High-Purity Carboxymethyl Cellulose Market Size (2023 – 2030)

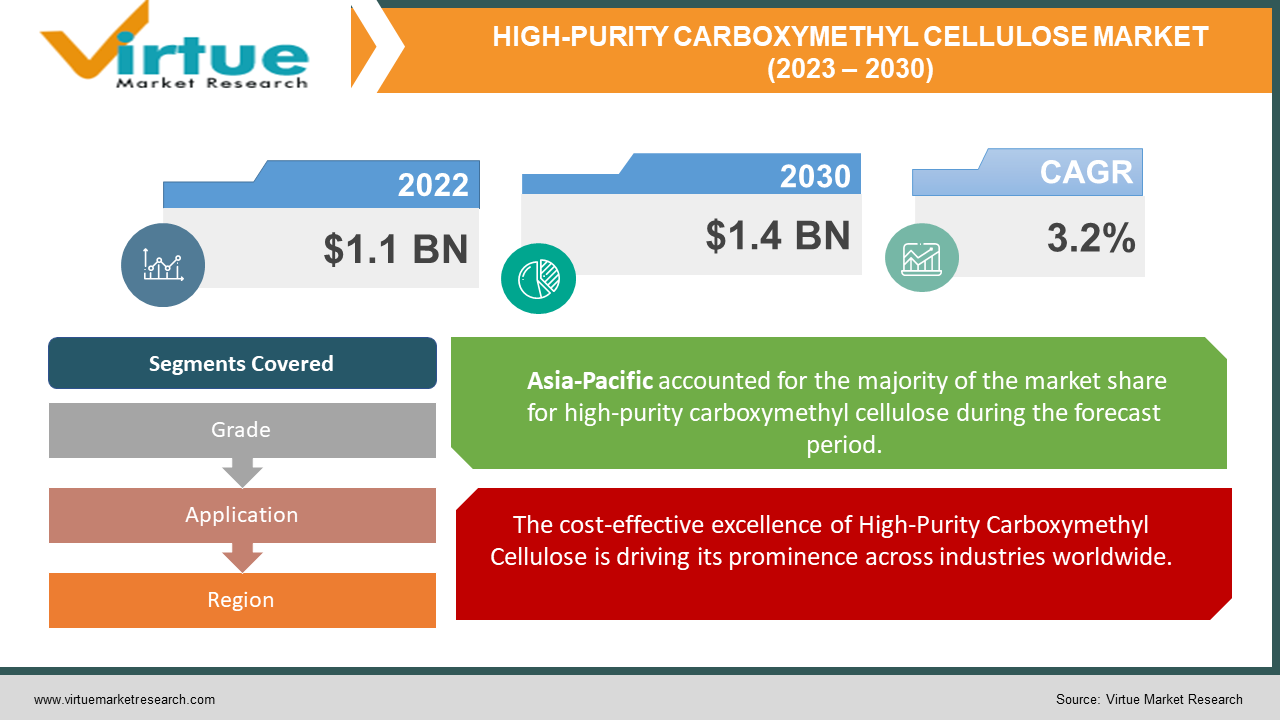

The Global High-Purity Carboxymethyl Cellulose Market was valued at USD 1.1 billion and is projected to reach a market size of USD 1.4 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 3.2%.

The High-Purity Carboxymethyl Cellulose (HPMC) market is experiencing trajectory of evolution and growth in the 21st Century. As industries across sectors continue to demand specialized solutions, HPMC has emerged as a vital component in various applications. This rising demand has captured the attention of professionals and researchers alike, leading to a surge in academic and industry interest. With the continuous expansion of its applications, the HPMC market is poised to present substantial career prospects over the coming decade, bridging the realms of chemistry, materials science, and industry-specific applications. To thrive in this dynamic landscape, industry leaders must cultivate new skill sets and cultivate a comprehensive grasp of the macro and micro factors influencing the HPMC market. This knowledge will be essential in navigating the intricate market dynamics while keeping sight of the overarching industry landscape.

