Holographic Display Market Size (2024 – 2030)

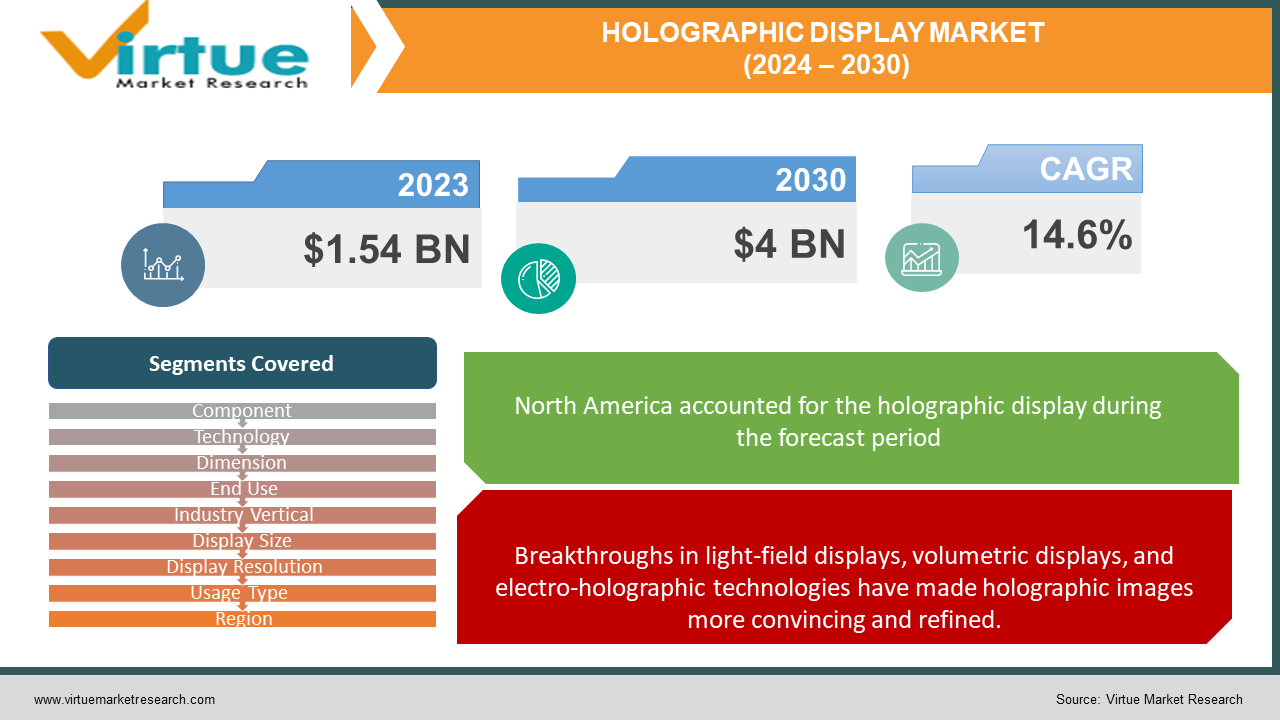

The Holographic Display Market was valued at USD 1.54 Billion in 2024 and is projected to reach a market size of USD 4 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.6%.

Stepping beyond conventional screens, holographic displays create the illusion of three-dimensional images floating in mid-air. Unlike virtual reality or 3D glasses, holographic displays require no additional headsets or special eyewear to experience the effect. This technology has the potential to transform how we interact with information, entertainment, and the world around us. Holographics offer a visual experience that goes beyond traditional 2D screens, capturing attention and leaving a lasting impression. Improvements in light sources, display materials, and computation are making holographic displays more realistic, affordable, and portable. The desire for immersive experiences in gaming, entertainment, and training drives interest in holographic technologies. The quest for more captivating experiences fuels interest in holographic displays, capable of delivering information in a way that transcends traditional screens. Improvements in display resolution, processing power, and software algorithms make holographic effects more convincing and accessible. Technologies are maturing to the point of viable commercial applications, with costs gradually declining. Holographic displays find new uses, from retail and entertainment to communication, design visualization, and prototyping. As technologies mature, holographic displays will become more cost-effective, broadening their reach in consumer and commercial settings. Expect continuous innovation in display types and underlying technologies, refining the visual experience and creating new niches.

