High Purity Chemical Market Size (2024 – 2030)

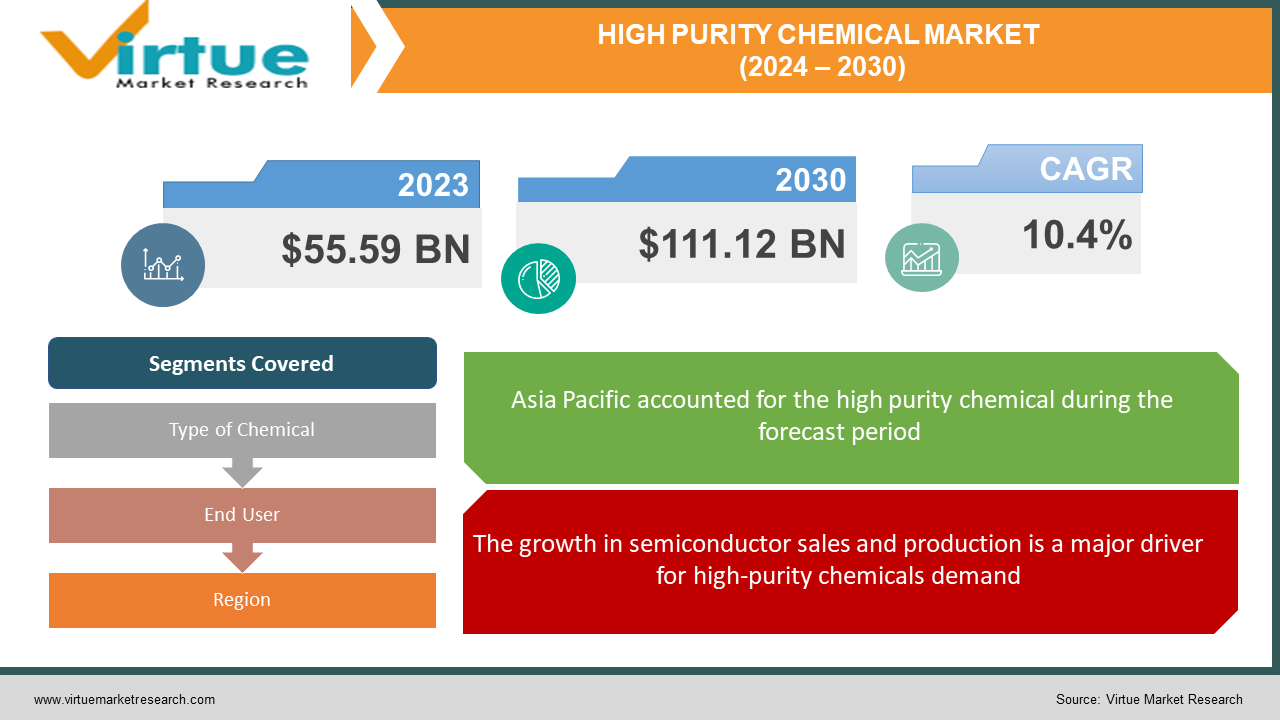

The Global High Purity Chemical Market was valued at USD 55.59 Billion in 2023 and is projected to reach a market size of USD 111.12 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.4%.

The global high-purity chemicals market refers to chemicals and reagents that are extremely pure, with purity levels over 99.999999% and impurity levels measured in parts per billion. These ultra-high purity chemicals find application across a diverse set of industries including semiconductors, aerospace, healthcare, and electronics among others. The high-purity chemicals market has been driven by the steady growth of end-use industries, especially semiconductors, Flat Panel Displays (FPDs), and light-emitting diodes (LEDs). Technological advancements leading to increasing complexity and precision requirements have also fueled demand for purer chemicals. Geographically, Asia Pacific dominates the market due to the concentration of electronics manufacturing and R&D activity in the region. Some of the major types of high-purity chemicals include acids, solvents, bases, dopants, photoresists, silicon wafers, and gases like ammonia, hydrogen chloride, nitrogen, oxygen, etc. Key applications include etching & cleaning processes, deposition, lithography, doping, and other critical steps in semiconductor and FPD production where trace impurities can significantly impact performance and yields.