Key Market Insights:

Anticipated within the timeframe of 2023 to 2027 is a 2.7% rise in the worldwide demand for high-purity carboxymethyl cellulose. This projection aligns with the escalating utilization of carboxymethyl cellulose spanning diverse industries such as food and beverage, pharmaceuticals, paints, and coatings, as well as textiles. This heightened demand will invariably prompt manufacturers of high-purity carboxymethyl cellulose to bolster their production capabilities. In tandem, expectations point to intensified research and development endeavors geared toward the creation of novel, innovative products boasting enhanced performance metrics.

With versatile applications spanning industries such as pharmaceuticals, food and beverages, cosmetics, and more, HPMC's demand is fueled by its multifunctional properties. As industries prioritize sustainable and health-conscious solutions, HPMC's plant-based origin and biodegradability resonate with the growing consumer preferences for natural additives. Technological advancements in the production of high-purity variants enhance its performance, aligning with the demand for innovative solutions. The globalization of supply chains facilitates efficient distribution, enabling manufacturers to cater to diverse industries globally. Cost efficiency remains a standout feature, attracting industries seeking optimal performance without compromising on budget. Regulatory compliance, functional benefits such as viscosity modification and stabilization, and environmental consciousness contribute to HPMC's expanding role in formulations. While challenges such as raw material sourcing persist, strategic investments in research and development drive continuous innovation, reflecting the market's responsiveness to evolving industry needs.

High-Purity Carboxymethyl Cellulose Market Drivers:

The cost-effective excellence of High-Purity Carboxymethyl Cellulose is driving its prominence across industries worldwide.

The global High-Purity Carboxymethyl Cellulose (HPMC) market experiences a parallel trend where its versatile applications and cost-effectiveness play a pivotal role. Just as patients seek quality medical care in developing nations due to the affordability and availability of resources, industries across the globe are turning to HPMC as a cost-efficient and resourceful solution for various applications. The appeal of developing nations offering top-notch medical practitioners resonates with the preference for HPMC as it provides high-quality functional properties at a fraction of the cost compared to alternatives. Comparable to the reduced medical treatment expenses in countries like Malaysia and Thailand, the HPMC market's economic advantage is driving its demand in various industries. As developing nations enhance healthcare infrastructure and provide accessible services at competitive prices, the HPMC market is poised to grow, parallel to the inflow of individuals seeking affordable and quality healthcare solutions.

The efficient performance of High-Purity Carboxymethyl Cellulose addresses concerns about waiting times, contributing to its growing demand across diverse sectors.

In a similar vein, the High-Purity Carboxymethyl Cellulose (HPMC) market addresses crucial concerns about efficiency and delayed processes. Just as prolonged waiting times in developed countries can exacerbate patients' conditions, delays in adopting effective solutions in various industries can hinder optimal outcomes. For instance, utilizing HPMC as a timely and efficient additive prevents the deterioration of product formulations, ensuring stability and performance.

The rising prevalence of ailments is driving the growth of the global High-Purity Carboxymethyl Cellulose market as its versatile applications find relevance in addressing diverse industry needs.

The escalating prevalence of health concerns, particularly among aging populations, coupled with the introduction of advanced solutions for addressing chronic disorders, is propelling the demand for High-Purity Carboxymethyl Cellulose (HPMC) across various industries. Just as the medical tourism industry gains momentum due to factors like expensive treatments and extended waiting times, HPMC emerges as a solution to diverse challenges in sectors such as pharmaceuticals, food, and cosmetics. The support extended by regulatory bodies and industry associations contributes to both markets' growth, as HPMC's versatility meets industry demands and medical tourism caters to patients seeking fast and accessible treatments. The parallel trends reflect the broader aspiration for efficient and affordable solutions, with HPMC aligning with industries' needs just as medical tourism addresses individuals' healthcare needs.

The market growth of the global High-Purity Carboxymethyl Cellulose is being driven by various factors such as its versatile applications, increasing demand for sustainable additives, and advancements in manufacturing processes.

