High-Performance Additives Market Size (2024 – 2030)

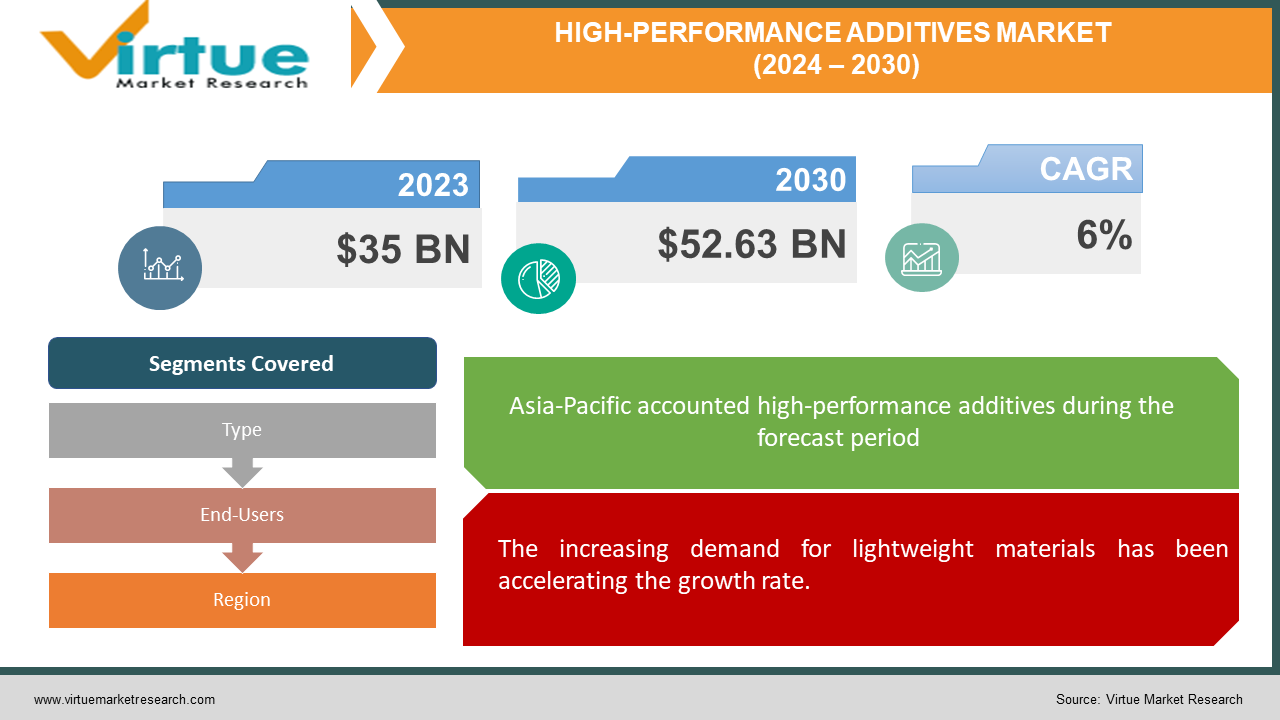

The global high-performance additives market was valued at USD 35 billion and is projected to reach a market size of USD 52.63 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6%.

High-performance additives are compounds that are added to polymers to enhance their characteristics and facilitate processing. Strength, flexibility, color, and UV resistance are just a few of the qualities they may enhance. Common additives include plasticizers, antioxidants, and stabilizers. Stabilizers, plasticizers, and antioxidants are examples of common additions. They had a notable presence from the past. These substances were mainly employed in the aerospace, construction, and automotive industries. Presently, the market has seen considerable expansion owing to technological advancements. In the future, with a focus on sustainability and superior performance, the market is predicted to witness an upsurge.

Key Market Insights:

With a market value of 911.5 million US dollars, the electrical and electronics industry is anticipated to emerge as the largest user of these high-performance plastic additives in 2031.The global market for additive manufacturing is expected to expand by around 24% between 2023 and 2025, according to Statista. According to various reports by Statista, by 2030, there will be over 2.7 million additive manufacturing and 3D printing machines worldwide.The market for additive manufacturing expanded by over 17% in 2023, as per Statista. It is estimated that each year, 20–30% of high-performance additives produced worldwide are disposed of as trash or wind up in landfills. To tackle this, organizations are implementing recycling initiatives to recover and reuse materials.

High-Performance Additives Market Drivers:

The increasing demand for lightweight materials has been accelerating the growth rate.

The automotive, aerospace, and electronics industries are among those whose use of lightweight materials is growing as a means of improving efficiency, reducing emissions, and maximizing fuel economy. Advanced polymers, carbon fiber composites, ceramics, alloys, specialized metals, aluminum, and other lightweight materials are finding increased application in many industries. High-performance additives are needed to improve the properties of these materials and ensure that they meet the stringent requirements for application performance, durability, and safety. Furthermore, lightweight and environmentally friendly materials are being pushed into the industry by more stringent environmental requirements. By lowering greenhouse gas emissions and resource consumption, lightweight materials support sustainability initiatives in addition to increasing transportation energy efficiency.

Technological advancements have been enabling the development.

