Hopped Malt Extract Market Size (2024-2030)

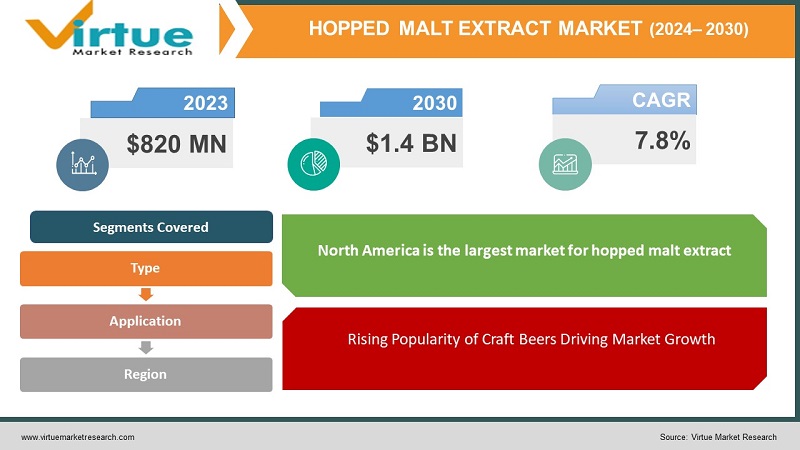

In 2023, the global hopped malt extract market was valued at USD 820 million and is expected to reach USD 1.4 billion by 2030, growing at a CAGR of 7.8% during the forecast period.

The market’s growth is fueled by the surging popularity of craft brewing, innovations in brewing technology, and the increasing number of hobbyists brewing beer at home. Additionally, large commercial breweries are utilizing hopped malt extract for specialty beer lines, contributing to market expansion. Moreover, the global trend toward premium, artisanal beers with unique flavors is driving the demand for high-quality hopped malt extracts. Emerging markets in Asia-Pacific and Latin America, where the craft beer culture is still developing, offer significant growth potential for the market.

Key Market Insights:

Liquid hopped malt extract dominates the market, accounting for more than 60% of the total revenue share due to its ease of use and widespread adoption in both home brewing and commercial brewing.

The home brewing segment is projected to witness the fastest growth, driven by the increasing number of craft beer enthusiasts and the rising availability of home brewing kits that include hopped malt extract.

North America remains the largest market for hopped malt extract, thanks to the well-established craft brewing industry in the U.S. and Canada. However, the Asia-Pacific region is emerging as a key growth area due to rising disposable income and the growing influence of Western beer culture in countries such as China, India, and Australia.

Rising consumer preference for natural ingredients and gluten-free beers is creating opportunities for innovative products in the market.

Advances in packaging and the development of new brewing techniques, including the use of dry hopping, are influencing market dynamics, offering brewers greater control over flavor and aroma profiles.

Global Hopped Malt Extract Market Drivers:

Rising Popularity of Craft Beers Driving Market Growth The increasing demand for craft beers is one of the primary drivers of the global hopped malt extract market. Craft beers, known for their unique flavors and premium quality, have gained immense popularity among consumers, particularly in North America and Europe. Small and independent breweries that focus on handcrafted beer production often rely on hopped malt extract to maintain consistency while experimenting with different hops and malt combinations. Hopped malt extract simplifies the brewing process and allows for greater flexibility, which is crucial for craft brewers aiming to create a diverse range of beer styles. Furthermore, as the craft beer movement expands globally, regions such as Asia-Pacific and Latin America are witnessing a surge in microbreweries and craft beer enthusiasts, further boosting the demand for hopped malt extract.

Growing Home Brewing Culture is Boosting the Market The home brewing trend has gained considerable momentum, particularly during the COVID-19 pandemic, when consumers turned to home-based hobbies. Hopped malt extract is a popular choice among home brewers because it simplifies the brewing process, offering a ready-to-use solution that includes both malt and hops in one product. The ease of brewing with hopped malt extract has made it accessible to beginners, allowing them to create high-quality beer without the need for extensive equipment or ingredients. This surge in home brewing culture, supported by the availability of home brewing kits and online tutorials, has contributed significantly to the growth of the hopped malt extract market. Additionally, the rise of home brewing clubs and communities, particularly in North America and Europe, has further fueled the demand for hopped malt extract among hobbyists and enthusiasts.