The robust surge in governmental investments aimed at advancing healthcare infrastructure echoes a parallel narrative in the High-Purity Carboxymethyl Cellulose (HPMC) market. Favorable regulatory policies, coupled with investments fostering material innovation and sustainable practices, drive the growth of the HPMC market. Similarly, initiatives promoting HPMC's applications across industries and enhancing its accessibility contribute significantly to its market development. The dissemination of comprehensive information regarding HPMC's properties, applications, and cost-effectiveness facilitates its adoption among manufacturers. Furthermore, just as the shortage of specialized healthcare professionals prompts medical tourism, the specialized attributes of HPMC make it a sought-after solution, with professionals across industries turning to it to enhance their products' performance. Just as the medical tourism market thrives due to tailored expertise, the HPMC market prospers through specialized properties that cater to evolving industry needs.

High-Purity Carboxymethyl Cellulose Market Restraints and Challenges:

The complex reimbursement procedures and language-related challenges act as significant constraints for the High-Purity Carboxymethyl Cellulose market, hindering its seamless adoption across industries.

Potential adverse health impacts are associated with carboxymethyl cellulose. Among these concerns are colitis, metabolic disorders linked to microflora imbalances, and inflammatory effects. Furthermore, evidence indicates that carboxymethyl cellulose can modify bacterial compositions, heighten intestinal inflammation, and act as a trigger for conditions like Crohn's disease and ulcerative colitis. These considerations are projected to temper the growth trajectory of the market.

Apollo Pharmacy reported adverse reactions related to carboxymethyl cellulose, including eye irritation, sustained redness of the eyes, ocular discomfort, and impaired vision. These health concerns underscore the potential limitations on the expansion of the carboxymethyl cellulose market.

High-Purity Carboxymethyl Cellulose Market Opportunities:

The High-Purity Carboxymethyl Cellulose (HPMC) market presents substantial growth opportunities across industries. Its multifunctional properties make it a sought-after additive in pharmaceuticals, food, cosmetics, and more. As consumers demand sustainable and natural solutions, HPMC's eco-friendly nature aligns with market trends. Moreover, advancements in manufacturing techniques and the development of high-purity variants open doors to innovative applications. The market's expansion is further fueled by its cost-effectiveness and compliance with industry standards, positioning HPMC as a versatile and indispensable component in various formulations.

HIGH-PURITY CARBOXYMETHYL CELLULOSE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.2% |

|

Segments Covered |

By Grade, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Allwyn Chem Industries, Amar Cellulose Industries, Ashland Global Holdings Inc., Barzaghi Srl Unipersonale, Cellulose Solutions Pvt Ltd., CMC SA, Daicel Miraizu Ltd., DKS Co. Ltd., Foodchem International Corp., Hefei TNJ Chemical Industry Co. Ltd., Jining Fortune Biotech Co. Ltd., Lamberti SpA, Nippon Paper Group, J.M. Huber Corporation, DuPont |

High-Purity Carboxymethyl Cellulose Market Segmentation:

Market Segmentation: By Grade

-

High Purity Grade (99.5%+)

-

Technical Grade (90 - 99.5%)

-

Industrial Grade (50 - 90%)

According the high purity grade (99.5%+) category, it is projected to have largest market share in the global carboxymethyl cellulose market. It held a significant portion, approximately 59.2%, in the market landscape of 2022. This can be attributed to the escalating adoption of carboxymethyl cellulose across sectors such as food and beverage, cosmetics, and pharmaceuticals, which have collectively propelled the demand for high-purity grades. The High-Purity Carboxymethyl Cellulose (HPMC) market demonstrates a dynamic segmentation based on grade, catering to various industry demands. The segmentation includes High Purity Grade (99.5 %+), Technical Grade (90 - 99.5%), and Industrial Grade (50 - 90%). HPMC's segmentation echoes the diverse needs of industries. The high purity grade, emphasis on precision and quality, aligns with industries demanding optimal performance. Similarly, the technical grade corresponds to the need for controlled and efficient processes, while the industrial grade caters to broader applications, paralleling the comprehensive spectrum of medical procedures. The HPMC market segmentation captures the multifaceted requirements of industries, akin to the medical tourism industry's responsiveness to distinct treatment preferences.