Key Market Insights:

Holographic displays create visually stunning and interactive product showcases, breaking away from traditional signage and capturing consumer attention in crowded retail environments. Holographic displays facilitate the creation of engaging brand stories. These displays can depict products in 3D, offering multiple perspectives and allowing for virtual try-ons or in-depth feature exploration. When coupled with data analytics, holographic displays can personalize content to demographics, interests, or even a shopper's real-time behavior. High-quality, well-designed 3D content optimized for the specific display technology is essential to unlock the full potential of holographic displays. Successful holographic displays become part of a larger ecosystem. This could mean integrating with mobile apps, collecting customer data, or even linking with back-end inventory management. Technologies like Pepper's Ghost variations offer accessible entry points for holographic effects. While not 'true' holography, they are impactful for product displays and targeted applications. Volumetric displays provide unmatched 3D realism, ideally suited for showcasing complex objects in design, medical training, or large-scale entertainment installations. Holographic head-mounted displays are at the forefront of augmented and mixed reality. These hold immense potential, but wider adoption hinges on overcoming challenges like image quality and bulky hardware. Holographic technology is finding uses in smart projection systems for navigation, guidance in workplaces, or as communication tools. Holographic displays could revolutionize the way we interact with complex data, allowing users to manipulate and understand information in three-dimensional space. While the 'wow factor' remains essential, there's a growing focus on reliable performance, ease of set-up, and integration into existing systems– key for long-term adoption

Holographic Display Market Drivers:

Holographic displays break away from the constraints of flat surfaces, creating the illusion of images that pop out into real space, offering depth and a sense of presence that cannot be replicated on traditional screens.

It is more difficult for any one message, item, or piece of material to genuinely stick out and have an impact when our attention is continuously diverted. The commonplace becomes boring to audiences. To captivate their imaginations, experiences must go beyond the monotonous, unchanging, and foreseeable. Holographic displays are a powerful remedy for these problems. They guarantee to provide an immersive experience that will last long after the noise subsides. Compared to staring at flat panels, holographic displays provide a more intuitive and natural experience by mimicking dimension and presence. Holographic displays are still somewhat uncommon, yet they have an intrinsic "wow" factor. Just by their stunning appearance and defiance of expectations, they arouse curiosity and compel interaction. Holographic displays could be used to provide whole-body experiences that are significantly more immersive than those possible with standard screens when combined with spatial audio, haptic feedback, or even fragrance technology. Games, environments, and interactive simulations can be made with holographic displays. Users' degree of involvement increases when they take on the role of active participants. If combined with clumsy 3D material, even the most technologically amazing display will seem bad. It is essential to develop material that makes use of holography's special advantages.

Breakthroughs in light-field displays, volumetric displays, and electro-holographic technologies have made holographic images more convincing and refined.

Considerable advancements have been achieved in the development of display technology that may provide believable holographic effects. Novel light-field displays, improvements to volumetric display techniques, and ongoing studies into real electro-holographic technology are a few examples. Advanced holographic displays require complex real-time image rendering and calculations, which require ever-increasing power from GPUs (Graphics Processing Units) and specialised CPUs. Complex 3D modelling tools, light manipulation algorithms, and content optimization strategies are essential for producing holographic experiences and pictures that merge with the actual environment. Developments in allied domains including sensor technology, augmented reality, and spatial audio facilitate the creation of more dynamic and immersive holographic applications. Businesses ready to spend more for state-of-the-art technology invest in and use holographic displays, which increases demand and fuels manufacturing economies of scale. Larger-scale production of optics, semiconductors, and display elements for a variety of applications lowers the cost of these components utilized in holographic systems. As more companies enter the holographic display market, competition encourages innovation, which frequently results in more effective and affordable solutions. It's critical to know that costs drop on a spectrum. Although pricey high-end holographic systems are still available, more affordable alternatives are becoming available for applications.

