Global Home Decorative Material Market Size (2024 – 2030)

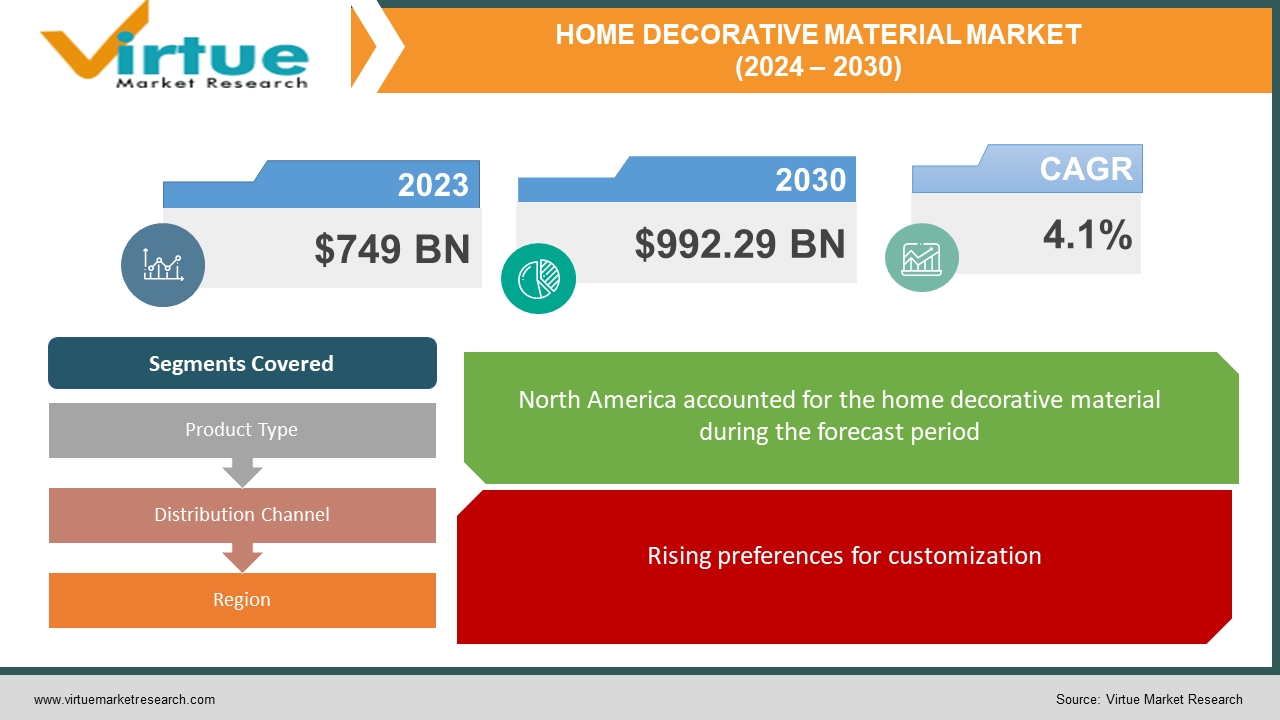

The Global Home Decorative Material Market was valued at USD 749 billion in 2023 and is projected to reach a market size of USD 992.29 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 4.1%.

Home decor products like furniture and textiles are set up across multiple settings, constituting spas, offices, clean rooms, restaurants, camping, bedrooms, the outdoors, the library, and stores. Home decor items involve multiple products such as furniture, home textiles, and floor coverings. Depending on end use, furniture designs can be altered through machine-based processes and handcrafting. The developing real estate industry is propelling the growth of the global home decor market in the current situation. Furthermore, the rise in the number of small houses has supported the use of products with facilities for additional storage and enhanced the aesthetical appearance of homes. Additionally, the rise in popularity of eco-friendly home decor products among customers, due to increased environmental issues, significantly adds to the growth of the global market.

Key Market Insights:

-

The recent trend represents that people are giving more significance to environmentally friendly and healthy home decor products as customers have become educated and researched the environmental indicators. They also focus on the safety of the decoration materials and want to be sure that human health and the environment are well protected throughout the product's construction.

-

Smart homes and advanced electrical components are also growing in demand. Home decor product sales have escalated, and consumers have slowly started preferring online channels for buying products, particularly after the pandemic. It has opened up space for small home decor furnishing brands. The market is becoming more in demand due to enhanced industrialization and urbanization.

-

One of the elements that are widening the market is the growing disposable income of the people due to the urbanization method, which also enhanced the number of households. There is also the demand for customized and unique home interiors with alterations in consumer lifestyles and choices. All these forces are eventually influencing the home decor furnishing market.