Market Segmentation: By Application

-

Food & Beverage

-

Detergent

-

Paper & Pulp

-

Oil Field Drilling Fluid

-

Others

The food and beverages segment has displayed fastest growing in market share. High- Purity Carboxymethyl cellulose serves as a crucial food additive in this segment, performing diverse roles across various food products. Acting as a stabilizer, suspension agent, and thickener, it offers precise control over rheological properties, structure, flavor, and appearance. Its pseudoplastic properties contribute to enhanced product characteristics. For instance, high-purity carboxymethyl cellulose prevents protein condensation, sedimentation, and layering in yogurt. Moreover, its remarkable homogeneity ensures exceptional stability, particularly in acidic beverages. This substantiates its significance in shaping the quality and appeal of food and beverage offerings.

Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific (APAC) region stands as having the largest market share of 36.2 % in the global carboxymethyl cellulose market. APAC boasts substantial shares in both HPMC consumption and production, with key nations like China, India, Japan, South Korea, and Southeast Asian countries driving this regional ascendancy. The region's preeminence can be attributed to a confluence of factors. These encompass the region's vast population, rapid industrialization, thriving end-use sectors such as food and beverages, pharmaceuticals, and personal care, alongside a burgeoning consumer appetite for processed and convenient products.

While, the Middle East and Africa (MEA) emerge as the fastest-growing zone in the global carboxymethyl cellulose market. The MEA region is witnessing remarkable expansion across diverse industries, encompassing food and beverages, oil and gas, and pharmaceuticals. Elevated population growth, urbanization trends, increasing disposable incomes, and evolving consumer preferences synergize to bolster demand for processed foods, pharmaceuticals, and personal care goods in this region. Consequently, the consumption of HPMC is poised to experience a remarkable surge within the MEA region, setting the stage for its status as the fastest-growing market segment.

COVID-19 Impact Analysis on the Global High-Purity Carboxymethyl Cellulose Market:

The high-purity carboxymethyl cellulose market is currently navigating the uncertainties arising from the COVID-19 crisis, exerting an impact on its business landscape. Nevertheless, the global scenario is witnessing a notable decline in coronavirus cases across various regions, with exceptions noted in the U.K. and Russia. Notably, India's achievement of administering 1 billion vaccine doses has garnered attention from market stakeholders, fostering interest in investment within this region. Manufacturers are strategically channeling efforts into essential applications within sectors like food and beverages (F&B), oilfield operations, and pharmaceuticals, thereby contributing to the sustenance of economies.

Latest Trends/ Developments:

The High-Purity carboxymethyl cellulose has solidified its position as a widely employed stabilizer and thickening agent within the realm of the food and beverage sector. This prevailing tendency is foreseen to persist throughout the projected period. The substance has garnered expanding utilization across an array of comestibles and refreshments, encompassing ice cream, baked goods, milk, and confectioneries.

Similarly, its reach extends to sectors such as pharmaceuticals, cosmetics, oil field drilling fluids, and textiles. Consequently, the swift advancement observed within the processed food industry, coupled with the escalating production and consumption of pharmaceuticals and cosmetics, in addition to the upswing in global oil drilling endeavors, collectively contribute to the probable sustenance of high-purity carboxymethyl cellulose sales growth throughout the anticipated forecast period.

Key Players:

-

Allwyn Chem Industries

-

Amar Cellulose Industries

-

Ashland Global Holdings Inc.

-

Barzaghi Srl Unipersonale

-

Cellulose Solutions Pvt Ltd.

-

CMC SA

-

Daicel Miraizu Ltd.

-

DKS Co. Ltd.

-

Foodchem International Corp.

-

Hefei TNJ Chemical Industry Co. Ltd.

-

Jining Fortune Biotech Co. Ltd.

