Home Security System Market Size (2024 – 2030)

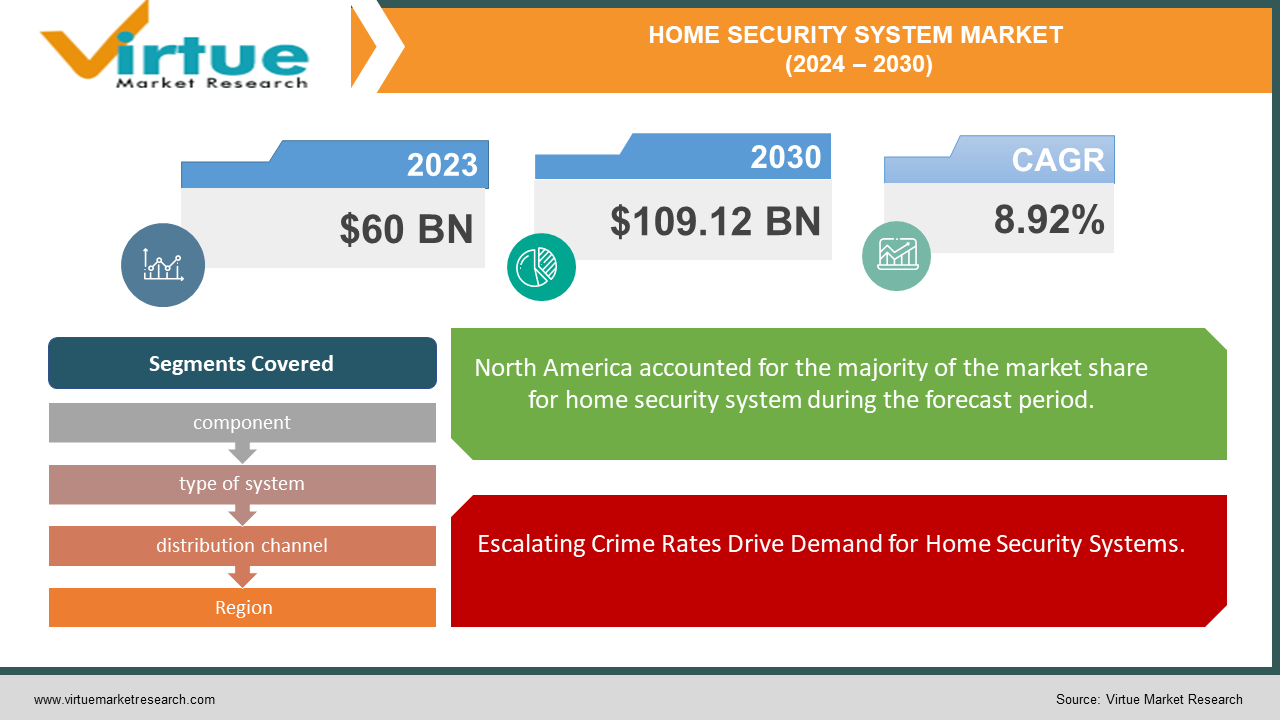

The Global Home Security System Market was valued at USD 60 billion in 2023 and is projected to reach a market size of USD 109.12 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 8.92% between 2024 and 2030.

A home security system aims to improve the safety and security of residential properties through an extensive network of interconnected devices and technology. It is made up of a number of sensors and detectors, such as smoke detectors, door and window contact sensors, motion sensors, and glass break detectors. It assists in keeping an eye on environmental changes and sets off alarms or responses to unexpected activity or crises. It sends data and alarms to mobile devices, monitoring centers, and homeowners via communication channels such as landlines, cellular networks, and Wi-Fi. When a security breach is discovered, homeowners can immediately act by receiving emails and notifications, allowing them to contact authorities or take immediate action. Strong home security systems are in high demand due to rising theft and other criminal activity rates as well as rapid urbanization. Aside from this, the market is expected to grow as a result of the incorporation of biometric technologies, such as facial and fingerprint recognition, into home security systems to improve identification and access control. Furthermore, these technologies are becoming more and more popular due to the growing need for reliable authentication techniques to stop illegal access. In addition, a number of top insurance providers are rewarding homeowners who install complete security systems with discounts on their premiums. Homeowners are being encouraged to invest in security measures by this financial incentive.

Key Market Insights:

Security cameras hold the dominant market share by component, likely exceeding 50%, due to versatility, integration, and feature advancements.

Historically, offline channels held over 60% market share, but online channels are rapidly growing, driven by DIY systems and competitive prices, approaching 50% or more in some regions.

