized hoses stand out as particularly effective and versatile. Medium-diameter hoses strike a balance between flow capacity and flexibility, making them suitable for a wide range of applications across various industries. These hoses are commonly used in applications such as water distribution, irrigation, firefighting, and industrial fluid transfer, where moderate flow rates and maneuverability are essential. Their medium size allows for efficient fluid transfer while still being manageable in terms of handling and installation. Moreover, medium-sized hoses offer flexibility in adapting to different working conditions and environments, making them highly adaptable for both indoor and outdoor use. As a result, medium-diameter hoses remain a popular choice among end-users seeking reliable and cost-effective solutions for their fluid transfer needs in the global market.

Hose Pipe Market Segmentation: By End-User Industry

-

Agriculture

-

Construction

-

Automotive

-

Oil & gas

-

Manufacturing

-

Residential

-

Commercial

Among the diverse end-user industries in the hose pipe market, the automotive sector emerges as one of the most impactful and versatile segments. In the automotive industry, hose pipes are integral components used in various applications such as engine cooling systems, fuel lines, brake systems, and HVAC (Heating, Ventilation, and Air Conditioning) systems. The reliability and performance of hose pipes are paramount in ensuring the efficient operation of automotive vehicles, with stringent requirements for durability, flexibility, and resistance to temperature fluctuations and chemical exposure. Additionally, the automotive industry's continuous innovation and adoption of advanced technologies drive the demand for specialized hose pipe solutions, such as lightweight hoses for electric vehicles and high-pressure hoses for turbocharged engines. With the automotive sector witnessing steady growth worldwide, driven by factors such as rising consumer demand, technological advancements, and stringent emissions regulations, the demand for hose pipes in automotive applications is expected to remain robust, presenting lucrative opportunities for manufacturers and suppliers in the global market.

Hose Pipe Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The distribution of market share by region in the hose pipe industry highlights a dynamic landscape influenced by diverse economic factors and industrial activities. North America leads the market with a substantial 38% share, driven by robust demand from end-user industries such as construction, automotive, and oil & gas. Meanwhile, Europe accounts for 25% of the market share, characterized by stringent regulatory standards and a strong emphasis on innovation and sustainability. In the Asia-Pacific region, accounting for 22% of the market share, rapid industrialization, urbanization, and infrastructure development initiatives propel significant growth opportunities, particularly in emerging economies like China and India. South America the Middle East and Africa regions contribute 8% and 7% respectively, with notable potential for growth fueled by infrastructure investments and expanding industrial activities. Overall, the regional distribution of market share underscores the global significance of the hose pipe industry, with each region presenting unique opportunities and challenges for market players.

COVID-19 Impact Analysis on the Global Hose Pipe Market:

The COVID-19 pandemic has had a significant impact on the global hose pipe market, disrupting supply chains, manufacturing operations, and demand dynamics. During the initial phases of the pandemic, lockdown measures and restrictions on movement led to a slowdown in construction activities, automotive production, and industrial operations, resulting in reduced demand for hose pipes. Moreover, disruptions in global supply chains, raw material shortages, and logistical challenges further exacerbated the situation, leading to production delays and supply shortages for manufacturers. However, as economies gradually reopened and construction activities resumed, coupled with increased adoption of e-commerce platforms for procurement, the market began to recover. Additionally, the pandemic highlighted the importance of hose pipes in critical applications such as healthcare infrastructure, sanitation, and emergency response, driving demand for specialized hose solutions. Looking ahead, the market is expected to rebound as industries adapt to the new normal, supported by infrastructure investments, technological advancements, and a focus on sustainability and resilience in supply chain management.

Latest Trends/ Developments:

In the rapidly evolving landscape of the hose pipe market, several trends and developments are shaping the industry's trajectory. One prominent trend is the growing adoption of advanced materials and manufacturing technologies to enhance hose pipe performance and durability. Manufacturers are increasingly focusing on developing hoses with superior chemical resistance, temperature tolerance, and flexibility to meet the diverse needs of end-user industries such as automotive, construction, and oil & gas. Additionally, there is a rising demand for eco-friendly hose pipe solutions, driven by environmental concerns and regulatory mandates, leading to the development of bio-based polymers and recyclable materials. Furthermore, digitalization and connectivity are revolutionizing the hose pipe industry, enabling real-time monitoring of hose performance, predictive maintenance, and remote diagnostics, thereby enhancing operational efficiency and reducing downtime. As the industry continues to innovate and adapt to changing market dynamics, these trends are expected to drive growth and shape the future of the hose pipe market.

Key Players:

-

Eaton Corporation plc

-

Gates Corporation

-

Parker Hannifin Corporation

-

Bridgestone Corporation

-

Continental AG

-

Alfagomma Spa

-

Flex Ltd.

-

Trelleborg AB

-

Kuriyama of America, Inc.

-

Semperit AG Holding

-

Sumitomo Riko Company Limited

-

Colex International Limited

Chapter 1. Hose Pipe Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hose Pipe Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hose Pipe Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hose Pipe MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hose Pipe Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hose Pipe Market– By Material Type

6.1 Introduction/Key Findings

6.2 PVC

6.3 Rubber

6.4 Polyurethane

6.5 Silicone

6.6 Metal

6.7 Y-O-Y Growth trend Analysis By Material Type

6.8 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. Hose Pipe Market– By Diameter

7.1 Introduction/Key Findings

7.2 Small

7.3 Medium

7.4 Large

7.5 Y-O-Y Growth trend Analysis By Diameter

7.6 Absolute $ Opportunity Analysis By Diameter, 2024-2030

Chapter 8. Hose Pipe Market– By End-User

8.1 Introduction/Key Findings

8.2 Agriculture

8.3 Construction

8.4 Automotive

8.5 Oil & gas

8.6 Manufacturing

8.7 Residential

8.8 Commercial

8.9 Y-O-Y Growth trend Analysis By End-User

8.10 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Hose Pipe Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material Type

9.1.3 By Diameter

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material Type

9.2.3 By Diameter

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material Type

9.3.3 By Diameter

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material Type

9.4.3 By Diameter

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material Type

9.5.3 By Diameter

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Hose Pipe Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Eaton Corporation plc

10.2 Gates Corporation

10.3 Parker Hannifin Corporation

10.4 Bridgestone Corporation

10.5 Continental AG

10.6 Alfagomma Spa

10.7 Flex Ltd.

10.8 Trelleborg AB

10.9 Kuriyama of America, Inc.

10.10 Semperit AG Holding

10.11 Sumitomo Riko Company Limited

10.12 Colex International Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global hose pipe market is projected to grow from an estimated USD 6.82 billion in 2023 to USD 9.47 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 4.8% over the forecast period of 2024-2030.

The primary drivers of the global hose pipe market are increasing demand from end-use industries such as construction, automotive, and oil & gas for fluid transfer applications.

The key challenge facing the global hose pipe market is the volatility of raw material prices, which can impact manufacturing costs and profitability.

In 2023, North America held the largest share of the global Hose Pipe market.

Eaton Corporation plc, Gates Corporation, Parker Hannifin Corporation, Bridgestone Corporation, Continental AG, Alfagomma Spa, Flex Ltd., Trelleborg AB, Kuriyama of America, Inc., Semperit AG Holding, Sumitomo Riko Company Limited, Colex International Limited are the main players.