Global High-Purity Aqueous Ammonium Market Size (2024 – 2030)

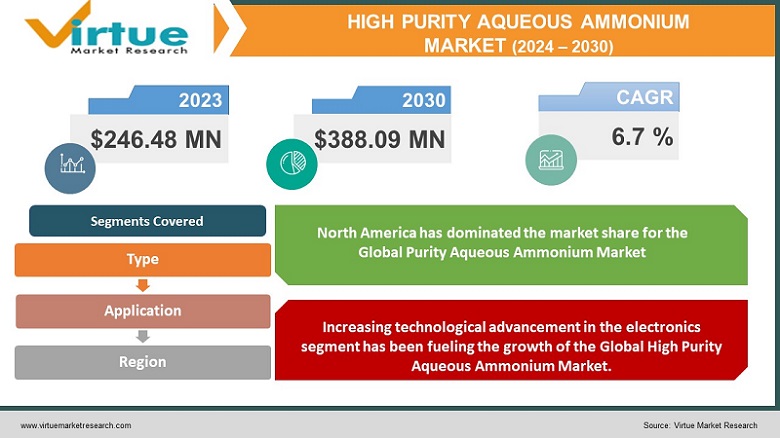

According to the report published by Virtue Market Research in Global High Purity Aqueous Ammonium Market is estimated to be USD 246.48 Million in 2023 and is estimated to reach a value of USD 388.09 Million by 2030, growing at a CAGR of 6.7 % during the forecast period of 2024 - 2030

High-purity aqueous ammonium chemical product, characterized by its remarkable absence of metal ion particles. It is a transparent, colorless solution that displays a powerful response to strong alkalis. Its distinctive feature is the robust and pungent scent attributed to the release of ammonia gas, which occurs even at room temperatures. Upon heating, this release of ammonia gas intensifies significantly. The solution possesses the ability to etch surfaces made of copper, nickel, zinc, tin, and their respective alloys. When exposed to acids or halogens, a vigorous reaction occurs, accompanied by the liberation of heat.

High-purity aqueous ammonium has remarkable chemical properties which makes it an important product spanning various applications such as in the electronics and semiconductor sector, it serves as an essential ingredient for cleaning, etching, and chemical vapor deposition during the intricate fabrication of microchips and electronic components. Its significance extends to chemical manufacturing processes, contributing to the creation of various compounds and fertilizers. High-purity aqueous ammonium is harnessed for water treatment, effectively removing chlorine and chloramine compounds. Its utilization in electroplating and surface finishing processes enhances surface quality for plating or coating. These applications collectively play an important role in displaying that high-purity aqueous ammonium array plays an industrial process.

Global High-Purity Aqueous Ammonium Market Drivers:

Increasing technological advancement in the electronics segment has been fueling the growth of the Global High Purity Aqueous Ammonium Market.

High-purity aqueous ammonium is increasingly being utilized in cutting-edge technologies such as semiconductor manufacturing, where its purity is crucial for ensuring the quality and reliability of electronic components. In the electronics and semiconductor manufacturing industry, high-purity aqueous ammonium is used for various critical processes, such as cleaning, etching, and chemical vapor deposition (CVD) steps during the fabrication of integrated circuits and electronic components. As technological advancements continue to progress, the need for high-purity products such as aqueous ammonium is poised to experience sustained growth. This upward trajectory is anticipated to significantly contribute to the expansion of the Global High Purity Aqueous Ammonium Market.

The growing Pharmaceutical Industry and its application in research have also been contributing to the growth of the Global High Purity Aqueous Ammonium Market.

In the pharmaceutical and biotechnology sectors, the demand for high-purity chemicals is significantly increasing owing to its diverse applications including research, drug formulation, and manufacturing processes. Notably, high-purity aqueous ammonium plays a vital role in pharmaceutical synthesis and analytical chemistry, perfectly aligning with the continuous expansion of these industries. The pharmaceutical industry relies heavily on high-purity chemicals to reflect its commitment to producing safe, effective, and reliable pharmaceutical products. These factors in the pharmaceutical sector are estimated to propel the growth of the Global High Purity Aqueous Ammonium Market.

