Home Projector/Consumer Projector Market Size (2024 – 2030)

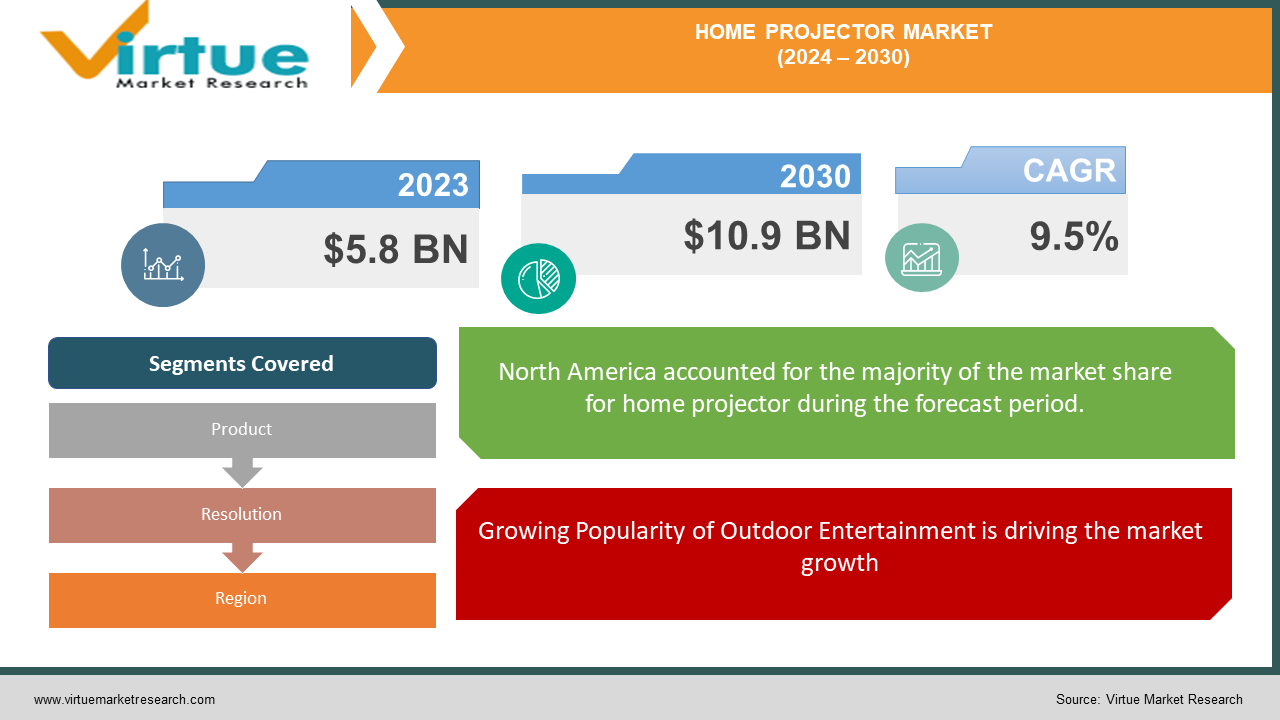

The Global Home Projector/Consumer Projector Market was valued at USD 5.8 billion in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030, reaching USD 10.9 billion by 2030.

The market encompasses a range of projectors designed for consumer use in home entertainment, education, and business applications. Home projectors serve as versatile devices capable of displaying large-screen content with high resolution and clarity, catering to the growing demand for immersive viewing experiences. Technological advancements such as 4K resolution, HDR (High Dynamic Range), and laser light sources continue to drive market growth, enhancing the visual quality and performance of projectors.

Key Market Insights

Continuous advancements in projector technology, such as the adoption of 4K resolution, HDR (High Dynamic Range), and laser light sources, are driving market growth. These technologies enhance image quality and improve user experience, particularly in home entertainment settings.

Increasing consumer spending on home entertainment systems, coupled with the trend towards creating immersive home theaters, is fueling the demand for home projectors. The versatility of projectors in displaying large-screen content for movies, gaming, and sports at home is a significant factor contributing to market expansion.

