High-purity Hydrofluoric Acid Market Size (2024 – 2030)

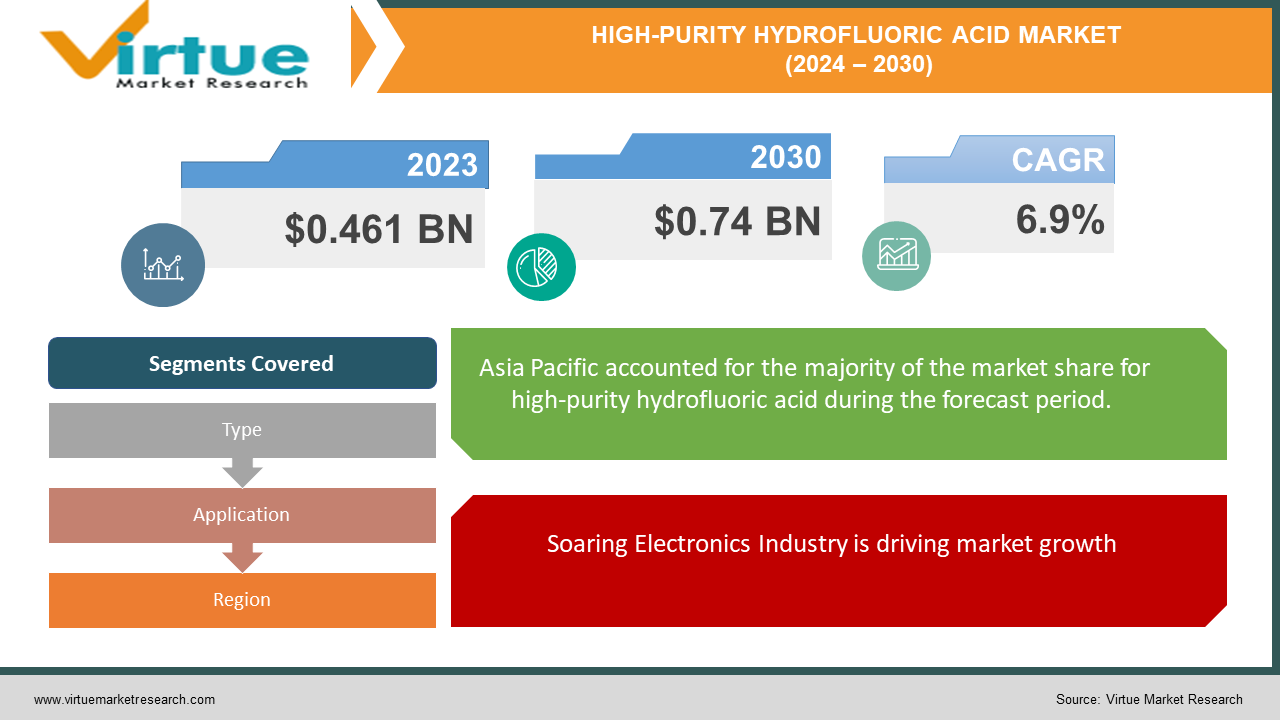

The Global High-purity Hydrofluoric Acid Market was valued at USD 0.461 billion in 2023 and will grow at a CAGR of 6.9% from 2024 to 2030. The market is expected to reach USD 0.74 billion by 2030.

The high-purity hydrofluoric acid market deals with a specific type of hydrofluoric acid crucial for high-tech industries like semiconductors and flat panel displays. This market is expected to grow steadily due to rising demand for these electronics and the essential role this acid plays in their precise manufacturing processes.

Key Market Insights:

Expanding oil refining activities and increasing the use of fluoropolymers in various applications contribute to market growth. Semiconductor, Flat Panel Display, Solar Energy (growing segment).

Hydrofluoric acid is corrosive and toxic, prompting stringent regulations on production, handling, and disposal. These regulations can impact production costs and limit market expansion. Fluorospar, the primary raw material, experiences price fluctuations impacting overall production costs.

The high-purity hydrofluoric acid market is expected to maintain a steady growth trajectory due to the factors mentioned above. Rising demand from the electronics and fluorinated products sectors, coupled with potential applications in solar energy, paint, and pharmaceuticals, paints a positive picture for the future.

