High-Entropy Materials Market Size (2024 – 2030)

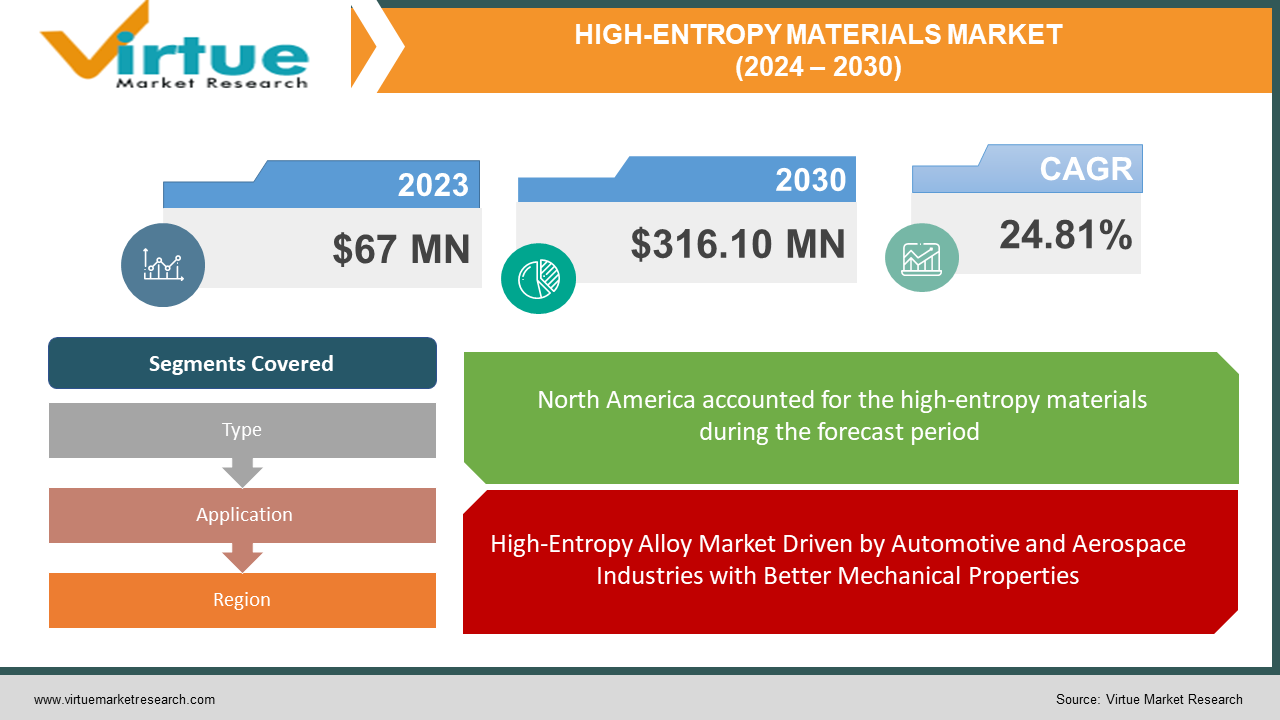

The High Entropy Market was valued at USD 67 million in 2023 and is projected to reach a market size of USD 316.10 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 24.81%.

Due to these materials' special qualities, they usually contain several principal elements in approximately similar proportions the market for High-Entropy Materials (HEMs) has seen an increase in demand. The aerospace, automotive, electronics, and energy sectors have demonstrated potential uses for high-entropy alloys (HEAs) and other high-entropy materials. These materials are desirable for use in harsh settings because of their high melting points, superior mechanical qualities, and resistance to wear and corrosion. HEAs have the potential to provide lightweight, durable components for the aerospace industry, as well as improve fuel efficiency and reduce total weight in automotive applications. High-entropy materials possessing high thermal and electrical conductivity could be advantageous for the electronics industry, and high-temperature settings found in power plants could find use in the energy sector.

Key Market Insights:

Because of their resistance to neutron radiation, high-energy alloys (HEAs) are garnering attention as possible materials for nuclear reactor core cladding. The composition of HEAs, which mixes several elements in about equal amounts to prevent dislocations from moving within the crystal lattice and increase their longevity in nuclear reactor conditions, gives rise to this special resistance. North America holds a dominant market share of 37.07% in the High-Entropy Alloy market as of 2023. A strong nuclear energy infrastructure, numerous R&D programmes, and a significant industry presence all contribute to this dominance, which reflects the rising need for HEAs in the development of nuclear technology. In 2023, Sandvik, a significant industry participant with a focus on material technology, mining, and rock extraction, will command a sizable 29.57% market share. With their dedication to innovation and proficiency in creating HEAs of the highest calibre for demanding applications, Sandvik is a significant player in the High-Entropy Alloy industry. The High-Entropy Alloy market is expected to grow at a robust rate over the next seven years, with a projected 24.81% CAGR, and reach a valuation of USD 0.31 billion by 2030. This positive prognosis is fuelled by the growing demand for materials with outstanding mechanical and thermal performance, continuous R&D efforts to improve alloy characteristics, and the growing acceptance of HEAs in a variety of industrial sectors.

