Hops Extract Market Size (2024-2030)

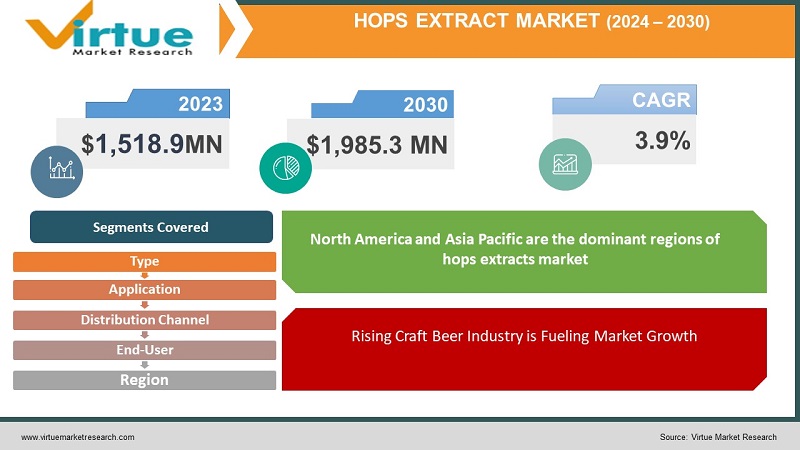

The Hops Extract Market was valued at USD 1,518.9 million in 2023 and is projected to reach a market size of USD 1,985.35 million by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.9%.

The Brewing industry plays a significant role as hops are a vital ingredient in beer production. With the growing global consumption of beer, especially craft beer, the request for hops extract continues to increase. In addition to above, the increasing focus on health and wellness among consumers has led to a rising interest in natural and plant-based products. With its ability of health benefits and bioactive compounds, it has received traction in the health and wellness sector, being utilized in dietary supplements and herbal remedies. The demand for functional food and beverages has also led the hops extract market as consumers seek products that offer additional health benefits. Moreover, this extract is used in the cosmetics and personal care industry, where it is incorporated into skincare and haircare products due to its potential soothing and antioxidant properties. Ongoing research on it and its bioactive compounds result to the growth of innovative products and expand the market. Geographically, countries with a strong tradition of hop cultivation and beer production exhibit consistent demand, but the rising beer market in other regions further drives the demand for this market.

Key Market Insights:

- Europe is considered as the largest beer consumer in the world, with the Czech Republic holding the highest share in the per capita consumption of beer at 143.3 litres, followed by Germany with 104.2 litres per capita, Poland with 100.8 litres per capita, Ireland with 98.2 litres per capita, and others.

- Approximately 2,600 farms in the European Union cultivate hops, covering 26,500 hectares with 60% of the total surface area used for hop-growing worldwide. Hops are cultivated in 14 European Union (EU) countries. Nearly 17,000 hectares are used for hop cultivation in Germany, which accounts for 60% of the European Union's hop-growing acreage and about 33.33% of the surface area devoted to hop cultivation worldwide.

Hops Extract Market Drivers:

- Rising Craft Beer Industry is Fueling Market Growth:

The global Craft Beer industry is facing significant growth, driven by changing consumer preferences and the increasing number of craft breweries. Hops extract plays a major role in the making of craft beers, which fuels the demand for this ingredient. Hops extract consists bioactive compounds that offer potential health benefits, including antioxidant and anti-inflammatory properties. This has resulted to the exploration of hops extract in functional foods, dietary supplements and herbal remedies.

- Growing demand for Natural Ingredients Propelling Market Growth:

Consumers are constantly seeking products made of natural and organic ingredients, Hops extract, being a plant-derived item, aligns with this trend and finds uses in various industries such as food, beverages and personal care.

Hops Extract Market Restraints and Challenges:

The availability of hops extract depends on the hop harvest, which can be persuaded by the factors like weather conditions and disease outbreaks. Fluctuations in supply can result in price volatility, posing challenges for makers and buyers.

The hops extract market is posed to a lot of regulations related to safety, labeling and quality standards. Compliance with these regulations could be complicated and time-consuming, particularly for small players in the industry.

Despite the growing demand for hops extract, there is still a lack of consciousness among consumers about its advantages and applications. Moreover, access to hops extract can finite in certain regions, impacted market growth.

Hops Extract Market Opportunities:

Hops extract can be used in the production of non-alcoholic beverages such as flavored water, carbonated drinks and functional beverages. The growing demand for healthier beverage options presents opportunities for hops extract manufacturers to expand their product offerings.

