Home Care Market Size (2025-2030)

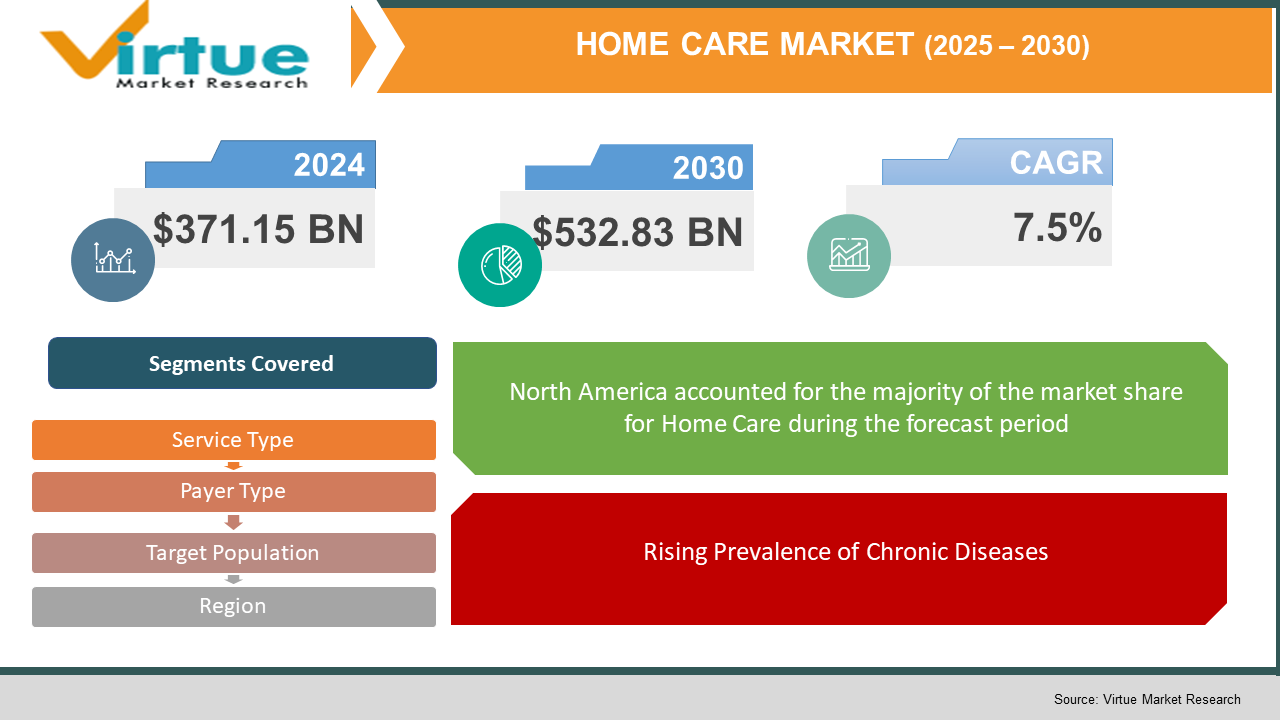

The Home Care Market was valued at USD 371.15 billion in 2024 and is projected to reach a market size of USD 532.83 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

The home care market provides a range of health and supportive services delivered in a patient’s home environment. It is a critical component of the broader healthcare system, offering both medical and non-medical services tailored to individual needs. Services can include personal care, skilled nursing, rehabilitation therapies, and companionship. Home care supports individuals recovering from illness or surgery, managing chronic conditions, or requiring assistance with daily living activities. It is especially vital for elderly populations who prefer aging in place rather than moving to institutional care settings.

Providers in this market range from independent caregivers to large home healthcare agencies. The market is influenced by healthcare policies, family dynamics, workforce availability, and the integration of digital health tools. Home care also intersects with insurance providers, government programs, and private payers, making financing structures diverse and complex. The scope of services varies significantly by region, reflecting local healthcare infrastructure and cultural expectations around caregiving. Overall, home care serves as a personalized, flexible alternative to hospital or long-term care settings.