-

Lamberti SpA

-

Nippon Paper Group

-

J.M. Huber Corporation

-

DuPont

-

On March 2020, the Nippon Paper Group revealed its plans to establish a novel facility dedicated to the production of carboxymethyl cellulose, a functional cellulose product, within the Gotsu Mill premises situated in Japan.

-

On January 2020, J.M. Huber Corporation disclosed the divestiture of its carboxymethyl cellulose business to Nouryon, a prominent global specialty chemicals company.

-

On February 2022, DuPont introduced TEXTURECEL 2000 P BA 07, a naturally derived, high-purity carboxymethyl cellulose (CMC) powder with a low molecular weight. This innovation serves as a binder for graphite lithium-ion battery anodes, contributing to enhanced performance in battery technology.

Chapter 1. High-Purity Carboxymethyl Cellulose Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. High-Purity Carboxymethyl Cellulose Market – Executive Summary

2.1. Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. High-Purity Carboxymethyl Cellulose Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. High-Purity Carboxymethyl Cellulose Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. High-Purity Carboxymethyl Cellulose Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. High-Purity Carboxymethyl Cellulose Market – By Grade

6.1. Introduction/Key Findings

6.2 High Purity Grade (99.5%+)

6.3 Technical Grade (90 - 99.5%)

6.4 Industrial Grade (50 - 90%)

6.5 Y-O-Y Growth trend Analysis By Grade

6.6 Absolute $ Opportunity Analysis By Grade, 2023-2030

Chapter 7. High-Purity Carboxymethyl Cellulose Market – By Application

7.1. Introduction/Key Findings

7.2 Food & Beverage

7.3 Detergent

7.4 Paper & Pulp

7.5 Oil Field Drilling Fluid

7.6 Other

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. High-Purity Carboxymethyl Cellulose Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2 By Grade

8.1.3 By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1. U.K.

8.2.2. Germany

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.2.2 By Grade

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. Rest of Asia-Pacific

8.3.2 By Grade

8.3.3. By Service Provider

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1. Brazil

8.4.2. Argentina

8.4.3. Colombia

8.4.4. Chile

8.4.5. Rest of South America

8.4.2. By Grade

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1. United Arab Emirates (UAE)

8.5.2. Saudi Arabia

8.5.3. Qatar

8.5.4. Israel

8.5.5. South Africa

8.5.6. Nigeria

8.5.7. Kenya

8.5.8. Egypt

8.5.9. Rest of MEA

8.5.2. By Grade

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. High-Purity Carboxymethyl Cellulose Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Allwyn Chem Industries

9.2 Amar Cellulose Industries

9.3 Ashland Global Holdings Inc.

9.4 Barzaghi Srl Unipersonale

9.5 Cellulose Solutions Pvt Ltd.

9.6 CMC SA

9.7 Daicel Miraizu Ltd.

9.8 DKS Co. Ltd.

9.9 Foodchem International Corp.

9.10 Hefei TNJ Chemical Industry Co. Ltd

9.11 .Jining Fortune Biotech Co. Ltd

9.12 Lamberti SpA

9.13 Nippon Paper Group

9.14 J.M. Huber Corporation

9.15 DuPont

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The high-purity carboxymethyl cellulose market caters to specific industry needs by offering versatile functionalities as a stabilizer, thickener, binder, and more in sectors like pharmaceuticals, food, cosmetics, and beyond.

Sustainability drives demand for high-purity carboxymethyl cellulose as its eco-friendly nature aligns with industries' preferences for natural and environmentally conscious additives.

The high-purity carboxymethyl cellulose market faces challenges related to complex reimbursement procedures, insurance coverage policies, and language barriers, hindering seamless adoption and growth.

The key factors driving the growth of the high-purity carboxymethyl cellulose market include its versatile applications, sustainability benefits and technological advancements.

The high-purity carboxymethyl cellulose market is segmented based on grade into High Purity Grade (99.5%+), Technical Grade (90 - 99.5%), and Industrial Grade (50 - 90%).