Hops extract has potential uses in cosmic and personal care industry. Its anti-inflammatory and anti-oxidant properties make it congenial for skincare items like creams, lotions and serums. The natural aroma of hops extract can also be used in the perfumes and fragrances.

Consistent research and development in the segment of hops extract can uncover new potential applications and advantages. Deploying in scientific studies and exploring innovative uses of hops extract can open up new avenues for market growth.

HOPS EXTRACT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, Application, Distribution Channel, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

John I. Haas , S. S. Steiner, Kalsec, Aromatrix Flora, Bristol Botanicals, Aunutra Industries, Yakima Chief Hops, BSG Hops, Glacier Hops Ranch |

Hops Extract Market Segmentation:

Hops Extract Market By Type

- Organic Hops Extract

- Conventional Hops Extract

Organic Hops extract is becoming more and more in demand from consumers, and hence is considered to be a dominating segment. This is caused by a variety of things, such as concerns about how conventional farming methods may affect human health and the environment. Because organic hop extract is made without the application of artificial fertilizers and pesticides, consumers view it as a healthier and more sustainable product.

Hops Extract Market By Application

- Bittering Agents

- Aroma Agents

- Dual Purposes

Bittering hops are added early in the brewing process to counterbalance the sweetness of the malt and provide a neat, crisp finish to the beer. The most common bittering hops like Magnum, Chinook, and Columbus, each offering its own unique flavor profile and level of bitterness.

Unlike Bittering agents, which are added to the boil during the final 15-20 minutes, aroma hops are introduced to the brew at the end of the boiling process. Also referred to as finishing hops, their purpose is to give the beer with a final layer of finish.

Hops Extract Market By Distribution Channel

- Online

- Offline

Post Covid, it is clearly observed that there is a traction towards Online distribution Channel and hence considered to be the dominating segment. As the fear of Covid has been fading away, Offline distribution channel has come to light. Therefore, it is expected to be the fastest growing segments in the upcoming years.

Hops Extract Market By End-User

- Breweries

- Pharmaceuticals

- Food & Beverage

- Cosmetics

Beers are widely consumed Alcoholic beverages and experiencing healthy growth all around the world. Hence Beverages industry with huge demand is considered to be the dominating market. This industry has huge demand for flavours, which creates a path for Hope extract manufacturers. Manufacturers are facing increased demand for unique & distinct Hop extract from brewers and alcoholic beverage manufacturers. Key manufacturers are eyeing on producing unique ingredients from hops extract with the aid of developing science and technology to fulfil the demand for end-use industries.

Hops extract is gaining traction in the Cosmetics industry and is therefore considered to be the fastest growing market. Dry skin is one of the most common problems that leaves the skin looking dull, older and wrinkled, often with a flaky and rough texture. Dry skin can also be experienced due to several problems like thyroid, diabetes and hormonal imbalance.

Hops are considered as a vital element in natural skin care products for treating dry and strained skin. Poultices made of hops have been exposed to benefit through skin staining. In addition, hops extracts are added as a sedative agent in facial products. They are dominating in tannins, which can decrease irritation.

Hops Extract Market By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America and Asia Pacific are the dominant regions of hops extracts market due to the highest number of consumers and giant market space. Asia-Pacific is the fastest-growing continent based on population and economy. The rising disposable incomes and leaning towards a modern lifestyle of consumers are driving the growth of alcoholic beverages across Asia-Pacific. Makers of alcoholic beverages and brewers are demanding more and more hops extracts with different flavours and tastes, which is leading to the improvement of hops extract market in Asia-Pacific and is expected to grow at a CAGR~4% in the estimated period.

In the region of Europe, hops have a traditional background as medicinal herbs and consumers are highly conscious of hops extracts and ingredients. Additionally, Beer is one of the most popular drinks around Europe having an established market. Europe is estimated to grow at a CAGR of ~3% in the forecast period of global hop extracts market and hence is known as the fastest growing region for hops extraction.

COVID-19 Impact Analysis on the Hops Extract Market:

The COVID-19 pandemic has had both positive and negative effects on the hops extraction market. On one side, the closure of bars, restaurant and breweries during lockdowns resulted in a fall in beer consumption and subsequently, a temporary setback for the hops extract market. On the other side, the pandemic led to a rise in at-home consumption of beer, with consumers asking for new flavors and experiences, thereby driving the demand for craft beer and specialty hops extract.

Latest Trends:

- Rising curiosity about organic hop extract

Organic products are getting more and more traction from consumers, and the hops extract market is no different. This is caused by multiple things, such as worries about how conventional farming methods may affect human health and the environment. Because organic hop extract is made without the use of artificial fertilizers and pesticides, consumers view it as a healthier and more sustainable product.

