High-Performance Alloys for Wind Energy Market Size (2024-2030)

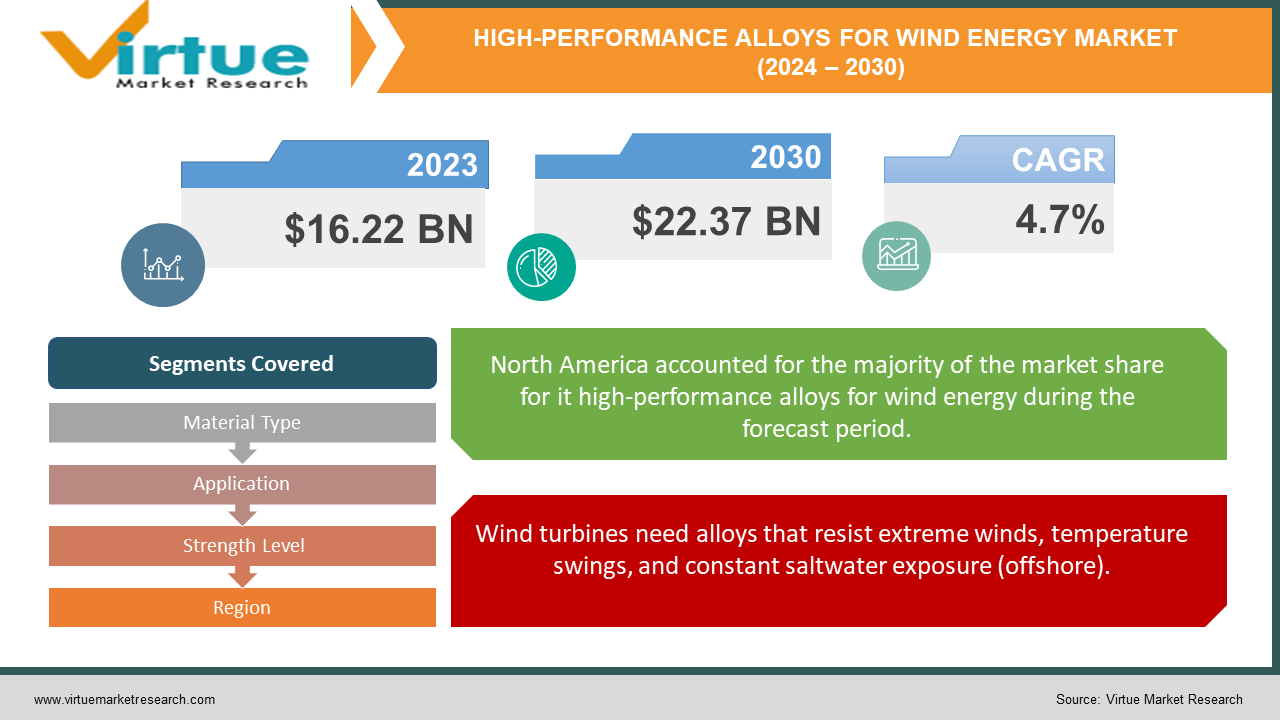

The High-Performance Alloys for the Wind Energy Market were valued at USD 16.22 billion in 2023 and are projected to reach a market size of USD 22.37 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.7%.

Wind energy relies heavily on high-performance alloys to ensure turbines function efficiently and endure harsh environments. These alloys need to be incredibly strong to withstand powerful winds and resist deformation at high temperatures, all while being lightweight to minimize stress on the turbine tower. Nickel-based superalloys are prime examples, used in critical components like gearbox shafts and generator rotors due to their exceptional strength and heat resistance

Key Market Insights:

The wind energy sector's rapid growth necessitates robust and efficient turbines. Enter high-performance alloys, the secret weapon behind these resilient machines. They excel in harsh environments, withstanding extreme winds and fluctuating temperatures

The future of this market is fixated on continuous improvement. Research and development tirelessly strive to create even better alloys. Lighter materials are also a key focus because they mean less stress on the turbine tower. Advancements aim to push the boundaries of lightness without compromising strength, paving the way for taller and more powerful turbines. Finally, saltwater exposure remains a constant threat to offshore turbines.

These advancements will ultimately lead to more efficient and cost-effective wind turbines. This will accelerate the growth of renewable energy and solidify wind as a major player in the global energy mix.

The High-Performance Alloys for Wind Energy Market Drivers:

Wind turbines need alloys that resist extreme winds, temperature swings, and constant saltwater exposure (offshore).

As mentioned previously, wind turbines face a brutal environment. The need for alloys that can withstand extreme winds, fluctuating temperatures, and (for offshore turbines) constant saltwater exposure is a major driver for this market. These alloys ensure the turbines function reliably and have a long lifespan.

Minimizing weight reduces stress on the turbine tower, enabling taller and more powerful designs.

Minimizing weight is crucial for wind turbine efficiency. Lighter components put less stress on the tower, allowing for taller and more powerful turbines that can capture more wind energy. High-performance alloys offer the unique advantage of being incredibly strong yet lightweight, making them ideal for wind turbine construction.