Global High-Purity Aqueous Ammonium Market Challenges:

Ammonium is considered potentially harmful to human health. Exposure to the product during its processing, manufacturing, and transportation phases can lead to severe respiratory infections due to the inhalation of dust and aqueous aerosols. Prolonged skin contact has the potential to cause dermatitis, while exposure to the eyes and lungs can result in lasting damage. Inhaling concentrated ammonia gas released from ammonium can induce coughing, respiratory distress, vomiting, bronchitis, fluid accumulation in the lungs, and even pneumonia. Eye contact with ammonium products can lead to clouding of the cornea, and excessive tearing, and may ultimately impair or even jeopardize vision. Handling ammonium products necessitates well-trained and skilled workers due to their complex nature. Managing these substances proves to be extremely challenging. As a consequence, these hurdles are anticipated to hinder the expansion of the market.

Global High-Purity Aqueous Ammonium Market Opportunities:

The rapid growth and advancements in technology and innovation showcase the potential for the development of novel applications by creating avenues for the expansion of this market. Industries such as electronics, pharmaceuticals, and biotechnology continue to seek high-purity chemicals, including aqueous ammonium, to meet their stringent quality and performance demands. High-purity aqueous ammonium's potential for precise medical applications may emerge, that will pave the path for breakthroughs in diagnostics and treatment. Increased globalization and cross-border trade open doors for aqueous ammonium to reach new regions and markets. High Purity Aqueous Ammonium Market projects lucrative business opportunities during the forecast period.

COVID-19 Impact on Global High-Purity Aqueous Ammonium Market:

The pandemic has global restrictions and lockdowns which led to massive disruptions of supply chains which hurt the market. As industries grappled with production slowdowns and logistical challenges, the demand for certain applications of high-purity aqueous ammonium experienced fluctuations. Sectors like electronics and semiconductor manufacturing, which heavily rely on high-purity chemicals, faced disruptions due to factory closures and reduced operational capacities. On the contrary, the pandemic also highlighted the importance of pharmaceutical research and healthcare, potentially leading to increased demand for high-purity chemicals used in drug development and analytical testing. In the post-pandemic phase, the market is set to stabilize and project growth during the forecast period. The overall effect of COVID-19 on the Global High Purity Aqueous Market has been moderate.

Global High Purity Aqueous Ammonium Market Recent Developments:

-

In January 2023, Azersulfat LLC plans to manufacture fertilizers incorporating ammonium sulfate. The company's objective is to enhance the production of sulfuric acid and ammonium sulfate fertilizers as a strategic response to counter the elevated pricing in the fertilizer market.

-

In January 2023, Entegris revealed a substantial investment of $50 million aimed at expanding the capacity of its high-purity electronic chemicals division in North America. This strategic move is designed to provide robust support for the projected upsurge in domestic semiconductor manufacturing.

- In September 2021, Sumitomo Chemical and Solvay embarked on investments in the realm of chemicals tailored for the semiconductor sector. Sumitomo is set to augment its operational capacity across Japan and South Korea, specifically in the production of cutting-edge photoresists employed in lithography for intricate circuit line creation. This expansion endeavor extends to plants in both countries that specialize in the manufacturing of high-purity sulfuric acid and aqueous ammonia, pivotal elements for chip-cleaning applications. Along with this, Solvay is poised to collaborate with Shinkong Synthetic Fibers, jointly establishing a facility in Taiwan to produce electronics-grade hydrogen peroxide, an essential component in the cleaning process.

HIGH PURITY AQUEOUS AMMONIUM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023- 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Avantor Inc., Honeywell Inc., Solvoy, Merck Kgaa, Entegris, Sumitomo Chemicals Co. ltd., Kanto Chemical Co. Inc., Mitsubishi Oil Chemical Company, Air Liquide |

Global High-Purity Aqueous Ammonium Market Segmentation:

Global High Purity Aqueous Ammonium Market Segmentation: By Type

-

Ammonium Hydroxide

-

Ammonium Sulfate

-

Ammonium Nitrate

-

Ammonium Chloride

-

Other types

Ammonium hydroxide is the most dominant type of aqueous ammonium in this segment with the largest market revenue in 2022. Ammonium hydroxide, also known as ammonia solution, is a common type of high-purity aqueous ammonium. It is used in various industries, including electronics, pharmaceuticals, and chemical manufacturing, for processes such as cleaning, etching, water treatment, and pH adjustment. Ammonium sulfate is the fastest-growing segment and is projected to hold significant market revenue during the forecast period.