Holographic Display Market Restraints and Challenges:

In actuality, many holographic display solutions—especially those that offer high-end visual experiences—remain out of reach for many potential consumers, even with declining pricing.

Despite decreasing costs, the reality is that many holographic display solutions, especially those delivering high-end visual experiences, remain out of reach for many potential users. High prices significantly limit the use of holographic displays by small businesses, independent creators, and consumer-focused applications. This restricts the market's growth trajectory. Integrating holographic elements with projection, AR, or other technologies could achieve compelling effects in a more cost-effective or accessible manner. Businesses with tight budgets may view holographic displays as a luxury expense rather than a necessity, hindering their adoption for widespread customer engagement or operational use. Cost creates a divide, allowing large, well-funded players to experiment with cutting-edge applications of holographic tech, potentially influencing the direction of innovation itself. The creation of 3D content optimized for holographic displays is often specialized and resource-intensive, adding development time and expense. Incorporating intuitive touch-based interactions, gesture control, or integration with external data feeds adds complexity and cost to holographic systems. Advanced holographic displays, especially those aiming for high-definition visuals, can be computationally demanding and create challenges for portable or battery-powered implementations. The strengths and weaknesses of current technology encourage a focus on specific use cases where the impact of holography is maximized and limitations can be mitigated (e.g., product showcases, and specialized training simulations). While holographic displays excel at creating an initial sense of wonder, ongoing user engagement hinges on providing deeper value beyond the visual spectacle. Focusing efforts on lowering the costs of specific components or simplifying the design of display systems tailored for particular applications.

Holographic Display Market Opportunities:

Holographic displays can turn product demonstrations into immersive experiences. Imagine trying on virtual clothing without a fitting room, visualizing furniture in your home before purchase, or interacting with exploded views of complex appliances to understand their features. When paired with customer data or real-time behavioral analysis, holographic displays become platforms for personalized content. This could mean product recommendations tailored to an individual, dynamic promotions, or even interactive games linked to loyalty programs. Holographic displays, offering experiences unattainable online, can inject an element of excitement and draw customers into physical stores, revitalizing brick-and-mortar retail. Holographic displays, offering experiences unattainable online, can inject an element of excitement and draw customers into physical stores, revitalizing brick-and-mortar retail.

HOLOGRAPHIC DISPLAY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.6% |

|

Segments Covered |

By Component, Technology, Dimension, End Use, Industry Vertical, Display Size, Display Resolution, Usage Type , and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

RealView Imaging, Zebra Imaging, Looking Glass Factory, Holoxica, Euclid Labs, AV Concepts, VNTANA, Leia Inc, SEE Real 3D |

Holographic Display Market Segmentation: By Component

-

Light Modulator

-

Digital Micrometer

-

Scanner

-

Lens

-

Monitor

Light modulators likely command the largest portion of the holographic display component market, potentially in the range of 35-45%. Their dominance may be tempered slightly by advances in alternative technologies, but continued refinement and wider availability of various light modulators will support substantial growth. Digital Micrometers are essential for high-precision holography, their specialized nature puts their market share likely below that of light modulators, perhaps 15-20%. Their Growth is intrinsically tied to advancements in electro-holographic displays seeking to push the boundaries of image realism. Scanners likely hold a moderate share, potentially around 15-20%. Cost, complexity, and trade-offs in image properties will influence market position. Their growth is dependent on whether laser-based systems and specific use cases gain wider traction. There is potential for new scanner technologies to improve performance. Lenses are essential but a less dominant component in market share terms, perhaps around 10-15%. This depends on the complexity of the optical system required for various display technologies. Growth is more closely tied to the general trajectory of the holographic display market rather than specific booms within a single lens technology. Monitors are less dominant in a dedicated holographic display system. Potentially 5-10%, heavily depending on whether we include simpler display solutions leveraging Pepper's Ghost principle. Growth is highly dependent on how holographic display integration evolves. A push for holographic displays as add-on modules would increase their importance, but true "holographic" systems reduce their necessity.