The global shift towards clean energy sources fuels the need for wind turbines, and consequently, high-performance alloys.

The global push for clean energy sources is driving significant growth in the wind energy sector. This increased demand for wind turbines directly translates to a higher demand for the high-performance alloys needed to build them.

Ongoing research strives to create even stronger, lighter, and more corrosion-resistant alloys for wind turbines.

The constant push for innovation in material science is another key driver. Research and development efforts aim to create even stronger, lighter, and more corrosion-resistant alloys. These advancements will lead to even more efficient and cost-effective wind turbines, further propelling the market.

The industry explores alloys with lower environmental impact, aligning with wind energy's core sustainability goals.

The wind energy sector inherently promotes sustainability. There's a growing focus within the high-performance alloys market to develop and utilize materials with lower environmental impact during production and disposal. This aligns with the overall sustainability goals of the wind energy industry.

The High-Performance Alloys for Wind Energy Market Restraints and Challenges:

While high-performance alloys are a boon for the wind energy sector, there are hurdles to overcome. A major challenge lies in their cost. These alloys are significantly more expensive than conventional materials due to a combination of factors. The raw materials themselves can be scarce, and the complex manufacturing processes involved further inflate the price tag. This high cost can be a deterrent, particularly for wind energy projects where budgets are tight.

Another concern involves the environmental and health impact of some high-performance alloys. Certain elements used in their composition can pose risks during production and disposal. As regulations tighten and sustainability awareness grows, the use of such alloys may become restricted.

Finally, the development of substitute materials presents a potential threat. Advancements in composites and ceramics offer lighter alternatives that might be suitable for specific applications in wind turbines. If these substitutes become cost-effective and deliver high performance, they could eat into the market share of high-performance alloys.

The High-Performance Alloys for Wind Energy Market Opportunities:

The future of high-performance alloys in wind energy is brimming with exciting opportunities. A key driver is the ever-increasing demand for renewable energy. As the world transitions towards clean energy sources, wind turbine installations are expected to skyrocket. This translates directly to a growing need for the high-performance alloys that make these turbines possible. Beyond simply fulfilling this demand, there's also exciting potential for these alloys in novel wind turbine applications. Research and development efforts are continuously exploring new ways to utilize these advanced materials, pushing the boundaries of wind turbine design and efficiency. These advancements could lead to the development of offshore turbines that can withstand even harsher ocean environments or floating wind turbines that harness wind power in deeper waters, previously inaccessible with current technologies. The focus on sustainability also presents an opportunity. Research is underway to develop high-performance alloys with lower environmental impact during production and disposal, aligning perfectly with the core values of the wind energy industry. As these challenges are addressed and innovations continue, high-performance alloys are poised to play an even more significant role in shaping the future of wind energy.

HIGH-PERFORMANCE ALLOYS FOR WIND ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Material Type, Application, Strength Level, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alcoa, Allegheny Technologies, Aperam, Carpenter Technology, Haynes International, Hitachi Metals, Outokumpu, Precision Castparts, Timken, VSMPO-AVISMA |

High-Performance Alloys for Wind Energy Market Segmentation: By Material Type

-

Nickel-based superalloys

-

Stainless steels

-

High-strength steels

-

Other high-performance alloys

The high-performance alloys market for wind energy is primarily segmented by Material Type. Stainless steels are the dominant segment due to their widespread use in towers, nacelles, and blades. They offer a versatile combination of corrosion resistance and mechanical strength at a competitive cost. The fastest-growing segment is likely nickel-based superalloys. With the increasing focus on efficiency and larger turbines, there's a rising demand for high performance in critical components like gearboxes and generators. Nickel-based superalloys, known for their exceptional strength and heat resistance, are well-suited for these applications.

High-Performance Alloys for Wind Energy Market Segmentation: By Application

-

Gearboxes

-

Generator rotors

-

Wind turbine blades

-

Towers and nacelles

The dominant segment by application in wind turbine alloys is likely to be wind turbine blades. These blades require a complex mix of properties – high strength and stiffness to handle wind loads, yet lightweight to minimize stress on the tower. This makes high-performance alloys like high-strength steel a perfect fit. The fastest-growing segment is expected to be offshore wind turbines. As wind farms move further out to sea, the need for alloys with superior corrosion resistance to combat saltwater exposure becomes critical.

High-Performance Alloys for Wind Energy Market Segmentation: By Strength Level

-

Low-strength alloys

-

Medium-strength alloys

-

High-strength alloys

High-performance alloy segmentation in wind energy offers valuable insights. By Strength Level, medium-strength alloys likely dominate the market, providing a good balance of strength and weight for various turbine components. However, the fastest-growing segment is high-strength alloys. The push for larger, more powerful turbines demands exceptional strength-to-weight ratios, making these advanced materials increasingly crucial for the future of wind energy.

High-Performance Alloys for Wind Energy Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Traditionally a strong player in wind energy, North America boasts a growing wind sector, particularly in the US and Canada. This translates to a significant market for high-performance alloys used in turbine construction. The focus here is often on balancing cost-effectiveness with technological advancements in alloys.