Convenience and Consistency Offered by Hopped Malt Extract The convenience of using hopped malt extract in beer production is a major factor driving its adoption among both home brewers and commercial breweries. Hopped malt extract eliminates the need for separate additions of malt and hops during the brewing process, simplifying production and ensuring consistency in the final product. This is particularly beneficial for small and medium-sized breweries that aim to maintain high quality and repeatability in their beer production while reducing labor and production time. The pre-hopped extract provides brewers with a balanced flavor profile, ensuring that each batch has a consistent level of bitterness and aroma. Furthermore, hopped malt extract can be easily stored and transported, making it an attractive option for breweries looking to streamline their operations.

Global Hopped Malt Extract Market Challenges and Restraints:

Competition from Traditional Brewing Methods One of the significant challenges facing the hopped malt extract market is the preference for traditional brewing methods among some brewers, particularly in large commercial breweries and among purists in the craft beer industry. While hopped malt extract offers convenience, many brewers prefer the control and flexibility that come with using whole hops or malt in their brewing process. Traditional brewing allows for greater customization, particularly in terms of hop varieties, bitterness levels, and flavor profiles, which can be challenging to achieve with pre-hopped extracts. This preference for traditional brewing techniques may limit the adoption of hopped malt extract, particularly among experienced brewers who prioritize artisanal methods and customized recipes.

Limited Consumer Awareness in Emerging Markets While the hopped malt extract market is growing rapidly in established beer markets such as North America and Europe, consumer awareness remains relatively low in emerging markets, particularly in regions such as Asia-Pacific, Latin America, and the Middle East. Although the craft beer movement is gaining traction in these regions, many consumers and brewers are still unfamiliar with hopped malt extract and its benefits. Additionally, the availability of brewing equipment and ingredients, including hopped malt extract, may be limited in certain markets, hindering the growth of home brewing and small-scale craft breweries. Overcoming this challenge will require increased marketing efforts, greater distribution networks, and education on the use and benefits of hopped malt extract.

Market Opportunities:

The Global Hopped Malt Extract Market presents several opportunities for growth, particularly in the areas of specialty beer production, emerging craft beer markets, and the development of innovative malt extract formulation. As the demand for unique and premium beer styles continues to rise, there is significant potential for hopped malt extract manufacturers to cater to the specialty beer market. Hopped malt extracts can be tailored to produce specific beer styles, such as IPAs (India Pale Ales), stouts, or lagers, offering brewers the ability to create distinctive and high-quality beers with ease. The growing craft beer culture in emerging markets such as Asia-Pacific and Latin America presents a significant opportunity for hopped malt extract manufacturers. These regions are witnessing a surge in microbreweries and home brewing enthusiasts, and as consumer preferences shift towards premium and artisanal beer, the demand for convenient brewing ingredients like hopped malt extract is expected to rise. The development of new and innovative malt extract formulations, including gluten-free and organic hopped malt extracts, presents a lucrative opportunity for manufacturers. As consumer preferences shift towards healthier and more sustainable products, breweries and home brewers alike are seeking malt extracts that align with these trends. Developing and marketing gluten-free hopped malt extracts, for instance, could cater to the growing demand for gluten-free beers among health-conscious consumers.

HOPPED MALT EXTRACT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Muntons Plc, Briess Malt & Ingredients Co., John I. Haas, Inc., Coopers Brewery Limited, Northern Brewer, BrewCraft USA, Edme Limited, Grainfather, P.A.B. GmbH, MaltEurop Group |

Hopped Malt Extract Market Segmentation:

Hopped Malt Extract Market Segmentation By Type:

- Liquid Hopped Malt Extract

- Dry Hopped Malt Extract

Liquid hopped malt extract holds the largest market share due to its widespread use and ease of application. It is favored by both home brewers and commercial breweries for its consistency and flavor profile. Dry hopped malt extract, though less common, is gaining traction as it offers longer shelf life and is easier to transport, making it appealing for small breweries and those in remote locations.