High-Entropy Materials Market Drivers:

High-Entropy Alloy Market Driven by Automotive and Aerospace Industries with Better Mechanical Properties:

Due to the exceptional mechanical qualities that high-entropy alloys possess, the automotive and aerospace sectors are driving a significant increase in demand for the product, which is driving the market for high-entropy alloys. Due to their remarkable strength, hardness, and resistance to wear, these alloys have become essential components in the manufacturing of high-performance automobiles and aircraft. High-entropy alloys are at the forefront of material innovation due to their exceptional mechanical performance and ability to survive harsh conditions. This has led to substantial breakthroughs in both automotive and aerospace technology.

The Biomedical Revolution: Superior Biocompatibility and Corrosion Resistance in High-Entropy Alloys:

The high-entropy alloy industry is undergoing a revolutionary shift because of the advanced materials' significant uptake in biological applications. High-entropy metals' exceptional corrosion resistance and biocompatibility are responsible for this adoption boom. High-entropy alloys have become game-changers as the healthcare sector looks for materials that are more human-body compatible and resistant to physiological circumstances. Their use in the production of medical devices and implant technologies represents a paradigm shift in the biomedical industry and holds the promise of improving the performance and longevity of healthcare products.

High-Entropy Alloys Fulfil Increasing Need in Engineering and Construction with Lightweight Solutions:

High-entropy alloys have become essential to this changing environment as the need for strong, lightweight materials in the engineering and construction industries grows. These alloys provide an inventive response to the industry's pursuit of sustainability and efficiency because of their remarkable mechanical strength and low density. High-entropy alloys are being used more and more by engineers and architects to design and build structures and components because of their ability to redefine the standards for structural materials in the search for long-lasting, lightweight, and ecologically friendly solutions

Unleashing the Potential of High-Entropy Alloys through Research and Development:

The market for high-entropy alloys is going through a revolutionary period driven by a constant emphasis on R&D projects. The goal of this coordinated effort is to develop new variations of high-entropy alloys with improved features, such as increased corrosion resistance and thermal stability, to fully realize their promise. This innovation wave is influencing future technological advancements as well as pushing the limits of material science. High-entropy alloys are positioned to be at the forefront of innovative developments, demonstrating a dedication to excellence and ongoing development in the field of materials innovation.

High-Entropy Materials Market Restraints and Challenges:

The High-Entropy Materials (HEMs) market encounters significant challenges, with cost constraints standing out as a prominent obstacle. The intricate alloying processes and precise composition requirements for high-entropy materials often result in elevated production costs, inhibiting their widespread adoption, particularly in industries sensitive to pricing considerations. Additionally, standardization hurdles pose a substantial challenge. The absence of established processes and specifications for high-entropy materials complicates their integration into existing manufacturing practices, impeding broad industry acceptance where standardized procedures are crucial. These challenges underscore the need for addressing economic factors and promoting standardization to facilitate the broader utilization of high-entropy materials across various sectors.

High-Entropy Materials Market Opportunities:

The market for high-energy materials (HEMs) offers a range of opportunities for many sectors. Aerospace can benefit from lightweight solutions provided by high-entropy alloys (HEAs), which enhance aircraft performance. High-entropy materials improve power plant efficiency in the energy sector. By addressing certain industry needs, tailoring compositions offers specialised material solutions. High-entropy materials show promise in electronics and semiconductors due to their superior electrical and thermal conductivity. Scalability and knowledge are accelerated through collaborative research. Opportunities for additive manufacturing appear, and high-entropy materials support environmentally friendly manufacturing. Data-driven design accelerates the identification of alloys by optimising compositions. It is vital to consistently observe market studies to remain up to date with the changing prospects of the High-Entropy Materials Market.

HIGH-ENTROPY MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.81% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alcoa Corporation, Allegheny Technologies Incorporated (ATI), Carpenter Technology Corporation, Heeger Materials, Meta lysis, Norsk Titanium AS, Oerlikon, POLEMA, QuesTek Innovations LLC, Sandvik AB |

High-Entropy Materials Market Segmentation: By Type

-

5 Base Metals

-

Above 5 Base Metals

The above 5 Base Metals segment is expected to increase at the highest rate throughout the projected period, while 5 Base Metals is the largest segment. This category is appealing because of its comparatively simpler composition, which enables easier manufacturing procedures and possibly cheaper production costs. Industries looking for the special qualities of HEAs without the complications of higher base metal compositions find it appealing because of its simplicity. A range of improved qualities provided by the HEA in the Above 5 bases make it especially desirable for cutting-edge applications in the high-tech, defence, and aerospace sectors. As industries search for cutting-edge materials to meet their changing needs, the segment is likely to rise rapidly due to the rising demand for complex alloys with outstanding mechanical and thermal characteristics.