Global High Purity Aqueous Ammonium Market Segmentation: By Application

-

Electronic Industry

-

Pharmaceutical Industry

-

Textile Industry

-

Fertilizers Production

-

Water Treatment

-

Paper Industry

-

Others

The electronics industry has been the most dominant in this segment as it holds the largest market revenue during 2022 because it serves as a vital component in the production of high-quality electronic components, contributing to the reliability and performance of integrated circuits. As the advancements in the electronics field continue, it will keep propelling the demand for high-purity aqueous ammonium. The pharmaceutical industry is the fastest-growing segment and is projected to grow significantly with the research and innovation in the pharmaceutical sector.

Global High Purity Aqueous Ammonium Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America has dominated the market share for the Global Purity Aqueous Ammonium Market owing to its well-established electronics and semiconductor manufacturing industries and has often been a dominant market for high-purity aqueous ammonium used in semiconductor fabrication processes. Countries like the United States and Canada play a significant role in driving demand. Europe is the fastest-growing segment and holds substantial market revenue.

Global High Purity Aqueous Ammonium Market Key Players:

-

BASF SE

-

Avantor Inc.

-

Honeywell Inc.

-

Solvoy

-

Merck Kgaa

-

Entegris

-

Sumitomo Chemicals Co. Ltd.

-

Kanto Chemical Co. Inc.

-

Mitsubishi Oil Chemical Company

-

Air Liquide

Chapter 1. High Purity Aqueous Ammonium Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. High Purity Aqueous Ammonium Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. High Purity Aqueous Ammonium Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. High Purity Aqueous Ammonium Market Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. High Purity Aqueous Ammonium Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. High Purity Aqueous Ammonium Market – By Type

6.1. Introduction/Key Findings

6.2 Ammonium Hydroxide

6.3 Ammonium Sulfate

6.4 Ammonium Nitrate

6.5 Ammonium Chloride

6.6 Other types

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. High Purity Aqueous Ammonium Market – By Application

7.1. Introduction/Key Findings

7.2 Electronic Industry

7.3 Pharmaceutical Industry

7.4 Textile Industry

7.5 Fertilizers Production

7.6 Water Treatment

7.7 Paper Industry

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. High Purity Aqueous Ammonium Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2 By Type

8.1.3 By Application

8.1.6. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1. U.K.

8.2.2. Germany

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.2.2 By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. Rest of Asia-Pacific

8.3.2 By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1. Brazil

8.4.2. Argentina

8.4.3. Colombia

8.4.4. Chile

8.4.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.6. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1. United Arab Emirates (UAE)

8.5.2. Saudi Arabia

8.5.3. Qatar

8.5.4. Israel

8.5.5. South Africa

8.5.6. Nigeria

8.5.7. Kenya

8.5.8. Egypt

8.5.9. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. High Purity Aqueous Ammonium Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Avantor Inc.

9.3 Honeywell Inc.

9.4 Solvoy

9.5 Merck Kgaa

9.6 Entegris

9.7 Sumitomo Chemicals Co. Ltd.

9.8 Kanto Chemical Co. Inc.

9.9 Mitsubishi Oil Chemical Company

9.10 Air Liquide

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

According to the report published by Virtue Market Research in Global High Purity Aqueous Ammonium Market is estimated to be USD 246.48 Million in 2023 and is estimated to reach a value of USD 388.09 Million by 2030, growing at a CAGR of 6.7 % during the forecast period of 2024 - 2030

The application of High Purity Aqueous Ammonium in the electronics and pharmaceutical sector is the key market driver.

Based on Application, the Global Purity Aqueous Ammonium Market is segmented into the Electronic Industry, Pharmaceutical Industry, Textile Industry, Fertilizers Production, Water Treatment, Paper Industry, and Others.

The United States of America is the most dominant country in the region of North America for the Global High Purity Aqueous Ammonium Market.

BASF SE, Avantor Inc., Honeywell Inc., Solvay, Merck Kgaa, Entegris, Sumitomo Chemicals Co. Ltd., Kanto Chemical Co. Inc., Mitsubishi Oil Chemical Company, Air Liquide.