Hopped Malt Extract Market Segmentation By Application:

- Home Brewing

- Commercial Brewing

The home brewing segment is expected to grow at the highest CAGR during the forecast period, driven by the increasing number of hobbyists and the rising availability of home brewing kits that include hopped malt extract. Commercial brewing, including microbreweries and large-scale breweries, continues to be a significant segment, with demand for hopped malt extract in specialty beer production and seasonal offerings.

Hopped Malt Extract Market Regional Segmentation:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

North America is the largest market for hopped malt extract, primarily due to the thriving craft beer industry in the United States and Canada. Europe is a key market for hopped malt extract, with countries like the UK, Germany, and Belgium being major hubs for beer production. The region’s long-standing brewing tradition and the growing demand for craft beers have fueled the market’s growth. The Asia-Pacific region is witnessing rapid growth in the hopped malt extract market, driven by the increasing influence of Western beer culture and rising disposable incomes. Latin America’s craft beer culture is in its early stages but is growing rapidly, particularly in countries like Brazil, Argentina, and Mexico. The market in the Middle East and Africa is still nascent but has potential for growth, particularly in countries with a developing craft beer culture.

COVID-19 Impact Analysis on the Global Hopped Malt Extract Market:

The COVID-19 pandemic had a mixed impact on the global hopped malt extract market. While large-scale commercial breweries experienced disruptions due to lockdowns and supply chain challenges, the home brewing sector saw a significant boost as consumers sought new hobbies and activities during periods of isolation. The demand for home brewing kits, including hopped malt extract, surged, particularly in North America and Europe. Post-pandemic, the market is expected to continue its growth trajectory, with the craft beer movement gaining further momentum and home brewing becoming a mainstream hobby for many consumers.

Latest Trends/Developments:

With the increasing demand for gluten-free beers, manufacturers are developing gluten-free hopped malt extracts to cater to this growing market. Breweries are increasingly focusing on sustainability, and hopped malt extract manufacturers are responding by offering organic and sustainably sourced malt extracts. Advances in packaging, such as resealable containers and eco-friendly materials, are influencing the market by making hopped malt extracts more convenient for home brewers and small breweries.

Key Players:

- Muntons Plc

- Briess Malt & Ingredients Co.

- John I. Haas, Inc.

- Coopers Brewery Limited

- Northern Brewer

- BrewCraft USA

- Edme Limited

- Grainfather

- P.A.B. GmbH

- MaltEurop Group

Chapter 1. GLOBAL HOPPED MALT EXTRACT MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL HOPPED MALT EXTRACT MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL HOPPED MALT EXTRACT MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL HOPPED MALT EXTRACT MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL HOPPED MALT EXTRACT MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL HOPPED MALT EXTRACT MARKET – By Type

6.1. Introduction/Key Findings

6.2. Liquid Hopped Malt Extract

6.3. Dry Hopped Malt Extract

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL HOPPED MALT EXTRACT MARKET – By Application

7.1. Introduction/Key Findings

7.2 Home Brewing

7.3. Commercial Brewing

7.4. Y-O-Y Growth trend Analysis By Application

7.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. GLOBAL HOPPED MALT EXTRACT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL HOPPED MALT EXTRACT MARKET – Company Profiles – (Overview, Product Types Portfolio, Financials, Strategies & Development

9.1. Muntons Plc

9.2. Briess Malt & Ingredients Co.

9.3. John I. Haas, Inc.

9.4. Coopers Brewery Limited

9.5. Northern Brewer

9.6. BrewCraft USA

9.7. Edme Limited

9.8. Grainfather

9.9. P.A.B. GmbH

9.10. MaltEurop Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 820 million in 2023 and is projected to reach USD 1.4 billion by 2030, growing at a CAGR of 7.8%.

The key drivers include the rising popularity of craft beers, the growing home brewing culture, and the convenience offered by hopped malt extract in brewing processes.

Liquid hopped malt extract holds the largest market share due to its ease of use and widespread adoption in both home brewing and commercial brewing.

North America dominates the market, driven by the thriving craft beer industry in the U.S. and Canada.

Leading players include Muntons Plc, Briess Malt & Ingredients Co., and Coopers Brewery Limited.