High-Entropy Materials Market Segmentation: By Application

-

Mechanical

-

Electrical

-

Magnetic

-

Aerospace

-

Automotive

-

Energy

-

Biomedical

Mechanical Application has the largest market, while Electrical Application will increase at the fastest rate throughout the projection period. The strong need for HEAs in sectors like aerospace and automotive propels the Mechanical segment. HEAs have special mechanical qualities that make them perfect for making components that are subjected to mechanical stress. These qualities include excellent strength and wear resistance. Due to its advantageous electrical conductivity and resistance to corrosion, HEAs are becoming more and more common in electrical components like conductors and connectors. Because certain HEAs have magnetic properties that make them appropriate for use in electronics and magnetic devices, the magnetic applications market is also expected to increase.

High-Entropy Materials Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads this market in size, while Asia-Pacific is expected to increase at the highest rate over the projection period. North America's dominance is largely due to its well-established research and development infrastructure, especially in the United States, which encourages innovation and the early adoption of HEAs across a variety of industries. Rapid industrialization and rising investments in the aerospace, automotive, and energy sectors in nations like China and Japan are driving the Asia-Pacific region. HEAs are essential to technological breakthroughs because of the increasing need for strong, lightweight materials in these areas and the growing emphasis on sustainable technology. A growing emphasis on sophisticated materials and infrastructure development is driving growth in Latin America, the Middle East, and Africa, while Europe trails closely behind, helped by a strong aerospace and automotive sector.

COVID-19 Impact Analysis on the Global High-Entropy Materials Market:

The COVID-19 epidemic had a severe effect on the High-Entropy Alloy (HEA) market. The production and uptake of HEAs were slowed down because of the temporary closure of manufacturing facilities and the global disruption of supply chains. Significant HEA users, the aerospace and automobile sectors, had difficulties due to operational limitations and a decline in demand. However, the epidemic also highlighted the need for strong, lightweight materials, which can spark interest in HEAs again due to their special qualities. The market for high-entropy alloys is expected to rebound as the world progressively gets better and industries pick up steam. The pandemic taught us how important innovative materials are to maintaining resilience and adaptation across a range of industries.

Latest Trends/ Developments:

The remarkable mechanical and physical qualities of high-entropy alloys have led to their increasing use across several industries, as seen by recent trends in the global market for these alloys. Strong, long-lasting, and lightweight materials are in greater demand, especially in the energy, automotive, and aerospace industries. Research and development efforts are increasing in the market, with an emphasis on investigating new alloy compositions and production procedures to augment the capabilities of high-entropy alloys. Using cutting-edge technologies like additive manufacturing, which provide more customisation and design flexibility, is becoming more and more popular. Together, these patterns show a dynamic environment in which high-entropy alloys are still developing and finding a wide range of uses in innovative sectors.

Key Players:

-

Alcoa Corporation

-

Allegheny Technologies Incorporated (ATI)

-

Carpenter Technology Corporation

-

Heeger Materials

-

Meta lysis

-

Norsk Titanium AS

-

Oerlikon

-

POLEMA

-

QuesTek Innovations LLC

-

Sandvik AB

Market News:

-

July 2022: Sandvik, a leading participant in the High-Entropy Alloy sector, possessed a notable market share of 29.57%. With expertise in mining, rock excavation, and material technology, Sandvik's considerable presence highlights its impact and meaningful contribution to the broader industry.

-

Sep 2022: Scientists have identified a novel mechanism for enhancing both the strength and ductility of high-entropy alloys. These discoveries offer crucial insights for shaping the future development of robust yet flexible high-entropy alloys and high-entropy ceramics.

Chapter 1. High-Entropy Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. High-Entropy Materials Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. High-Entropy Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. High-Entropy Materials Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. High-Entropy Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. High-Entropy Materials Market – By Types

6.1 Introduction/Key Findings

6.2 5 Base Metals

6.3 Above 5 Base Metals

6.4 Y-O-Y Growth trend Analysis By Types

6.5 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. High-Entropy Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Mechanical

7.3 Electrical

7.4 Magnetic

7.5 Aerospace

7.6 Automotive

7.7 Energy

7.8 Biomedical

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. High-Entropy Materials Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. High-Entropy Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Alcoa Corporation

9.2 Allegheny Technologies Incorporated (ATI)

9.3 Carpenter Technology Corporation

9.4 Heeger Materials

9.5 Meta lysis

9.6 Norsk Titanium AS

9.7 Oerlikon

9.8 POLEMA

9.9 QuesTek Innovations LLC

9.10 Sandvik AB

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The High Entropy Market was valued at USD 67 million in 2023 and is projected to reach a market size of USD 316.10 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 24.81%.

Aerospace Demand, Energy Sector Applications, Material Science Innovations, and Additive Manufacturing are the market drivers of the Global High-Entropy Materials Market.

5 Base Metals, above 5 Base Metals are the segments under the Global High-Entropy Materials Market by Type of Material.

North America is the most dominant region for the Global High-Entropy Materials Market.

Alcoa Corporation, Allegheny Technologies Incorporated (ATI), Carpenter Technology Corporation, Heeger Materials, Meta lysis, Norsk Titanium AS, Oerlikon, POLEMA, QuesTek Innovations LLC, Sandvik AB