Holographic Display Market Segmentation: By Technology

-

Electro-holographic

-

Laser

-

Touchable

-

Piston

Electro-holographic Displays recreate true, dynamic holograms by manipulating the phase of light waves with high precision. They offer the most convincing illusion of three-dimensionality, potentially with full parallax and wide viewing angles. While holding the potential for the most "authentic" holographic experience, their complexity and cost lead to a relatively smaller current share, likely around 15-20%. Laser-based Displays Utilize lasers to generate volumetric 3D images within specific mediums or by projecting into space. This creates eye-catching displays with true depth. Often limited in image size, interactivity, or viewing angle. Laser-based Displays are best suited for specialized applications, displays highlighting a single object or creating visual effects for marketing or entertainment. A moderate share, potentially around 20-25%, is driven by their ability to create visually stimulating displays for targeted use cases. Touchable Holographic Displays Open doors for collaborative design, education, product configuration, data exploration, surgical simulation, and interactive experiences. Holds a respectable segment of the market. Touchable Displays perhaps hold a 20-25% share, as the practicality of touch interaction offers value across various industries. Piston-based Displays are an evolution of a classic stage illusion, using reflections and clever projection angles to create a 3D effect. These are more accessible than true electro-holographic systems. Holds a significant portion, likely around 30-40%, due to lower costs and suitability for specific applications less demanding in terms of image quality. As of right now, Piston-based systems dominate the holographic display market thanks to their modernized versions of Pepper's Ghost-style projections. These displays are more affordable and easier to utilise for a larger variety of applications and enterprises. In the upcoming years, touchable holographic displays are predicted to increase at the fastest rate

Holographic Display Market Segmentation: By Dimension

-

2D

-

3D

-

4D

3D holographic displays claim the largest share of the market. This is due to ongoing innovation, offering a balance between convincing visual effects, and relative accessibility compared to more complex technologies. While 2D might seem less exciting, they hold a notable share. This is due to their wider use in simple signage, cost-effectiveness, and providing a stepping stone for industries dipping their toes into holographic visuals.4D displays likely hold the smallest current share. However, their potential for interactive applications and data visualization could drive significant future growth. It's fair to expect the 4D segment to witness the fastest growth in the coming years. The demand for experiences transcending passive viewing is strong. 4D holograms, with their ability to react and be manipulated, align perfectly with this desire. As the volume of complex data increases, tools to visualize it intuitively become more valuable. 4D holographic displays offer an exciting avenue for this.

Holographic Display Market Segmentation: By End Use

-

Camera

-

Digital Signage

-

Medical Imaging

-

Smart TV, Laptops

-

Others

Camera: Holographic technology is used in specialised cameras to record and process 3D light field data, albeit this is not the main use case that most people are aware of. Scientific imaging, microscopy, and specialised inspection systems can all benefit from this. Possibly one of the most noticeable uses of holographic displays is digital signage. These are employed in retail settings for interactive displays, eye-catching advertising, and "wow" factor product demonstrations. Medical imaging is a potent application where holographic displays allow medical professionals to see intricate scans (MRIs, CT scans, etc.) in three dimensions. This facilitates medical education, surgical planning, and diagnostics. Smart TV: Although the concept of holographic entertainment in our homes has a lot of potential, it is still mostly theoretical and aspirational. It would require significant technological advancements to make this a mass-market reality. Laptops: By incorporating holographic displays inside laptops, new applications for improved communication, 3D data visualisation, and design may become possible. At this point, widespread adoption is not the primary driver of this industry; rather, it is a technological improvement. Others: A catch-all category that includes a variety of niches that may not cleanly fit into the sectors, such as emerging applications, specialised industrial visualisations, military simulations, and distinctive creative expression. Digital Signage driven by the retail sector's desire for captivating displays, the sheer volume and visibility of signage applications makes it a major force. Several factors make digital signage well-positioned for sustained and rapid growth. Businesses seek a competitive edge in grabbing attention, and holographic displays remain a powerful tool to do so. Holographics are explored as a way to bridge the online-offline gap, showcasing products with greater realism in physical stores or via virtual showrooms.