North America holds a significant share of the global market, possibly exceeding 30%, due to high-security awareness, disposable income, and major security system players.

The Asia Pacific region shows strong growth potential, with market share potentially reaching 20-25% due to rising disposable incomes, urbanization, and increasing security concerns.

The initial COVID-19 impact included a 10-15% decrease in production due to supply chain disruptions. Increased home security focus during lockdowns led to a long-term positive impact on the market. Growth in DIY systems exceeded 20%, driven by pandemic-related demand.

Global Home Security System Market Drivers:

Escalating Crime Rates Drive Demand for Home Security Systems.

As crime rates surge in various regions, homeowners are increasingly anxious about the safety and security of their properties. This growing concern is propelling a significant uptick in the demand for advanced home security systems, which are seen as vital deterrents against burglary and other criminal activities. Modern security systems, equipped with features such as surveillance cameras, motion detectors, and smart alarms, offer homeowners peace of mind by providing real-time monitoring and swift response capabilities. The heightened awareness of potential threats has led many to invest in these technologies, not only to protect their assets but also to ensure the safety of their families. This trend underscores a broader societal shift towards prioritizing personal security and leveraging technology to mitigate risks. As a result, the home security industry is experiencing robust growth, driven by a market that increasingly values preventative measures in safeguarding their homes. This surge in demand reflects a collective response to the perceived increase in crime, highlighting a proactive stance among homeowners in fortifying their residences against potential.

Innovations in Technology Drive the Smart Home Security Industry.

Modern smart home technology integration is a major driver of the home security system market's growth. Advanced video analytics, wireless connectivity, Internet of Things (IoT) devices, and remote monitoring capabilities are just a few of the innovations that are redefining classic security systems into smart, approachable products that appeal to a wider range of customers. Thanks to these developments, different security components may now be seamlessly integrated, giving homeowners access to their systems' remote monitoring and control through smartphones and other internet-enabled devices. An unparalleled degree of convenience and protection is provided by enhanced features like real-time video feeds, automated alarms, and cognitive analytics that can distinguish between benign and suspicious actions. An unparalleled degree of convenience and protection is provided by enhanced features like real-time video feeds, automated alarms, and cognitive analytics that can distinguish between benign and suspicious actions. The advancement of technology has not only increased the effectiveness of home security systems but also made them more appealing to tech-savvy consumers and those looking for increased peace of mind. The capacity to expand and modify systems in response to specific requirements further piques customer interest and propels market expansion. The need for integrated security solutions is expected to increase as smart homes become more commonplace, highlighting how crucial technology breakthroughs will be in determining the direction of home security in the future.

Global Home Security System Market Restraints and Challenges:

The global home security system industry faces a number of obstacles that could prevent it from expanding, despite consumers' growing awareness of security issues. The initial cost is a major obstacle because, in addition to expert installation fees, building a complete security system usually entails hefty expenditures for equipment like cameras, sensors, and control panels. Budget-conscious buyers who might find the first outlay too high may be discouraged by this commitment. Furthermore, non-techies may find advanced security systems intimidating due to their complexity and abundance of functions. Over time, user irritation may result in decreased engagement or utilization due to the complex setup procedures and continuing management required for these systems. Further complicating their decision to adopt such technology, some consumers might be worried about the privacy implications of continuous surveillance and data storage. These difficulties underscore the necessity for producers and suppliers to deliver more accessible, user-friendly products along with all-encompassing assistance in order to guarantee increased market share and long-term expansion. These obstacles can be reduced by making home security systems easier to install, giving clear instructions, and providing strong customer support. This will increase the accessibility and appeal of home security systems to a larger market.

Global Home Security System Market Opportunities:

The need for increased safety among consumers and the development of technology have created a plethora of opportunities in the worldwide home security system market. The widespread adoption of smart home technologies presents a noteworthy prospect as it facilitates the easy integration of security systems with other home automation devices, thereby establishing a unified and intelligent living space. The increasing prevalence of Internet of Things (IoT) devices enables automated responses, remote access, and real-time monitoring, hence enhancing the efficiency and usability of security systems. Furthermore, there is a strong need for sophisticated security systems designed for urban living due to the growing urbanization and global expansion of smart city programs. The growing middle class and rising disposable incomes in emerging economies in places like Africa, Latin America, and Asia-Pacific provide unrealized promise. Additionally, as artificial intelligence and machine learning technologies continue to advance, home security systems will be able to provide personalized security measures and predictive analytics. Additionally, as consumers realize how important it is to protect their homes, a growing market for subscription-based security services that offer round-the-clock monitoring and support is emerging. These opportunities highlight the potential for sustained growth and innovation within the home security system market as it adapts to meet the ever-changing needs of a global consumer base.