Key Market Insights:

The global high-purity chemicals market provides critical ultra-high purity chemicals, reagents, gases, and other materials to a diverse set of industries where purity levels in the parts per billion or even trillion range are required. The silicon wafer market is the largest segment, accounting for around 35% of total revenues. Other key segments include high-purity acids, high-purity solvents, and high-purity bases. The semiconductors end-use industry consumes close to half of the total high-purity chemicals supplied, owing to the need for contamination-free materials in fabricating integrated circuits and chips. Consumer electronics, especially smartphones and laptops, are the largest application driving usage in semiconductors. 5G connectivity and AI capabilities are increasing purity requirements. Display panels and advanced LEDs require high-purity gases like ammonia along with metalorganic precursors for depositing coatings and dopants onto substrates. Healthcare is an emerging segment, with high-purity reagents needed in the biopharmaceutical manufacturing of vaccines and injectable drugs as well as diagnostic kits. Suppliers with vertically integrated production, extensive purification capabilities through repeated distillation, crystallization, specialized filtration, etc., and accredited quality control have the highest market share. Mergers and acquisitions are commonly used by companies to increase their production capacities and expand their product portfolios. Patent-protected purification techniques also confer a competitive advantage. Regulatory standards for materials purity, manufacturing processes, and safety/environmental compliance have tightened, especially in North America, Europe, and Japan.

Global High-Purity Chemical Market Drivers:

The growth in semiconductor sales and production is a major driver for high-purity chemicals demand.

The market for high-purity chemicals worldwide has been significantly influenced by the consistent rise in semiconductor manufacture and sales over the previous ten years. Since semiconductors are essential parts of many different types of electronics, there is an increasing need for ultra-pure chemicals for the processes involved in making them. The consumer electronics sector, particularly smartphones, which now account for close to 25% of all semiconductor demand, has been the main driver of this rise. Every year, new smartphone models with increasingly sophisticated features and components are introduced; thus, the standards for purity have also gone up. Furthermore, modern smartphones come equipped with advanced features like AI capabilities, machine learning, facial recognition, and high-resolution cameras. This necessitates the employment of specialist semiconductors, such as neural processing units and sophisticated CMOS image sensors, which require contamination-free materials throughout production to maintain yields and performance. In addition to smartphones, other items such as laptops, tablets, smart wearables, smart home appliances, and car infotainment systems have also included semiconductors, leading to an increase in volume. The market for automotive semiconductors is being further supported by emerging technologies such as driverless and electrified automobiles. The need for semiconductors and related ultra-pure chemicals has also increased due to the ongoing move towards the Internet of Things and the growth of linked devices throughout the manufacturing, utility, transportation, and healthcare sectors. The use of sensors, CPUs, and networking chips will rise as IoT adoption rises.

High-purity chemicals like electronic-grade ammonia, phosphine, arsine, and metal-organic precursors are vital for manufacturing LCD/OLED displays and LEDs.