Global High-purity Hydrofluoric Acid Market Drivers:

Soaring Electronics Industry is driving market growth:

High-purity hydrofluoric acid acts like a microscopic sculptor in the world of electronics. It's an essential ingredient in the etching process, which precisely carves intricate patterns onto silicon wafers, the foundation of semiconductors and flat panel displays. As our appetite for ever-more powerful and sleek smartphones, laptops, TVs, and other devices grows, so too does the demand for this high-purity acid. It's this etching process that enables the creation of the miniaturized circuits that power our devices and the high-resolution displays that bring our entertainment and information to life. In simpler terms, without high-purity hydrofluoric acid, the devices we rely on daily wouldn't exist in their current form – their functionality and sleek design are intricately linked to the precise etching this acid facilitates. So, the next time you marvel at the power and clarity of your favorite electronic device, remember, that there's a good chance that high-purity hydrofluoric acid played a vital role in its creation.

Expanding Fluorinated Products Market is driving market growth:

High-purity hydrofluoric acid goes beyond its role in electronics; it's also the backbone for a class of versatile materials called fluorocarbons. These fluorocarbons boast unique properties that make them irreplaceable in various industries. Imagine a world with less efficient air conditioning – that's the reality without fluorocarbons in refrigerants. As global temperatures climb and urbanization increases, the demand for powerful and efficient cooling systems grows, making fluorocarbons even more crucial. But their reach extends far beyond keeping us comfortable. Fluorocarbons are the secret ingredient in many polymers, crafting materials with exceptional strength, heat resistance, and low friction. This makes them invaluable in the automotive industry, where lighter, more fuel-efficient cars are paramount. They're also essential for constructing buildings that can withstand harsh weather conditions and for crafting lightweight yet sturdy components in the aerospace industry. Finally, fluorinated solvents play a vital role in the very industry that relies on high-purity hydrofluoric acid – electronics. These specialized cleaning agents ensure the intricate components of our devices are meticulously etched and remain free of impurities, contributing to the flawless functioning of our smartphones, laptops, and other gadgets. In essence, high-purity hydrofluoric acid acts as the springboard for a range of fluorocarbon applications, silently shaping the world around us from the devices in our hands to the cars we drive and the buildings we inhabit.

Growth in Oil Refining and Fluoropolymers are driving market growth:

High-purity hydrofluoric acid's influence extends beyond the realm of cutting-edge technology. It also plays a supporting role in the traditional oil industry. As the global reliance on oil continues, the market for this acid is poised to benefit. But its impact doesn't stop there. High-purity hydrofluoric acid serves as the foundation for a class of remarkable materials known as fluoropolymers. These polymers boast exceptional properties, making them the go-to choice for applications that demand resilience. Imagine pipelines and tubing that can withstand the harshest environments, from scorching deserts to freezing tundras. Fluoropolymers make this a reality, ensuring the safe and efficient transportation of oil and other crucial materials. Their strength and heat resistance also make them ideal for insulating electrical wires and cables, safeguarding against electrical hazards. Even the non-stick coating on your favorite frying pan likely owes its existence to fluoropolymers, derived from high-purity hydrofluoric acid. In essence, this specialized acid underpins a range of fluoropolymer applications, silently contributing to the smooth functioning of our infrastructure, the safety of our electrical systems, and even the convenience of our kitchens.

Global High-purity Hydrofluoric Acid Market challenges and restraints:

Stringent Environmental Regulations are a significant hurdle for High-purity Hydrofluoric Acid:

The shadow side of high-purity hydrofluoric acid's effectiveness lies in its hazardous nature. Strict regulations encompass its entire life cycle, from cradle to grave. These regulations are necessary to protect human health and the environment from its corrosive and toxic properties. However, navigating this complex web of rules can be a major headache for manufacturers. Compliance often requires significant investment in specialized equipment, rigorous training for personnel, and robust safety protocols. This adds a hefty price tag to production, potentially squeezing profit margins and hindering expansion plans. Furthermore, the regulations themselves can be intricate and ever-evolving, requiring constant monitoring and adaptation for manufacturers to stay compliant. In essence, the safety measures that make high-purity hydrofluoric acid a responsible product also introduce a layer of complexity and cost that the market must navigate.

Safety and Handling Concerns are throwing a curveball at the High-purity Hydrofluoric Acid market:

High-purity hydrofluoric acid's effectiveness comes at a cost - its inherent dangers. Working with it necessitates a multi-pronged approach to safety. Specialized equipment is crucial to shield workers from accidental exposure. This could include things like chemical-resistant suits and respirators, and specially designed ventilation systems to control fumes. Furthermore, rigorous safety protocols are paramount. These protocols dictate procedures for safe handling and storage of the acid, as well as proper training for personnel on handling procedures and emergency response. These essential measures translate to significant additional costs. Training, equipment, and maintaining safety protocols all add to the bottom line. This can squeeze profit margins for manufacturers, potentially hindering their ability to invest in growth or forcing them to raise prices.

