High-Pressure Pumps Market Size (2024 – 2030)

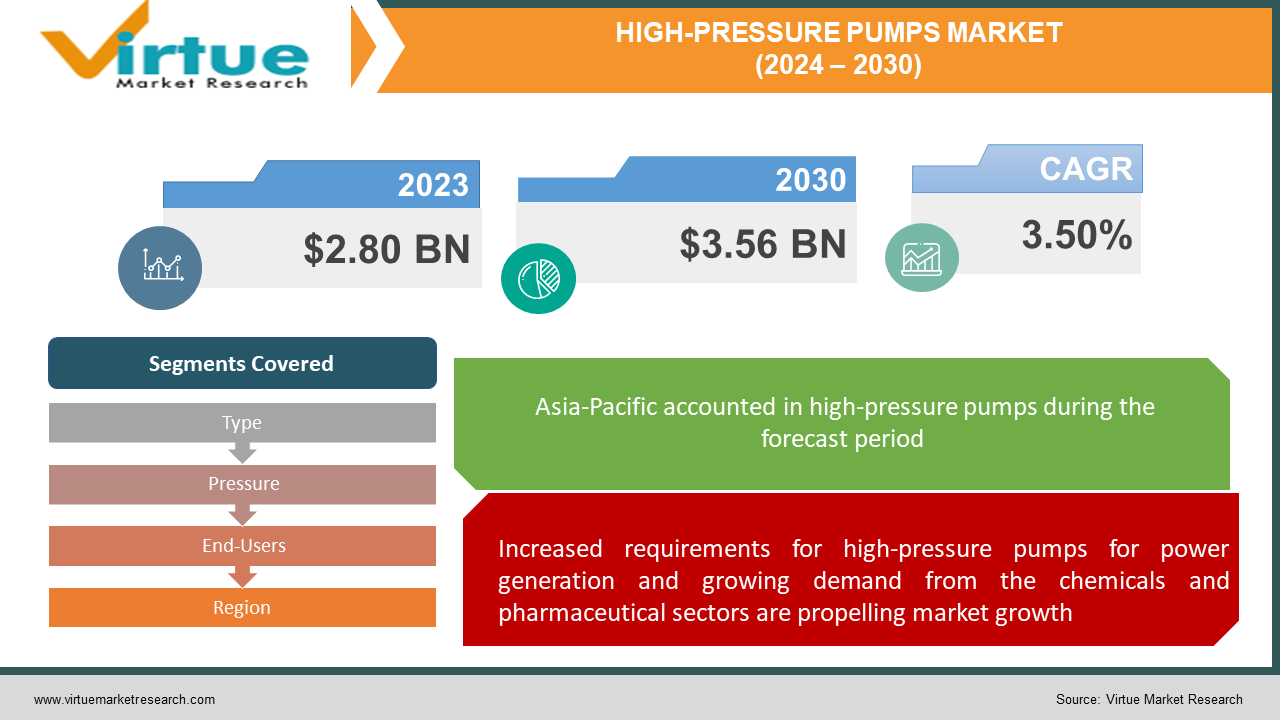

The high-pressure pumps market was valued at USD 2.80 billion in 2023 and is projected to reach a market size of USD 3.56 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.50%.

High-pressure pumps are mechanical devices that raise fluid pressure to between 70 and 700 bars. They function by drawing in a lower-pressure fluid and pushing it up to a greater pressure. High-pressure pumps are in handy for operations that call for more power or effectiveness. They can move fluids via pipelines and across great distances with little pressure loss.

Key Market Insights:

Despite promising growth, issues related to excessive energy consumption and the environment provide obstacles that require effective and eco-friendly pump solutions. In addition to impeding market expansion, geopolitical instability, regulatory compliance, and economic changes all call for cooperative efforts to maintain stability and sustainable progress in the face of growing demand.

Notable trends include the use of digital technology for remote monitoring, solutions that prioritize sustainability, and developments in material science that broaden the possibilities for pumps. Asia-Pacific is the dominant region due to advances in technology, infrastructural expansion, and quick manufacturing. The market with the quickest rate of growth is North America, which is being propelled by automation and strict environmental restrictions.

High Pressure Pumps Market Drivers:

Increased requirements for high-pressure pumps for power generation and growing demand from the chemicals and pharmaceutical sectors are propelling market growth.

