Home Entertainment Devices Market Size (2025 – 2030)

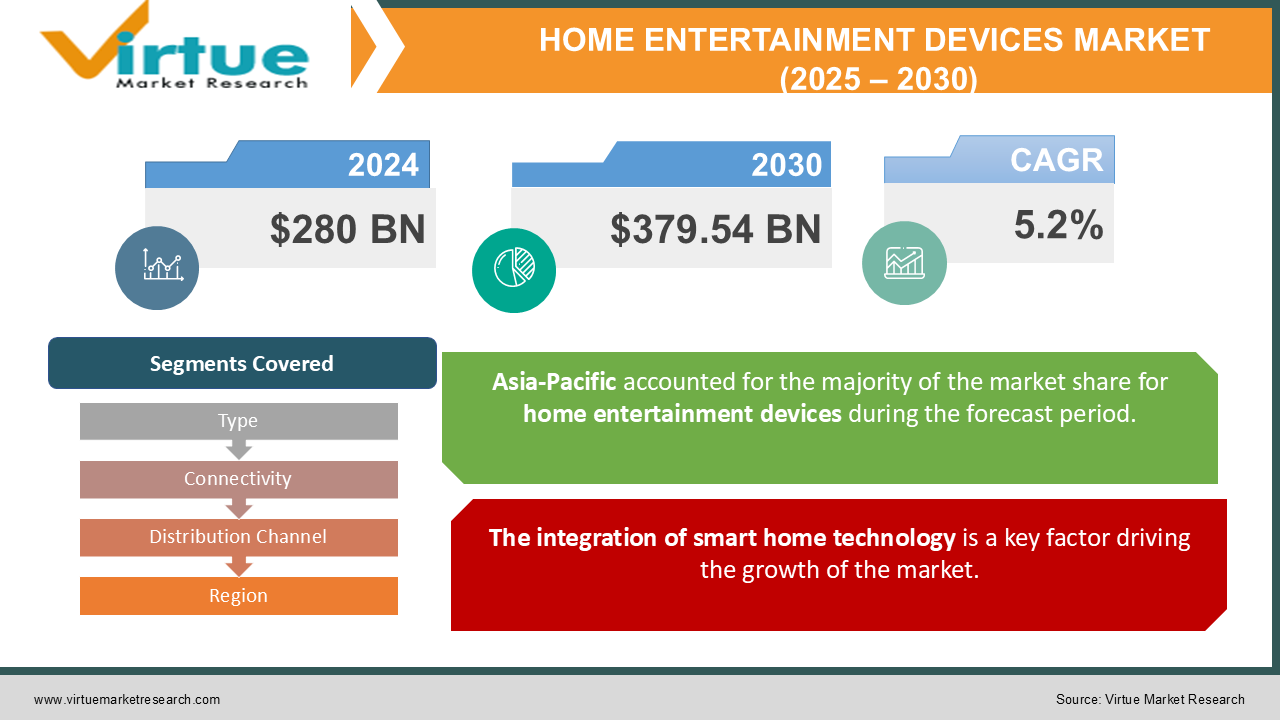

The Home Entertainment Devices Market was valued at USD 280 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 379.54 billion by 2030, growing at a CAGR of 5.2%.

Home entertainment products, including audio systems, radios, headphones, DVD players, televisions, and gaming consoles, have been experiencing a notable rise in demand among consumers. This trend can be attributed to factors such as growing disposable income, swift urban development, evolving lifestyles, and an expanding middle-class population. In emerging markets like India, China, Brazil, South Korea, and Japan, disposable income has been increasing significantly, which in turn has driven the demand for premium products like home entertainment devices.

Key Market Insights:

- The growing popularity of gaming consoles, such as PlayStation, Xbox, and Nintendo Switch, has significantly contributed to the expansion of the market. As a result, the gaming console segment is projected to represent nearly 12% of the total market share by 2030. These consoles provide highly immersive gaming experiences, featuring top-notch graphics, sophisticated gameplay, and cutting-edge features.

- The demand for diverse, high-performance gaming options has been a key factor in driving the adoption and sales of these systems. Meanwhile, home entertainment systems have been designed to replicate the cinematic experience at home, utilizing advanced audio and video equipment for high-resolution output. These devices are increasingly becoming essential in households globally, driven by rising living standards and growing disposable incomes.

Home Entertainment Devices Market Drivers:

The integration of smart home technology is a key factor driving the growth of the market.

Voice-activated assistants, smart speakers, and home automation systems significantly enhance convenience by allowing users to easily control and customize their audiovisual experiences. This integration transforms home entertainment by creating a modern, immersive environment that is tailored to individual preferences. The growth of the market is largely driven by the seamless incorporation of smart home technology, which merges entertainment systems with advanced features to improve accessibility and overall enjoyment for consumers.