Holographic Display Market Segmentation: By Industry Vertical

-

Consumer Electronics

-

Retail

-

Media and Entertainment

-

Healthcare

-

Automotive

-

Industrial

-

Military & Defence

-

Others

Retail (20-25%): The retail sector is a significant force driving advancements in the holographic display market. Competition in retail is fierce. Holographic displays offer a way to break out of the mold and create memorable in-store experiences that set stores and brands apart. Consumer Electronics (15-20%): Adoption here is very dependent on costs and compelling use cases. Integration in future smart home devices, gaming, or portable projectors could drive growth but remains more aspirational at present. Media and Entertainment (15-20%): Concerts, immersive art installations, and events increasingly leverage holographic effects. However, this sector often favors rental models or custom installations rather than a mass-market product focus. Healthcare (15-20%): The healthcare sector is poised for significant expansion in its utilization of holographic displays. Holograms of CT scans, MRI data, etc., allow surgeons to visualize complex procedures in 3D, improving planning, and collaboration, and potentially leading to better patient outcomes. Holographic models that accurately simulate human anatomy offer a new generation of training tools, reducing reliance on cadavers and providing repeatable, realistic scenarios. Automotive (8-12%): Holographic heads-up displays (HUDs), 3D design visualization, and holographic navigational aids hold potential, but adoption is likely to be gradual due to cost and safety considerations. Industrial (5-8%): Holographic displays for prototyping, data visualization in manufacturing, and remote maintenance assistance offer substantial value. Adoption here is often tailored to specific needs within the industry. Military and Defence (5-8%): Uses in battlefield simulations, terrain mapping, and training have long been an area of interest. While vital, this sector is often characterized by highly specialized applications and less broad market growth. Others (5%): Diverse and nascent applications exist - holographic displays in education museums, architectural planning, or even niche advertising installations fall within this category. The healthcare sector is poised for the fastest growth expansion.

Holographic Display Market Segmentation: By Display Size

-

Small

-

Medium

-

Large

Small Displays generally hold 30-40% of the market shares. Generally, tabletop-sized or even more compact displays with 3D image volumes often on the scale of a few inches to perhaps a foot across. These could include point-of-sale displays, personal 3D model viewers, or concept devices integrated into smartphones. Medium Displays hold 40-50% of market share. Larger displays offer a 3D image volume suitable for showcasing multiple objects or more complex visualizations. These might be found at trade shows, and museums, or used in design settings. Large Displays holds 10-20% of the market shares. Installations create expansive holographic visuals, often designed for high-impact settings like stages, lobbies, or advertising. These prioritize spectacle and visibility from a distance. Right now, medium-sized screens probably account for the biggest portion of the market. These exhibits can be used for a wide range of purposes, such as product demonstrations in retail, medical data visualisation, engineering prototypes, etc. More advanced methods exist for producing realistic holographic effects at this size than for very small or large-scale solutions. Holographic displays on a small scale could emerge as the fastest-growing market

Holographic Display Market Segmentation: By Display Resolution

-

4K

-

OLED

-

Others

4K holds 40-50% of the market shares. It is a rapidly growing segment. While 4K may seem standard for flat screens, it represents a significant leap in visual fidelity for holographic displays. Offers good detail for many commercial and visualization purposes. OLED Displays hold 10-20% of the market shares. OLED (Organic Light-Emitting Diode) displays are prized for deep blacks, wide color gamuts, and potential flexibility. Their use in holographics is primarily tied to smaller-scale displays or specific components of larger systems. Other technologies hold 30-40% of the market shares. These include:LCOS/LCD: Variants used in some holographic systems, particularly for projector-based or lower-cost applications. DMD: Digital Micromirror Devices, often used in conjunction with lasers for precision light modulation, are found in niche holographic solutions. Emerging Tech: The future might see increased use of micro-LEDs or other novel display solutions as they mature and are adapted for holographic applications. While OLED and other bespoke technologies play a vital role in specific holographic applications, we're likely to see the 4K segment expand its market share as the fastest-growing technology.