Volatile Raw Material Prices are a growing nightmare for High-purity Hydrofluoric Acid:

The high-purity hydrofluoric acid market faces a hidden challenge – the fickleness of its key ingredient: fluorspar. This mineral is the lifeblood of the production process, but its price can be as volatile as the weather. When fluorspar prices surge, the entire production cost structure for high-purity hydrofluoric acid gets shaken. Manufacturers are left scrambling to adjust, as these fluctuations eat into their profit margins. This uncertainty can be crippling, hindering long-term planning and investment in the market's growth. Imagine a manufacturer securing a big contract based on a stable fluorspar price, only to see their profits vanish due to a sudden price hike. This volatility creates a ripple effect, potentially leading to market instability and impacting the overall affordability and availability of high-purity hydrofluoric acid for end-user industries.

Market Opportunities:

The high-purity hydrofluoric acid market presents exciting opportunities fueled by the ever-evolving technological landscape. The booming electronics industry remains a key driver, with this acid acting as an irreplaceable sculptor in the etching processes for semiconductors and flat panel displays. As demand for these devices continues to soar, the market for high-purity hydrofluoric acid is poised for parallel growth. Beyond electronics, this acid unlocks the potential of fluorocarbons, a versatile class of materials. The rising global temperatures and urbanization are propelling the demand for efficient cooling systems, creating a prime opportunity for fluorocarbon refrigerants. Furthermore, fluoropolymers derived from high-purity hydrofluoric acid offer a unique combination of strength, heat resistance, and low friction, making them ideal for the automotive, construction, and aerospace industries. This translates to lighter, more fuel-efficient cars, sturdier buildings, and lighter yet stronger aircraft components. The potential doesn't stop there. High-purity hydrofluoric acid even plays a role in the traditional oil industry and the non-stick coatings on our cookware. Looking ahead, potential applications in solar energy and advancements in other industries further expand the horizon for this market. However, navigating stringent environmental regulations, ensuring worker safety, and adapting to volatile raw material prices remain challenges that need to be addressed for the high-purity hydrofluoric acid market to fully flourish. By overcoming these hurdles and embracing innovation, this market has the potential to become a cornerstone for the development of cutting-edge technologies and the creation of a more sustainable future.

HIGH-PURITY HYDROFLUORIC ACID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc. (US), Solvay (Belgium), Stella Chemical Corporation (Japan), Daikin Industries Limited (Japan), Lanxess (Germany), Sinochem Group (China), Mexichem S.A.B. de C.V. (Mexico), Yingpeng Group (China), Dongyue Group Ltd (China), Fluorchemie Group (Europe) |

High-purity Hydrofluoric Acid Market Segmentation - By Type

-

UP/SEMI G4

-

UP-S/SEMI G3 & UP-SS/SEMI G2

Within the high-purity hydrofluoric acid market, the most prominent sector between UP/SEMI G4 (highest purity) and UP-S/SEMI G3 & UP-SS/SEMI G2 (varying high-purity levels) is likely UP/SEMI G4. This is because it caters to the most advanced applications in the booming semiconductor industry, where the demand for high-performance microchips and transistors is constantly rising. While UP-S/SEMI G3 & UP-SS/SEMI G2 find use in the same industry, their slightly lower purity makes them suitable for less critical processes. As the focus remains on miniaturization and ever-increasing chip complexity, the demand for unparalleled etching precision offered by UP/SEMI G4 is expected to remain dominant.

High-purity Hydrofluoric Acid Market Segmentation - By Application

-

Semiconductor Industry

-

Flat Panel Display Industry

Currently, the Semiconductor Industry is the most prominent user of high-purity hydrofluoric acid compared to the Flat Panel Display Industry. While both rely on this acid for etching processes, the sheer volume and growth trajectory of the semiconductor industry outpace flat panel displays. The ever-increasing demand for high-performance microchips in everything from smartphones to artificial intelligence drives the need for UP/SEMI G4, the highest purity grade of this acid. Flat panel displays, though significant, cater to a more mature market with slower growth. This, coupled with the potential use of slightly lower purity grades (UP-S/SEMI G3 & UP-SS/SEMI G2) in some display applications, puts the semiconductor industry at the forefront of high-purity hydrofluoric acid consumption. However, the potential for future growth in solar energy, which also utilizes this acid, could alter the landscape in the coming years.

High-purity Hydrofluoric Acid Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific reigns supreme in the high-purity hydrofluoric acid market, boasting the highest consumption, and is projected to maintain the fastest growth. This dominance stems from the region's thriving electronics industry, a major driver for high-purity acid. Countries like China, India, and Japan are leading the charge in manufacturing semiconductors and flat panel displays, all heavily reliant on this acid for precise etching processes. Additionally, the burgeoning fluorocarbon market in Asia fuels the demand for high-purity hydrofluoric acid as a key raw material. While North America and Europe also hold significant market share, their growth is expected to be slower compared to the booming Asian market.

