High-Performance Nylon in Tribology Market Size (2024 – 2030)

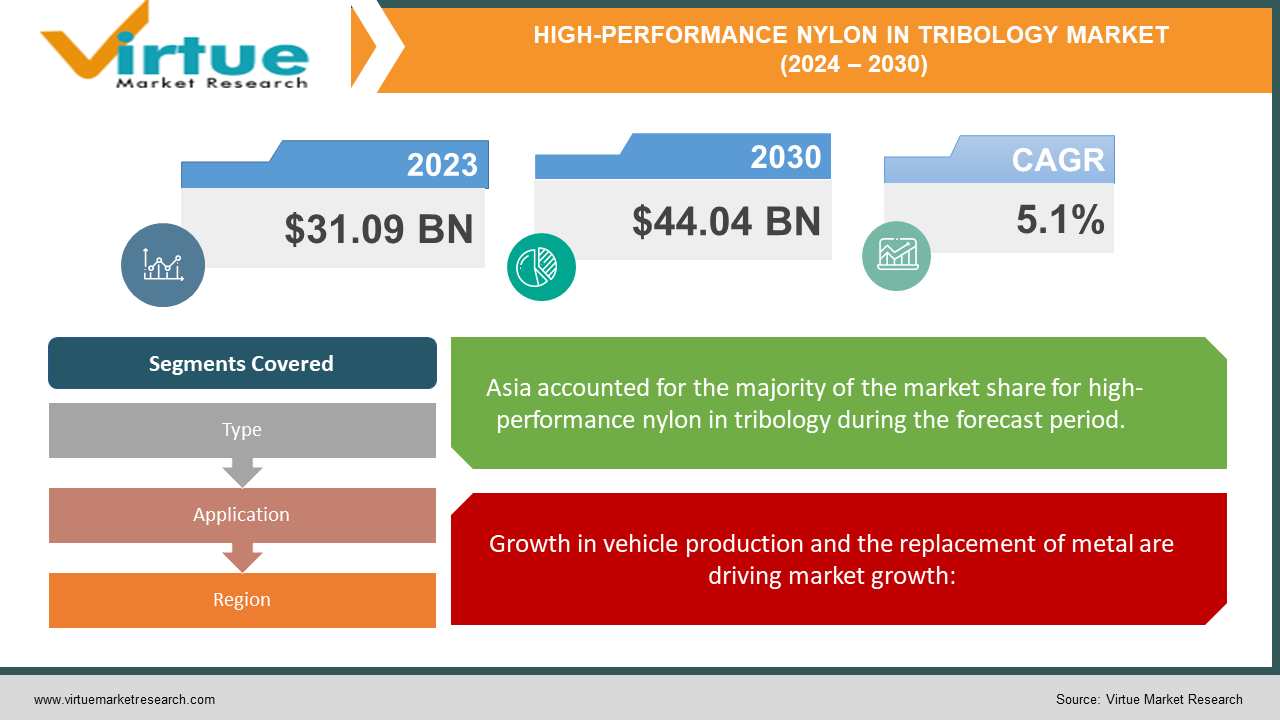

The Global High-Performance Nylon in Tribology Market was valued at USD 31.09 billion in 2023 and will grow at a CAGR of 5.1% from 2024 to 2030. The market is expected to reach USD 44.04 billion by 2030.

The high-performance nylon in the tribology market focuses on specialized nylon materials used in components that experience friction, wear, and lubrication (tribology). These nylons offer superior properties compared to standard nylons, making them ideal for bearings, gears, seals, and other parts in demanding applications. The market is expected to continue growing due to the increasing need for durable and low-maintenance components in various industries.

Key Market Insights:

Machinery in industries like automotive, manufacturing, and renewable energy requires parts that can withstand harsh operating conditions.Across sectors like automotive and aerospace, weight reduction is a priority for improved efficiency.High-performance nylons often come at a premium compared to standard nylons.These nylons might require specific design expertise to maximize their benefits compared to traditional materials.The increasing demand for durable and wear-resistant materials in various end-use industries such as automotive, aerospace, industrial machinery, and electronics is a primary driver for the growth of High-Performance Nylon in Tribology. These industries require materials that can withstand friction, abrasion, and mechanical stress.