High-performance additives are being developed as a result of ongoing developments in material science, nanotechnology, and manufacturing techniques. Smart additives and functional materials are emerging as a result of technological advancements, providing increased capabilities beyond those of standard additives. For instance, self-healing polymers with nanoscale compounds may fix damage on their own, prolonging material life and lowering maintenance expenses. Moreover, the additives sector is witnessing a change in production processes due to the incorporation of digital technologies, including machine learning, artificial intelligence, and the Internet of Things. They help in providing real-time data, accelerating the product development cycle, reducing time, ensuring quality control, and performing predictive maintenance. Due to these developments, producers may now produce materials with better strength, conductivity, durability, and resistance to chemicals.

High-Performance Additives Market Restraints and Challenges:

Cost constraints, formulation challenges, and environmental & human health impacts are the main issues that the market is currently facing.

The price of high-performance additives is usually higher than that of conventional ones due to their unique characteristics and superior performance. This can create pressure on small and medium-sized businesses, causing a hindrance to market growth. Secondly, it can be difficult and time-consuming to get basic materials and additives to work together as well as to optimize additive formulations for particular uses. To guarantee that additives work in harmony with current procedures and provide the required performance improvements without sacrificing material qualities, manufacturers must make research and development investments. Thirdly, a few of them might have a lot of adverse impacts. Additives can leak into the environment and cause ecotoxicity since they are not biodegradable. Certain chemicals have the potential to cause cancer, inflammation, neurotoxicity, and changes in lipid metabolism. Besides, waste generation is another major drawback, leading to landfills and pollution.

High-Performance Additives Market Opportunities:

Sustainability has become an absolute need in many industries. Manufacturers in this market are working on R&D activities to develop biodegradable and recyclable substances that have minimal impact on our environment. Secondly, the healthcare industry is providing an ample number of possibilities. In biotechnology and healthcare applications such as drug delivery systems, tissue engineering, and medical devices, high-performance additives are essential. To meet unmet needs in these quickly expanding sectors, there are opportunities to create additives with biocompatibility, controlled release capabilities, and antibacterial qualities. Moreover, the traits of additives like durability, strength, and corrosion resistance are constantly being improved by working on the formulations and enhancing their properties through chemical reactions. Apart from this, tailoring the additives as per the needs of the industry and client is extremely beneficial.

HIGH-PERFORMANCE ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Clariant AG, Solvay S.A., Evonik Industries AG, Akzo Nobel N.V., Dow Inc., Lanxess AG, Arkema Group, Huntsman Corporation, Cabot Corporation |

High-Performance Additives Market Segmentation: By Type

-

Antioxidants

-

UV Stabilizers

-

Flame Retardants

-

Plasticizers

-

Rheology Modifiers

-

Anti-static Agents

-

Biocides

-

Others

Plasticizers are the largest growing type. They are widely used in so many different sectors, including consumer products, automotive, construction, and packaging. These additives play a crucial role in the manufacturing of flexible films, PVC products, and polymer compounds by enhancing the plastic materials' flexibility, durability, and processability. This demand is likely to drive the growth of this segment. Additionally, ongoing innovation in plasticizer chemistry and the creation of environmentally acceptable substitutes are fueling the market. UV stabilizers are the fastest-growing category. The market for high-performance additives is seeing a sharp increase in the use of UV stabilizers due to the growing need for materials with improved UV resistance in outdoor applications. By shielding polymers, coatings, and other materials from UV-induced deterioration, these additives help to prolong their lifespan and maintain their functional and aesthetic qualities. Furthermore, the segment is expected to grow significantly as regulations for UV protection become more stringent. In emerging regions, UV stabilizer usage is also increasing due to the demand for weather-resistant and long-lasting materials in the packaging, automotive, and construction sectors.

High-Performance Additives Market Segmentation: By End-Users

-

Automotive

-

Aerospace

-

Construction

-

Electronics

-

Packaging

-

Healthcare

-

Industrial

-

Agriculture

-

Others

The automotive sector is the largest growing end-user. This industry uses additives in a variety of parts and materials to improve performance, toughness, and safety. High-performance additives are widely used in automobile fuel systems, lubricants, adhesives, polymers, and coatings. They improve vehicle safety, fuel economy, and lightweighting.

Besides, they are heavily consumed in the automobile industry due to rising vehicle production, stricter regulations, technical developments, and an increase in the demand for electric and self-driving cars. The packaging industry is the fastest-growing category. The desire for creative packaging solutions that provide improved barrier qualities, durability, and sustainability is driving. For packaging materials—such as plastics, films, coatings, and adhesives—to better satisfy changing consumer demands and legal requirements, high-performance additives are essential. Furthermore, the emergence of e-commerce, convenience packaging, food safety worries, sustainability programs, and improvements in packaging technologies, including active and intelligent packaging solutions, are some of the factors propelling the expansion.