Home Entertainment Devices Market Restraints and Challenges:

The high cost of home entertainment devices poses a challenge to market growth.

Asia-Pacific is home to a highly price-sensitive consumer base, presenting significant opportunities for emerging market players. In India, electronics manufacturers are focusing on providing quality products at competitive prices. For example, Xiaomi Corporation recently launched a range of home entertainment devices in the Indian market, including televisions, mobile phones, headphones, audio systems, and speakers, all of which have gained widespread popularity. The company offers reliable, feature-rich products at affordable prices, catering to the demand for cost-effective home entertainment solutions.

Home Entertainment Devices Market Opportunities:

The growing use of streaming services presents new opportunities in the market.

Streaming platforms such as Netflix, Disney+, Amazon Prime Video, and Hulu, with their convenience, affordability, and extensive content libraries, cater to a wide range of consumer preferences, driving the growing demand for digital entertainment experiences. This growth fosters heightened competition and innovation within the industry, opening up substantial opportunities for the consumption of home entertainment.

For example, the New York State Energy Research and Development Authority (NYSERDA) reports that integrating smart technologies and real-time energy management systems can lead to average cost savings of 15%. Additionally, this integration enhances financial performance by creating an ecosystem that reduces energy waste, offering substantial economic benefits while promoting sustainability and efficiency.

HOME ENTERTAINMENT DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, Connectivity, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sony Corporation, Panasonic Corporation Xiaomi Corporation LG Electronics Inc., Microsoft Corporation Bose Corporation, Apple Inc., Haier Inc., Samsung Electronics Co. Ltd., Mitsubishi Electric Corporation |

Home Entertainment Devices Market Segmentation: By Type

-

Audio Device

-

Video Device

-

Gaming Console

The demand for video devices is anticipated to rise significantly in the near future, driven by the increasing popularity of watching movies, original content, gaming, and other home entertainment activities. Consumers are increasingly favoring visual entertainment, and the growth of internet services along with the incorporation of smart features in video devices are key factors contributing to this segment's expansion.

Similarly, the audio device market is also expected to experience notable growth. Audio devices such as soundbars, home theaters, and speakers, which enhance sound quality for events like social gatherings, birthday parties, and other celebrations, are likely to drive market growth in the coming years.

Home Entertainment Devices Market Segmentation: By Connectivity

-

Wired Device

-

Wireless Device

The wireless devices segment is expected to grow at a faster rate due to their convenience and compact size, as they eliminate the need for wires. Additionally, the growing adoption of newer technologies by consumers is driving the demand for wireless devices. As the electronics industry increasingly focuses on producing more compact products for user convenience, more people are opting for wireless solutions.

Home Entertainment Devices Market Segmentation: By Distribution Channel

-

Store-Based Retail

-

Online Retail

The store-based retail segment continues to hold a significant market share, as many consumers still prefer purchasing electronic products from physical stores like hypermarkets and specialty shops. This preference is largely due to the trust and satisfaction associated with the tactile experience of shopping in-store. However, online retailing is experiencing rapid growth, driven by the convenience it offers. Online retail is expected to see the highest compound annual growth rate (CAGR) over the forecast period, as consumers increasingly adopt e-commerce due to their busier lifestyles and the ease of online shopping. Additionally, digital platforms like Amazon and Flipkart have gained consumer trust, thanks to their user-friendly policies, such as easy returns and quick refunds. As a result, consumers are increasingly purchasing home entertainment devices with just a few clicks from the comfort of their homes, offices, or other locations. These advantages contribute to the continued expansion of online retail.

Home Entertainment Devices Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia Pacific region is projected to be the fastest-growing market for home entertainment devices, driven by the rising consumption of consumer electronics and appliances. Key macro factors contributing to this growth include increasing disposable incomes, a growing middle-class population, the adoption of advanced technologies, and decreasing electronics prices. Additionally, technological advancements and favorable government policies in emerging markets like India are positively influencing the market. The rollout of 4G/LTE networks and the Internet of Things (IoT) in India are further accelerating demand for electronics, which is expected to drive the home entertainment devices market. Government initiatives like the Smart City and Digital India programs are encouraging the adoption of smart devices and technologies. Furthermore, China holds a 40% share of the global electronics market, further supporting growth in the region.