The expanding production of display panels and LED lighting has emerged as a major demand driver for high-purity chemicals in recent years. From the deposition of films to cleaning and etching, these processes involve specialized ultra-pure gases, metals, and other reagents. For LCD and OLED display panels, which are ubiquitous in smartphones, televisions, laptops, and other devices, high-purity chemicals play a critical role. Ammonia gas is used to deposit thin film transistor layers onto glass substrates through chemical vapor deposition in LCD manufacturing. Similarly, in OLED displays, phosphines, arsines, and metalorganic precursors deposit precise amounts of dopants for producing efficient, uniform light-emitting films. Photolithography and etching of display layers also require electronic-grade solvents and acids such as sulfuric acid. Specialty polymers and epoxies of extreme purity are also used for encapsulation. The demand for bigger screen sizes with higher resolution has meant rapid growth of high-purity chemicals consumption. LED lighting manufacturing likewise depends on similar high-purity gases, metals, and compounds. Gallium, indium, and rare earth metals are key materials employed along with hydrides and other high-purity reagents. The global transition towards energy-efficient LED lighting driven by lower costs and environmental policies has accelerated uptake. LED production also necessitates high levels of purity for the deposition, lithography, and etching steps involved in forming the semiconductor diode wafers. Chemical vapor deposition and metal-organic CVD processes utilize gases like ammonia, phosphine, arsine, and trimethylgallium. Acids and solvents are also used for photoresist application and cleaning. With demand for LED lighting in smart buildings and households rising, the market for associated high-purity chemicals is projected to expand steadily. Additionally, manufacturers are developing more complex LED display screens which require new advanced precursor materials to deposit precise, ultrathin multi-layers.

Global High-Purity Chemical Market Restraints and Challenges:

Achieving the ultra-high purity levels demanded by the semiconductor, LED, and display panel industries requires heavy investments in specialized manufacturing infrastructure.

Achieving the stringent purity levels in the parts per trillion or even parts per quadrillion range demanded by the electronics industry requires massive capital investments by high-purity chemical manufacturers. This acts as a key restraint, especially for new entrants. Constructing specialized facilities with extensive purification and quality control infrastructure is extremely capital-intensive. Highly controlled cleanroom environments, advanced distillation columns, efficient filtration systems, precision crystal growth reactors, isolated filling lines, and stringent contamination protocols all add major fixed costs. The production equipment also requires expensive high-end materials like titanium, nickel alloys, high-density polyethylene, and stainless steel to prevent metal or organic impurities. Software, automation, and analytical tools needed for quality control and ultra-trace analysis further add to costs. Additionally, as semiconductor roadmaps evolve and require purities in the parts per trillion levels, existing manufacturing assets need frequent upgrading to meet tighter specifications. This leads to higher depreciation and additional capex. The short product lifecycles in electronics also mean facilities risk being outdated quickly if unable to adapt. For instance, new thin film deposition chemicals for OLEDs or DRAM memory may become obsolete within 5 years as formulations change.

Global High-Purity Chemical Market Opportunities:

Asia Pacific currently dominates the high-purity chemicals market, accounting for over 60% of global demand. With increasing manufacturing and R&D activity in key end-use segments like semiconductors, LEDs, and lithium-ion batteries concentrated in the region, further expansion potential exists. Setting up additional production capacities in China, Taiwan, South Korea, and Japan close to major electronics hubs will be advantageous. Localization also helps in reducing logistics costs and lead times. Firms can also target high-growth niche applications in biologics, solar PV manufacturing, and silicon carbide semiconductors emerging in the Asia Pacific. Introducing innovative chemistries for niche applications provides attractive opportunities to gain market share. For instance, developing custom dopant packages for OLED or GaN RF device makers. Emerging technologies like quantum computing, AI chips, 2D materials, and advanced LEDs require specialized ultra-pure precursors, gases, and other reagents that companies can focus on providing. Leveraging core capabilities in purification technologies and contamination control to expand into adjacent high-purity markets also offers growth potential. Markets like high-purity metals, ceramics, polymers, and reagents used in biopharma manufacturing present cross-selling opportunities.