HOME SECURITY SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.92% |

|

Segments Covered |

By component, type of system, distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., ADT Inc., Johnson Controls, Hangzhou Hikvision Digital Technology , ASSA ABLOY, SECOM Robert Bosch GmbH, United Technologies Corporation, Godrej & Boyce, Alarm.com, Allegion PLC |

Global Home Security System Market Segmentation: By component

-

electronic locks

-

security cameras

-

fire sprinklers

-

window sensors

-

door sensors

The Global Home Security System Market is Segmented by Component, Security Cameras had the largest market share last year and are poised to maintain their dominance throughout the forecast period. Security cameras are a cornerstone of home security systems, providing essential visual evidence of break-ins or suspicious activities that enable more effective responses from homeowners or security companies. Their mere presence acts as a strong deterrent to potential intruders, who are less likely to target properties with visible cameras. Beyond capturing video, modern security cameras boast versatile features such as night vision, motion detection, and remote access, enhancing their utility and appeal. They integrate seamlessly with other smart home components like smart lights and alarms, forming a comprehensive and cohesive security network. Technological advancements continuously improve their functionality, with higher image resolutions, facial recognition, and artificial intelligence (AI) capabilities, making them increasingly effective and attractive to homeowners. While sensors and control panels are also vital components, the diverse benefits and ongoing innovations in security cameras solidify their dominant position in the home security market.

Global Home Security System Market Segmentation: By type of system

-

video surveillance system

-

alarm system

-

access control system

-

fire protection system

The Global Home Security System Market is Segmented by type of system, Alarm System had the largest market share last year and is poised to maintain its dominance throughout the forecast period. With the biggest market share in the previous year and the potential to sustain this position of leadership for the duration of the forecast period, alarm systems have emerged as the dominating sector in the worldwide home security system market. This supremacy is mostly attributable to their crucial function of promptly alerting homes and security services when they detect illegal entry, fires, or the presence of carbon monoxide, so effectively discouraging invasions and guaranteeing prompt reactions to emergencies. A broad spectrum of customers, including those on a tight budget, find alarm systems attractive and accessible due to their cost-effectiveness and user-friendliness. Modern alarm systems are now far more reliable and functional thanks to technological breakthroughs. They have become more complex and appealing to tech-savvy customers thanks to features like wireless connectivity, integration with other smart home appliances, and remote monitoring capabilities. These developments improve the overall security and convenience of homes by enabling smooth control and monitoring through cell phones or other internet-enabled devices. The widespread use and ongoing development of these technologies highlight how important alarm systems are to complete home security packages. Alarm systems will continue to rule the market because of their shown efficacy, usability, and continuous improvements. They will satisfy changing customer demands and hold their top spot when it comes to home security.

Global Home Security System Market Segmentation: By distribution channel

-

Online

-

Offline

The Global Home Security System Market is Segmented by Distribution Channel, Offline had the largest market share last year. The internet component of the home security system market is growing significantly because of its convenience, pricing transparency, and the rise of do-it-yourself systems. Traditionally, offline channels have dominated the market by providing skilled installation and customized customer service. Customers who prefer hands-on assistance can develop confidence with offline businesses and security providers by offering a one-stop shop with in-person demos and expert suggestions. Online stores, on the other hand, appeal to tech-savvy customers since they provide easy access to a wider selection of products around the clock and make comparing features and costs simple. Online channels have become more appealing due to the rising popularity of self-monitored, user-friendly systems. This is especially true since a lot of online shops now offer expert installation services and extensive customer assistance via phone, chat, and video lessons. This change implies that although clients requiring individualized care will still be served by offline channels, internet channels are set to take a larger market share and may even overtake traditional sales as they meet the changing needs of contemporary consumers.

Global Home Security System Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Home Security System Market is Segmented by Region, North America had the largest market share last year. Because of their high rates of crime, rising disposable incomes, and a strong emphasis on home security, North American nations—particularly the US and Canada—now control the majority of the market for home security systems. The population's openness to new ideas and the region's superior technology infrastructure allows for the early adoption of sophisticated security solutions, including remote monitoring and smart home integration. The existence of significant international firms that make significant investments in product development and marketing also supports market expansion. However, because of growing urbanization, rising disposable incomes, and increased security concerns, the Asia Pacific region—especially China and India—is quickly becoming an important market. The need for home security systems is further fueled by government programs that encourage the development of smart cities in these areas. Even while North America now has the biggest market share, the impressive growth in the Asia Pacific area points to a possible future shift in the home security system industry toward a more evenly distributed worldwide market.