There is a growing preference for portable and compact projector models, driven by the need for flexibility and convenience. These projectors cater to consumers who seek easy setup and use both indoors and outdoors for various entertainment and presentation purposes.

Integration of smart features such as wireless connectivity, built-in streaming apps, and voice control capabilities is becoming prevalent in consumer projectors, enhancing their appeal and usability in smart home environments

Global Home Projector/Consumer Projector Market Drivers

Increasing Demand for Home Entertainment Solutions is driving the market growth: The primary driver for the global home projector market is the escalating demand among consumers for advanced home entertainment solutions. Projectors offer a compelling alternative to traditional large-screen TVs by providing a cinematic experience within the comfort of home settings. This trend is fueled by consumers' desire to recreate the immersive theater experience, characterized by larger-than-life visuals and enhanced sound quality. Unlike TVs, projectors enable users to enjoy content on significantly larger screens, making them ideal for viewing movies, sports events, and gaming with friends and family. Moreover, the affordability of projectors compared to large-screen TVs appeals to budget-conscious consumers looking to upgrade their home entertainment systems without breaking the bank. As technology continues to improve, projectors are becoming more compact, easier to install, and capable of delivering sharper images and richer colors, further enhancing their appeal in the home entertainment market.

Technological Advancements are driving the market growth: Continuous innovations in projector technology are pivotal in driving market growth. Manufacturers are constantly improving image resolution, brightness levels, and color accuracy to deliver superior viewing experiences. The shift towards 4K resolution projectors has been particularly significant, as it allows for clearer and more detailed images, making it ideal for watching high-definition content. Additionally, the adoption of laser light sources in projectors has revolutionized the industry by offering a longer lifespan, lower maintenance costs, and superior color reproduction compared to traditional lamp-based projectors. Laser projectors also provide consistent brightness over their lifespan, ensuring optimal viewing conditions even in well-lit environments. These technological advancements not only cater to the growing demand for high-quality visual experiences but also contribute to the overall competitiveness of projectors in the home entertainment market.

Growing Popularity of Outdoor Entertainment is driving the market growth: There is a noticeable surge in the popularity of outdoor entertainment setups, driven by social gatherings, sports events, and movie screenings held in open spaces. Portable projectors equipped with features like battery operation and wireless connectivity have played a crucial role in facilitating this trend. These projectors allow users to effortlessly set up large-screen projections in various outdoor environments, enhancing the versatility and utility of home entertainment systems. Whether used for backyard movie nights, outdoor parties, or public screenings, portable projectors provide flexibility and convenience, enabling users to enjoy immersive visual experiences outside traditional indoor settings. The ability to wirelessly connect to smartphones, tablets, and streaming devices further enhances their appeal, making outdoor entertainment more accessible and enjoyable for a wider audience. As outdoor leisure activities continue to gain traction, portable projectors are expected to maintain strong growth momentum in the consumer market, catering to the evolving preferences of entertainment enthusiasts worldwide.

Global Home Projector/Consumer Projector Market Challenges and Restraints

Price Sensitivity is restricting market growth: High upfront costs associated with premium home projector models present a significant challenge, particularly in price-sensitive markets. While projectors offer the advantage of creating large-screen displays at a fraction of the cost compared to equivalent-sized TVs, the initial investment required for high-end projector models can deter budget-conscious consumers. Factors contributing to the high costs include advanced features such as 4K resolution, HDR support, and laser light sources, which enhance viewing experiences but also increase product prices. In emerging markets and among consumers with limited discretionary income, affordability remains a critical consideration. The price gap between entry-level projectors and mid-to-high-end models further complicates adoption, as lower-priced options may lack the desired features or image quality, while premium models are often perceived as too expensive. Moreover, ongoing costs associated with maintenance, replacement lamps, and additional accessories can contribute to the overall cost of ownership, further impacting affordability considerations for prospective buyers.