Global High-Performance Nylon in Tribology Market Drivers:

Growth in vehicle production and the replacement of metal are driving market growth:

The automotive industry is a major champion for high-performance nylon in tribology applications. This engineered material is increasingly replacing metal parts in cars and trucks due to a winning combination of properties. Firstly, high-performance nylon boasts a significantly lighter weight compared to metals. This translates directly to improved fuel efficiency, a critical factor for both manufacturers and environmentally conscious consumers. Furthermore, these nylons excel at reducing noise levels. Engine components and cabin parts constructed from high-performance nylon experience less friction and vibration, leading to a quieter and more comfortable driving experience. This translates to a double benefit for automakers: not only do they meet stricter emission regulations through weight reduction, but they can also enhance the overall driving experience for their customers. As a result, applications for high-performance nylon in vehicles are expanding rapidly, encompassing everything from engine components like intake manifolds and timing chain gears to interior parts like door handles and window regulators.

Increasing demand from the consumer goods industry is driving market growth:

High-performance nylons are quietly revolutionizing the world of consumer goods, finding their way into everything from the appliances in your kitchen to the sporting equipment you use for your weekend hike. Their secret lies in their exceptional combination of durability, wear resistance, and self-lubrication. In demanding kitchen appliances like blenders and food processors, high-performance nylons ensure gears and bearings withstand the rigors of constant use and maintain smooth operation. This translates to a longer lifespan for your appliances and less frequent replacements. For sporting goods enthusiasts, high-performance nylons are a game-changer. Components in bicycles, skis, and snowboards benefit from the material's toughness, reducing wear and tear even under intense use. The self-lubricating properties further enhance performance by minimizing friction, leading to smoother operation and potentially improved energy transfer in activities like cycling. Even the electronics you rely on daily can benefit from high-performance nylons. Certain components within laptops and mobile devices can be constructed from these nylons to improve durability and heat resistance, ensuring your tech gadgets can keep up with your active lifestyle. The versatility and performance benefits of high-performance nylons are making them a hidden champion in the world of consumer goods.

Growing demand for renewable energy is driving market growth:

The surge in renewable energy is creating a new frontier for high-performance nylons in tribology. These engineered nylons are becoming increasingly valuable components in wind turbines, solar panels, and other clean energy technologies. One key advantage is their resilience in harsh weather conditions. Wind turbines operating in high winds and icy storms require components that can withstand extreme stress and temperature fluctuations. High-performance nylons excel in these environments, offering exceptional strength and dimensional stability to ensure the smooth operation of turbine blades and internal mechanisms. Similarly, solar panels exposed to scorching sun and relentless UV rays benefit from the material's durability. Nylon components within the panel structure and tracking systems resist warping and degradation, maximizing the panel's lifespan and energy production. Beyond these core applications, high-performance nylons are finding use in auxiliary components across the renewable energy spectrum. Their self-lubricating properties make them ideal for bearings and gears in hydropower plants and wave energy systems. The ability to withstand a variety of environmental stresses positions high-performance nylons as a versatile material for the future of clean energy.

Global High-Performance Nylon in Tribology Market challenges and restraints:

Cost Competitiveness is a significant hurdle for High-Performance Nylon in Tribology:

The Achilles' heel of high-performance nylons might be their price tag. While they offer undeniable advantages in durability, wear resistance, and even self-lubrication, these advancements often come at a premium compared to standard nylons. This can be a major hurdle for manufacturers, particularly those focused on high-volume production. In these scenarios, even a small cost difference per unit can significantly impact the overall budget. For instance, car manufacturers producing millions of vehicles annually might be hesitant to switch from traditional materials to high-performance nylons if the cost increase translates to millions of dollars. This price pressure can stifle innovation and limit the adoption of high-performance nylons in applications where cost efficiency remains a top priority. However, advancements in manufacturing processes and economies of scale have the potential to gradually decrease the cost gap. Additionally, as the value proposition of high-performance nylons becomes more widely recognized, manufacturers might be willing to invest in the upfront cost in exchange for potential benefits like extended product lifespans and reduced maintenance overheads.