Holographic Display Market Segmentation: By Usage Type

-

Window Displays

-

Endcap Placements

-

In-store Marketing

-

Events/Expos Displays

-

Large Event Spaces

-

Others

Window Displays (20-25%): Eye-catching holographic displays within store windows entice shoppers, showcasing products in a dynamic, attention-grabbing way. Endcap Placements (15-20%): Holographic displays positioned at the ends of retail aisles highlight promotions, feature specific products, or create interactive experiences for customers. In-store Marketing (25-30%): A broad category, this encompasses holographic signage, product demonstrations, wayfinding, or creating immersive brand experiences within physical stores of all kinds. Events/Expos Displays (15-20%): From trade shows to product launches, holographic displays add a 'wow' factor, visually demonstrating concepts, or making announcements more memorable. Large Event Spaces (5-10%): Concerts, theme parks, museums, and public installations utilize the large-scale, visually striking nature of holographic displays to engage audiences. Others (5-10%): This includes a wide range of niche applications – holographic navigation aids in vehicles, medical training models, design showcases in architectural firms, etc. Several factors make in-store marketing the most dominant driver for holographic display adoption. With customers bombarded by stimuli, holographic displays offer retailers a way to cut through the visual noise and create unforgettable product interactions. The events and expos sector is likely to see significant growth in holographic display adoption due to Advances in volumetric displays and large-scale holographic open doors for use within this sector, where display size and visual impact matter.

Non-Interactive holds 60-65% of the market share. These displays primarily focus on delivering a 3D visual experience. The user is a passive observer and cannot directly manipulate the holographic content. Examples include holographic product showcases, pre-rendered scenes for entertainment, or medical visualizations used for explanation but not surgical planning. Interactive holds 35-40% of the market share. These displays incorporate technologies that allow users to interact with holographic content in various ways. This might involve touch-based interaction with holographic elements, gesture control, voice commands, or the integration of external sensors and data feeds for real-time manipulation. Non-interactive holographic displays currently hold a larger market share. Technologies enabling non-interactive displays are often more mature, making systems more readily available and potentially less expensive to produce. In many applications, the core value lies in the stunning 3D visualization. This includes retail displays, museum exhibits, and some forms of advertising or entertainment experiences. Interactive holographic displays hold immense potential, and the market is witnessing rapid growth in this segment.

Holographic Display Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Three-quarters of the market is held by North America. It has historically been a strong force in the market, propelled by elements including large R&D investments, innovation clusters, and a culture open to early adoption of new technology. 27% of the market is held by Europe. Europe is a major player in the development and application of holographic display technology, as it is home to reputable research institutes, experts in optics, and innovation hubs. With a quarter of the market, Asia-Pacific leads. The region is seeing rapid growth as a result of various causes such as enhanced manufacturing capacities, growing disposable incomes driving demand for sophisticated electronics, and government backing for innovative technology endeavors. 13% of the market is occupied by the Rest of the World. spanning continents such as Africa, the Middle East, and Latin America. Although there is now less market share in these regions, several of the countries have significant potential as adoption rises and investment in next-generation displays rises. The Asia-Pacific region is a driving force behind the growth of the holographic display market due to several factors. Holographic displays can meet the growing demand for novel consumer electronics experiences driven by a growing middle class and growing disposable budgets in nations like China and India.