The high-pressure pump market is driven by a combination of factors that determine its growth and evolution. One of the main factors is the growing demand in various industries for efficient pump solutions that can handle high-pressure applications. Sectors such as oil and gas, manufacturing, construction, and automotive are increasingly relying on high-pressure pumps to meet their operational needs. Additionally, the growing range of applications of high-pressure pumps, ranging from water jet cutting to high-pressure cleaning, is driving market growth. In addition, the growing focus on energy efficiency and sustainability makes manufacturers innovate and create pressure pumps that are not only powerful but also environmentally friendly. Technological advances, such as the integration of IoT and automation, increase the efficiency and reliability of high-pressure pumps, expanding their adoption. Also, increasing infrastructure activity across the world and the rapid development of emerging economies are creating huge opportunities for market expansion. As companies continue to prioritize productivity, safety, and environmental concerns, the demand for high-pressure pumps is expected to increase, driving the market toward face value in the coming years.

High Pressure Pumps Market Restraints and Challenges:

The high-pressure pump market is driven by a combination of factors that determine its growth and evolution. One of the main factors is the growing demand in various industries for efficient pump solutions that can handle high-pressure applications. Sectors such as oil and gas, manufacturing, construction, and automotive are increasingly relying on high-pressure pumps to meet their operational needs. Additionally, the growing range of applications of high-pressure pumps, ranging from water jet cutting to high-pressure cleaning, is driving market growth. In addition, the growing focus on energy efficiency and sustainability makes manufacturers innovate and create pressure pumps that are not only powerful but also environmentally friendly. Technological advances, such as the integration of IoT and automation, increase the efficiency and reliability of high-pressure pumps, expanding their adoption. Also, the rising infrared pump market, although experiencing great growth, faces many obstacles and challenges that deserve attention. The main obstacle lies in the complex balance between the demand for high-pressure pumps and the resulting costs. These pumps, often needed in industrial applications such as oil and gas, manufacturing, and water treatment, require high energy consumption, resulting in high operating costs. Additionally, the market faces challenges of environmental sustainability and regulatory compliance. Strict regulations aimed at reducing emissions and promoting environmental friendliness require the development of high-pressure pumps that are efficient in the environment, adding complexity to research and development efforts. The market growth may be subject to economic fluctuations and geopolitical instability, affecting investment in infrastructure projects where high-pressure pumps are an important component. Furthermore, technological advances introduce both opportunities and challenges. While innovation leads to improved efficiency and effectiveness, it also requires constant adaptation and investment. Addressing these obstacles and challenges requires a multifaceted approach, including collaboration between industry players, government agencies, and technology developers to ensure sustainable progress and stability, and the salvage market is high. Global processing operations, along with rapid production in emerging economies, create great opportunities for market expansion. As companies continue to prioritize productivity, safety, and environmental concerns, the demand for high-pressure pumps is expected to increase, driving the market toward face value in the coming years.

High Pressure Pumps Market Opportunities:

The high-end pump market offers opportunities for many reasons. With increasing production in various sectors such as oil and gas, manufacturing, automotive, and construction, the demand for high-pressure pumps continues to increase. These pumps play a vital role in many applications, including water jet cutting, steam generation, cleaning systems, and hydraulic power packs. Furthermore, the focus on energy efficiency and sustainability has promoted the development of advanced pumping technologies that provide better performance and reduce environmental impact. In addition, the growing awareness of the importance of water and wastewater management has led to the adoption of advanced water pumps, water treatment, and irrigation plants. Also, the expansion of the oil and gas industry, especially in poor materials such as shale gas and solid oil, increases the demand for high-pressure pumps for efficient stimulation and enhancing oil recovery operations. With technological advancements and innovations driving the market forward, manufacturers are allowed to meet different customer needs, explore new applications, and expand their footprint. the world together. Partnerships, strategic partnerships, and investment in research and development are key strategies to take advantage of the emerging opportunities in the high-end salvage market.

HIGH-PRESSURE PUMPS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.50% |

|

Segments Covered |

By Type, Pressure, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sulzer Ltd, Danfoss A/S, Maximator GmbH, Teledyne Group, ANDRITZ AG,. The Weir Group PLC, GEA Group Aktiengesellschaft, Ardelyx, Inc., Comet Spa |

High Pressure Pumps Market Segmentation: By Type

-

Positive Displacement

-

Dynamic

The dynamic segment is the largest growing type. The high-pressure pump market segment is witnessing significant growth, driven by several factors that are reshaping its landscape. An important factor is the rapid development of technology, which leads to the development of high-quality pumps suitable for various industrial applications. In addition, the growing demand for high-pressure pumps in areas such as oil and gas, manufacturing, and water treatment is driving innovation and competition in this tough segment. The focus on sustainability and energy efficiency enables manufacturers to introduce user-friendly solutions, thereby increasing market growth. This change is having a major impact on the global high-pressure pump market, driving intense competition and investment in research and development. As the company strives to stay ahead in this competitive environment, the dynamic segment continues, providing new opportunities for innovation, expansion, and market leadership. The positive displacement segment of the high-pressure pump market is witnessing the fastest growth, fueled by several factors. One important factor is the growing need in areas such as oil and gas, chemical processing, and water treatment, where variable flow rates are important. Positive displacement pumps offer advantages such as high efficiency, reliability, and the ability to handle a wide range of viscosities and pressures, making them important in a variety of applications.

