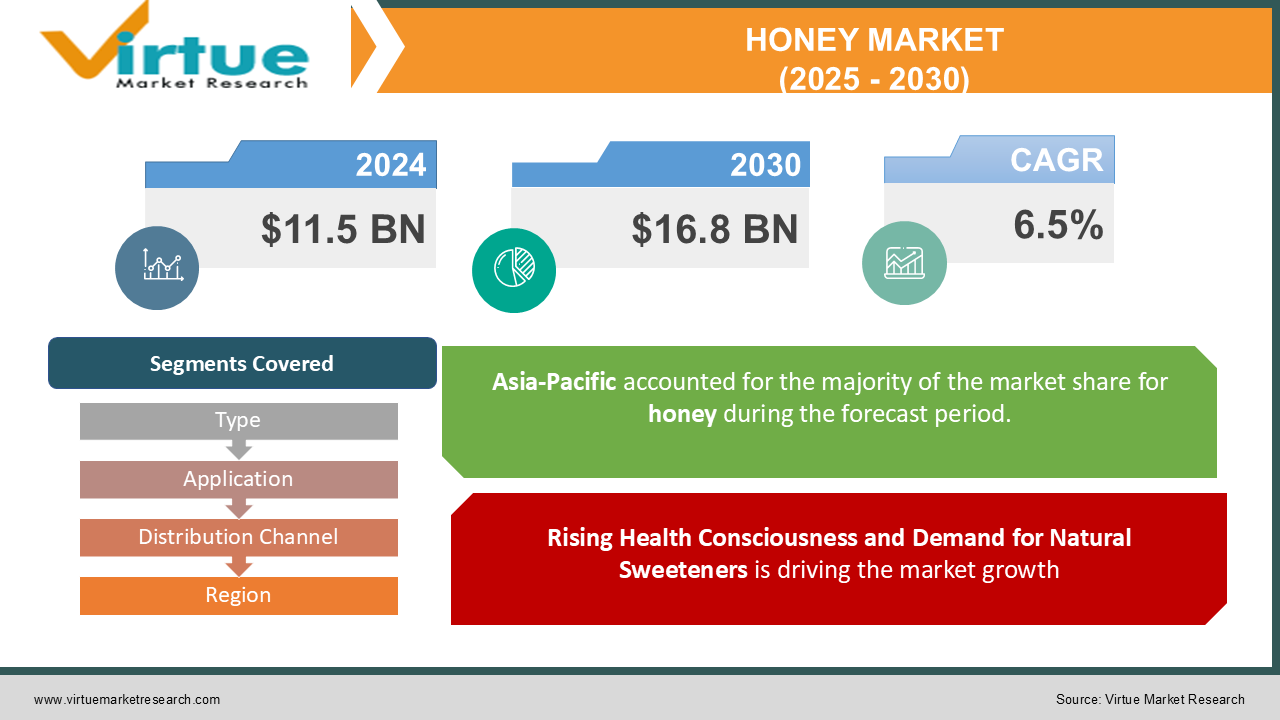

Honey Market Size (2025 – 2030)

The Global Honey Market was valued at USD 11.5 billion in 2024 and is projected to reach USD 16.8 billion by 2030, expanding at a CAGR of 6.5% from 2025 to 2030.

Honey, renowned for its nutritional value and diverse health benefits, is widely used across industries including food & beverages, cosmetics, and pharmaceuticals. The rising consumer preference for natural sweeteners over artificial options, coupled with increasing awareness about honey’s antimicrobial and antioxidant properties, has significantly contributed to its market growth.

Key Market Insights

-

Growing health consciousness has led to a shift from sugar to natural sweeteners, with honey becoming a key substitute. Premium honey types like Manuka are witnessing higher demand due to their superior medicinal properties and immunity-boosting benefits.

-

Honey is increasingly used in cosmetic formulations for its hydrating, healing, and anti-inflammatory properties. The emphasis on sustainability has encouraged practices that protect bee populations, ensuring long-term honey production.

-

E-commerce platforms account for a growing share of honey sales, driven by convenience and access to diverse product options.

-

The Asia-Pacific region dominates the market due to its large-scale production and consumption of honey, especially in China and India.

-

Honey's application has expanded from traditional food uses to modern sectors like nutraceuticals and health supplements. The demand for organic honey is surging as consumers prioritize products free from synthetic additives and pesticides.

Global Honey Market Drivers

Rising Health Consciousness and Demand for Natural Sweeteners is driving the market growth

The global shift toward healthier lifestyles has propelled the demand for natural sweeteners like honey as consumers reduce their sugar intake. Honey's versatility as a natural product with functional benefits, including antioxidants and antimicrobial properties, positions it as an ideal substitute for refined sugars and artificial sweeteners. The adoption of honey in diets, particularly in beverages, snacks, and cereals, reflects its growing role in healthy eating trends. The increasing prevalence of lifestyle diseases such as diabetes and obesity has further driven consumers to seek alternatives like honey, which offers health benefits alongside its natural sweetness.

