Homogenous Catalyst Market Size (2023 - 2030)

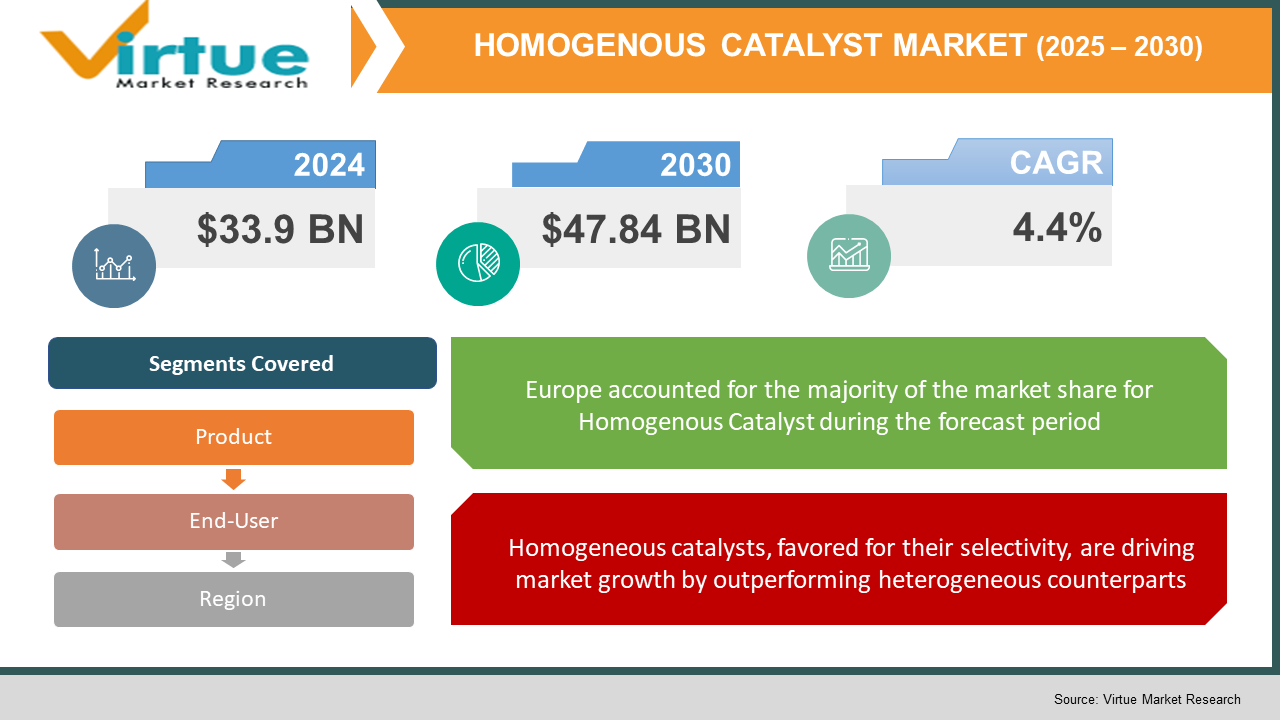

In 2022, the Global Homogenous Catalyst Market was valued at $33.9 billion, and is projected to reach a market size of $47.84 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 4.4%. The increasing need for catalysts from industries like chemical synthesis, petroleum refining, polymers and petrochemicals, and environmental is what is driving the demand for process optimization, yield improvement, cost reduction, and energy reduction among manufacturers globally.

Industry Overview:

When the catalyst is in the same phase as the reactants in the solution, this reaction is referred to as homogeneous catalysis. An illustration of homogeneous catalysis is the production of acetic acid. Homogeneous catalysis in chemistry is the catalysis of a soluble catalyst in a solution. Homogeneous catalysis describes reactions in which the catalyst and the reactants are in the same phase, typically in solution. Heterogeneous catalysis, in contrast, refers to reactions in which the catalysts and substrate are in different phases, often solid-gas, respectively. The phrase suggests catalysis by organometallic compounds and is virtually solely used to describe solutions. Homogeneous catalysis is a well-known technique that is still developing. The creation of acetic acid is an example of a significant application. Examples of homogeneous catalysts include enzymes. The typical liquid catalyst for a reaction between two other liquids is a liquid solution. An organometallic solution is an illustration of a homogenous catalyst. Homogeneous catalysts are better because they can carry out the reaction at softer conditions, have higher activity and selectivity, are simpler to spectroscopically monitor, and have controlled and adjustable reaction sites.