Europe is also a significant market for home entertainment devices, ranking as the second-largest market after Asia Pacific. The region’s growth is primarily driven by rising disposable incomes and the availability of products at more affordable prices. Additionally, the increasing adoption of IoT-connected devices is expected to further stimulate market growth. Germany is anticipated to hold the largest market share in Europe, with the demand for subscription video-on-demand (SVOD) services rising. The growing interest in digital gaming, particularly among millennials, is also expected to fuel market expansion.

COVID-19 Pandemic: Impact Analysis

The gathering of large groups in specific locations has caused disruptions in events, from major occasions like the Tokyo Olympics to everyday activities such as grocery shopping. Public spaces like malls, parks, and auditoriums have been affected, leading to the cancellation of significant events for extended periods. In response, technology has played a crucial role, enabling people to stay connected through virtual platforms.

According to a survey by 6Connex, Inc., the number of virtual events surged by 1,000% since the beginning of 2020, with more than 52,000 events and sub-events hosted on virtual event platforms in recent months. Many webinar platforms, including Virtual Show, Adobe Connect, Accelevents, and On24, have experienced unprecedented growth. However, emerging virtual event platforms still face fierce competition from industry giants like YouTube and Zoom.

Latest Trends/ Developments:

October 2023: Sony Corporation launched the Pulse Explorer wireless earbuds, featuring lossless PlayStation link technology and ultra-low latency mode, along with AI-powered noise cancellation for an enhanced listening experience.

August 2023: Koninklijke Philips N.V. unveiled the Philips TAB7007 soundbar, which includes a 2.1-channel wireless subwoofer for multidimensional audio and two front-firing speakers for a surround sound effect.

July 2023: Toshiba Corporation released the M650 TV, equipped with Mini LED technology and the REGZA Engine ZR for an enhanced viewing experience. It also features a Dolby Atmos-powered dedicated subwoofer for a three-dimensional sound experience.

June 2023: Apple, Inc. introduced the Apple Vision Pro, a spatial computer designed to seamlessly integrate digital content with the physical world. The device creates a three-dimensional user interface controlled by eyes, hands, and voice, featuring a spatial operating system for a smooth interaction experience.

Key Players:

These are top 10 players in the Home Entertainment Devices Market :-

-

Sony Corporation

-

Panasonic Corporation

-

Xiaomi Corporation

-

LG Electronics Inc.

-

Microsoft Corporation

-

Bose Corporation

-

Apple Inc.

-

Haier Inc.

-

Samsung Electronics Co. Ltd.

-

Mitsubishi Electric Corporation

Chapter 1. Home Entertainment Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Home Entertainment Devices Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Home Entertainment Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Home Entertainment Devices Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Home Entertainment Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Home Entertainment Devices Market – By Type

6.1 Introduction/Key Findings

6.2 Audio Device

6.3 Video Device

6.4 Gaming Console

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Home Entertainment Devices Market – By Connectivity

7.1 Introduction/Key Findings

7.2 Wired Device

7.3 Wireless Device

7.4 Y-O-Y Growth trend Analysis By Connectivity

7.5 Absolute $ Opportunity Analysis By Connectivity, 2024-2030

Chapter 8. Home Entertainment Devices Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Store-Based Retail

8.3 Online Retail

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Home Entertainment Devices Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Connectivity

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Connectivity

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Connectivity

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Connectivity

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Connectivity

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Home Entertainment Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sony Corporation

10.2 Panasonic Corporation

10.3 Xiaomi Corporation

10.4 LG Electronics Inc.

10.5 Microsoft Corporation

10.6 Bose Corporation

10.7 Apple Inc.

10.8 Haier Inc.

10.9 Samsung Electronics Co. Ltd.

10.10 Mitsubishi Electric Corporation

10.11 Meril Life Sciences Pvt. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growing popularity of gaming consoles, such as PlayStation, Xbox, and Nintendo Switch, has significantly contributed to the expansion of the market. As a result, the gaming console segment is projected to represent nearly 12% of the total market share by 2030.

The top players operating in the Home Entertainment Devices Market are - Sony Corporation, Panasonic Corporation, Xiaomi Corporation, LG Electronics Inc., Microsoft Corporation and Bose Corporation.

The gathering of large groups in specific locations has caused disruptions in events, from major occasions like the Tokyo Olympics to everyday activities such as grocery shopping. Public spaces like malls, parks, and auditoriums have been affected, leading to the cancellation of significant events for extended periods. In response, technology has played a crucial role, enabling people to stay connected through virtual platforms.

Streaming platforms such as Netflix, Disney+, Amazon Prime Video, and Hulu, with their convenience, affordability, and extensive content libraries, cater to a wide range of consumer preferences, driving the growing opportunities for digital entertainment experiences.

Asia-Pacific is the fastest-growing region in the Home Entertainment Devices Market.