HIGH PURITY CHEMICAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.4% |

|

Segments Covered |

By Type of Chemical, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF, Solvay, Evonik, Air Liquide , Linde, Honeywell, DuPont, Mitsubishi Chemical Corporation |

Global High-Purity Chemical Market Segmentation: By Type of Chemical

-

Electronic Grade Chemicals

-

Reagent Grade Chemicals

-

Specialty Gases

-

Others

Electronic Grade Chemicals are specialized chemicals designed for electronics manufacturing, including ultra-pure acids (hydrofluoric acid, sulfuric acid), solvents (acetone, isopropyl alcohol), and gases (silane, ammonia). This segment holds the largest market share, roughly 55-60%, due to the ever-growing demand for semiconductors and electronics. Reagent Grade Chemicals segment encompasses high-purity chemicals used in analytical labs, research, and various industries. Examples include solvents, buffers, and acids with lower impurities than electronic-grade counterparts. This segment accounts for approximately 20-25% of the market. Specialty Gases include highly purified gases like nitrogen, oxygen, helium, and argon are essential for medical uses, industrial processes, and research applications. This segment holds a share of around 10-15% of the market. Other categories include specific high-purity chemicals used in niche applications like pharmaceuticals, food additives, and specialized industrial processes. It generally holds a smaller market share around 5-10%.

Global High-Purity Chemical Market Segmentation: By End User

-

Semiconductors

-

Analytical Laboratories

-

Life Sciences & Pharmaceuticals

-

Food Industry

-

Other Industrial Applications

Semiconductors represent the most dominant application segment, accounting for roughly 40-45% of the market share. The stringent purity requirements for semiconductor manufacturing drive substantial demand for these chemicals. Analytical Laboratories hold a significant segment with approximately 20-25% of the market. This includes labs across various sectors like research, pharmaceuticals, and quality control, generating steady demand. Life Sciences & Pharmaceuticals account for around 15-20% of the market share. The need for high-purity reagents and solvents in drug development, manufacturing, and medical applications fuels this segment's growth. Food Industry represents approximately 5-8% of the market. High-purity additives, preservatives, and quality control chemicals are used to ensure food safety and maintain desired characteristics. Other Industrial Applications encompass applications in solar panels, fiber optics, and various niche sectors. Collectively, these make up around 10-15% of the market. The life sciences and pharmaceuticals segment is projected to be the fastest-growing application area for high-purity chemicals.

Global High-Purity Chemical Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With more than 60% of the global market for high-purity chemicals in 2023, Asia Pacific is the leading and fastest-growing region. With over 18% of the market in 2023, North America accounted for the second-largest proportion. But in comparison to other regions, growth is only expected to be moderate. Europe came next in 2023 with a 12 percent share, expanding steadily once more. Although they already account for less than 5% of the global market share, investments in the manufacturing of electronics are likely to propel growth rates in the Middle East Africa, and Latin America. The significant and increasing market share of Asia Pacific is ascribed to the region's widespread production of LEDs, display panels, and semiconductors. Taiwan, South Korea, Japan, and China are important centers for electronics R&D and manufacturing. This creates a large need for compounds with high purity. Growth has been further stimulated by government attempts to boost indigenous technology businesses. China is the biggest national market in Asia-Pacific, but South Korea and Japan also use significant amounts of high-purity chemicals. Important rising markets include Singapore, Taiwan, and India. The demand has also benefited from China's increasing manufacture of electric vehicles.

COVID-19 Impact Analysis on the Global High-Purity Chemical Market:

The COVID-19 pandemic caused major disruptions in the global high-purity chemicals market in 2020 and 2021. Lockdowns, supply chain disruptions, changes in consumer demand, and economic uncertainty all contributed to significant challenges for high-purity chemical manufacturers and suppliers. One of the biggest impacts was on production operations. With lockdowns imposed in many countries, manufacturing of high-purity chemicals faced labor shortages, raw material delays, and output cuts. For instance, key suppliers in China, Japan, Taiwan, and the United States saw months-long factory shutdowns and capacity reductions. Limited availability of high-purity chemicals led to higher costs and delays for electronics manufacturers. On the demand side, the closure of electronics factories and a slowdown in R&D activities during stringent lockdowns led to order deferments and reduced demand. For example, smartphone, automobile, and consumer electronics production slumped initially. This had an instant effect on high-purity chemical consumption. However, some segments like pharmaceuticals and healthcare sustained demand. Overall, revenues for most major high-purity chemical companies declined 15-25% in the first half of 2020 compared to pre-pandemic levels. Smaller suppliers focused only on electronics faced even steeper drops. The market witnessed supply-demand imbalances, inventory buildup, and falling prices. However, the market also displayed resilience, with demand recovering quickly in the second half as lockdowns eased, electronics production resumed, and consumer spending rebounded. Many firms reported demand recovery to near 2019 levels by the end of 2020.