COVID-19 Impact Analysis on the Global High-purity Hydrofluoric Acid Market

The COVID-19 pandemic cast a temporary shadow on the high-purity hydrofluoric acid market. Initial disruptions in production and supply chains due to lockdowns and travel restrictions caused a slowdown in demand, particularly from the automotive and electronics industries. However, the impact proved uneven. The surge in demand for personal electronics like laptops and tablets for remote work and communication partially offset the decline. Additionally, stockpiling by manufacturers in anticipation of shortages helped mitigate the immediate impact. As the world adapted to the new normal, the high-purity hydrofluoric acid market exhibited a swift rebound. The continued importance of semiconductors for technology powering remote work and communication, coupled with a resurgence in demand from other sectors like construction and healthcare, fueled the market's recovery. Looking ahead, the long-term impact of COVID-19 might be an increased focus on domestic production and diversification of supply chains for high-purity hydrofluoric acid, potentially leading to a more geographically balanced market in the future.

Latest trends/Developments

The high-purity hydrofluoric acid market is etching its way forward with exciting trends. Semiconductor manufacturers are pushing the boundaries of miniaturization, demanding ever-higher purity grades like UP/SEMI G4 for the precise etching needed in advanced chip production. This focus on miniaturization and chip complexity is expected to keep UP/SEMI G4 in high demand. Beyond the established giants, the Flat Panel Display industry is exploring the use of high-purity hydrofluoric acid for next-generation displays with improved resolution and flexibility. Sustainability is also etching its mark on the market. The potential application of high-purity hydrofluoric acid in solar cell manufacturing holds promise for future growth, aligning with the global shift towards renewable energy. Research is also ongoing to explore the use of this acid in eco-friendly alternatives for refrigerants and non-stick coatings. However, challenges remain. Stringent environmental regulations and volatile raw material prices require innovative solutions to ensure responsible production and cost stability. Overall, the high-purity hydrofluoric acid market is poised for continued growth, fueled by advancements in technology, a growing focus on sustainability, and the relentless march of miniaturization in the semiconductor industry.

Key Players:

-

Honeywell International Inc. (US)

-

Solvay (Belgium)

-

Stella Chemical Corporation (Japan)

-

Daikin Industries Limited (Japan)

-

Lanxess (Germany)

-

Sinochem Group (China)

-

Mexichem S.A.B. de C.V. (Mexico)

-

Yingpeng Group (China)

-

Dongyue Group Ltd (China)

-

Fluorchemie Group (Europe)

Chapter 1. High-purity Hydrofluoric Acid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. High-purity Hydrofluoric Acid Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. High-purity Hydrofluoric Acid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. High-purity Hydrofluoric Acid Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. High-purity Hydrofluoric Acid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. High-purity Hydrofluoric Acid Market – By Type

6.1 Introduction/Key Findings

6.2 UP/SEMI G4

6.3 UP-S/SEMI G3 & UP-SS/SEMI G2

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. High-purity Hydrofluoric Acid Market – By Application

7.1 Introduction/Key Findings

7.2 Semiconductor Industry

7.3 Flat Panel Display Industry

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. High-purity Hydrofluoric Acid Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. High-purity Hydrofluoric Acid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International Inc. (US)

9.2 Solvay (Belgium)

9.3 Stella Chemical Corporation (Japan)

9.4 Daikin Industries Limited (Japan)

9.5 Lanxess (Germany)

9.6 Sinochem Group (China)

9.7 Mexichem S.A.B. de C.V. (Mexico)

9.8 Yingpeng Group (China)

9.9 Dongyue Group Ltd (China)

9.10 Fluorchemie Group (Europe)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global High-purity Hydrofluoric Acid Market was valued at USD 0.461 billion in 2023 and will grow at a CAGR of 6.9% from 2024 to 2030. The market is expected to reach USD 0.74 billion by 2030.

The soaring Electronics Industry, Expanding Fluorinated Products Market, and Growth in Oil Refining and Fluoropolymers are the reasons that are driving the market.

Based on Application it is divided into two segments – the Semiconductor Industry, and Flat Panel Display Industry.

Asia Pacific is the most dominant region for the luxury vehicle Market.

Honeywell International Inc. (US), Solvay (Belgium), Stella Chemifa Corporation (Japan), Daikin Industries Limited (Japan), Lanxess (Germany).