COVID-19 Impact Analysis on the Global Home Security System Market.

The market for home security systems was first severely hampered by the COVID-19 epidemic, mostly as a result of limitations and lockdowns in China, a major hub for manufacturing. The availability and sales of security systems were immediately impacted by these interruptions, which also caused supply chain problems, component shortages, and production delays. Additionally, people were reluctant to spend money on non-essential goods like home security systems during the early stages of the epidemic due to the unpredictability of the economy. But as individuals stayed at home more, their worries about security grew, which raised the need for devices that provided improved safety and remote monitoring. This change in lifestyle also contributed to the rise in popularity of DIY security systems, since social distancing policies discouraged people from choosing professional installations and instead encouraged them to choose simple, do-it-yourself options. The market has rebounded and showed endurance despite the early failures, with a persistent rise in the DIY segment and an increasing focus on home security. The pandemic's long-term effects on the home security system business seem to be favorable since increased security awareness and the adaptability of do-it-yourself systems will probably spur further expansion and innovation in the industry.

Latest Trends/ Developments:

Artificial intelligence (AI)-powered technologies like facial recognition, object identification, and anomaly recognition are propelling substantial developments in the home security system market by improving automation and security. Algorithms that leverage machine learning are enhancing the precision of motion detection and personalizing user interfaces. Security systems are becoming more and more integrated with doorbells, lighting, thermostats, and other components of smart home ecosystems to provide an all-encompassing automation and security experience. Tech-savvy consumers find DIY systems especially appealing because they are simple to install and use, and because internet sellers provide self-installation tools and low rates, DIY systems are becoming more and more popular. Businesses are prioritizing cybersecurity issues as systems grow increasingly linked, with a focus on secure communication methods and data encryption. The market's responsiveness to a variety of customer needs is also seen in the growing emphasis on solutions designed for elderly and child monitoring, such as remote monitoring features for children's safety and fall detection and medication reminders for elders.

Key Players:

-

Honeywell International Inc.

-

ADT Inc.

-

Johnson Controls

-

Hangzhou Hikvision Digital Technology

-

ASSA ABLOY

-

SECOM

-

Robert Bosch GmbH

-

United Technologies Corporation

-

Godrej & Boyce

-

Alarm.com

-

Allegion PLC

Chapter 1. Home Security System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Home Security System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Home Security System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Home Security System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Home Security System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Home Security System Market – By component

6.1 Introduction/Key Findings

6.2 electronic locks

6.3 security cameras

6.4 fire sprinklers

6.5 window sensors

6.6 door sensors

6.7 Y-O-Y Growth trend Analysis By component

6.8 Absolute $ Opportunity Analysis By component, 2024-2030

Chapter 7. Home Security System Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Offline

7.3 Online

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Home Security System Market – By type of system

8.1 Introduction/Key Findings

8.2 video surveillance system

8.3 alarm system

8.4 access control system

8.5 fire protection system

8.6 Y-O-Y Growth trend Analysis By type of system

8.7 Absolute $ Opportunity Analysis By type of system , 2024-2030

Chapter 9. Home Security System Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By component

9.1.3 By Distribution Channel

9.1.4 By type of system

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By component

9.2.3 By Distribution Channel

9.2.4 By type of system

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By component

9.3.3 By Distribution Channel

9.3.4 By type of system

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By component

9.4.3 By Distribution Channel

9.4.4 By type of system

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By component

9.5.3 By Distribution Channel

9.5.4 By type of system

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Home Security System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Honeywell International Inc.

10.2 ADT Inc.

10.3 Johnson Controls

10.4 Hangzhou Hikvision Digital Technology

10.5 ASSA ABLOY

10.6 SECOM

10.7 Robert Bosch GmbH

10.8 United Technologies Corporation

10.9 Godrej & Boyce

10.10 Alarm.com

10.11 Allegion PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Home Security System market is expected to be valued at US$ 60 billion.

Through 2030, the global Home Security System market is expected to grow at a CAGR of 8.92%.

By 2030, the global Home Security System is expected to grow to a value of US$ 109.12 billion.

North America is predicted to lead the market globally for Home Security Systems.

The global Home Security System has segments like Type of system, component, distribution channel, and Region.