The Asia Pacific region is currently the global leader in wind energy installations, and this dominance is reflected in the high-performance alloys market. China, India, and Japan are key players driving the demand for these alloys. The focus here might prioritize rapid development and affordability, with a growing emphasis on catching up with advancements in Europe and North America.

COVID-19 Impact Analysis on the High-Performance Alloys for Wind Energy Market:

The COVID-19 pandemic undoubtedly impacted the high-performance alloys market for wind energy. Supply chain disruptions caused by lockdowns and travel restrictions led to shortages and price fluctuations of raw materials and manufactured alloys. This hindered wind turbine production and consequently, demand for these specialized materials. Additionally, the pandemic caused delays or cancellations of wind energy projects due to labor shortages and financing difficulties, further dampening demand. The economic downturn also played a role, with budget constraints potentially pushing wind energy companies towards more cost-effective solutions, even if they meant sacrificing some performance benefits offered by high-performance alloys.

However, there are also potential silver linings. The pandemic's emphasis on clean energy sources could lead to a renewed focus on renewable energy in the long run, ultimately benefiting the wind energy sector and the high-performance alloys market it relies on. Furthermore, the vulnerabilities exposed in global supply chains might encourage wind energy companies and governments to invest in domestic manufacturing capabilities for these alloys, creating new market opportunities in certain regions. Finally, the economic pressure might push manufacturers to develop more cost-competitive high-performance alloys or optimize production processes, making these advanced materials more accessible for wider adoption in wind turbine projects.

Latest Trends/ Developments:

The high-performance alloy market for wind energy is a hotbed of innovation, constantly striving for lighter and more efficient materials. The research delves into novel alloy compositions, exploring materials like titanium aluminides and high-entropy alloys with unique properties potentially superior to traditional options. Additive manufacturing, or 3D printing, is emerging as a game-changer, allowing for the creation of complex shapes from these advanced alloys. This could revolutionize wind turbine design and production, enabling lighter and more efficient components. Sustainability remains a key focus, with research aimed at developing alloys with lower environmental impact throughout their life cycle, including reduced production footprint and higher recyclability rates.

Key Players:

-

Alcoa

-

Allegheny Technologies

-

Aperam

-

Carpenter Technology

-

Haynes International

-

Hitachi Metals

-

Outokumpu

-

Precision Castparts

-

Timken

-

VSMPO-AVISMA

Chapter 1. High-Performance Alloys for Wind Energy Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. High-Performance Alloys for Wind Energy Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. High-Performance Alloys for Wind Energy Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. High-Performance Alloys for Wind Energy Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. High-Performance Alloys for Wind Energy Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. High-Performance Alloys for Wind Energy Market – By Material Type

6.1 Introduction/Key Findings

6.2 Nickel-based superalloys

6.3 Stainless steels

6.4 High-strength steels

6.5 Other high-performance alloys

6.6 Y-O-Y Growth trend Analysis By Material Type

6.7 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. High-Performance Alloys for Wind Energy Market – By Application

7.1 Introduction/Key Findings

7.2 Gearboxes

7.3 Generator rotors

7.4 Wind turbine blades

7.5 Towers and nacelles

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. High-Performance Alloys for Wind Energy Market – By Strength Level

8.1 Introduction/Key Findings

8.2 Low-strength alloys

8.3 Medium-strength alloys

8.4 High-strength alloys

8.5 Y-O-Y Growth trend Analysis By Strength Level

8.6 Absolute $ Opportunity Analysis By Strength Level, 2024-2030

Chapter 9. High-Performance Alloys for Wind Energy Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material Type

9.1.3 By Application

9.1.4 By By Strength Level

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material Type

9.2.3 By Application

9.2.4 By Strength Level

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material Type

9.3.3 By Application

9.3.4 By Strength Level

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material Type

9.4.3 By Application

9.4.4 By Strength Level

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material Type

9.5.3 By Application

9.5.4 By Strength Level

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. High-Performance Alloys for Wind Energy Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Alcoa

10.2 Allegheny Technologies

10.3 Aperam

10.4 Carpenter Technology

10.5 Haynes International

10.6 Hitachi Metals

10.7 Outokumpu

10.8 Precision Castparts

10.9 Timken

10.10 VSMPO-AVISMA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The High-Performance Alloys for the Wind Energy Market was valued at USD 16.22 billion in 2023 and is projected to reach a market size of USD 22.37 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.7%.

Harsh Operating Conditions, Lightweight Advantage, Growing Demand for Renewable Energy, Technological Advancements, Focus on Sustainability.

Gearboxes, Generator rotors, Wind turbine blades, Towers and nacelles.

The Asia Pacific region currently holds the dominant position in the High-Performance Alloys for Wind Energy Market, driven by massive wind energy installations.

Alcoa, Allegheny Technologies, Aperam, Carpenter Technology, Haynes International, Hitachi Metals, Outokumpu, Precision Castparts, Timken, and VSMPO-AVISMA.