High Pressure Pumps Market Segmentation: By Pressure

-

30 bars to 100 bar

-

100 bar to 500 bar

-

Above 500 bar

The 30-bar to 100-bar sector holds the largest market share. The range from 30 bar to 100 bar in high-pressure pumps signifies a critical segment within the market, characterized by significant growth factors and profound impacts on the global industry. This pressure range caters to a wide array of industrial applications, including but not limited to industrial cleaning, chemical processing, and high-pressure water jet cutting. The growing demand for high-pressure pumps within this range is attributed to various factors, such as expanding industrialization, stringent regulations concerning process efficiency and emissions, and the need for enhanced productivity. Moreover, the evolution of advanced materials and technologies has enabled manufacturers to develop high-pressure pumps that offer greater efficiency, reliability, and durability, further driving their adoption across different sectors. Consequently, the heightened demand for high-pressure pumps in the 30-bar to 100-bar range significantly influences the dynamics of the global market, fostering innovation, competition, and strategic partnerships among industry players to capitalize on emerging opportunities and address evolving customer requirements. The range of high-pressure pumps spanning from 100 bar to 500 bar is experiencing the fastest growth, driven by various factors that impact the global market.

High Pressure Pumps Market Segmentation: By End-Users

-

Oil & Gas

-

Chemical & Pharmaceutical

-

Power Generation

-

Manufacturing

-

Others

The manufacturing sector is the largest growing end-user. In industrial operations spanning sectors including automotive, aerospace, electronics, and metal fabrication, high-pressure pumps are essential. These pumps are utilized in applications where accuracy and dependability are critical, such as cutting, cleaning, shaping, and surface treatment. The increasing need for superior goods, quicker production cycles, and lean manufacturing techniques necessitate high-pressure pump solutions from manufacturers that are effective, adaptable, and compatible with automated production systems. Oil & gas is the fastest-growing segment. High-pressure pumps are essential to many upstream and downstream processes in the oil and gas sector. Well-stimulation, increased oil recovery, pipeline cleaning, and offshore platform maintenance are among the operations for which these pumps are employed.

High Pressure Pumps Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest growing market. Rapid production, especially in emerging economies such as China, India, and South Korea, is driving demand for high-pressure pumps in various sectors such as manufacturing, oil and gas, and automotive. Moreover, increasing infrastructure development, urbanization, and investments in water resources are driving market expansion. Technological progress and innovation in the area contribute to the development of high-performance, energy-efficient solutions, meeting the changing needs of the industry. As Asia-Pacific continues to assert its dominance in the global market, its growth patterns have a significant impact on the dynamics of the global surface pump market. Manufacturers are focusing on this area, offering opportunities and strategic partnerships to increase the demand for young people, thus reshaping the global nature of the high-end pump industry. North America is the fastest-growing market. The equipment is working in the area, especially in the section like oil, resulting in automation, eating for the high pump. In addition, strict environmental regulations are leading to the adoption of advanced pump technologies that provide high efficiency and low emissions, thereby increasing market growth. Additionally, North America's focus on infrastructure development and investment in the water and wastewater industry is increasing the demand for high-pressure pumps in the region. As a result, the North American market has a significant impact on the global high-pressure pump market. Market trends, innovations, and regulatory developments from North America ripple across the industry, shaping policies and opportunities for manufacturers and stakeholders around the world.

COVID-19 Impact Analysis on the High-Pressure Pumps Market:

The outbreak of COVID-19 has had a major impact on the high-pressure pump market, disrupting various industries across the globe. Pandemic-induced lockdowns, travel restrictions, and supply chain disruptions have led to a slowdown in industrial activity, resulting in a temporary drop in demand for high-pressure pumps. Sectors such as manufacturing, oil and gas, and construction, which are major consumers of high-pressure pumps, have experienced reduced production and service delays during the pandemic. However, within these challenges, opportunities have also emerged. The increased attention to hygiene and sanitation processes has led to an increase in the demand for high-pressure pumps for preventive purposes in medical facilities, public spaces, and industrial facilities. In addition, the rapid adoption of digital and automation to ensure efficiency and safety in operation has led people to demand high-pressure pump systems. As the industry recovers and slowly adapts to new technologies, it is expected that the high-pressure pump market will see continuous growth, which is changing with changing customer needs.