Design Expertise is throwing a curveball at High-Performance Nylon in the Tribology market:

High-performance nylons are like powerful tools – they require the right know-how to unlock their true potential. While engineers are familiar with traditional materials like metals, maximizing the benefits of high-performance nylons might necessitate a shift in design thinking. These advanced nylons often exhibit unique properties like lower stiffness and higher thermal expansion compared to metals. Traditional designs optimized for metals might not fully translate to nylons, potentially leading to inefficiencies or even performance drawbacks. To overcome this challenge, engineers might need to explore design approaches that leverage the specific strengths of high-performance nylons. For instance, designers could utilize the inherent flexibility of nylons to create parts with snap-fit features, reducing reliance on additional fasteners. Additionally, understanding the material's response to heat can lead to design adjustments that minimize potential warping or dimensional changes. By bridging the gap between traditional engineering practices and the unique properties of high-performance nylons, designers can unleash the full potential of these materials and unlock a new era of innovation.

Performance Trade-offs are a growing nightmare for High-Performance Nylon in Tribology:

High-performance nylons are impressive contenders, but they aren't superheroes. While they shine in wear resistance and self-lubrication, they might not always outmuscle metals in raw strength or handle extreme temperatures. This reality necessitates a nuanced approach to material selection. For instance, a gear in a food processor primarily needs to withstand wear and tear during everyday use. Here, high-performance nylon's self-lubricating properties and good wear resistance make it a perfect choice. However, a critical engine component in a race car might experience tremendous heat and stress. In such high-performance environments, a metal with superior thermal tolerance and peak strength might be a safer bet, even if it requires additional lubrication. Ultimately, the key lies in understanding the specific demands of the application. By carefully evaluating factors like load, temperature, and wear requirements, engineers can make informed decisions. In some cases, a combination of materials might even be the optimal solution, leveraging the strengths of both high-performance nylons and metals to create a truly high-performing component.

Market Opportunities:

The high-performance nylon in the tribology market presents a confluence of opportunity and innovation across various industries. A key driver is the automotive sector, where these nylons are increasingly replacing metal parts in cars and trucks. Their lighter weight translates to improved fuel efficiency, a win for both manufacturers and environmentally conscious consumers. Additionally, the noise-dampening properties of high-performance nylons enhance the driving experience. Beyond automotive, the consumer goods market is embracing these nylons for their durability and wear resistance. From gears in kitchen appliances to components in bicycles and sports equipment, high-performance nylons ensure smooth operation and extended lifespans. The renewable energy sector is another exciting frontier. Wind turbines and solar panels benefit from the nylons' ability to withstand harsh weather conditions, ensuring optimal energy production. However, some challenges remain. The higher cost of high-performance nylons compared to standard nylons can be a hurdle, especially in high-volume applications. Additionally, unlocking their full potential might require design expertise that goes beyond traditional approaches used for metals. Despite these hurdles, advancements in material science are continuously improving the cost-performance ratio, while increased awareness within industries can address knowledge gaps. Ultimately, the growing demand for lightweight, low-maintenance, and durable components positions high-performance nylon as a versatile material poised to revolutionize tribology applications across various sectors.

HIGH-PERFORMANCE NYLON IN TRIBOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF, DSM, DuPont, Mitsubishi Chemical Advanced Materials, Ascend Performance Materials, Kuraray Co. Ltd., Sabic Corporation, EMS Chemie Holding AG, Evonik Industries AG, Radici Group |

High-Performance Nylon in Tribology Market Segmentation - By Type

-

Reinforced Nylon

-

Non-reinforced Nylon

Reinforced nylon reigns supreme in the high-performance nylon for tribology market. This segment boasts the largest market share and the fastest growth rate. The secret lies in the added strength and resilience achieved by incorporating reinforcements like glass, carbon, or PTFE fibers into the base nylon. This translates to superior performance compared to non-reinforced nylons in tribology applications. Reinforced nylons offer enhanced stiffness, wear resistance, and thermal properties, making them ideal for demanding components like bearings, gears, and seals across various industries.

High-Performance Nylon in Tribology Market Segmentation - By Application

-

Specific performance requirements

-

Industry focus

While specific performance requirements and industry focus are crucial considerations in the high-performance nylon market, pinpointing the single most prominent sector is difficult. Therefore, both specific performance requirements and industry focus play a vital role in determining the most prominent nylon type. Understanding these factors is key for manufacturers to select the optimal high-performance nylon for their specific tribology application.