- Rising interest in specialty drinks like artisan brews

The growing demand for specialty beverages like craft beers is a significant factor propelling the hops extract industry. Hop extracts are receiving higher demand as a result of the fact that craft beers are usually prepared with a greater variety of hops than regular beers. The capability to add particular hop flavours and smells to beers, consistency, and convenience of usage are just some benefits that brewers can get from using hop extracts.

- Advancements in the technology of hop extraction

The market for hops extract is expanding as a result of modernisations in hop extraction technologies. The primary ingredients that provide hops their flavour and bitterness, alpha and beta acids, are concentrated in higher concentrations in hop extracts made using new extraction techniques that are being developed. Hop extract prices are being reducing due to the increased efficiency of these new extraction techniques.

Key Players:

- John I. Haas

- S. S. Steiner

- Kalsec

- Aromatrix Flora

- Bristol Botanicals

- Aunutra Industries

- Yakima Chief Hops

- BSG Hops

- Glacier Hops Ranch

Recent Developments

- In August 2023, Kirin’s Joint venture with Japanese advertising mammoth Dentsu introduced one of its first consumer products, a gummy and tablet for cognition containing Kirin’s proprietary matured hop extract. Matured hops are extracted using water to create matured hops extract. It can be mixed with a variety of foods and drinks and is practically risk-free for people of all ages, even young ones. It has just 10% of the bitterness of hops.

- In January 2023, BarthHaas introduced an all-new company website where hop services providers can present their extensive portfolio in an updated design and very clearly structured form. Hence, finding for information about the company, its products, and its services will be easier, quicker and more intuitive.

- January 2023, Crosby Hops, an integrated hop grower, processor, and merchant, made it public about the official expansion of its product offerings to include cryogenically processed lupulin pellets. Its new CGX concentrated pellets are accessible in several varieties, which makes it possible to brew aggressively-hopped beers that can better yields and margins while decreasing the environmental footprint of production.

Chapter 1. Global Hops Extract Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Hops Extract Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Hops Extract Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Hops Extract Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Hops Extract Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Hops Extract Market– By Application

6.1. Introduction/Key Findings

6.2. Bittering Agents

6.3. Aroma Agents

6.4. Dual Purposes

6.5. Y-O-Y Growth trend Analysis By Application

6.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. Global Hops Extract Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Online

7.3. Offline

7.4. Y-O-Y Growth trend Analysis By Distribution Channel

7.5. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Global Hops Extract Market– By Type

8.1. Introduction/Key Findings

8.2. Organic Hops Extract

8.3. Conventional Hops Extract

8.4. Y-O-Y Growth trend Analysis Type

8.5. Absolute $ Opportunity Analysis Type, 2024-2030

Chapter 9. Global Hops Extract Market– By End-User

9.1. Introduction/Key Findings

9.2. Breweries

9.3. Pharmaceuticals

9.4. Food & Beverage

9.5. Cosmetics

9.6. Y-O-Y Growth trend Analysis End-User

9.7. Absolute $ Opportunity Analysis End-User , 2024-2030

Chapter 10. Global Hops Extract Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Application

10.1.3. By Distribution Channel

10.1.4. By End-User

10.1.5. Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Application

10.2.3. By Distribution Channel

10.2.4. By End-User

10.2.5. Type

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Application

10.3.3. By Distribution Channel

10.3.4. By End-User

10.3.5. Type

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Application

10.4.3. By Distribution Channel

10.4.4. By End-User

10.4.5. Type

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Application

10.5.3. By Distribution Channel

10.5.4. By End-User

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Hops Extract Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 John I. Haas

11.2. S. S. Steiner

11.3. Kalsec

11.4. Aromatrix Flora

11.5. Bristol Botanicals

11.6. Aunutra Industries

11.7. Yakima Chief Hops

11.8. BSG Hops

11.9. Glacier Hops Ranch

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Hops Extract Market was valued at USD 1,518.9 million in 2023 and is projected to reach a market size of USD 1,985.35 million by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.9%.

The rising demand for Craft beers and awareness about natural ingredients among consumers is propelling the global Organic Spices industry

Hops Extract Market is segmented based on Type, Application, Distribution Channel, End-User and Region

North America and Asia- Pacific are the most dominant region for the Hops Extract Market

John I. Haas, S. S. Steiner, Kalsec, Aromatrix Flora, Bristol Botanicals, Aunutra Industries, Yakima Chief Hops and BSG Hops are the few of the key players operating in the Hops Extract Market