An intermediate is created when the catalyst reacts with one of the reactants. Because the intermediate chemical is unstable, it either breaks down or mixes with the other reactants to create the product, which regenerates the catalyst. The interactions between gases and liquids or chemicals dissolved in liquids, such as when ordinary home gas and oxygen combine to form a flame, are the most significant homogeneous reactions (e.g., the reactions between aqueous solutions of acids and bases). In addition to increasing the effectiveness of refining machinery, catalysts are increasingly utilized to speed up the processing of crude oil. Over the past few years, the market has been driven by favorable environmental legislation about the beneficial benefits of catalysts in numerous industries. The use of catalysts in various industries is encouraged by the European Catalyst Manufacturers Association (ECMA) to lower emissions and lessen pollution. Additionally, the development of biocatalysts is anticipated to expand market opportunities in the next years.

COVID-19 impact on the Homogenous Catalyst Market

The COVID-19 pandemic's immediate effects include a slowdown in the automotive industry's growth, which would be problematic for the market's expansion. The fundamental cause is that the automotive industry is a notable application field for catalysts. 78% of businesses lack the supplies necessary to run a full production line. China, the pandemic's epicenter, is linked to almost 80% of the global car supply chain. China has an 18% decline in car sales as of January 2020. One of the four main auto manufacturing hubs in the country is Hubei, the Chinese province where the global pandemic started. More than 100 automobile suppliers are present. Automotive factories in the area were shut down until March 11 and have since slowly reopened. As a result, such a pulling effect on the automotive sector's growth rate would function as a factor slowing the sector's growth, which would be particularly noticeable in the first three quarters of the fiscal year 2020. The oil demand has significantly decreased, the first time this has happened in ten years, as a result of the unprecedented COVID-19 epidemic, which has forced the closure of companies and production facilities. Additionally, the price conflict between KSA and Russia has significantly reduced oil prices.

MARKET DRIVERS:

Homogeneous catalysts, favored for their selectivity, are driving market growth by outperforming heterogeneous counterparts

The Covid-19 pandemic is estimated to result in a significant increase in demand for PGM catalysts because they are utilized in the manufacture of several APIs, including those antibiotics needed to treat Covid-19. The guided synthesis of a composite organic intermediate can be completed catalytically using homogeneous precious metal catalysts, yielding a product that would not be possible without them. A homogeneous catalytic approach can boost a current process's overall economics and product superiority. For lab preparations, several well-known homogeneous catalysts are suitable. Market players are always coming up with new ideas to increase their user bases and drive future market growth.

Rising Demand for Environmental Catalysts and Increasing Utilization in a Variety of Industries to Support the Growth of the Homogenous Catalyst Industry.

The primary factor fueling the industry's expansion is the increasing use of catalysts in a variety of industries, including chemical synthesis, petroleum refining, polymers and petrochemicals, and environmental applications for process optimization, yield improvement, cost reduction, and energy conservation. Environmental catalysts also help manufacturers adhere to the stringent NOx, SOx, and carbon dioxide emission laws. As a result, the need for catalysts has increased in response to shifting energy trends involving renewable fuels like biodiesel and shale gas fuel. Manufacturers looking to add value to their feedstock or refiners processing value-added petrochemicals and chemicals like methanol and polyolefins are predicted to increase demand for the product in petrochemical and chemical applications over the projection period.

MARKET RESTRAINTS:

The necessity of separating the reaction products is the main drawback of homogenous catalysts.

It is required to separate the homogeneous catalysts and recover the catalyst. This may be pricey and complicated. Other drawbacks include the relatively quick decomposition of these catalysts, which necessitates careful temperature control, and the deactivation of these catalysts in the presence of hazardous byproducts. Reactor corrosion caused by metal complexes is another possibility. If the homogeneous catalyst is either injected onto a solid substrate or chemically linked to it, the benefits may be kept and the drawbacks may be eliminated.

HOMOGENOUS CATALYST MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.4% |

|

Segments Covered |

By Product, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Evonik Industries AG, Johnson Matthey Plc, Heraeus Group, Clariant International Ltd, Umicore SA, Alfa Aesar, Vineeth Precious Catalysts Pvt. Ltd., Haldor Topsoe, Umicore N.V., American Elements, Chimet S.p.A., Shanxi Kaida Chemical. |

This research report on the Homogenous Catalyst Market has been segmented and sub-segmented based on product, end-use, and region.

Homogenous Catalyst Market By Product

- Platinum

- Palladium

- Rhodium

- Ruthenium

- Iridium

- Gold

- Others

The market is divided into platinum, palladium, rhodium, ruthenium, iridium, gold, and other product categories. Throughout the projection period, a respectable market share is anticipated for platinum catalysts. Its steady electrical qualities are one of the main drivers of the growth of the worldwide homogeneous catalyst market. It is a common component of processing catalysts due to its resistance to chemical reactions and the fact that it does not oxidize even at high temperatures. Because of its exceptional resistance to rust, heat, and sulphur poisoning present in gasoline and diesel engines, platinum is the precious metal most frequently used in car catalytic converters.