Key Market Insights:

More seniors are choosing to remain in their homes as they age, rather than moving to assisted living or nursing facilities. This preference is reshaping demand for home care services, especially those focused on personal and companionship care. It reflects both emotional comfort and a desire for greater independence.

Digital tools like remote patient monitoring, telehealth, and electronic visit verification are becoming standard in home care. These technologies improve care coordination, compliance, and patient engagement. They also help agencies optimize operations and reduce unnecessary hospital readmissions.

The home care market is highly fragmented, with many small, independent providers and a few national or regional players. This creates inconsistencies in service quality, pricing, and access across geographies. Consolidation is slowly occurring, often through mergers, acquisitions, or franchising.

Home Care Market Drivers:

Aging Population Accelerating Home Care Market Growth.

The global elderly population is growing rapidly due to increased life expectancy and declining birth rates. As individuals age, they often require assistance with daily living activities and ongoing health management. Home care offers a more comfortable and cost-effective alternative to institutional care, aligning with the preference of many seniors to age in place.

Rising Prevalence of Chronic Diseases.

Chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders are becoming more common across all age groups. These conditions often require continuous monitoring, medication management, and lifestyle support, which can be effectively delivered at home. Home care allows for personalized, consistent care that reduces the need for frequent hospital visits.

Healthcare System Decentralization.

Many healthcare systems are shifting focus from centralized hospital care to community- and home-based solutions. This transition is driven by the need to reduce hospital overcrowding, lower healthcare costs, and improve patient satisfaction. Home care services support this model by offering high-quality care in a more familiar and less resource-intensive setting.

Home Care Market Restraints and Challenges:

Caregiver Shortages and High Turnover

The home care industry faces a significant shortage of qualified caregivers, nurses, and support staff. Low wages, physically demanding work, and limited career advancement lead to high turnover rates. This staffing instability affects service quality, patient satisfaction, and the ability of agencies to scale operations.

Regulatory and Reimbursement Complexity

Home care providers must navigate a complex web of regulations, licensing requirements, and reimbursement policies that vary widely by region and payer. Inconsistent rules and slow approval processes can limit access to services and delay care delivery. Smaller agencies often struggle to remain compliant while managing administrative burdens.

Limited Access to Technology and Infrastructure

While digital health tools are transforming care delivery, many home care providers—especially smaller or rural ones—lack the infrastructure or funding to adopt them. Inadequate internet access, low digital literacy among patients, and high implementation costs create barriers. This technology gap can widen disparities in care quality and operational efficiency.

Home Care Market Opportunities:

The home care market presents several promising opportunities driven by evolving healthcare needs and technological innovation. One major opportunity lies in expanding services for aging populations, especially in emerging markets where home care infrastructure is still developing. The integration of telehealth, remote monitoring, and AI-driven tools opens new avenues for improving care quality, reducing hospital visits, and optimizing caregiver workflows. There is also growing demand for specialized care, such as dementia-focused home care or pediatric home health, creating space for niche service providers. Franchising and partnerships between hospitals and home care agencies offer additional growth channels. Furthermore, supportive government policies and increased insurance coverage are making home care more accessible and financially sustainable for broader segments of the population.

HOME CARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By service Type, payer type, target population, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kindred at Home, Amedisys, Inc., LHC Group, Inc., Bayada Home Health Care , AccentCare, Home Instead Senior Care, Right at Home, Curaçao Group, Bupa Home Healthcare, Helincare Group etc. |

Home Care Market Segmentation:

Home Care Market Segmentation: by Service Type

- Personal Care Services

- Companion Services

- Skilled Nursing Services

- Therapy Services

- Hospice and Palliative Care

- Homemaker Services

Personal care services involve assistance with daily activities such as bathing, dressing, toileting, grooming, and mobility. These services are essential for individuals with physical limitations, chronic illnesses, or age-related impairments. They are typically provided by trained caregivers or home health aides, often without the need for medical licensing. Personal care services represent 35% of the total home care market.