Global Home Decorative Material Market Drivers:

-

Rising preferences for customization

The escalating demand for decor items for homes due to the modifying preferences of individuals is supporting the development of the market. Parallel to this, rising preferences for personalized and aesthetically pleasing interior designs among the masses across the world. Additionally, people are extensively seeking unique and customized decor items that represent their personality and style. Besides this, the increasing stress on handmade and artisanal decor products is impelling the market development. In addition, the growing demand for decor items that are manufactured from sustainable materials is providing a positive market outlook. Apart from this, the accelerating demand for decor products on account of the rising social media influence on people is bolstering the market enhancement. Moreover, various social media platforms showcase inspiring interior designs, encouraging individuals to buy similar decor elements. Moreover, the widened adoption of decor items with minimalist designs, vintage aesthetics, or environmentally friendly alternatives is contributing to the market growth.

- Growing focus on health and wellness

Health-conscious consumers are choosing home decor items made from natural and sustainable materials. Additionally, people are opting for materials like bamboo, reclaimed wood, organic cotton, and sustainable paints as they lower exposure to harmful chemicals and promote a healthier indoor ambiance. Apart from this, the biophilic design approach initiates natural elements like plants, natural light, and natural textures into interior spaces. Biophilic design is called to reduce stress and enhance overall well-being. In addition, the rising need for ergonomics and comfortable products among consumers is propelling the market growth. Also, there is a rise in the demand for furniture and accessories that are made to support good posture and lower physical strain. Moreover, circadian lighting systems, which mimic natural daylight patterns, aid in regulating sleep patterns and enhance mood. In line with this, smart lighting control systems permit customized lighting experiences. Moreover, decor items involve storage solutions and furniture designs that encourage tidiness and reduce visual clutter.

Global Home Decorative Material Market Restraints and Challenges:

-

Rising Cost of Raw Materials

Suppliers of raw materials are significant in the home decor industry. The availability of high-quality wood is also restricted due to strict controls placed on manufacturing and importing natural materials like wood, which affects the uptake of home decor products. Due to the major demand created by industries like footwear and textiles, the requirement for leather is considerable. On the other hand, there is a limited amount of leather. The market's growth is affected by the growing cost of raw materials brought on by these factors.

Global Home Decorative Material Market Opportunities:

-

Rising integration of smart technology

Integration of smart technology in decor products helps in offering enhanced experiences to individuals. Additionally, it offers better convenience and control. Homeowners can manage several aspects of their living environment with ease, varying from lighting and thermostats to voice-activated assistants and motorized window shades. This level of control advantages in increasing comfort and efficiency. Apart from this, smart decor items add to energy efficiency by permitting users to monitor and optimize energy consumption. Smart lighting systems can automatically monitor brightness based on natural light levels, reducing electricity usage and lowering energy bills. Moreover, smart technology facilitates personalization and permits users to customize lighting colors, brightness levels, and patterns to suit their mood or occasion. In addition, voice-activated assistants provide customized assistance and information. Smart decor items often include security features like linked cameras, doorbell cameras, and smart locks. These enhance home security and give peace of mind to homeowners, permitting them to monitor their properties remotely.

HOME DECORATIVE MATERIAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ashley Furniture Industries Inc., Duresta Upholstery Ltd., Forbo Holding AG, Hanssem Co. Ltd., Herman Miller Inc., Inter IKEA Systems B.V., Kimball International Inc. (HNI Corporation), Koninklijke Philips N.V., Mannington Mills Inc., Mohawk Industries Inc. |

Global Home Decorative Material Market Segmentation: By Product Type:

-

Home Furniture

-

Home Textiles

-

Flooring

-

Wall Decor

-

Lighting

-

Others

Home furniture dominates the market owing to its market share. Home furniture consists of numerous items, such as sofas, chairs, tables, beds, cabinets, and other furniture pieces, used for functional and decorative purposes. Proving this, people are increasingly boosting high-quality furniture to increase the aesthetics and functionality of their homes. Home Textiles holds a wide range of products, including curtains, drapes, bedding, cushions, rugs, and towels. These pieces add texture, color, and warmth to interior spaces. Additionally, the widening demand for attractive home textiles among individuals is pushing the market growth.

Global Home Decorative Material Market Segmentation: By Distribution Channel:

-

Home Decor Stores

-

Supermarkets and Hypermarkets

-

Online Store

-

Gift Shops

-

Others

Home decor stores hold the biggest market share. Home decor stores are retail outlets that particularly sell decor products. These stores provide a wide selection of furniture, textiles, wall decor, and lighting, permitting individuals to physically inspect and purchase items. They also provide expert advice and design consultations to aid people make informed choices.