High-Performance Nylon in Tribology Market Segmentation - Regional Analysis

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

Asia currently reigns supreme in the high-performance nylon for tribology market, and this dominance is likely to continue. The booming automotive and manufacturing sectors in China, India, and Japan are major drivers. Additionally, government support for renewable energy in these countries is fueling demand for high-performance nylons in wind turbines and solar panels. While North America and Europe boast established markets, Asia's rapid industrial growth and focus on clean energy solidify its position as the frontrunner in this market.

COVID-19 Impact Analysis on the Global High-Performance Nylon in Tribology Market

The COVID-19 pandemic caused a temporary disruption to the high-performance nylon for the tribology market. Lockdowns and supply chain disruptions initially hampered production and demand across industries that rely on these materials, such as automotive and manufacturing. However, the impact wasn't uniform. The renewable energy sector, which also utilizes high-performance nylons, saw a resurgence in some regions due to continued government investment in clean energy projects. As economies recovered and restrictions eased, the demand for high-performance nylons in traditional sectors like automotive gradually rebounded. Looking ahead, the long-term impact of COVID-19 might be a positive one. The renewed focus on sustainability and potential shifts towards near-shoring manufacturing in certain regions could create new opportunities for high-performance nylons, particularly in Asia, as these materials align well with these trends. Overall, while the pandemic caused a temporary setback, the high-performance nylon for tribology market appears to be on a trajectory for continued growth in the coming years.

Latest trends/Developments

The high-performance nylon market for tribology is witnessing a wave of innovation with a focus on sustainability, improved performance, and wider applicability. Bio-based nylons derived from castor beans or other renewable resources are gaining traction, driven by environmental concerns. Research and development efforts are also directed towards nylons with enhanced properties like self-lubrication under extreme temperatures or improved flame retardancy. This caters to the growing demand for high-performance materials in demanding environments like electric vehicle batteries or high-speed machinery. The focus on lightweight components for fuel efficiency continues, with advancements in composite nylons that combine the benefits of nylons with other materials like carbon fibers for superior strength-to-weight ratios. Additionally, there's a growing trend of integrating sensors into high-performance nylons, allowing for real-time monitoring of wear and tear, predictive maintenance, and ultimately, extending the lifespan of critical components. This integration signifies a shift towards "smart" tribological materials, paving the way for a future of intelligent and self-aware components.

Key Players:

-

BASF

-

DSM

-

DuPont

-

Mitsubishi Chemical Advanced Materials

-

Ascend Performance Materials

-

Kuraray Co. Ltd.

-

Sabic Corporation

-

EMS Chemie Holding AG

-

Evonik Industries AG

-

Radici Group

Chapter 1. High-Performance Nylon in Tribology Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. High-Performance Nylon in Tribology Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. High-Performance Nylon in Tribology Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. High-Performance Nylon in Tribology Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. High-Performance Nylon in Tribology Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. High-Performance Nylon in Tribology Market – By Type

6.1 Introduction/Key Findings

6.2 Reinforced Nylon

6.3 Non-reinforced Nylon

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. High-Performance Nylon in Tribology Market – By Application

7.1 Introduction/Key Findings

7.2 Specific performance requirements

7.3 Industry focus

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. High-Performance Nylon in Tribology Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. High-Performance Nylon in Tribology Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF

9.2 DSM

9.3 DuPont

9.4 Mitsubishi Chemical Advanced Materials

9.5 Ascend Performance Materials

9.6 Kuraray Co. Ltd.

9.7 Sabic Corporation

9.8 EMS Chemie Holding AG

9.9 Evonik Industries AG

9.10 Radici Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global High-Performance Nylon in Tribology Market was valued at USD 31.09 billion in 2023 and will grow at a CAGR of 5.1% from 2024 to 2030. The market is expected to reach USD 44.04 billion by 2030.

Growth in vehicle production and replacement of metal, increasing demand from the consumer goods industry, and Growing demand for renewable energy are the reasons that are driving the market.

Based on Application it is divided into two segments – Specific performance requirements and industry focus.

Asia is the most dominant region for the luxury vehicle Market.

BASF, DSM, DuPont, Mitsubishi Chemical Advanced Materials, Ascend Performance Materials.