Skilled nursing involves medically necessary care provided by licensed nurses, such as wound care, IV therapy, medication administration, and chronic disease management. This service type is typically prescribed by a physician and often reimbursed through insurance or government programs. It plays a critical role in post-hospitalization recovery and managing complex health conditions at home. Skilled nursing services account for 25% of the home care market.

Homemaker services support clients with household tasks such as cleaning, laundry, meal preparation, and grocery shopping. These services are vital for maintaining a safe, clean, and functional home environment for individuals who are unable to manage on their own. Often paired with personal care, homemaker services are typically non-medical in nature. Market Share: Homemaker services make up 10% of the home care market.

Home Care Market Segmentation: by Payer Type

- Public Payers

- Private Insurance

- Out-of-Pocket Payments

- Veterans Affairs or Other Government Programs

Public payers like Medicare and Medicaid are the largest sources of funding for home care services, especially in the U.S. Medicare typically covers skilled nursing and therapy services on a short-term basis, while Medicaid often funds long-term personal and homemaker care for low-income individuals. These programs are critical for elderly and disabled populations who rely on publicly funded care. Public payers account for 40% of the home care market.

Many individuals or families pay directly for home care services, especially those that are non-medical and not covered by insurance, such as personal or companion care. This payer type offers the greatest flexibility in service selection but can be financially burdensome over time. Out-of-pocket payments are common among middle-income families and those not qualifying for public aid. Out-of-pocket payments make up about 25% of the home care market.

Home Care Market Segmentation: by Target Population

- Elderly (Geriatric) Population

- Chronically Ill Patients

- Post-Acute/Recovery Patients

- Disabled Individuals

- Pediatric Patients

- End-of-Life Patients

The elderly represent the largest user group of home care services due to age-related decline in mobility, cognition, and overall health. They often require a combination of personal care, homemaker services, and skilled nursing. Aging in place is a strong preference among this group, making home care a critical alternative to institutional care. Elderly individuals account for 50% of the home care market.

Patients with chronic conditions such as diabetes, heart disease, COPD, and arthritis need continuous care and monitoring. Home care helps manage these conditions through medication management, vital signs monitoring, and lifestyle support. This segment is growing due to rising rates of non-communicable diseases globally. Chronically ill patients represent around 15% of the market.

Home Care Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America, particularly the United States and Canada, has the most mature and structured home care market globally. High healthcare spending, a large aging population, and strong reimbursement frameworks (e.g., Medicare, Medicaid) support widespread adoption of home care services. The region is also a leader in integrating technology, such as telehealth and remote patient monitoring, into home-based care models. North America holds 40% of the global home care market.

Asia-Pacific is witnessing rapid growth in the home care sector, driven by aging populations in countries like Japan, China, and South Korea. Cultural preferences for family-based care, along with rising healthcare costs, are encouraging governments to promote home care services. However, infrastructure limitations and regional disparities in care access remain key challenges across developing markets. Asia-Pacific accounts for around 30% of the global market.

Europe has a well-established home care system, supported by robust public health policies and aging demographics, especially in countries like Germany, France, and the UK. Many European nations prioritize home care over institutionalization for cost efficiency and quality-of-life benefits. The region is also focusing on workforce development and digital innovation to address caregiver shortages. Europe represents approximately 20% of the global home care market.

COVID-19 Impact Analysis on the Global Home Care Market:

The COVID-19 pandemic significantly accelerated the demand for home care services as patients and families sought safer alternatives to institutional care. With hospitals overwhelmed and many long-term care facilities becoming hotspots for infections, home care emerged as a critical solution for both acute and chronic care needs. The crisis highlighted the vulnerabilities of traditional healthcare systems and reinforced the value of decentralized, home-based models. It also pushed governments and insurers to expand coverage for telehealth and remote monitoring, enabling care continuity while minimizing exposure risks.

Home care providers rapidly adopted digital tools, such as virtual consultations and electronic health records, to adapt to social distancing requirements. However, the sector also faced challenges like caregiver shortages, PPE supply issues, and increased operational costs. Families began to view home care not just as a convenience, but as a necessity for safety and control. Overall, the pandemic reshaped perceptions, increased investment, and created lasting momentum for innovation and growth in the home care market.