Latest Trends/ Developments:

The global high-purity chemicals market has been experiencing several emerging trends and developments driven by changing technologies, sustainability goals, and evolving purity requirements. One major trend is the move towards more localized and diversified supply chains by electronics manufacturers. Events like trade disputes, the pandemic, and extreme weather have increased focus on reducing logistics risks. Firms are setting up production closer to demand centers and qualifying multiple regional suppliers. This provides opportunities for high-purity chemical companies to expand localized capacities. Another noticeable trend is the growing adoption of renewable feedstocks and greener chemistries. Using bio-based or recycled materials as raw materials allows high-purity chemical producers to reduce their carbon footprint. Companies are also minimizing waste, energy use, and emissions at facilities through technology improvements. Stricter purity standards instituted by industry bodies like SEMI are also driving innovation. For instance, contamination specifications for trace metals can be as low as parts per quadrillion level now. This requires the development of cutting-edge purification and quality control technologies to achieve such ultra-low impurity levels. Additionally, high-purity chemical manufacturers are increasingly adopting Industry 4.0 solutions like automation, IoT sensors, predictive analytics, and artificial intelligence to enhance productivity, yields, compliance, and safety. Advances in analytical testing methods like ICP-MS and GC-MS also help improve quality control. Emerging semiconductor designs using new advanced materials like silicon carbide and gallium nitride are increasing demand for associated specialty high-purity chemicals. High-purity reagents for biologics manufacturing are also a growth segment.

Key Players:

-

BASF

-

Solvay

-

Evonik

-

Air Liquide

-

Linde

-

Honeywell

-

DuPont

-

Mitsubishi Chemical Corporation

Chapter 1. High Purity Chemical Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. High Purity Chemical Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. High Purity Chemical Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. High Purity Chemical Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. High Purity Chemical Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. High Purity Chemical Market – By Type of Chemical

6.1 Introduction/Key Findings

6.2 Electronic Grade Chemicals

6.3 Reagent Grade Chemicals

6.4 Specialty Gases

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type of Chemical

6.7 Absolute $ Opportunity Analysis By Type of Chemical, 2024-2030

Chapter 7. High Purity Chemical Market – By End User

7.1 Introduction/Key Findings

7.2 Semiconductors

7.3 Analytical Laboratories

7.4 Life Sciences & Pharmaceuticals

7.5 Food Industry

7.6 Other Industrial Applications

7.7 Y-O-Y Growth trend Analysis By End User

7.8 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. High Purity Chemical Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type of Chemical-

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type of Chemical-

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type of Chemical-

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type of Chemical-

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type of Chemical-

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. High Purity Chemical Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF

9.2 Solvay

9.3 Evonik

9.4 Air Liquide

9.5 Linde

9.6 Honeywell

9.7 DuPont

9.8 Mitsubishi Chemical Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of semiconductors across electronics, computing, and telecommunications drives massive demand for high-purity chemicals. These chemicals are essential in the complex, multi-step process of semiconductor fabrication.

Producing high-purity chemicals requires specialized facilities, rigorous quality control, and often expensive raw materials. This translates to higher costs compared to standard-grade chemicals.

BASF, Solvay, Evonik, Air Liquide, Linde, Honeywell.

Asia Pacific currently holds the largest market share, estimated at around 60%.

Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.