High-Performance Additives Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market. Countries like China, India, Japan, South Korea, and Southeast Asia are experiencing fast industrialization, urbanization, and powerful economic growth. High-performance additives are heavily used by the region's manufacturing industry, which is mostly involved in the automotive, construction, electronics, packaging, and industrial sectors. The existence of important manufacturing centers, developing end-user industries, rising investments in infrastructure and development, and rising consumer demand for high-quality products are some of the factors that have contributed to the Asia-Pacific market's supremacy. Furthermore, the region's emphasis on energy efficiency, environmental sustainability, and technical innovation is propelling the adoption of cutting-edge additives that fulfill regulatory requirements while providing greater performance.

COVID-19 Impact Analysis on the Global High-Performance Additives Market:

The market had a mixed impact from the viral pandemic. Among the new norms were movement restrictions, lockdowns, and social seclusion. This affects supply chain management, transportation, and logistics. Operations related to import-export suffered as a result. All businesses, including manufacturing plants, were forced to close to contain the illness. As a result, production and other activities were suspended. Priority was given to remote work to stop the virus from spreading. Because of how unpredictable the economy was, layoffs were common. A lot of people lost their jobs. As such, launches and partnerships were postponed. Industries like construction, automobiles, and aerospace experienced a decline in demand. The number of workers who lost their jobs in the construction sector decreased from 30% to 90% in India, as per a report by MDPI. However, the healthcare industry saw an increase. The pandemic caused a sharp increase in the market for medical goods, including ventilators, medical packaging, diagnostic kits, and personal protective equipment (PPE). High-performance additives are used in the production of these supplies to provide attributes including longevity, stabilizability, and barrier protection. According to a Statista Consumer Market Insights analysis, 402 billion masks were sold globally during the second half of the pandemic. Following the epidemic, the market has started to stabilize. The increase in income has been attributed to the establishment of businesses. The regulations and limitations are now relaxed, allowing for normal operation.

Latest Trends/ Developments:

High-performance additives utilized in battery technology, lightweight materials, and thermal management systems have prospects due to the shift toward electric transportation. As the demand for electric cars rises worldwide, additives that increase the EV components' longevity, efficiency, and safety may become more popular.

Key Players:

-

BASF SE

-

Clariant AG

-

Solvay S.A.

-

Evonik Industries AG

-

Akzo Nobel N.V.

-

Dow Inc.

-

Lanxess AG

-

Arkema Group

-

Huntsman Corporation

-

Cabot Corporation

-

In January 2024, a long-lasting phosphate methacrylate monomer with nonmigratory properties, VISIOMER® HEMA-P 100, was released by Evonik. Polymerization allows HEMA-P to be integrated, which enhances adhesion, lowers corrosion, and offers clear flame retardancy. It works well as an anti-corrosive and adhesion enhancer. VISIOMER® HEMA-P functions as a complexing agent and enhances dispersibility.

-

In October 2022, at K 2022, Clariant introduced new additives to help the sustainable evolution of plastics. These innovations provide applications with increased durability to enable extended use and reuse. Additionally, overcoming industrial obstacles to improve efficiency and reduce carbon emissions during compounding and processing is possible.

-

In August 2022, at its Pudong location in Shanghai, China, BASF launched a new fuel performance additive production facility. This facility, which meets the growing need for fuel performance additives in the area, is the newest addition to BASF's global network. Customers in Asia will also benefit from increased supply flexibility and stability due to the new factory.

Chapter 1. HIGH-PERFORMANCE ADDITIVES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. HIGH-PERFORMANCE ADDITIVES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. HIGH-PERFORMANCE ADDITIVES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. HIGH-PERFORMANCE ADDITIVES MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. HIGH-PERFORMANCE ADDITIVES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. HIGH-PERFORMANCE ADDITIVES MARKET – By Type

6.1 Introduction/Key Findings

6.2 Antioxidants

6.3 UV Stabilizers

6.4 Flame Retardants

6.5 Plasticizers

6.6 Rheology Modifiers

6.7 Anti-static Agents

6.8 Biocides

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Type

6.11 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. HIGH-PERFORMANCE ADDITIVES MARKET – By End-Users

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Construction

7.5 Electronics

7.6 Packaging

7.7 Healthcare

7.8 Industrial

7.9 Agriculture

7.10 Others

7.11 Y-O-Y Growth trend Analysis By End-Users

7.12 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 8. HIGH-PERFORMANCE ADDITIVES MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By End-Users

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By End-Users

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By End-Users

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By End-Users

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End-Users

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. HIGH-PERFORMANCE ADDITIVES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Clariant AG

9.3 Solvay S.A.

9.4 Evonik Industries AG

9.5 Akzo Nobel N.V.

9.6 Dow Inc.

9.7 Lanxess AG

9.8 Arkema Group

9.9 Huntsman Corporation

9.10 Cabot Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global high-performance additives market was valued at USD 35 billion and is projected to reach a market size of USD 52.63 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6%.

The increasing demand for lightweight materials and technological advancements are the main factors propelling the global high-performance additives market.

Based on end-users, the global high-performance additives market is segmented into automotive, aerospace, construction, electronics, packaging, healthcare, industrial, agriculture, and others.

Asia-Pacific is the most dominant region for the global high-performance additives market.

BASF SE, Clariant AG, and Solvay S.A. are the key players operating in the global high-performance additives market.