Competition from Large-Screen TVs is restricting the market growth: The home projector market faces intense competition from large-screen TVs equipped with advanced display technologies like OLED (Organic Light Emitting Diode) and QLED (Quantum Dot LED). Unlike projectors, which require a dedicated projection surface and installation setup, TVs offer convenience in terms of installation and maintenance. This inherent ease of use appeals to consumers seeking hassle-free home entertainment solutions without the need for additional accessories or adjustments. Large-screen TVs also benefit from their ability to deliver high-resolution images and vibrant colors directly on a flat screen, eliminating concerns related to image quality degradation or ambient light interference that can affect projector performance. Moreover, advancements in TV technology, such as ultra-thin designs and integrated smart features, further enhance their appeal in modern home environments where aesthetics and functionality play crucial roles.

Market Opportunities

The global home projector market is ripe with opportunities for strategic growth and innovation. One key opportunity lies in expanding product offerings to include enhanced smart features that align with the increasing consumer demand for connected home entertainment devices. Integrating features such as built-in streaming apps, voice control capabilities, and compatibility with smart home ecosystems can significantly enhance user experience and differentiate projector offerings in the competitive market landscape. Moreover, there is substantial potential for market penetration in emerging economies by developing and promoting more affordable projector models tailored to local preferences and purchasing power. By addressing price sensitivity and adapting product designs to meet specific regional needs, projector manufacturers can effectively broaden their customer base and capture new market segments. The rise of hybrid work and learning environments further expands opportunities for projectors designed for home offices and educational purposes. These settings demand versatile, high-performance projectors capable of supporting presentations, video conferencing, and multimedia content delivery with ease. Manufacturers can capitalize on this trend by developing projectors with advanced connectivity options, robust security features, and ergonomic designs that enhance productivity and facilitate seamless transitions between work and leisure activities. Furthermore, forming strategic partnerships with content providers and streaming platforms represents another avenue for growth. By optimizing projector performance for streaming services, enhancing content accessibility, and improving integration with popular platforms, manufacturers can enhance product appeal, foster consumer engagement, and reinforce brand loyalty in an increasingly digital and content-driven market environment.

HOME PROJECTOR/CONSUMER PROJECTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.5% |

|

Segments Covered |

By Product, Resolution, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Epson, Sony, Optoma, BenQ, LG Electronics, ViewSonic, Panasonic, Acer, NEC Display Solutions, Christie Digital Systems |

Home Projector/Consumer Projector Market Segmentation - By Product

-

LCD Projectors

-

DLP Projectors

-

Laser Projectors

-

LED Projectors

Laser projectors stand out as the most dominant segment in the market, prized for their exceptional brightness, precise color reproduction, and extended operational lifespan compared to conventional lamp-based alternatives. These projectors utilize laser light sources that deliver consistent performance over time, making them ideal for both residential and commercial applications where image quality and reliability are paramount. Their superiority lies in maintaining optimal viewing conditions even in well-lit environments, offering users enhanced visual experiences across various settings. As a result, laser projectors continue to drive significant adoption and innovation within the global home and consumer projector market.

Home Projector/Consumer Projector Market Segmentation - By Resolution

-

HD (720p and 1080p)

-

4K

-

8K

-

3D

4K projectors are asserting dominance within the market due to rising consumer preferences for superior image quality and immersive cinematic experiences in home entertainment. With their ability to deliver high-resolution visuals that enhance viewing pleasure, 4K projectors cater to a growing demand for sharper details and vibrant colors. This trend reflects a shift towards more advanced display technologies among consumers seeking to replicate theater-quality experiences within their residences. As a result, 4K projectors are poised to continue driving market growth, supported by ongoing innovations in visual technology and increasing affordability, making them a preferred choice for discerning home entertainment enthusiasts.

Home Projector/Consumer Projector Market Segmentation - Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the global home projector market, fueled by high consumer spending on home entertainment systems, early technology adoption, and a strong presence of key market players. The region's inclination towards creating home theaters and the popularity of outdoor entertainment contribute significantly to its dominant position in the market.