Latest Trends/ Developments:

The integration of telehealth and virtual consultations has rapidly expanded, allowing patients to receive quality care at home with minimal in-person contact. Remote patient monitoring devices—such as wearable sensors for vitals and AI‑powered analytics—are enabling proactive care and early detection of health issues. Agencies are increasingly adopting electronic visit verification (EVV) and mobile care coordination platforms to streamline scheduling, documentation, and compliance. Specialized home care programs, such as dementia-focused care and pediatric support services, are gaining traction as providers seek to create niche offerings.

Partnerships between home care providers and hospitals or payer systems are becoming more common to support value‑based care and reduce hospital readmissions. Workforce development initiatives are emphasizing caregiver training in technology use and empathetic communication to boost retention. There’s also growing interest in using robotics and smart home technologies—like voice‑activated assistants and fall‑detection systems—to improve safety and independence. Lastly, sustainability has emerged as a priority, with agencies implementing green practices such as low‑waste PPE solutions and energy‑efficient service models.

Key Players:

- Kindred at Home

- Amedisys, Inc.

- LHC Group, Inc.

- Bayada Home Health Care

- AccentCare

- Home Instead Senior Care

- Right at Home

- Curaçao Group

- Bupa Home Healthcare

- Helincare Group

Chapter 1. Home Care Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Home Care Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Home Care Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Home Care Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Home Care Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Home Care Market – By Target Population

6.1 Introduction/Key Findings

6.2 Elderly (Geriatric) Population

6.3 Chronically Ill Patients

6.4 Post-Acute/Recovery Patients

6.5 Disabled Individuals

6.6 Pediatric Patients

6.7 End-of-Life Patients

6.8 Y-O-Y Growth trend Analysis By Target Population

6.9 Absolute $ Opportunity Analysis By Target Population , 2025-2030

Chapter 7. Home Care Market – By Service Type

7.1 Introduction/Key Findings

7.2 Personal Care Services

7.3 Companion Services

7.4 Skilled Nursing Services

7.5 Therapy Services

7.6 Hospice and Palliative Care

7.7 Homemaker Services

7.8 Y-O-Y Growth trend Analysis By Service Type

7.9 Absolute $ Opportunity Analysis By Service Type, 2025-2030

Chapter 8. Home Care Market – By Payer Type

8.1 Introduction/Key Findings

8.2 Public Payers

8.3 Private Insurance

8.4 Out-of-Pocket Payments

8.5 Veterans Affairs or Other Government Programs

8.6 Y-O-Y Growth trend Analysis Payer Type

8.7 Absolute $ Opportunity Analysis Payer Type , 2025-2030

Chapter 9. Home Care Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Target Population

9.1.3. By Payer Type

9.1.4. By Service Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Target Population

9.2.3. By Payer Type

9.2.4. By Service Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Target Population

9.3.3. By Payer Type

9.3.4. By Service Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Payer Type

9.4.3. By Service Type

9.4.4. By Target Population

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Payer Type

9.5.3. By Target Population

9.5.4. By Service Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Home Care Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Kindred at Home

10.2 Amedisys, Inc.

10.3 LHC Group, Inc.

10.4 Bayada Home Health Care

10.5 AccentCare

10.6 Home Instead Senior Care

10.7 Right at Home

10.8 Curaçao Group

10.9 Bupa Home Healthcare

10.10 Helincare Group

.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Home Care Market was valued at USD 371.15 billion in 2024 and is projected to reach a market size of USD 532.83 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Aging Population, Rising Prevalence of Chronic Diseases, Healthcare System Decentralization are some of the key market drivers in the Home Care Market.

Personal Care Services, Companion Services, Skilled Nursing Services, Therapy Services, Hospice and Palliative Care, Homemaker Services are the segments by Service Type in the Home Care Market.

North America is the most dominant region for the Global Home Care Market.

Kindred at Home, Amedisys, Inc., LHC Group, Inc., Bayada Home Health Care , AccentCare, Home Instead Senior Care, Right at Home, Curaçao Group, Bupa Home Healthcare, Helincare Group etc.