COVID-19 Impact Analysis on the Holographic Display Market:

The transportation of supplies and parts required for the manufacture of holographic displays was impeded by lockdowns and interruptions in international commerce channels. Project rollouts and manufacturing were delayed as a result. Businesses were compelled to review their spending and concentrate on pressing requirements. This frequently means postponing purchases of cutting-edge gadgets like holographic screens. The abrupt transition to remote work reduced demand for holographic displays used in collaborative office settings, for example. Events, trade exhibits, and conferences—a sector that was starting to investigate holographic elements—saw cancellations or virtual shifts, which diminished the size of a possible market. An increasing demand for more impactful and engaging distant communication arose as video conferencing became the standard. This increased curiosity in holographic technology, which has the potential to produce a more lifelike sensation of presence. Immersion-based online buying experiences became more necessary as physical stores faced constraints. Holographic displays have become a promising technology for virtual showroom creation and product showcases. Requirements for social distancing presented difficulties for traditional medical training approaches. One possible answer was the use of holographic screens, which allowed medical students to participate in remote yet realistic simulations.

Latest Trends/ Developments:

Progress in faster refresh rates, higher resolution spatial light modulators (SLMs), and more powerful processors brings us closer to real-time, dynamic holographic images of increased visual fidelity. Research avenues include acoustic levitation to physically manipulate particles into 3D shapes and the use of metamaterials to achieve unprecedented levels of light control. Algorithms that can accurately calculate light-field data and optimize it for specific display technologies are essential for generating realistic holographic content. Volumetric displays can be combined with haptics, allowing users to feel and interact with the 3D image, opening possibilities for design, surgical training, and truly immersive experiences. High-speed lasers that "draw" or scatter off particles to create 3D imagery are becoming more compact and sophisticated, with improvements in color representation and resolution. Emerging volumetric technologies can create 3D displays within non-traditional surfaces, like water columns, mist, or specialized materials, leading to visually striking applications.

Key Players:

-

RealView Imaging

-

Zebra Imaging

-

Looking Glass Factory

-

Holoxica

-

Euclid Labs

-

AV Concepts

-

VNTANA

-

Leia Inc

-

SEE Real 3D

Chapter 1. Holographic Display Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Holographic Display Market – Executive Summary

2.1 Market Size & Forecast – (2024– 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Holographic Display Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Holographic Display Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Holographic Display Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Holographic Display Market – By Component

6.1 Introduction/Key Findings

6.2 Light Modulator

6.3 Digital Micrometer

6.4 Scanner

6.5 Lens

6.6 Monitor

6.7 Y-O-Y Growth trend Analysis By Component

6.8 Absolute $ Opportunity Analysis By Component , 2024-2030

Chapter 7. Holographic Display Market – By Technology

7.1 Introduction/Key Findings

7.2 Electro-holographic

7.3 Laser

7.4 Touchable

7.5 Piston

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology , 2024-2030

Chapter 8. Holographic Display Market – By Dimension

8.1 Introduction/Key Findings

8.2 2D

8.3 3D

8.4 4D

8.5 Y-O-Y Growth trend Analysis End-Use Industry

8.6 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Holographic Display Market – By End Use