Expanding Applications in Pharmaceuticals and Cosmetics is driving the market growth

Honey’s medicinal properties have made it a valuable ingredient in pharmaceuticals and skincare products. In medicine, honey is used to treat wounds, sore throats, and digestive disorders due to its antimicrobial and anti-inflammatory properties. In the cosmetic industry, honey's hydrating and healing attributes have led to its inclusion in a variety of skincare products such as moisturizers, lip balms, and masks. These expanding applications not only broaden honey’s consumer base but also increase its value proposition across industries, enhancing its market potential.

Sustainability and Ethical Beekeeping Practices is driving the market growth

Sustainable and ethical practices in honey production are gaining momentum as environmental concerns rise. Beekeeping practices that support biodiversity and protect bee populations are being prioritized by both producers and consumers. Honey derived from ethical and eco-friendly methods is commanding higher prices, particularly in markets with stringent sustainability standards like Europe and North America. The growing consumer preference for sustainable products has also encouraged companies to emphasize traceability and eco-certifications, driving further growth in the global honey market.

Global Honey Market Challenges and Restraints

Adulteration and Quality Concerns is restricting the market growth

Adulteration remains a significant challenge in the honey market, with counterfeit products undermining consumer trust and affecting market credibility. The introduction of low-quality and artificially sweetened honey impacts the reputation of genuine products and creates challenges for producers aiming to maintain high standards. Regulatory bodies worldwide are working to implement stricter quality controls and testing mechanisms. However, the prevalence of fraudulent practices continues to pose a threat to market growth, especially in emerging economies where regulatory enforcement is less stringent.

Fluctuations in Production Due to Environmental Factors is restricting the market growth

Honey production is highly dependent on environmental conditions, making it vulnerable to climate change, pesticide use, and habitat loss. Unpredictable weather patterns and declining bee populations significantly impact global honey supply, leading to price volatility and production inefficiencies. Furthermore, the extensive use of agrochemicals can harm pollinator health, further exacerbating supply issues. Addressing these challenges requires coordinated efforts between governments, producers, and environmental organizations to safeguard bee populations and ensure consistent honey production.

Market Opportunities

The Global Honey Market is ripe with opportunities, particularly in premium and organic segments. As consumer preferences shift toward high-quality products, producers are focusing on specialized varieties like Manuka and acacia honey, which offer superior health benefits. Organic honey, free from synthetic chemicals and pesticides, is gaining popularity as health-conscious consumers prioritize natural and sustainable choices. Additionally, the growing awareness of honey's therapeutic properties has opened new avenues in the nutraceutical and health supplement industries. E-commerce platforms also present a significant growth opportunity, allowing producers to reach wider audiences and cater to the rising demand for diverse honey varieties. In emerging markets, increasing disposable incomes and expanding urbanization are further driving demand for honey as both a food ingredient and a functional product. Collaborations between producers and sustainability advocates can ensure the long-term viability of honey production, fostering innovation and market expansion.

HONEY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dabur India Ltd.,Capilano Honey Ltd., New Zealand Honey Co., Comvita Ltd., Bee Maid Honey Ltd., Barkman Honey, LLC, The Honey Company, Dutch Gold Honey, Rowse Honey Ltd., Ziyad Brothers Importing |

Honey Market Segmentation - By Type

-

Manuka Honey

-

Clover Honey

-

Acacia Honey

-

Wildflower Honey

-

Others

Manuka honey leads the premium segment due to its unique medicinal properties and high antibacterial activity. It is particularly sought after in the healthcare and skincare industries. Manuka honey, sourced from the Manuka tree in New Zealand, commands a premium price due to its unique medicinal properties and potent antibacterial activity. This honey contains high levels of methylglyoxal (MGO), a compound responsible for its powerful antimicrobial effects. This unique characteristic makes Manuka honey highly sought after in both the healthcare and skincare industries. It is used in various applications, including wound care, soothing sore throats, and treating skin conditions like acne and eczema. The high demand for Manuka honey, coupled with its limited supply, has driven its premium status in the market.

Honey Market Segmentation - By Application

-

Food & Beverages

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Others

The food & beverages segment accounts for the largest market share as honey is widely used as a natural sweetener in baking, cooking, and beverages. Its versatility in culinary applications ensures its continued dominance.