Homogenous Catalyst Market By End-use

- Pharmaceutical & Biomedical

- Refineries

- Agrochemicals

- Electrochemical

- Power generation

- Other Industrial

Pharmaceutical and biomedical, refineries, agrochemicals, electrochemical, power generation, and others are the market segmented based on end-use. By end-use, the worldwide homogeneous catalyst market will be dominated by the refinery end-use segment. In the upcoming years, this market sector is anticipated to grow at the fastest rate. They contribute to the optimization and cost-effective production of oil as homogenous catalysts. Numerous mainline refineries throughout Europe provide a sizable potential for market growth in the anticipated future. However, the unexpected Covid-19 outbreak has hurt the refinery industry because of the localized lockdowns, which have reduced oil consumption in the transportation sector. On the other hand, as the current situation improves, product demand is anticipated to increase.

Homogenous Catalyst Market By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Based on geography, Europe has historically dominated the market for homogeneous catalysts and is predicted to do so once more over the projected period. The automotive sector is being reinvigorated with greater manufacturing of hydrogen fuel cell vehicles as a result of growing environmental concerns, which is driving market expansion. Starting in 2021, new passenger automobiles must adhere to an emission limit of 95 grams per kilometer set by the European Union. The need for products is being increased even more by the growing healthcare sector and rising healthcare spending. On the other hand, in the next years, the market for homogeneous catalysts is anticipated to grow at the highest rate in the Asia Pacific. The automobile sector is expanding in emerging nations and rising disposable income is a key driver of global growth. On the market for homogeneous precious metal catalysts, North America is a key region despite this. One of the main factors promoting market expansion is revitalizing the automotive industry through rising demand for lightweight automobiles. Additionally, the Comprehensive Environmental Responsibility and Liability Act in the US has established precise rules for the refinement of used catalysts. The aging population and the expanding pharmaceutical sector are accelerating the market's expansion.

Homogenous Catalyst Market Share by Company

The leading companies in the global homogenous catalyst market include, among others

- BASF SE

- Evonik Industries AG

- Johnson Matthey Plc

- Heraeus Group

- Clariant International Ltd

- Umicore SA

- Alfa Aesar

- Vineeth Precious Catalysts Pvt. Ltd.

- Haldor Topsoe

- Umicore N.V.

- American Elements

- Chimet S.p.A.

- Shanxi Kaida Chemical.

NOTABLE HAPPENINGS IN THE HOMOGENOUS CATALYST MARKET IN THE RECENT PAST:

- Product Launch: The development of a sizable battery recycling black matter factory in Schwarzheide, Germany, was announced by BASF in June 2022. The location is ideal for the expansion of battery recycling activities, indicating the prevalence of multiple EV car manufacturers and cell manufactures in Central Europe. With a start date of early 2024, this investment will result in the creation of about 30 new production posts.

- Partnership: In partnership with the US government, Evonik will invest $220 million in a new triglyceride manufacturing facility for mRNA-based medications in the US in June 2022. The company will be better prepared to expand into cutting-edge mRNA-based therapies in the future beyond COVID-19 vaccines thanks to the new facility, further solidifying its position as a key strategic partner for forward-thinking pharmaceutical companies throughout the globe.

Chapter 1.HOMOGENOUS CATALYST MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Homogenous Catalyst Market MARKET – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3 Homogenous Catalyst Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Homogenous Catalyst Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. HOMOGENOUS CATALYST MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 Homogenous Catalyst Market – By Product

6.1. Platinum

6.2. Palladium

6.3. Rhodium

6.4. Ruthenium

6.5. Iridium

6.6. Gold

6.7. Others

Chapter 7.HOMOGENOUS CATALYST MARKET – End-use

7.1. Pharmaceutical & Biomedical

7.2. Refineries

7.3. Agrochemicals

7.4 Electrochemical

7.5. Power generation

7.6. Other Industrial

Chapter 9. Homogenous Catalyst Market Share- By Region

8.1. North America

8.2. Europe

8.3. Asia Pacific

8.4. Latin America

8.5. Middle East & Africa

Chapter 9. Homogenous Catalyst Market Share- by Company

9.1. BASF SE

9.2. Evonik Industries AG

9.3. Johnson Matthey Plc

9.4. Heraeus Group

9.5. Clariant International Ltd

9.6. Umicore SA

9.7. Alfa Aesar

9.8. Vineeth Precious Catalysts Pvt. Ltd

9.9. Umicore N.V.,

9.9. ., Haldor Topso

9.10. American Elements

9.11. Chimet S.p.A

9.12. Shanxi Kaida Chemical

Download Sample

Choose License Type

2500

4250

5250

6900