9.1 Introduction/Key Findings

9.2 Camera

9.3 Digital Signage

9.4 Medical Imaging

9.5 Smart TV, Laptops

9.6 Others

9.7 Y-O-Y Growth trend Analysis By End Use

9.8 Absolute $ Opportunity Analysis By End Use, 2024-2030

Chapter 10. Holographic Display Market – By Industry Vertical

10.1 Introduction/Key Findings

10.2 Consumer Electronics

10.3 Retail

10.4 Media and Entertainment

10.5 Healthcare

10.6 Automotive

10.7 Industrial

10.8 Military & Defence

10.9 Others

10.10 Y-O-Y Growth trend Analysis By Industry Vertical

10.11 Absolute $ Opportunity Analysis By Industry Vertical , 2024-2030

Chapter 11. Holographic Display Market – By By Display Resolution

11.1 Introduction/Key Findings

11.2 Small

11.3 Medium

11.4 Large

11.5 Y-O-Y Growth trend Analysis By By Display Resolution

11.6 Absolute $ Opportunity Analysis By By Display Resolution , 2024-2030

Chapter 12. Holographic Display Market – By Display Resolution

12.1 Introduction/Key Findings

12.2 4K

12.3 OLED

12.4 Others

12.5 Y-O-Y Growth trend Analysis By Display Resolution

12.6 Absolute $ Opportunity Analysis By Display Resolution , 2024-2030

Chapter 13. Holographic Display Market – By Usage Type

13.1 Introduction/Key Findings

13.2 Window Displays

13.3 Endcap Placements

13.4 In-store Marketing

13.5 Events/Expos Displays

13.6 Large Event Spaces

13.7 Others

13.8 Y-O-Y Growth trend Analysis By Usage Type

13.9 Absolute $ Opportunity Analysis By Usage Type , 2024-2030

Chapter 14. Holographic Display Market, By Geography – Market Size, Forecast, Trends & Insights

14.1 North America

14.2 By Country

14.1.1.1 U.S.A.

14.1.1.2 Canada

14.1.1.3 Mexico

14.1.1 By Component

14.1.1.1 By Technology

14.1.2 By Dimension

14.1.3 By Industry Vertical

14.1.4 Countries & Segments - Market Attractiveness Analysis

14.2 Europe

14.2.1 By Country

14.2.1.1 U.K

14.2.1.2 Germany

14.2.1.3 France

14.2.1.4 Italy

14.2.1.5 Spain

14.2.1.6 Rest of Europe

14.2.2 By Component

14.2.3 By Technology

14.2.4 By Dimension

14.2.5 By End Use

14.2.6 By Industry Vertical

14.2.7 Countries & Segments - Market Attractiveness Analysis

14.3 Asia Pacific

14.3.1 By Country

14.3.1.1 China

14.3.1.2 Japan

14.3.1.3 South Korea

14.3.1.4 India

14.3.1.5 Australia & New Zealand

14.3.1.6 Rest of Asia-Pacific

14.3.2 By Component

14.3.3 By Technology

14.3.4 By Dimension

14.3.5 By End Use

14.3.6 By Industry Vertical

14.3.7 Countries & Segments - Market Attractiveness Analysis

14.4 South America

14.4.1 By Country

14.4.1.1 Brazil

14.4.1.2 Argentina

14.4.1.3 Colombia

14.4.1.4 Chile

14.4.1.5 Rest of South America

14.4.2 By Component

14.4.3 By Technology

14.4.4 By Dimension

14.4.5 By End Use

14.4.6 By Industry Vertical

14.4.7 Countries & Segments - Market Attractiveness Analysis

14.5 Middle East & Africa

14.5.1 By Country

14.5.1.1 United Arab Emirates (UAE)

14.5.1.2 Saudi Arabia

14.5.1.3 Qatar

14.5.1.4 Israel

14.5.1.5 South Africa

14.5.1.6 Nigeria

14.5.1.7 Kenya

14.5.1.8 Egypt

14.5.1.9 Rest of MEA

14.5.2 By Component

14.5.3 By Technology

14.5.4 By Dimension

14.5.5 By End Use

14.5.6 By Industry Vertical

14.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 15. Holographic Display Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

15.1 RealView Imaging

15.2 Zebra Imaging

15.3 Looking Glass Factory

15.4 Holoxica

15.5 Euclid Labs

15.6 AV Concepts

15.7 VNTANA

15.8 Leia Inc

15.9 SEE Real 3D

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Consumers and businesses crave experiences that transcend traditional screens, seeking greater engagement and a 'wow' factor. Holographic displays offer unrivaled visual depth and a sense of presence.

High-end, true-holographic displays remain expensive, hindering their widespread use by consumers and smaller businesses. This restricts market growth and limits innovation sparked by wider access.

RealView Imaging, Zebra Imaging, Looking Glass Factory, Holoxica, Euclid Labs, AV Concepts, VNTANA, Leia Inc.

North America currently holds the largest market share, estimated at around 35%.

The Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.