Honey Market Segmentation - By Distribution Channel

-

Supermarkets & Hypermarkets

-

Online Retail

-

Specialty Stores

-

Others

Online retail is growing rapidly due to the convenience of e-commerce platforms, offering customers access to diverse honey varieties and brands. The rapid growth of online retail has revolutionized the honey market. E-commerce platforms offer unparalleled convenience, allowing customers to access a diverse range of honey varieties and brands from the comfort of their homes. These platforms often feature detailed product descriptions, customer reviews, and ratings, empowering consumers to make informed choices. Furthermore, online retailers frequently offer exclusive deals, discounts, and loyalty programs, making honey more affordable and accessible. This increased accessibility has led to a surge in honey consumption, particularly among younger demographics who are more tech-savvy and prefer online shopping. As a result, online retail has become a significant driver of the honey market's growth, shaping consumer preferences and expanding the market's reach.

Honey Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific leads the honey market, driven by large-scale production in China and India, combined with high domestic consumption. The region benefits from traditional uses of honey in medicine and cuisine, as well as growing exports to North America and Europe. Increasing health awareness and the shift to natural sweeteners further bolster demand.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the global honey market. On one hand, supply chain disruptions and labor shortages affected honey production and distribution. On the other hand, the heightened focus on health and immunity boosted the demand for honey as a natural remedy and health supplement. Consumers increasingly turned to honey for its antimicrobial and immunity-boosting properties, leading to a surge in retail sales, particularly through e-commerce channels. Increased consumer awareness of immunity-boosting foods and natural remedies led to a surge in honey demand. People turned to honey as a natural sweetener and a potential immune booster. However, lockdowns and supply chain disruptions posed challenges to the industry. Beekeepers faced difficulties in accessing essential equipment and labor, affecting honey production. Moreover, the closure of food service establishments, a significant market for honey, impacted sales. Nevertheless, the pandemic accelerated the shift towards online sales and e-commerce, providing new opportunities for honey producers. Honey's role as a functional food ingredient gained prominence during the pandemic, with rising adoption in home remedies and health drinks. These trends are expected to sustain post-pandemic, as health-conscious consumers continue to incorporate honey into their diets.

Latest Trends/Developments

The honey market is witnessing significant innovation, with a focus on premium and flavored varieties catering to diverse consumer preferences. Infused honey products, such as those blended with spices or herbs, are gaining popularity in gourmet segments. There is also a rise in sustainable packaging initiatives, as consumers demand eco-friendly options. Moreover, technological advancements in beekeeping, such as AI-powered hive monitoring systems, are enhancing production efficiency and ensuring the health of bee populations. Key trends shaping the market include the rising demand for organic honey, which is perceived as purer and more nutritious. Additionally, there's a growing interest in specialty honeys, such as Manuka honey, known for its unique antibacterial properties. The market is also witnessing innovation in honey-based products, including honey-infused beverages, skincare products, and supplements. However, challenges like adulteration and inconsistent quality standards remain concerns. To address these, industry players are focusing on traceability and certification to ensure product authenticity. The increasing prominence of organic certifications and traceability programs reflects the demand for transparency and quality assurance in honey production.

Key Players

-

Dabur India Ltd.

-

Capilano Honey Ltd.

-

New Zealand Honey Co.

-

Comvita Ltd.

-

Bee Maid Honey Ltd.

-

Barkman Honey, LLC

-

The Honey Company

-

Dutch Gold Honey

-

Rowse Honey Ltd.

-

Ziyad Brothers Importing

Chapter 1. Honey Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Honey Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Honey Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Honey Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Honey Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Honey Market – By Type

6.1 Introduction/Key Findings

6.2 Manuka Honey

6.3 Clover Honey

6.4 Acacia Honey

6.5 Wildflower Honey

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Honey Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Pharmaceuticals

7.4 Cosmetics & Personal Care

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Honey Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets & Hypermarkets

8.3 Online Retail

8.4 Specialty Stores

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Honey Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Honey Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Dabur India Ltd.

10.2 Capilano Honey Ltd.

10.3 New Zealand Honey Co.

10.4 Comvita Ltd.

10.5 Bee Maid Honey Ltd.

10.6 Barkman Honey, LLC

10.7 The Honey Company

10.8 Dutch Gold Honey

10.9 Rowse Honey Ltd.

10.10 Ziyad Brothers Importing

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market was valued at USD 11.5 billion in 2024 and is projected to reach USD 16.8 billion by 2030, with a CAGR of 6.5%.

Key drivers include rising health consciousness, the demand for natural sweeteners, and expanding applications in pharmaceuticals and cosmetics.

The market is segmented by type (Manuka, Clover, Acacia), application (food & beverages, cosmetics), and distribution channel (supermarkets, online retail).

Asia-Pacific leads the market with a 35% share, driven by large-scale production in China and India and rising domestic demand.

Leading players include Dabur India Ltd., Capilano Honey Ltd., Comvita Ltd., Bee Maid Honey Ltd., and Dutch Gold Honey.