Latest Trends/ Developments:

In the ever-evolving high-pressure pump market, many notable trends and developments have emerged, shaping the industry's landscape. An important trend is the increase in digital technology and automation in the high-pressure pumping system, enabling remote monitoring, forecasting, and better operational efficiency. In addition, there is an increased focus on sustainability, leading to the creation of high-efficiency, environmentally friendly solutions that reduce energy consumption and environmental impact. The progress in material science and engineering has led to the introduction of new types of pumps that can withstand high pressure and severe operating conditions, thus expanding the application of high-pressure pumps in various industries. The market has an increasing appetite for customized solutions designed for the industrial sector, prompting manufacturers to offer flexible products. These trends reinforce the dynamic nature of the high-pressure pump market, presenting both challenges and opportunities for players across the spectrum.

Additionally, they contribute to sustainability efforts by promoting resource utilization. This practice is especially important in marketing, where brands strive to create attractive advertising, personalized advertising, and e-commerce, where product design is becoming increasingly important. GAN is the cornerstone of innovation in the generation of AI images, changing the quality, diversity, and environmental effectiveness of images.

Key Players:

-

Sulzer Ltd

-

Danfoss A/S

-

Maximator GmbH

-

Teledyne Group

-

ANDRITZ AG

-

The Weir Group PLC

-

GEA Group Aktiengesellschaft

-

Ardelyx, Inc.

-

Comet Spa

-

In April 2022, Clean Energy & Industrial Gases Group (Group), a cryogenic industry and a part of Nikkiso Co., Ltd. in Japan, will supply one of the launch support systems in the world. For the last four decades, the company has provided uninterrupted operating systems for the space and launch industry.

-

In April 2022, D Group's Cryogenic Pumps Unit (Nikkiso ACD) designed, engineered, and manufactured HD SLS as a vigorous, reliable addition to the reciprocating high-pressure line of pumps. These pumps are designed for rigorous requirements, including minimum cool-down time, wide turndown ratios, and maximized mean time between overhauls.

Chapter 1. High Pressure Pumps Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. High Pressure Pumps Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. High Pressure Pumps Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. High Pressure Pumps Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. High Pressure Pumps Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. High Pressure Pumps Market – By Type

6.1 Introduction/Key Findings

6.2 Positive Displacement

6.3 Dynamic

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. High Pressure Pumps Market – By Pressure

7.1 Introduction/Key Findings

7.2 30 bars to 100 bar

7.3 100 bar to 500 bar

7.4 Above 500 bar

7.5 Y-O-Y Growth trend Analysis By Pressure

7.6 Absolute $ Opportunity Analysis By Pressure, 2024-2030

Chapter 8. High Pressure Pumps Market – By End-Users

8.1 Introduction/Key Findings

8.2 Oil & Gas

8.3 Chemical & Pharmaceutical

8.4 Power Generation

8.5 Manufacturing

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-Users

8.8 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 9. High Pressure Pumps Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Pressure

9.1.4 By End-Users

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Pressure

9.2.4 By End-Users

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Pressure

9.3.4 By End-Users

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Pressure

9.4.4 By End-Users

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Pressure

9.5.4 By End-Users

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. High Pressure Pumps Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sulzer Ltd

10.2 Danfoss A/S

10.3 Maximator GmbH

10.4 Teledyne Group

10.5 ANDRITZ AG

10.6 The Weir Group PLC

10.7 GEA Group Aktiengesellschaft

10.8 Ardelyx, Inc.

10.9 Comet Spa

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The high-pressure pumps market was valued at USD 2.80 billion in 2023 and is projected to reach a market size of USD 3.56 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.50%.

The increased requirement for high-pressure pumps for power generation and growing demand from the chemicals and pharmaceutical sectors.

Based on type, the high-pressure pump market is segmented into positive displacement and dynamic.

Asia-Pacific is the most dominant region for the high-pressure pump market.

Sulzer Management Ltd., Grundfos Holding A/S, the Weir Group PLC, CAT Pumps, Comet S.p.A., Teledyne Technologies Incorporated, Zhejiang Danau Industries Co., Udor S.p.A., Andritz AG, and Danfoss A/S are the major players in the high-pressure pump market.