COVID-19 Impact Analysis on the Home Projector Market

The COVID-19 pandemic acted as a catalyst for the widespread adoption of home projectors, spurred by increased time spent at home and a heightened desire for enhanced entertainment options. As restrictions on theaters and social gatherings forced consumers to seek alternatives, there was a notable surge in demand for home entertainment solutions, particularly projectors. Consumers invested in upgrading their home setups to recreate immersive cinematic experiences, driving significant sales of high-resolution and portable projector models. Despite initial challenges such as supply chain disruptions and manufacturing delays, which temporarily hindered market growth, the resilience of the market became evident as economies began to reopen. Continued innovation in product offerings, including advancements in visual technology and features like wireless connectivity and smart capabilities, further fueled market recovery. Moreover, the shift towards hybrid work and learning environments bolstered the adoption of projectors for professional and educational purposes, expanding their utility beyond leisure activities. Overall, the COVID-19 pandemic not only accelerated the adoption of home projectors but also underscored their versatility and resilience in meeting evolving consumer needs for both entertainment and productivity in the home environment.

Latest Trends/Developments

The home projector market is undergoing dynamic changes driven by several key trends. Smart projectors equipped with integrated streaming services and voice control capabilities are becoming increasingly popular, offering enhanced convenience and connectivity within smart home environments. This trend reflects a growing consumer preference for seamless integration and easy access to digital content. Simultaneously, portable projectors with features like battery operation and compact designs are gaining traction, particularly for outdoor and mobile entertainment scenarios. These projectors cater to consumers' desire for flexibility and on-the-go usability, enabling them to enjoy large-screen experiences in diverse settings beyond traditional indoor environments. Advancements in laser projection technology are another significant trend shaping the market. These innovations are improving brightness levels and color accuracy, enhancing overall projector performance, and ensuring consistent image quality even in well-lit conditions. Laser projectors are increasingly favored for their longevity and maintenance benefits compared to traditional lamp-based models. Furthermore, collaborations between projector manufacturers and content providers are optimizing viewing experiences for streaming services and live events. By tailoring projector capabilities to better integrate with popular platforms, manufacturers are meeting consumer demands for immersive and high-quality home entertainment solutions. Overall, these trends underscore the evolving landscape of the home projector market, where technological innovation, consumer preferences for connectivity and mobility, and partnerships with content providers play pivotal roles in driving market growth and enhancing user experiences.

Key Players

-

Epson

-

Sony

-

Optoma

-

BenQ

-

LG Electronics

-

ViewSonic

-

Panasonic

-

Acer

-

NEC Display Solutions

-

Christie Digital Systems

Chapter 1. Home Projector/Consumer Projector Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Home Projector/Consumer Projector Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Home Projector/Consumer Projector Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Home Projector/Consumer Projector Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Home Projector/Consumer Projector Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Home Projector/Consumer Projector Market – By Product

6.1 Introduction/Key Findings

6.2 LCD Projectors

6.3 DLP Projectors

6.4 Laser Projectors

6.5 LED Projectors

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Home Projector/Consumer Projector Market – By Resolution

7.1 Introduction/Key Findings

7.2 HD (720p and 1080p)

7.3 4K

7.4 8K

7.5 3D

7.6 Y-O-Y Growth trend Analysis By Resolution

7.7 Absolute $ Opportunity Analysis By Resolution, 2024-2030

Chapter 8. Home Projector/Consumer Projector Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Resolution

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Resolution

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Resolution

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Resolution

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Resolution

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Home Projector/Consumer Projector Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Epson

9.2 Sony

9.3 Optoma

9.4 BenQ

9.5 LG Electronics

9.6 ViewSonic

9.7 Panasonic

9.8 Acer

9.9 NEC Display Solutions

9.10 Christie Digital Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Home Projector/Consumer Projector Market was valued at USD 5.8 billion in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030, reaching USD 10.9 billion by 2030.

The primary drivers include increasing demand for home entertainment solutions, technological advancements in projector technology, and the growing popularity of outdoor entertainment setups.

Segments include product types (LCD, DLP, laser, LED) and application types (HD, 4K,8K, 3D).

North America is the dominant region due to high consumer spending on home entertainment, early technology adoption, and a strong market presence of key players.

Leading players include Epson, Sony, Optoma, BenQ, LG Electronics, ViewSonic, Panasonic, Acer, NEC Display Solutions, and Christie Digital Systems.