Supermarkets and hypermarkets have different categories for decor products. These stores offer convenience and approachability, making it easy for shoppers to pick up decor items while doing their day-to-day grocery shopping. While the selection may be more restricted as compared to specialized decor stores, they reach a broad consumer seeking cost-friendly alternatives.

Global Home Decorative Material Market Segmentation: By Region:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the market, accounting for the biggest home decor market share. As per the report, North America accounted for the largest market share owing to the rising emphasis on interior design and home improvement solutions among individuals. In line with this, the rising desire to create aesthetically appealing and comfortable living environments is encouraging the growth of the market. Furthermore, the presence of well-established online retail platforms that give away wide selections of decor products is bolstering the market growth. Besides this, the existence of key manufacturers, retailers, and designers in the region is propelling the market growth.

COVID-19 Impact Analysis on the Global Home Decorative Material Market:

The outbreak of COVID-19 posed crucial challenges in all sectors including the Global Home Decorative Material sector across the globe. It has resulted in the negative growth of the Global Home Decorative Material services as supply chain disruptions due to trade regulations and restrictions affected the product demand.

Latest Trends:

- Rising e-commerce sector and social media influence

The home decor furnishing market is expected to grow due to the growing influence of social media and the growth in the penetration of the e-commerce sector. Also, there is a rise in people's disposable income coupled with rapid urbanization. Furthermore, construction activities have also risen, and the millennial and Gen-Z population is also widening. These factors will propel the market in the estimated period. Also, in this sophisticated and chaotic lifestyle, people want to bring comfort and aesthetics to their homes. Social media has made decor more cost-effective and accessible and thus aided people express their style and spaces despite the budget. The millennial and Gen-Z populations are tech-savvy, and mostly into social media. Recent trends suggest that social media culture will continue to be significant in shaping home décor product trends. Social media has given the stage for interior designers to present their work all across the world. Leading social media platforms such as Pinterest, Instagram, and Houzz have offered these designers to share their designs globally and inspire people to design their living spaces and homes.

Key Players:

-

Ashley Furniture Industries Inc.

-

Duresta Upholstery Ltd.

-

Forbo Holding AG

-

Hanssem Co. Ltd.

-

Herman Miller Inc.

-

Inter IKEA Systems B.V.

-

Kimball International Inc. (HNI Corporation)

-

Koninklijke Philips N.V.

-

Mannington Mills Inc.

-

Mohawk Industries Inc.

Recent Developments

- In January 2023: Mannington Mills, Inc. introduced its new dwelling collections, involving broadloom carpets that offered comfort to all living areas. This introduction of collections widens the organization's market share in the flooring segment, which eventually stretches its market share in the Home Decor Furnishing market.

- In March 2023: Ashley Furniture launched its new HomeStore store in Denpasar, Indonesia. This HomeStore provides a wide variety of aesthetic home furnishings at a good rate. These plans exhibit the Company’s responsibility and efforts in the home furniture market, eventually pushing the Home Decor Furnishing market.

Chapter 1. Global Home Decorative Material Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Home Decorative Material Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Global Home Decorative Material Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Global Home Decorative Material Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Global Home Decorative Material Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Global Home Decorative Material Market – By Product Type

6.1 Introduction/Key Findings

6.2 Home Furniture

6.3 Home Textiles

6.4 Flooring

6.5 Wall Decor

6.6 Lighting

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Global Home Decorative Material Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Home Decor Stores

7.3 Supermarkets and Hypermarkets

7.4 Online Store

7.5 Gift Shops

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Global Home Decorative Material Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type-

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type-

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type-

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type-

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type-

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Global Home Decorative Material Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Ashley Furniture Industries Inc.

9.2 Duresta Upholstery Ltd.

9.3 Forbo Holding AG

9.4 Hanssem Co. Ltd.

9.5 Herman Miller Inc.

9.6 Inter IKEA Systems B.V.

9.7 Kimball International Inc. (HNI Corporation)

9.8 Koninklijke Philips N.V.

9.9 Mannington Mills Inc.

9.10 Mohawk Industries Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Home Decorative Material Market was valued at USD 749 billion in 2023 and is projected to reach a market size of USD 992.29 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 4.1%.

The heightened interest in customization and awareness of health among consumers is propelling the Global Home Decorative Material Market.

Global Home Decorative Material Market is segmented based on Product type, Distribution Channel, and Region.

North America is the most dominant region for the Global Home Decorative Material Market.

Kimball International Inc., Koninklijke Philips N.V., Mannington Mills Inc., Mohawk Industries Inc., Samson Holding Ltd., Herman Miller Inc., and Inter IKEA Systems B.V. are a few of the key players operating in the Global Home Decorative Material Market.